Chapter 8: Monetary Theory and Policy Summary of Key Lessons

... times each dollar is spent for new goods and services in a year, or how often the money supply turns over each year. Changing the Money Supply Increase in money supply (M) • If not at full employment/production, then (Q) increases more than (P) increases. • If at full employment/production, then ( ...

... times each dollar is spent for new goods and services in a year, or how often the money supply turns over each year. Changing the Money Supply Increase in money supply (M) • If not at full employment/production, then (Q) increases more than (P) increases. • If at full employment/production, then ( ...

L21-23. - Harvard Kennedy School

... Does it really work this way? Question 3: How integrated are financial markets, and what are the remaining barriers? ...

... Does it really work this way? Question 3: How integrated are financial markets, and what are the remaining barriers? ...

Repo (Repurchase) Rate Repo rate is the rate at which banks

... the Reserve Bank of India that prints money. It gives that money to banks who further lend it to end-consumers like you and me. That is how money simply flows in an economy. Now RBI gives the money to banks at a certain?? – yes, interest rate. The banks in turn lend it to consumer at a higher intere ...

... the Reserve Bank of India that prints money. It gives that money to banks who further lend it to end-consumers like you and me. That is how money simply flows in an economy. Now RBI gives the money to banks at a certain?? – yes, interest rate. The banks in turn lend it to consumer at a higher intere ...

Intergrated Bank Corporation (IBC) is a medium

... caps/floors limiting change in the GNMA rate to +/- 50 basis points per year. Thus, if the oneyear CMT rate in one year is, hypothetically, 3.40 percent, then the seasoned 9-year GNMA rate for year 2 will be min{3.87 + 0.50 (old rate with cap), 3.40 + 1.25 (new CMT with seasoned spread)} = 4.37 perc ...

... caps/floors limiting change in the GNMA rate to +/- 50 basis points per year. Thus, if the oneyear CMT rate in one year is, hypothetically, 3.40 percent, then the seasoned 9-year GNMA rate for year 2 will be min{3.87 + 0.50 (old rate with cap), 3.40 + 1.25 (new CMT with seasoned spread)} = 4.37 perc ...

- Wasatch Advisors

... days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully. Investing in bonds, you are subject, but not limited to, the sa ...

... days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully. Investing in bonds, you are subject, but not limited to, the sa ...

The Rule of 72 - Riverside School District

... How many years it will take an investment to double at a given interest rate using compounding interest. How long it will take debt to double if no payments are made. The interest rate an investment must earn to double within a specific time period. How many times money (or debt) will double i ...

... How many years it will take an investment to double at a given interest rate using compounding interest. How long it will take debt to double if no payments are made. The interest rate an investment must earn to double within a specific time period. How many times money (or debt) will double i ...

official - Government Printing Press

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

14-June-Property-buyers-face-new-threat-from

... Property buyers are being let down because lenders are increasingly pulling out of deals at the last moment, forcing loan renegotiations on worse terms or the need to start looking for another loan. Prudent buyers getting pre-approvals up to six months before finding the property they want to buy ar ...

... Property buyers are being let down because lenders are increasingly pulling out of deals at the last moment, forcing loan renegotiations on worse terms or the need to start looking for another loan. Prudent buyers getting pre-approvals up to six months before finding the property they want to buy ar ...

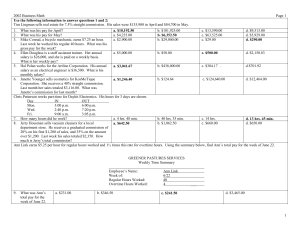

Day IN OUT

... finance charge of $2.12. He made purchases of $46.96. What is Larry Mannington’s new balance? Use the following information to answer questions 42 and 43: Wilson Zywocki took out a $6,000 simple interest loan at 10% annually for 24 months. After 5 payments the balance was $4,846.97. He pays off the ...

... finance charge of $2.12. He made purchases of $46.96. What is Larry Mannington’s new balance? Use the following information to answer questions 42 and 43: Wilson Zywocki took out a $6,000 simple interest loan at 10% annually for 24 months. After 5 payments the balance was $4,846.97. He pays off the ...

CUTTING THROUGH THE JARGON: A Basic Primer on

... condominium project) before the loan has been fully repaid. Lockbox (cash management agreement) refers to an arrangement by which rent gets paid by tenants directly to a particular bank account (subject to a lender security interest) to be applied in accordance with a Waterfall (see below). Mezzanin ...

... condominium project) before the loan has been fully repaid. Lockbox (cash management agreement) refers to an arrangement by which rent gets paid by tenants directly to a particular bank account (subject to a lender security interest) to be applied in accordance with a Waterfall (see below). Mezzanin ...

1 Solutions to End-of-Chapter Problems in

... (a) Expected future taxes will be lower and expected future output higher – both effects causing the current IS schedule to shift to the right. However, future interest rates are expected to be higher and this causes the current IS schedule to shift to the left. The net effect on the IS curve is amb ...

... (a) Expected future taxes will be lower and expected future output higher – both effects causing the current IS schedule to shift to the right. However, future interest rates are expected to be higher and this causes the current IS schedule to shift to the left. The net effect on the IS curve is amb ...

interest rate credit card financed by the Federal Reserve System and

... from the federal government (taxpayers). Pleasing the Wall St bankers by eliminating the Fed's purchases of government bonds only adds to the national debt and taxpayer burdens. It is in the people's interest for the Federal Government to issue not only coins and currency, but "checkbook money" as w ...

... from the federal government (taxpayers). Pleasing the Wall St bankers by eliminating the Fed's purchases of government bonds only adds to the national debt and taxpayer burdens. It is in the people's interest for the Federal Government to issue not only coins and currency, but "checkbook money" as w ...

Chapter 19 Residential Real Estate Finance: Mortgage

... mortgage which reduce interest rate risk for lenders and increase this risk for borrowers are a common alternative to fixed rate loans ...

... mortgage which reduce interest rate risk for lenders and increase this risk for borrowers are a common alternative to fixed rate loans ...

Willem and the negative nominal interest rate

... 0.40 percentage points (Gerlach-Kristin, 2009). He is a man with attention to detail. Because of his, to some, unorthodox writings, he was nicknamed "Maverick". This moniker he brought with him when he later in his career, at the London School of Economics, started his blog "maverecon", which ended ...

... 0.40 percentage points (Gerlach-Kristin, 2009). He is a man with attention to detail. Because of his, to some, unorthodox writings, he was nicknamed "Maverick". This moniker he brought with him when he later in his career, at the London School of Economics, started his blog "maverecon", which ended ...

The low-interest

... liquidity, and this should take into account the fact that crises are spikes in the value of liquidity. If they fail to do so, central bankers run the risk keeping interest rates too low – specifically, keeping them below the shadow price of liquidity – which is the value of liquidity when you take ...

... liquidity, and this should take into account the fact that crises are spikes in the value of liquidity. If they fail to do so, central bankers run the risk keeping interest rates too low – specifically, keeping them below the shadow price of liquidity – which is the value of liquidity when you take ...

Real estate terms and definitions

... notary public swear to the fact that the persons named in the documents did, in fact, sign them. Points: Also known as a loan's origination fee, points are interest charges paid upfront when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan ...

... notary public swear to the fact that the persons named in the documents did, in fact, sign them. Points: Also known as a loan's origination fee, points are interest charges paid upfront when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan ...

Fractional Reserve Banking

... • Another way of thinking about potential output is the equilibrium rate of unemployment or NAIRU (Non-accelerating Inflation Rate of Unemployment) • NAIRU is the rate of unemployment below which there will be inflationary pressures • The exact level of NAIRU is an issue of debate. – Most economists ...

... • Another way of thinking about potential output is the equilibrium rate of unemployment or NAIRU (Non-accelerating Inflation Rate of Unemployment) • NAIRU is the rate of unemployment below which there will be inflationary pressures • The exact level of NAIRU is an issue of debate. – Most economists ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.