Adjustable Rate Mortgage

... Uses part of down payment to purchase an annuity which is pledged as additional collateral. Allows borrower to build a nest egg BUT the after tax return is generally negative when compared to a disciplined investment plan. Comparison of Conventional Mortgage to AIM (See Diagram) ...

... Uses part of down payment to purchase an annuity which is pledged as additional collateral. Allows borrower to build a nest egg BUT the after tax return is generally negative when compared to a disciplined investment plan. Comparison of Conventional Mortgage to AIM (See Diagram) ...

CH17

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

The Fed's Intertemporal Game - Center for Financial Stability

... doubling down of a bet being waged over time. If the game ends poorly and market interest rates rise sharply, all players lose. “Forward guidance” is predicated on the idea that comments and communiqués from the Fed can lower short-term interest rate expectations, thereby reducing longer term rates. ...

... doubling down of a bet being waged over time. If the game ends poorly and market interest rates rise sharply, all players lose. “Forward guidance” is predicated on the idea that comments and communiqués from the Fed can lower short-term interest rate expectations, thereby reducing longer term rates. ...

Algebra 2B - Barrington 220

... 2) Psychology: Educational psychologists sometimes use mathematical models of memory. Suppose a group of students take a chemistry test. After some time, without review of the material, they take an equivalent form of the same test. The mathematical model describing the students’ retention of the ma ...

... 2) Psychology: Educational psychologists sometimes use mathematical models of memory. Suppose a group of students take a chemistry test. After some time, without review of the material, they take an equivalent form of the same test. The mathematical model describing the students’ retention of the ma ...

What should we make of the negative interest rates that

... Federal Reserve (Fed) have carried out policies of massive asset purchases, but have never lowered their key interest ...

... Federal Reserve (Fed) have carried out policies of massive asset purchases, but have never lowered their key interest ...

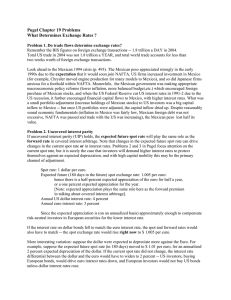

Pugel Chapter 19 Problems What Determines Exchange Rates ?

... changes in the current spot rate or in interest rates. Problems 2 and 3 in Pugel focus attention on the current spot rate, but it is surely the case that investors will demand higher interest rates to protect themselves against an expected depreciation, and with high capital mobility this may be the ...

... changes in the current spot rate or in interest rates. Problems 2 and 3 in Pugel focus attention on the current spot rate, but it is surely the case that investors will demand higher interest rates to protect themselves against an expected depreciation, and with high capital mobility this may be the ...

Chapter 16_20e

... bank must keep (can’t be loaned). Reserve Ratio: Percentage of demand deposits bank must maintain for required reserves. ...

... bank must keep (can’t be loaned). Reserve Ratio: Percentage of demand deposits bank must maintain for required reserves. ...

Chapter 16

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

Liquidity ratios

... current situation as a baseline for planning. Planning next requires a forecast of macroeconomic conditions and an analysis of the strengths and weaknesses of the company in terms of the conditions. Timing is an essential element of planning. Financial policies can be built into the plan. Marketing ...

... current situation as a baseline for planning. Planning next requires a forecast of macroeconomic conditions and an analysis of the strengths and weaknesses of the company in terms of the conditions. Timing is an essential element of planning. Financial policies can be built into the plan. Marketing ...

What Do Financial Market Indicators Tell Us?

... Financial market data are reported daily in the news—usually as prices, indexes, or interest rates. While these data provide direct information (e.g., a Treasury bill pays 2 percent interest), they also give some indication of future economic growth, inflation, and financial market stability. Change ...

... Financial market data are reported daily in the news—usually as prices, indexes, or interest rates. While these data provide direct information (e.g., a Treasury bill pays 2 percent interest), they also give some indication of future economic growth, inflation, and financial market stability. Change ...

Document

... What affects interest rates? The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in th ...

... What affects interest rates? The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in th ...

Setting aside the debate on when the exact date of an interest rate

... They can have sudden and material impacts on performance of investment products. Interest rates and the prices of bonds have an inverse relationship; as rates rise bond prices fall and vice versa. During the past 30 years, investors have enjoyed a long cycle of declining interest rates. In Sep ...

... They can have sudden and material impacts on performance of investment products. Interest rates and the prices of bonds have an inverse relationship; as rates rise bond prices fall and vice versa. During the past 30 years, investors have enjoyed a long cycle of declining interest rates. In Sep ...

The Savings Plan Formula The savings plan formula

... Ex.4 A confortable retirement. You would like to retire 25 years from now, and you would like to have a retirement fund from which you can draw an income of $50, 000 per year, forever!! How can you do it? Assume a constant APR of 9%. You can achieve your goal by building a retirement fund that is la ...

... Ex.4 A confortable retirement. You would like to retire 25 years from now, and you would like to have a retirement fund from which you can draw an income of $50, 000 per year, forever!! How can you do it? Assume a constant APR of 9%. You can achieve your goal by building a retirement fund that is la ...

Positioning your portfolio for rising interest rates

... losses during periods of rising rates. 2. Active management may offer advantages over indexing. Active management can help you achieve appropriate levels of exposure to various areas of the bond market during changing cycles, with greater flexibility to avoid some risks currently reflected in broade ...

... losses during periods of rising rates. 2. Active management may offer advantages over indexing. Active management can help you achieve appropriate levels of exposure to various areas of the bond market during changing cycles, with greater flexibility to avoid some risks currently reflected in broade ...

Why Are Long-Term Interest Rates So Low?

... The expectations component of, say, a 10-year interest rate is the average of expected short rates over the next 10 years. Model-based estimates suggest that a declining expectations component played an important role in explaining the downward trend in long-term Treasury yields since the 1980s (Bau ...

... The expectations component of, say, a 10-year interest rate is the average of expected short rates over the next 10 years. Model-based estimates suggest that a declining expectations component played an important role in explaining the downward trend in long-term Treasury yields since the 1980s (Bau ...

International Macro

... From UIP, we can interpret this as maintaining an interest rate that is fixed at the level of foreign rates r*. Output will be more sensitive to shocks to planned expenditure. ...

... From UIP, we can interpret this as maintaining an interest rate that is fixed at the level of foreign rates r*. Output will be more sensitive to shocks to planned expenditure. ...

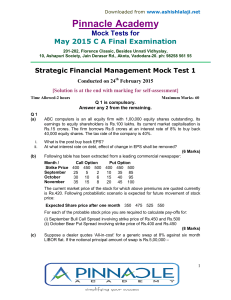

Pinnacle Academ y

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

Sovency Unit 1

... Compile Industry data on Interest Rate Stress Scenarios such as the New York 7 documented in AOMR. Compile Industry profile of asset rollover rate focusing on scheduled maturities. Compile Industry profile of renewal premium income Determine scenarios causing solvency break points. ...

... Compile Industry data on Interest Rate Stress Scenarios such as the New York 7 documented in AOMR. Compile Industry profile of asset rollover rate focusing on scheduled maturities. Compile Industry profile of renewal premium income Determine scenarios causing solvency break points. ...

8.3 The number e

... • What is the Euler number? Natural base e • How is it defined? 2.718 - - it is an irrational number like pi • Do laws of exponents apply to “e” number? Yes- - all of them. • How do When graphing base e, how do you know if you have growth or decay? Growth rises on the right and decay rises on the ...

... • What is the Euler number? Natural base e • How is it defined? 2.718 - - it is an irrational number like pi • Do laws of exponents apply to “e” number? Yes- - all of them. • How do When graphing base e, how do you know if you have growth or decay? Growth rises on the right and decay rises on the ...

Monetary Policy Update September 2009

... Note. The difference beween 3-month interbank rate and expected policy rate (basis-spread) ...

... Note. The difference beween 3-month interbank rate and expected policy rate (basis-spread) ...

Chapter 5a Recommended End-of-Chapter Problems and Solutions

... $1,000 at end of 3 years. What discount rate equates this payment stream to $978.30? ...

... $1,000 at end of 3 years. What discount rate equates this payment stream to $978.30? ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.