Asymmetric Information and Financial Crises: A Historical

... One way that lenders can reduce the adverse selection problem in debt markets is to have the borrower provide collateral for the loan. Thus, if the borrower defaults on the loan, the lender can take title to the collateral and sell it to make up the loss. Note that if the collateral is of good enoug ...

... One way that lenders can reduce the adverse selection problem in debt markets is to have the borrower provide collateral for the loan. Thus, if the borrower defaults on the loan, the lender can take title to the collateral and sell it to make up the loss. Note that if the collateral is of good enoug ...

Chapter 15 The Term Structure of Interest Rates

... A. is a graphical depiction of term structure of interest rates. B. is usually depicted for U. S. Treasuries in order to hold risk constant across maturities and yields. C. is usually depicted for corporate bonds of different ratings. D. is a graphical depiction of term structure of interest rates a ...

... A. is a graphical depiction of term structure of interest rates. B. is usually depicted for U. S. Treasuries in order to hold risk constant across maturities and yields. C. is usually depicted for corporate bonds of different ratings. D. is a graphical depiction of term structure of interest rates a ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... reporting system. Designations, assignments, and allocations may change from time to time as management accounting systems are enhanced or product lines change. During 1994 certain methodologies were changed, and accordingly, results for 1993 have been restated to conform to the current presentation ...

... reporting system. Designations, assignments, and allocations may change from time to time as management accounting systems are enhanced or product lines change. During 1994 certain methodologies were changed, and accordingly, results for 1993 have been restated to conform to the current presentation ...

The Effects of Credit Subsidies on Development

... In this paper we study a related but different question to the existing literature on the quantitative effects of financial reform. Given the institutional level of a particular economy (strength of creditors’ protection, efficiency of the judicial system, intermediation costs, etc.) and the potent ...

... In this paper we study a related but different question to the existing literature on the quantitative effects of financial reform. Given the institutional level of a particular economy (strength of creditors’ protection, efficiency of the judicial system, intermediation costs, etc.) and the potent ...

Money and Banking - Your home for free Leaving Cert Notes

... exchange a specified asset of standardized quanAty and quality for a price agreed today. I will buy 1,000 bananas off you in 6 months for €500. In finance, an opAon is a something that specifies a contract between two parAes for a future transacAon on an asset at a reference price. The buyer of the ...

... exchange a specified asset of standardized quanAty and quality for a price agreed today. I will buy 1,000 bananas off you in 6 months for €500. In finance, an opAon is a something that specifies a contract between two parAes for a future transacAon on an asset at a reference price. The buyer of the ...

What is a bond?

... investors receive less than the promised return. Therefore, the expected return on corporate and municipal bonds is less than the promised return. ...

... investors receive less than the promised return. Therefore, the expected return on corporate and municipal bonds is less than the promised return. ...

Understanding the Fed

... never borrow to buy a car or a house at this rate, the interest rates you confront are heavily influenced by the federal funds rate. For example, over the past few years, the federal funds rate has decreased from 5.25 percent in 2006 to a value of 0.25 percent at the time of writing (mid-2011). Over ...

... never borrow to buy a car or a house at this rate, the interest rates you confront are heavily influenced by the federal funds rate. For example, over the past few years, the federal funds rate has decreased from 5.25 percent in 2006 to a value of 0.25 percent at the time of writing (mid-2011). Over ...

After Osbrown - Talk Carswell

... do not tell us the full story. They only tell us about headline growth, not why there is growth. Strong though the increase in output may well be, the recovery is likely to be flawed. It is possible to raise output – and all other kinds of economic indices – with a combination of cheap credit and by ...

... do not tell us the full story. They only tell us about headline growth, not why there is growth. Strong though the increase in output may well be, the recovery is likely to be flawed. It is possible to raise output – and all other kinds of economic indices – with a combination of cheap credit and by ...

INSTITUTE OF ECONOMIC STUDIES Faculty of social sciences of

... counterparty compensates the other counterparty for the loss of expected profit over the remainder of the life of the swap) assignment of a swap is the sale of the swap by one of the counterparties to a third party with an agreement of the other counterparty coupon swap is fixed-against-floating swa ...

... counterparty compensates the other counterparty for the loss of expected profit over the remainder of the life of the swap) assignment of a swap is the sale of the swap by one of the counterparties to a third party with an agreement of the other counterparty coupon swap is fixed-against-floating swa ...

Can Low Interest Rates be Harmful: An Assessment of the Bank Risk

... methodology, in addition to the loan and bank specific characteristics as per Ioannidou et al. (2009), Paligorova and Santos (2012) also control for borrower specific characteristics and find over the period of 1990 to 2010, when the US federal funds rates were low, banks demanded relatively lower s ...

... methodology, in addition to the loan and bank specific characteristics as per Ioannidou et al. (2009), Paligorova and Santos (2012) also control for borrower specific characteristics and find over the period of 1990 to 2010, when the US federal funds rates were low, banks demanded relatively lower s ...

The Effect of Change in Base Lending Rate on

... When base lending rates increase commercial banks increases their interest rates on loans and mortgages. This therefore discourages many people from seeking credit facility to finance long term and short term projects leading to slowed economic growth. Taherizadeh (2001) noted that increase in centr ...

... When base lending rates increase commercial banks increases their interest rates on loans and mortgages. This therefore discourages many people from seeking credit facility to finance long term and short term projects leading to slowed economic growth. Taherizadeh (2001) noted that increase in centr ...

The Value of Fiat Money with an Outside Bank

... where it has no value at the end of the last period. The market structure is a clearinghouse. The backward induction predicted by rational expectations was not observed. Duffy and Ochs (1999) utilize a search theoretic model based on the work of Kiyotaki and Wright (19889) to study which of several ...

... where it has no value at the end of the last period. The market structure is a clearinghouse. The backward induction predicted by rational expectations was not observed. Duffy and Ochs (1999) utilize a search theoretic model based on the work of Kiyotaki and Wright (19889) to study which of several ...

G.S. 24-1.1E - North Carolina General Assembly

... the loan closing if the borrower has no right or option under the loan documents to repay all or any portion of the outstanding balance of the open-end credit plan at a fixed interest rate over a specified period of time or, (ii) if the borrower has a right or option under the loan documents to repa ...

... the loan closing if the borrower has no right or option under the loan documents to repay all or any portion of the outstanding balance of the open-end credit plan at a fixed interest rate over a specified period of time or, (ii) if the borrower has a right or option under the loan documents to repa ...

2- money - Macroeconomics@Lourdes College

... with which the values of all other goods and services are expressed or quoted; (b) Money serves a medium of exchange which implies that money is an accepted means of payment for goods and services; (c) Money serves as a store of value (and a standard of deferred payment). This means that money can b ...

... with which the values of all other goods and services are expressed or quoted; (b) Money serves a medium of exchange which implies that money is an accepted means of payment for goods and services; (c) Money serves as a store of value (and a standard of deferred payment). This means that money can b ...

2. DYNAMIC EQUILIBRIUM MODELS I: TWO

... Thus, the allocation {c1 = y1 , c2 = y2 } and prices {p1 = 1, p2 = β(y1 /y2 )} constitute a competitive equilibrium for this economy. Now one of the things we know about competitive equilibria in such economies (in fact, for a large class of economies) is the fundamental theorems of welfare economi ...

... Thus, the allocation {c1 = y1 , c2 = y2 } and prices {p1 = 1, p2 = β(y1 /y2 )} constitute a competitive equilibrium for this economy. Now one of the things we know about competitive equilibria in such economies (in fact, for a large class of economies) is the fundamental theorems of welfare economi ...

Expression of Interest Form - Mid and East Antrim Borough Council

... ⎕ Commercial ⎕ Residential ⎕ Both Commercial & Residential ⎕ Other If Other Please Specify ………………………………………………………………………………….. Have you already employed an architect / architectural technician or other professional to prepare drawings and costings for proposed scheme? Yes ⎕ / No ⎕ Anticipated start da ...

... ⎕ Commercial ⎕ Residential ⎕ Both Commercial & Residential ⎕ Other If Other Please Specify ………………………………………………………………………………….. Have you already employed an architect / architectural technician or other professional to prepare drawings and costings for proposed scheme? Yes ⎕ / No ⎕ Anticipated start da ...

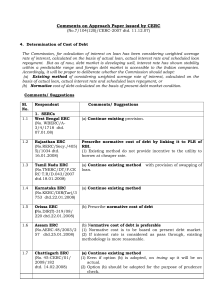

Comments on approach paper 04 - Central Electricity Regulatory

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.