Bank of Canada`s mandate renewed

... I mportant: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provided has been determined on the basis of data obtained from sources that are deemed to be reliable, Desjardins Group in no way w ...

... I mportant: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provided has been determined on the basis of data obtained from sources that are deemed to be reliable, Desjardins Group in no way w ...

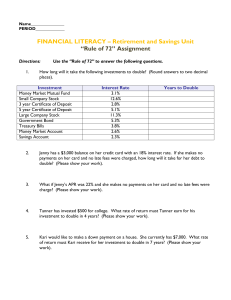

InterestRate assignment

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

money notes

... to real estate because they expect a favorable financial return in the future *investments, such as stocks, bonds, and mutual funds, that give their holders the right to receive some sort of return, or profit *In general, there is a strong relationship between risk and reward. ...

... to real estate because they expect a favorable financial return in the future *investments, such as stocks, bonds, and mutual funds, that give their holders the right to receive some sort of return, or profit *In general, there is a strong relationship between risk and reward. ...

Chapter 2 Economic Systems and Decision Making Section 1 p. 33

... • If the consumers reject the product and refuse to purchase it, the firm may go out of business. • + do you know of any examples? (even a company that got close to such a problem?) ...

... • If the consumers reject the product and refuse to purchase it, the firm may go out of business. • + do you know of any examples? (even a company that got close to such a problem?) ...

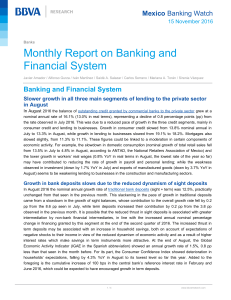

Monthly Report on Banking and Financial System

... observed in the previous month. It is possible that the reduced thrust in sight deposits is associated with greater intermediation by non-bank financial intermediaries, in line with the increased annual nominal percentage change in financing granted by this segment at the end of the second quarter o ...

... observed in the previous month. It is possible that the reduced thrust in sight deposits is associated with greater intermediation by non-bank financial intermediaries, in line with the increased annual nominal percentage change in financing granted by this segment at the end of the second quarter o ...

Changing Interest Rates: The Impact on Your Portfolio

... permission. All indices are unmanaged. An investment cannot be made in an index. Please see page 10 for asset class breakdowns and corresponding indices. ...

... permission. All indices are unmanaged. An investment cannot be made in an index. Please see page 10 for asset class breakdowns and corresponding indices. ...

MBS Note

... • Investor – Compare MBS against other fixed income investment alternatives – Yield from MBS needs to cover: • Funding costs • Option costs (prepayment risk and default risk) • Liquidity risk ...

... • Investor – Compare MBS against other fixed income investment alternatives – Yield from MBS needs to cover: • Funding costs • Option costs (prepayment risk and default risk) • Liquidity risk ...

Fun with Exponential Growth and Decay and e

... down at a rate of 20% per hour in her bloodstream. This means that as each hour passes, 20% of the active medicine is used. a) Using a continuous exponential model, write an equation that would predict the amount of medicine in Cassie’s bloodstream at time, t. ...

... down at a rate of 20% per hour in her bloodstream. This means that as each hour passes, 20% of the active medicine is used. a) Using a continuous exponential model, write an equation that would predict the amount of medicine in Cassie’s bloodstream at time, t. ...

Fun with Exponential Growth and Decay]

... down at a rate of 20% per hour in her bloodstream. This means that as each hour passes, 20% of the active medicine is used. a) Using a continuous exponential model, write an equation that would predict the amount of medicine in Cassie’s bloodstream at time, t. ...

... down at a rate of 20% per hour in her bloodstream. This means that as each hour passes, 20% of the active medicine is used. a) Using a continuous exponential model, write an equation that would predict the amount of medicine in Cassie’s bloodstream at time, t. ...

Chapter 3 Interbank Lending Interbank lending forms a critical

... represented by the three‐month London Interbank Offered Rate (LIBOR). LIBOR is the rate that banks in London charge each other for three‐month loans in U.S. dollars (see Chapter 13). The second measure is the expected policy interest rate, represented by a special financial instrument, called the ...

... represented by the three‐month London Interbank Offered Rate (LIBOR). LIBOR is the rate that banks in London charge each other for three‐month loans in U.S. dollars (see Chapter 13). The second measure is the expected policy interest rate, represented by a special financial instrument, called the ...

What do low interest rates mean for your retirement?

... “We've had more than half a decade of very low interest rates and that means someone who has been putting money into a savings account or into a pension fund - the value of their lifetime retirement is about half the value of someone who retired in 2000," said Catherine Mann, the OECD's chief econom ...

... “We've had more than half a decade of very low interest rates and that means someone who has been putting money into a savings account or into a pension fund - the value of their lifetime retirement is about half the value of someone who retired in 2000," said Catherine Mann, the OECD's chief econom ...

Savings and Investing

... Bank pays you interest to use your money When interest is expressed as a percentage of the original investment, it is called the rate of return or yield Interest rates are usually based on one year time periods They can be given on other periods such as daily, weekly, monthly Usually, the ...

... Bank pays you interest to use your money When interest is expressed as a percentage of the original investment, it is called the rate of return or yield Interest rates are usually based on one year time periods They can be given on other periods such as daily, weekly, monthly Usually, the ...

There are, no doubt, other dimensions to the productivity puzzle

... the average British worker’s output in a week, and still take Friday off. It would seem that, in addition to the factors affecting all developed economies, the UK has particularly weak management. Some contributing factors are generally acknowledged. During the crisis and its immediate aftermath, wh ...

... the average British worker’s output in a week, and still take Friday off. It would seem that, in addition to the factors affecting all developed economies, the UK has particularly weak management. Some contributing factors are generally acknowledged. During the crisis and its immediate aftermath, wh ...

20 Dec 15 AGNC stock price appreciation in 2016

... of the hedge funds, the company will become less stagnate in its investments, and increase earnings. Based on the numbers above from the company, as of 30 September, 2015, it has $62.2 billion invested in interest earning investments and $45.2 billion in the hedge fund. I would look for an adjustmen ...

... of the hedge funds, the company will become less stagnate in its investments, and increase earnings. Based on the numbers above from the company, as of 30 September, 2015, it has $62.2 billion invested in interest earning investments and $45.2 billion in the hedge fund. I would look for an adjustmen ...

The RBI holds and the US Fed raises

... The US Federal Reserve would raise interest rates when economic indicators suggest growth. On 14th December 2016 the US Federal Reserve raised the interest rates for only the 2nd time since the Great Recession and 3rd time in the last decade. A lot of positive indicators backed this. In the Quarter ...

... The US Federal Reserve would raise interest rates when economic indicators suggest growth. On 14th December 2016 the US Federal Reserve raised the interest rates for only the 2nd time since the Great Recession and 3rd time in the last decade. A lot of positive indicators backed this. In the Quarter ...

The Origins of the U.S. Financial and Economic Crises

... only a great investment, but it was also widely perceived as a very safe investment," the study said. The prices eventually moved "out of line with fundamentals like household income," creating the so-called bubble, the study said. There were two trends developing at that time that contributed to th ...

... only a great investment, but it was also widely perceived as a very safe investment," the study said. The prices eventually moved "out of line with fundamentals like household income," creating the so-called bubble, the study said. There were two trends developing at that time that contributed to th ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.

![Fun with Exponential Growth and Decay]](http://s1.studyres.com/store/data/010315583_1-c4286e94658106423eeb9e17ea548f0d-300x300.png)