chapter 5

... Applying the theory Suppose V is constant, M is growing 5% per year, Y is growing 2% per year, and r = 4. a. Solve for i. b. If the Fed increases the money growth rate by 2 percentage points per year, find i. c. Suppose the growth rate of Y falls to 1% per year. ...

... Applying the theory Suppose V is constant, M is growing 5% per year, Y is growing 2% per year, and r = 4. a. Solve for i. b. If the Fed increases the money growth rate by 2 percentage points per year, find i. c. Suppose the growth rate of Y falls to 1% per year. ...

slides - Seán M Muller

... When the State does provide funding, one approach to accountability and oversight is to stipulate conditions on funding (cash transfers or loans) A problem with this is the issue of fungibility: money used for the purpose stipulated by the conditions might just mean the SOE shifts funds it would h ...

... When the State does provide funding, one approach to accountability and oversight is to stipulate conditions on funding (cash transfers or loans) A problem with this is the issue of fungibility: money used for the purpose stipulated by the conditions might just mean the SOE shifts funds it would h ...

Input to SCAP planning - Parliamentary Monitoring Group

... When the State does provide funding, one approach to accountability and oversight is to stipulate conditions on funding (cash transfers or loans) A problem with this is the issue of fungibility: money used for the purpose stipulated by the conditions might just mean the SOE shifts funds it would h ...

... When the State does provide funding, one approach to accountability and oversight is to stipulate conditions on funding (cash transfers or loans) A problem with this is the issue of fungibility: money used for the purpose stipulated by the conditions might just mean the SOE shifts funds it would h ...

Access the Investor Brochure

... hereof. CION has not established limits on the amount of funds it may use from available sources to make distributions. Through December 31, 2014, a portion of CION’s distributions resulted from expense support from CIG, and future distributions may result from expense support from CIG and AIM, each ...

... hereof. CION has not established limits on the amount of funds it may use from available sources to make distributions. Through December 31, 2014, a portion of CION’s distributions resulted from expense support from CIG, and future distributions may result from expense support from CIG and AIM, each ...

DOWNLOAD PAPER

... improves the ability to support a higher foreign debt and reduces the foreign premium or interest differential. Finally, the last version uses the habit formation parametrization. The Habit Formation version modifies the Baseline version by assuming that the consumer’s preferences exhibit habit for ...

... improves the ability to support a higher foreign debt and reduces the foreign premium or interest differential. Finally, the last version uses the habit formation parametrization. The Habit Formation version modifies the Baseline version by assuming that the consumer’s preferences exhibit habit for ...

Chapter 18 "Saving Investment and the

... of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow. Copyright © 2004 South-Western ...

... of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow. Copyright © 2004 South-Western ...

National Grid Company plc Annual Report and Accounts 2003/04

... maintains the physical assets, develops the network to accommodate new connections/ disconnections, manages a programme of asset replacement and investment to ensure the longterm reliability of the systems. Revenue from charges for using the transmission network and charges for connections made befo ...

... maintains the physical assets, develops the network to accommodate new connections/ disconnections, manages a programme of asset replacement and investment to ensure the longterm reliability of the systems. Revenue from charges for using the transmission network and charges for connections made befo ...

Loanable Funds

... • The U.S. financial system is made up of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow. ...

... • The U.S. financial system is made up of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow. ...

Important Information about Certificates of Deposit

... withdrawing your funds prior to maturity, thus preventing you from taking advantage of the higher rate environment. Callable CDs that are paying an interest rate that is above prevailing rates may be called by the issuer and you may not be able to reinvest the proceeds at the rate you had been earni ...

... withdrawing your funds prior to maturity, thus preventing you from taking advantage of the higher rate environment. Callable CDs that are paying an interest rate that is above prevailing rates may be called by the issuer and you may not be able to reinvest the proceeds at the rate you had been earni ...

C01_Reilly1ce

... Pure Rate of Interest – Exchange rate between future consumption (future dollars) and present consumption (current dollars) • Market forces determine rate • Example: – If you can exchange $100 today for $104 next year, this rate is ...

... Pure Rate of Interest – Exchange rate between future consumption (future dollars) and present consumption (current dollars) • Market forces determine rate • Example: – If you can exchange $100 today for $104 next year, this rate is ...

The Use of Derivative Financial Instruments to

... and interest-rate swaps. They are called derivatives because they are based on (or derived from) actual (“physical”) financial instruments. For example, one type of financial future is based on 90-day bank-accepted bills; this futures contract enables the finance manager to agree, in advance, the fu ...

... and interest-rate swaps. They are called derivatives because they are based on (or derived from) actual (“physical”) financial instruments. For example, one type of financial future is based on 90-day bank-accepted bills; this futures contract enables the finance manager to agree, in advance, the fu ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... S&P 500 total return x Notional Principal Payment details on next slide ...

... S&P 500 total return x Notional Principal Payment details on next slide ...

The influence of macroeconomic developments on Austrian banks

... payments (due to rising interest rates and/or growing debt ratios) reduces the borrowers’ scope to service their debt. ...

... payments (due to rising interest rates and/or growing debt ratios) reduces the borrowers’ scope to service their debt. ...

Uncertainty, Default and Risk

... A hedge fund wants to bet that the $10M in bonds does not have default risk and is the counterparty to the pension fund’s credit default swap. The hedge fund is providing insurance and collecting a fee to do so. ...

... A hedge fund wants to bet that the $10M in bonds does not have default risk and is the counterparty to the pension fund’s credit default swap. The hedge fund is providing insurance and collecting a fee to do so. ...

N. Financial Assumptions and Discount Rate

... The literature on corporate investment decisions almost uniformly holds that the correct discount rate is the firm’s tax-adjusted cost of capital. Broadly considered, this perspective uses the cost of capital to the entity making the investment decision. While most of the literature focuses on priva ...

... The literature on corporate investment decisions almost uniformly holds that the correct discount rate is the firm’s tax-adjusted cost of capital. Broadly considered, this perspective uses the cost of capital to the entity making the investment decision. While most of the literature focuses on priva ...

M.Sc. ACTUARIAL SCIENCE

... The attendance of students for each course shall be another component of internal assessment. The minimum requirement of aggregate attendance during a semester for appearing the end semester examination shall be 75%. Condonation of shortage of attendance to a maximum of 10 days in a semester subject ...

... The attendance of students for each course shall be another component of internal assessment. The minimum requirement of aggregate attendance during a semester for appearing the end semester examination shall be 75%. Condonation of shortage of attendance to a maximum of 10 days in a semester subject ...

A Note on Unconventional Monetary Policy in HANK

... effects exactly offset the smaller partial equilibrium response. In contrast, McKay, Nakamura and Steinsson (2015) consider an alternative incomplete-market economy in which forward guidance is less effective than conventional monetary policy. Here, we follow the lead of these two papers and examin ...

... effects exactly offset the smaller partial equilibrium response. In contrast, McKay, Nakamura and Steinsson (2015) consider an alternative incomplete-market economy in which forward guidance is less effective than conventional monetary policy. Here, we follow the lead of these two papers and examin ...

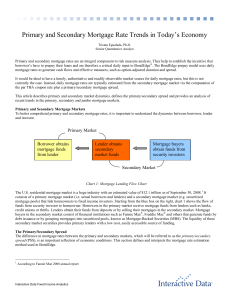

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... is usually linearly interpolated using the two TBA coupons most closely bracketing par (i.e. 100). The PSS is the servicing fee over the par TBA mortgage rate that delivers the primary lending rate. The buyer sends a monthly payment that is managed by the original lender or servicer for a fee. The r ...

... is usually linearly interpolated using the two TBA coupons most closely bracketing par (i.e. 100). The PSS is the servicing fee over the par TBA mortgage rate that delivers the primary lending rate. The buyer sends a monthly payment that is managed by the original lender or servicer for a fee. The r ...

Economics of Money, Banking, and Financial Markets, 8e

... 6.1 Risk Structure of Interest Rates 1) The risk structure of interest rates is A) the structure of how interest rates move over time. B) the relationship among interest rates of different bonds with the same maturity. C) the relationship among the term to maturity of different bonds. D) the relatio ...

... 6.1 Risk Structure of Interest Rates 1) The risk structure of interest rates is A) the structure of how interest rates move over time. B) the relationship among interest rates of different bonds with the same maturity. C) the relationship among the term to maturity of different bonds. D) the relatio ...

what was the role of monetary policy in the greek financial crisis

... Herald Tribune 2006, Economist 2011b). Problems began to emerge in Greece during the late 2000’s financial crisis and economic downturn, with the sovereign debt crisis beginning to unfold in 2010. Specifically, the government of Greece had accumulated large debts, saw declining tax revenues as a r ...

... Herald Tribune 2006, Economist 2011b). Problems began to emerge in Greece during the late 2000’s financial crisis and economic downturn, with the sovereign debt crisis beginning to unfold in 2010. Specifically, the government of Greece had accumulated large debts, saw declining tax revenues as a r ...

reported - Commerzbank

... cuts by several central banks, next week’s meeting of the Swedish central bank is eagerly anticipated. The Riksbank is worried about an inflation rate that has mainly been negative since late 2012, and about falling inflation expectations. With its key rate at zero percent since October, the central ...

... cuts by several central banks, next week’s meeting of the Swedish central bank is eagerly anticipated. The Riksbank is worried about an inflation rate that has mainly been negative since late 2012, and about falling inflation expectations. With its key rate at zero percent since October, the central ...

The Neutral Rate of Interest in Canada

... concept being used can be a source of confusion in discussions about the neutral rate. Box 1 provides an overview of the most commonly used concepts. We define the neutral rate as the real policy rate consistent with output at its potential level and inflation equal to the 2 per cent target after th ...

... concept being used can be a source of confusion in discussions about the neutral rate. Box 1 provides an overview of the most commonly used concepts. We define the neutral rate as the real policy rate consistent with output at its potential level and inflation equal to the 2 per cent target after th ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.