Minutes from the meeting of the Financial Stability Council held on

... noted that prices of commercial property are rising and that bank lending has increased in this sector, which needs to be monitored going forward. In addition to their bank loans, many households are also indirectly in debt via tenant-owner associations’ loans. The authorities also noted that the gl ...

... noted that prices of commercial property are rising and that bank lending has increased in this sector, which needs to be monitored going forward. In addition to their bank loans, many households are also indirectly in debt via tenant-owner associations’ loans. The authorities also noted that the gl ...

Lender of last resort: Put it on the agenda!

... channelled mostly to the US (and arguably sowed the seeds of the dotcoms and subprime crises), but in Latin America, for example, growth stopped for several years. Emerging markets in Asia and Latin America learned the lesson and sought protection in sizable accumulation of international reserves an ...

... channelled mostly to the US (and arguably sowed the seeds of the dotcoms and subprime crises), but in Latin America, for example, growth stopped for several years. Emerging markets in Asia and Latin America learned the lesson and sought protection in sizable accumulation of international reserves an ...

Chapter 23

... prices up • A fall in interest rate target it drives the mortgage rate down leading to higher demand for residential housing, driving up the prices of existing homes ...

... prices up • A fall in interest rate target it drives the mortgage rate down leading to higher demand for residential housing, driving up the prices of existing homes ...

types of investments - hrsbstaff.ednet.ns.ca

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

Public Guarantees on Bank Bonds: Effectiveness and Costs

... has heightened fears for the soundness of heavily indebted borrowers, public and private alike Concerns are emerging that the phase of weakness will persist, in particular as a consequence of the deleveraging process of the public (necessary consolidation measures) and private sectors (banks, but ...

... has heightened fears for the soundness of heavily indebted borrowers, public and private alike Concerns are emerging that the phase of weakness will persist, in particular as a consequence of the deleveraging process of the public (necessary consolidation measures) and private sectors (banks, but ...

www.thegeographeronline.net

... educational spending as an investment in the future. • Pollution and environmental damage are counted as costs. Long term negative adjusted savings suggest an economy is on an unsustainable path. Poor territories are visible only if they are getting very much poorer. • 75% of negative savings in 200 ...

... educational spending as an investment in the future. • Pollution and environmental damage are counted as costs. Long term negative adjusted savings suggest an economy is on an unsustainable path. Poor territories are visible only if they are getting very much poorer. • 75% of negative savings in 200 ...

MOD B - SBH SC/ST WELFARE

... • A lien is the right of a creditor in possession of goods, securities or any other assets belonging to the debtor to retain them until the debt is repaid, provided that there is no contract express or implied, to the contrary. It is a right to retain possession of specific goods or securities or ot ...

... • A lien is the right of a creditor in possession of goods, securities or any other assets belonging to the debtor to retain them until the debt is repaid, provided that there is no contract express or implied, to the contrary. It is a right to retain possession of specific goods or securities or ot ...

Weekly Report 30th November 2014

... Company’s market capitalisation is $69.6bn. Ivan Glasenberg, diamond-hard Glencore’s CEO, executed the highly successful acquisition of Xstrata and in July personally approached Rio Tinto. Rio Tinto is a British-Australian mining giant with a market capitalization of $88bn. It is also currently the ...

... Company’s market capitalisation is $69.6bn. Ivan Glasenberg, diamond-hard Glencore’s CEO, executed the highly successful acquisition of Xstrata and in July personally approached Rio Tinto. Rio Tinto is a British-Australian mining giant with a market capitalization of $88bn. It is also currently the ...

The Power of Many” Helps Main Street Banks Offer Services Too

... in the industry that is helping community banks attract deposits once held at large national and regional banks. New Basel III Liquidity Coverage Ratio (LCR) requirements are starting to affect the behavior of big banks. These LCR requirements, which came about as a result of the financial crisis, a ...

... in the industry that is helping community banks attract deposits once held at large national and regional banks. New Basel III Liquidity Coverage Ratio (LCR) requirements are starting to affect the behavior of big banks. These LCR requirements, which came about as a result of the financial crisis, a ...

here

... Reduced wealth of the bank shareholders Rapid fall in money supply (bank failures lead to a withdrawal of currency from the financial system) Deflationary spiral: Low prices lead to lower production, that leads to lower wages and demand, ultimately to a further decrease in prices But this ex ...

... Reduced wealth of the bank shareholders Rapid fall in money supply (bank failures lead to a withdrawal of currency from the financial system) Deflationary spiral: Low prices lead to lower production, that leads to lower wages and demand, ultimately to a further decrease in prices But this ex ...

Layout Bologna

... Valuations of systemically large banks are lower when located in countries with weaker public finances. ...

... Valuations of systemically large banks are lower when located in countries with weaker public finances. ...

22 - The Citadel

... Federal Reserve can serve as a substitute for deposit insurance. The Fed can act as a lender of last resort in two ways. It can either increase advances or make open market purchases. To increase advances, the Fed decreases the discount rate so that banks find it more attractive to borrow. The Fed c ...

... Federal Reserve can serve as a substitute for deposit insurance. The Fed can act as a lender of last resort in two ways. It can either increase advances or make open market purchases. To increase advances, the Fed decreases the discount rate so that banks find it more attractive to borrow. The Fed c ...

Market Update: 3rd Quarter (2015) On a global basis, stocks

... As I am writing this market update, the September jobs report was released (Friday October 2). The topline number for job creation was a big disappointment … a real surprise. This appears to be the economic equivalent of a punch to the gut. The Dow Industrials reacted by dropping 200 points at the o ...

... As I am writing this market update, the September jobs report was released (Friday October 2). The topline number for job creation was a big disappointment … a real surprise. This appears to be the economic equivalent of a punch to the gut. The Dow Industrials reacted by dropping 200 points at the o ...

Economics and Moral Sentiments: The Case of Moral Hazard

... The problem: need to rebuild trust, to create a climate of confidence, in banks and central banks Prevent narrow moral hazard by simple regulatory restrictions in line with traditional banking culture: prohibit some activities (eg proprietary trading) and apply simple regulations (eg liquidity r ...

... The problem: need to rebuild trust, to create a climate of confidence, in banks and central banks Prevent narrow moral hazard by simple regulatory restrictions in line with traditional banking culture: prohibit some activities (eg proprietary trading) and apply simple regulations (eg liquidity r ...

Negative Interest Rates Spread Worldwide

... It depends. In the cases of interest rate targets set by central banks like the E.C.B. and Swedish Riksbank, they set a negative target rate for banks, and banks in turn pass it along to their customers. The E.C.B., for example, currently has a negative 0.3 percent rate, meaning that when banks depo ...

... It depends. In the cases of interest rate targets set by central banks like the E.C.B. and Swedish Riksbank, they set a negative target rate for banks, and banks in turn pass it along to their customers. The E.C.B., for example, currently has a negative 0.3 percent rate, meaning that when banks depo ...

200 kb PowerPoint presentation

... Firms that could roll over external debt were less cyclical Profit as a share of assets Percent ...

... Firms that could roll over external debt were less cyclical Profit as a share of assets Percent ...

Kenya February 2017 Markets update PDF

... Short-term interest rates remained stable in February. The 91 day and 182 day Treasury bill rates averaged 8.6% and 10.5% respectively, same as January 2017. The 364 day Treasury bill rate declined marginally to average 10.9% compared to 11.0%% previously. Prior, to non-auction of the 182 day Tenor, ...

... Short-term interest rates remained stable in February. The 91 day and 182 day Treasury bill rates averaged 8.6% and 10.5% respectively, same as January 2017. The 364 day Treasury bill rate declined marginally to average 10.9% compared to 11.0%% previously. Prior, to non-auction of the 182 day Tenor, ...

National Banking Acts of 1863 and 1864 - mrs. la ferney

... Despite these private or state-sponsored efforts at reform, the state banking system still exhibited the undesirable properties enumerated earlier. The National Banking Acts of 1863 and 1864 were attempts to assert some degree of federal control over the banking system without the formation of anoth ...

... Despite these private or state-sponsored efforts at reform, the state banking system still exhibited the undesirable properties enumerated earlier. The National Banking Acts of 1863 and 1864 were attempts to assert some degree of federal control over the banking system without the formation of anoth ...

Riksbank will most likely revise its repo rate - Nordea e

... It would have the possibility of both keep rates down and weakening the currency. ...

... It would have the possibility of both keep rates down and weakening the currency. ...

effective interest rate

... purchasing power over time. A store of value is used to save purchasing power from the time income is received until the time it is spent. Money is not unique as a store of value; any asset-whether money, stocks, bonds, land-can be used of store of value….but… …it relates to the important economic c ...

... purchasing power over time. A store of value is used to save purchasing power from the time income is received until the time it is spent. Money is not unique as a store of value; any asset-whether money, stocks, bonds, land-can be used of store of value….but… …it relates to the important economic c ...

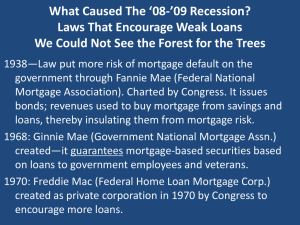

What Caused This Mess? Bad Laws Built Up Over Time

... Insurance companies, AIG, insure the purchase of the SIVs and other mortgage products by “credit default swaps.” No loss possible! Hedge funds take positions on mortgages—derivatives. Those on the wrong side took huge losses. Lehman bankrupt overnight in ‘08. Almost impossible to sort out who has wh ...

... Insurance companies, AIG, insure the purchase of the SIVs and other mortgage products by “credit default swaps.” No loss possible! Hedge funds take positions on mortgages—derivatives. Those on the wrong side took huge losses. Lehman bankrupt overnight in ‘08. Almost impossible to sort out who has wh ...

Are Multinational Banks Different

... I want to turn now to some direct evidence on internal capital markets of Austrian and German multinational banks in Eastern Europe based on original firm level survey data of 2200 direct investments in Eastern Europe of the Chair of International Economics of the University of Munich.1The data are ...

... I want to turn now to some direct evidence on internal capital markets of Austrian and German multinational banks in Eastern Europe based on original firm level survey data of 2200 direct investments in Eastern Europe of the Chair of International Economics of the University of Munich.1The data are ...

Financial regulation and the invisible hand

... money at risk. These shareholders have a substantial financial incentive to monitor the bank’s activities and to insist on changes if they are dissatisfied. Bank managers are also quite aware that a low share price could invite a hostile takeover, an outcome they usually want to avoid. The incentive ...

... money at risk. These shareholders have a substantial financial incentive to monitor the bank’s activities and to insist on changes if they are dissatisfied. Bank managers are also quite aware that a low share price could invite a hostile takeover, an outcome they usually want to avoid. The incentive ...

SU12_Econ 2630_Study..

... -How the FED changes interest rates by changing the money supply -Open market operations -Discount window lending (the discount rate) -Reserve requirements -The Taylor Rule -The liquidity trap Financial Economics -Bonds -The price of bonds and its relationship with interest rates -Stocks -Dividends ...

... -How the FED changes interest rates by changing the money supply -Open market operations -Discount window lending (the discount rate) -Reserve requirements -The Taylor Rule -The liquidity trap Financial Economics -Bonds -The price of bonds and its relationship with interest rates -Stocks -Dividends ...

1930: The Federal Reserve during the Great Depression

... Federal Reserve System: The central bank of the United States. It is responsible for controlling the money supply of our nation, and includes serving as a bank for all other banks and a bank for the U.S. Government. Central Bank: A bank that regulates the money supply for a nation and oversees the o ...

... Federal Reserve System: The central bank of the United States. It is responsible for controlling the money supply of our nation, and includes serving as a bank for all other banks and a bank for the U.S. Government. Central Bank: A bank that regulates the money supply for a nation and oversees the o ...