Finding Value in US High Yield Fixed Income

... of high yield returns is not primarily interest rates or duration, but the underlying strength of the individual issuer. While the asset class is not entirely immune to interest rate risk, it does have lower sensitivity to this variable than other fixed income assets (with approximately half the sen ...

... of high yield returns is not primarily interest rates or duration, but the underlying strength of the individual issuer. While the asset class is not entirely immune to interest rate risk, it does have lower sensitivity to this variable than other fixed income assets (with approximately half the sen ...

NBER WORKING PAPER SERIES

... 1970's. the in seen pattern —the asset tangible second the of price the in rise a and rates, interest real in drop a prices, stock in fall a to lead would sector corporate the in growth productivity lower and risk increased both that likely is it wealth, total of quarter a than more been rarely has ...

... 1970's. the in seen pattern —the asset tangible second the of price the in rise a and rates, interest real in drop a prices, stock in fall a to lead would sector corporate the in growth productivity lower and risk increased both that likely is it wealth, total of quarter a than more been rarely has ...

Domestic and International Macroeconomic Effects of

... Following persistently weak economic conditions and deflation risks, since September 2014 the euro area (EA) monetary policy rate has been set very close to zero. Such a low rate has nevertheless failed to stimulate the economy to a degree judged consistent with the price stability target. Therefore ...

... Following persistently weak economic conditions and deflation risks, since September 2014 the euro area (EA) monetary policy rate has been set very close to zero. Such a low rate has nevertheless failed to stimulate the economy to a degree judged consistent with the price stability target. Therefore ...

Monetary Policy with Interest on Reserves

... then roughly $50 billion dollars of reserves, an enormous multiplier. These promises were backed by assets. If people wanted to be paid, each issuer planned to sell or borrow against assets such as mortgage-backed securities to raise the needed cash. But asset values can fall, and issuers can fail. ...

... then roughly $50 billion dollars of reserves, an enormous multiplier. These promises were backed by assets. If people wanted to be paid, each issuer planned to sell or borrow against assets such as mortgage-backed securities to raise the needed cash. But asset values can fall, and issuers can fail. ...

Determinants of Financial Leverage in Indian Pharmaceutical Industry

... Asset structure refers to the proportion of fixed assets to total assets. Higher the proportion, higher will be the debt. Thus, these variables have a positive relationship. The relationship between leverage and asset structure in the developed and developing countries is ...

... Asset structure refers to the proportion of fixed assets to total assets. Higher the proportion, higher will be the debt. Thus, these variables have a positive relationship. The relationship between leverage and asset structure in the developed and developing countries is ...

Scrutiny November 3 2011 - Hertfordshire County Council

... How do external consultants support the Council’s treasury team? How does the economic climate impact upon treasury strategies and activities? ...

... How do external consultants support the Council’s treasury team? How does the economic climate impact upon treasury strategies and activities? ...

ECNS 313 Money and Banking Fall 2016 Course Packet Dr. Gilpin

... • Compute assets’ prices and appropriate measures of key risks. • Identify the implications, risks, and opportunities of global financial markets. • Assess responses of the economy to both monetary and fiscal policies. • Explain the nature and functions of money and the financial markets. Prerequisi ...

... • Compute assets’ prices and appropriate measures of key risks. • Identify the implications, risks, and opportunities of global financial markets. • Assess responses of the economy to both monetary and fiscal policies. • Explain the nature and functions of money and the financial markets. Prerequisi ...

Copyright © 2001 by Harcourt, Inc. All rights reserved.

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

Standardized Approach for Calculating the Solvency Buffer for

... buffer for hedgeable risks, illiquid assets and unhedgeable risks. 17) All calibrations of the calculations to determine the solvency buffer in this paper are those which will be used as the base scenario in the quantitative impact study. They will be adjusted based on the results of that study. Mea ...

... buffer for hedgeable risks, illiquid assets and unhedgeable risks. 17) All calibrations of the calculations to determine the solvency buffer in this paper are those which will be used as the base scenario in the quantitative impact study. They will be adjusted based on the results of that study. Mea ...

Interest rate volatility in 1980 - Federal Reserve Bank of Chicago

... 1980, reaching record highs in early spring, then plummeting until midsummer, only to rise above their previous peaks by late fall. Interest rates were more variable not only in a cyclical sense, but also in their weekly and daily behavior. It is unlikely that any single factor was responsible for t ...

... 1980, reaching record highs in early spring, then plummeting until midsummer, only to rise above their previous peaks by late fall. Interest rates were more variable not only in a cyclical sense, but also in their weekly and daily behavior. It is unlikely that any single factor was responsible for t ...

CHAP1.WP (Word5)

... For now, explain that high-powered money (currency and bank reserves) is simply the base component of the money supply that the Fed can influence. The detailed analysis of the money supply and of the various instruments of monetary control available to the Federal Reserve is presented in Chapter 13. ...

... For now, explain that high-powered money (currency and bank reserves) is simply the base component of the money supply that the Fed can influence. The detailed analysis of the money supply and of the various instruments of monetary control available to the Federal Reserve is presented in Chapter 13. ...

Inflation Risk Management in Project Finance

... The main findings are applicable also to Project Finance (PF), a long-term highly leveraged investment, based on discounted and segregated cash flows. For a statistic of the main PF applications, see Dla Piper[6] and http://online. ...

... The main findings are applicable also to Project Finance (PF), a long-term highly leveraged investment, based on discounted and segregated cash flows. For a statistic of the main PF applications, see Dla Piper[6] and http://online. ...

Money market instruments

... together with interest. Simple interest is applied, usually calculated using the convention ACT/365. 1.4 A time deposit could have a more complex design of interest payments over the course of its life. For example, a one-year deposit could earn interest at the end of each month. In such a case, the ...

... together with interest. Simple interest is applied, usually calculated using the convention ACT/365. 1.4 A time deposit could have a more complex design of interest payments over the course of its life. For example, a one-year deposit could earn interest at the end of each month. In such a case, the ...

sc5_h - Homework Market

... 10. Which of the following statements is FALSE? The internal rate of return (IRR) of an investment in a zero-coupon bond is the rate of return that investors will earn on their money if they buy a default free bond at its current price and hold it to maturity. The yield to maturity of a bond is the ...

... 10. Which of the following statements is FALSE? The internal rate of return (IRR) of an investment in a zero-coupon bond is the rate of return that investors will earn on their money if they buy a default free bond at its current price and hold it to maturity. The yield to maturity of a bond is the ...

Plain Talk Guide

... Moody’s, evaluate the ability of bond issuers to meet their interest and principal repayments. These agencies assign credit ratings ranging from Aaa or AAA (highest quality) to C or D (lowest quality). Bond credit ratings are important because they indicate the likelihood that an issuer will fail to ...

... Moody’s, evaluate the ability of bond issuers to meet their interest and principal repayments. These agencies assign credit ratings ranging from Aaa or AAA (highest quality) to C or D (lowest quality). Bond credit ratings are important because they indicate the likelihood that an issuer will fail to ...

harnessing fixed-income returns through the cycle

... Investing in a low term premium environment. ...

... Investing in a low term premium environment. ...

Glossary of Money Market Terms

... A method of valuing assets, based on the acquisition cost, which may include a discount or premium to the face value, adjusted over the life of the security to account for any discount or premium, such that amortized cost equals the principal value at maturity. ...

... A method of valuing assets, based on the acquisition cost, which may include a discount or premium to the face value, adjusted over the life of the security to account for any discount or premium, such that amortized cost equals the principal value at maturity. ...

Chapter 6 Bonds, Bond Prices and the Determination of Interest Rates

... The Bond Market and the Determination of Interest Rates • How are bond prices determined and why do they change? • We must look at bond supply, bond demand, and equilibrium prices. • First we will restrict discussion to the quantity of bonds outstanding - stock of bonds. • Secondly, we will talk ab ...

... The Bond Market and the Determination of Interest Rates • How are bond prices determined and why do they change? • We must look at bond supply, bond demand, and equilibrium prices. • First we will restrict discussion to the quantity of bonds outstanding - stock of bonds. • Secondly, we will talk ab ...

Chapter 6 Bonds, Bond Prices and the Determination of Interest Rates

... The Bond Market and the Determination of Interest Rates • How are bond prices determined and why do they change? • We must look at bond supply, bond demand, and equilibrium prices. • First we will restrict discussion to the quantity of bonds outstanding - stock of bonds. • Secondly, we will talk ab ...

... The Bond Market and the Determination of Interest Rates • How are bond prices determined and why do they change? • We must look at bond supply, bond demand, and equilibrium prices. • First we will restrict discussion to the quantity of bonds outstanding - stock of bonds. • Secondly, we will talk ab ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... annualized basis. Return on average assets and equity measure how effectively an entity utilizes its total resources and capital, respectively. Both the return on average assets and the return on average equity ratios increased for the quarter and six month periods compared to the same periods a yea ...

... annualized basis. Return on average assets and equity measure how effectively an entity utilizes its total resources and capital, respectively. Both the return on average assets and the return on average equity ratios increased for the quarter and six month periods compared to the same periods a yea ...

Sec 6, Mod 32, 33, 34

... •Seignorage (revenue generated by the FEDs right to print money) •Inflation Tax (financial loss of value suffered by holders of cash and fixed-rate bonds, as well those on fixed income (not indexed to inflation), due to the effects of inflation) ...

... •Seignorage (revenue generated by the FEDs right to print money) •Inflation Tax (financial loss of value suffered by holders of cash and fixed-rate bonds, as well those on fixed income (not indexed to inflation), due to the effects of inflation) ...

Financial Stability and Monetary Policy Erdem BAŞÇI Hakan KARA

... financial stability, credit growth, and asset prices. In fact, more and more studies have tackled the question of designing appropriate macroprudential instruments to deal with financial stability. This new approach of multiple instrument framework admits that the economy is more complicated than i ...

... financial stability, credit growth, and asset prices. In fact, more and more studies have tackled the question of designing appropriate macroprudential instruments to deal with financial stability. This new approach of multiple instrument framework admits that the economy is more complicated than i ...

Supplementary Paper Series for the "Comprehensive Assessment

... Further, a decline in real interest rates will boost private consumption by households. In Q-JEM, private consumption is mainly linked to labor income, other sources of income, and wealth effects driven by changes in the value of financial assets. A decline in real interest rates increases firms' p ...

... Further, a decline in real interest rates will boost private consumption by households. In Q-JEM, private consumption is mainly linked to labor income, other sources of income, and wealth effects driven by changes in the value of financial assets. A decline in real interest rates increases firms' p ...

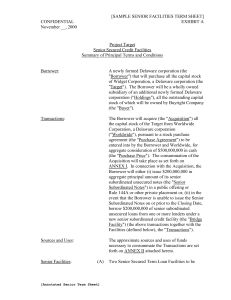

Senior Loan Term Sheet

... The above-described mandatory prepayments shall be allocated between the Term Loan Facilities pro rata, subject to the provisions set forth below under the caption "Special Application Provisions". Within each Term Loan Facility, mandatory prepayments shall be applied, first, to the next installment ...

... The above-described mandatory prepayments shall be allocated between the Term Loan Facilities pro rata, subject to the provisions set forth below under the caption "Special Application Provisions". Within each Term Loan Facility, mandatory prepayments shall be applied, first, to the next installment ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.