Tutorial 8 - Peter Foldvari

... Q4 Simply because the economy is always changing, new firms are created old firms may shut down. Also the structure of labor demand changes. The government can reduces frictional unemployment by imporving the flow of information on the labor market and by offering training for the unemployed. Q5 For ...

... Q4 Simply because the economy is always changing, new firms are created old firms may shut down. Also the structure of labor demand changes. The government can reduces frictional unemployment by imporving the flow of information on the labor market and by offering training for the unemployed. Q5 For ...

The Current Financial Environment 1 The Current Financial

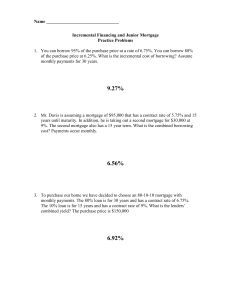

... In addition to the list information on mortgage pricing, banks also price depending on how much is borrowed. Credit Unions are great to borrow money from because they are not imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every ...

... In addition to the list information on mortgage pricing, banks also price depending on how much is borrowed. Credit Unions are great to borrow money from because they are not imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every ...

Monetary Policy

... The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank's lending facility--the discount window. The Federal Reserve Banks offer three discount window programs to depository institutions: prim ...

... The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank's lending facility--the discount window. The Federal Reserve Banks offer three discount window programs to depository institutions: prim ...

Deflation: Economic Significance, Current Risk, and Policy Responses

... Another form of qualitative easing (changing composition of feds’ balance sheet) The borrowers are financial institutions with assets exceeding liabilities ...

... Another form of qualitative easing (changing composition of feds’ balance sheet) The borrowers are financial institutions with assets exceeding liabilities ...

RBI IFRS Session - Impairment

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

Weekly Commentary 02-10-14 PAA

... downturn was due to hedge funds derisking their portfolios, and some credit earnings with stocks’ positive movement as almost 66 percent of companies in the Standard & Poor’s 500 Index that have reported this quarter have exceeded earnings expectations forecast by analysts. Bonds aren’t doing what t ...

... downturn was due to hedge funds derisking their portfolios, and some credit earnings with stocks’ positive movement as almost 66 percent of companies in the Standard & Poor’s 500 Index that have reported this quarter have exceeded earnings expectations forecast by analysts. Bonds aren’t doing what t ...

Federal Reserve Raises Interest Rates

... But Beware While the size of the initial rise in the Federal Funds Rate is hardly earth shattering, it does signal an upward trend that will have an immediate effect, albeit small at first, on consumer and commercial borrowing, credit, and savings. In general, consumers are likely to see savings acc ...

... But Beware While the size of the initial rise in the Federal Funds Rate is hardly earth shattering, it does signal an upward trend that will have an immediate effect, albeit small at first, on consumer and commercial borrowing, credit, and savings. In general, consumers are likely to see savings acc ...

Don`t confuse numbers with measurements

... that it will yield more meaningful information. This gives rise to the distinction that is made between nominal and real variables. Nominal variables are numbers given in plain dollar terms. For example, your income may be stated as $500 per week. We say that this number is a variable because your i ...

... that it will yield more meaningful information. This gives rise to the distinction that is made between nominal and real variables. Nominal variables are numbers given in plain dollar terms. For example, your income may be stated as $500 per week. We say that this number is a variable because your i ...

Read More - FPA of Minnesota

... 2016, perhaps to 1.25%. Any such increases likely will make it more expensive to borrow money (through a bank loan) or carry credit card debt. Borrowing money: The potential silver lining to higher interest rates is that they may encourage banks to more readily loan money to consumers through mortga ...

... 2016, perhaps to 1.25%. Any such increases likely will make it more expensive to borrow money (through a bank loan) or carry credit card debt. Borrowing money: The potential silver lining to higher interest rates is that they may encourage banks to more readily loan money to consumers through mortga ...

Monetary Policy

... • Khan Academy – Discount Rate – http://www.khanacademy.org/humanities--other/finance/banking-and-money/v/the-discount-rate ...

... • Khan Academy – Discount Rate – http://www.khanacademy.org/humanities--other/finance/banking-and-money/v/the-discount-rate ...

neophotonics corporation

... On February 25, 2015, NeoPhotonics Semiconductor GK (the “ Japanese Subsidiary ”), an indirect wholly-owned Japanese subsidiary of NeoPhotonics Corporation (the “ Company ”), entered into certain loan agreements and related special agreements (collectively, the “ Loan Documents ”) with The Bank of T ...

... On February 25, 2015, NeoPhotonics Semiconductor GK (the “ Japanese Subsidiary ”), an indirect wholly-owned Japanese subsidiary of NeoPhotonics Corporation (the “ Company ”), entered into certain loan agreements and related special agreements (collectively, the “ Loan Documents ”) with The Bank of T ...

(MP) and Phillips Curve

... Conceptually, a central bank sets the nominal interest rate on overnight loans by stating that it is willing to borrow or lend any amount at the specified rate. In practice, the open market desk at the Federal Reserve Bank of New York buys and sells securities to adjust the supply of reserves in ...

... Conceptually, a central bank sets the nominal interest rate on overnight loans by stating that it is willing to borrow or lend any amount at the specified rate. In practice, the open market desk at the Federal Reserve Bank of New York buys and sells securities to adjust the supply of reserves in ...

Turkey: More than Expected Hike by the CBRT

... based on sources we consider to be reliable, and have not been independently verified by BBVA. Therefore, BBVA offers no warranty, either express or implicit, regarding its accuracy, integrity or correctness. Estimations this document may contain have been undertaken according to generally accepted ...

... based on sources we consider to be reliable, and have not been independently verified by BBVA. Therefore, BBVA offers no warranty, either express or implicit, regarding its accuracy, integrity or correctness. Estimations this document may contain have been undertaken according to generally accepted ...

Adjustable Rate Mortgage

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

Morgan Stanley Newsletter

... instance. But those have been more tactical moves for us. The core longer-term thesis still applies. We are very hesitant about emerging-market exposure. That would probably be the biggest differentiator, in terms of how we seek to achieve returns, relative to the larger players in the category. Eme ...

... instance. But those have been more tactical moves for us. The core longer-term thesis still applies. We are very hesitant about emerging-market exposure. That would probably be the biggest differentiator, in terms of how we seek to achieve returns, relative to the larger players in the category. Eme ...

The Risk and Term Structure of Interest Rates

... the risk premium for Aaa corporate bonds almost vanished. Clearly, the risk premium varies inversely with the business cycle. While the risk premium seems to be sensitive to all other factors - business conditions, maturity, marketability, and the level of interest rates - the size of the risk premi ...

... the risk premium for Aaa corporate bonds almost vanished. Clearly, the risk premium varies inversely with the business cycle. While the risk premium seems to be sensitive to all other factors - business conditions, maturity, marketability, and the level of interest rates - the size of the risk premi ...

Comparing Different Asset Classes for Banking

... Not all 401(k) plans allow for loans, but many do if the provisions are written into the plan document. The plan administrator usually charges an annual fee to process and track the loan. Loans are typically limited to half of your vested account balance or $50,000, whichever is lower. Although 401( ...

... Not all 401(k) plans allow for loans, but many do if the provisions are written into the plan document. The plan administrator usually charges an annual fee to process and track the loan. Loans are typically limited to half of your vested account balance or $50,000, whichever is lower. Although 401( ...

FREE Sample Here

... changing a number in its computer system. d. spending money on government purchases. ...

... changing a number in its computer system. d. spending money on government purchases. ...

The Decision-Making Process

... leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savings means you will no longer obtain interest on thos ...

... leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savings means you will no longer obtain interest on thos ...

Econ Unit 2 Personal Finance Notes

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

Characteristics of Money Market Instruments

... maturity date. For example, an interest rate of 6% per annum means either that the borrower must pay the lender interest of 6% on the value of the principal every year, or that the borrower must pay a proportion of 6% if interest payments are made more frequently, or that the borrower must pay the e ...

... maturity date. For example, an interest rate of 6% per annum means either that the borrower must pay the lender interest of 6% on the value of the principal every year, or that the borrower must pay a proportion of 6% if interest payments are made more frequently, or that the borrower must pay the e ...

Bank Reserves

... • Confused Market signals: – Firms do not know if their price went up due to inflation or increased popularity. ...

... • Confused Market signals: – Firms do not know if their price went up due to inflation or increased popularity. ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.