Wimpy - Kapstream

... the currency game as prior structural and banking reforms promote greater growth prospects – the USD should continue its rally. In today’s environment, bond investors have two choices: 1) accept lower and lower yields and returns, or 2) take more risks. The high yield, emerging market, bank loan and ...

... the currency game as prior structural and banking reforms promote greater growth prospects – the USD should continue its rally. In today’s environment, bond investors have two choices: 1) accept lower and lower yields and returns, or 2) take more risks. The high yield, emerging market, bank loan and ...

The Roaring Twenties to The Great Depression

... to make a quick profit. This works during a “bull” market but not during a “bear”. ...

... to make a quick profit. This works during a “bull” market but not during a “bear”. ...

Producing Liquidity

... • Suggestion: critics of the SNA argue that it overstates the share of GDP originated by banks; primary service liquidity is a justification (different from the asset pricing basis they use) for their approach to output measurement from the deposit liabilities of banks, but only regarding these liqu ...

... • Suggestion: critics of the SNA argue that it overstates the share of GDP originated by banks; primary service liquidity is a justification (different from the asset pricing basis they use) for their approach to output measurement from the deposit liabilities of banks, but only regarding these liqu ...

The Central Bank Report on the Financial System

... Commission) are working on the regulatory framework for their implementation, and this is expected to become effective in the opening months of 2015. In general, implementation is not predicted to have a significant effect on the banking system, as most institutions already fully satisfy the Liquidi ...

... Commission) are working on the regulatory framework for their implementation, and this is expected to become effective in the opening months of 2015. In general, implementation is not predicted to have a significant effect on the banking system, as most institutions already fully satisfy the Liquidi ...

INFORMATION AND COMMUNICATIONS UNIVERSITY SCHOOL

... affect the internal financing of the business and hamper its growth contributing to low economic activity in the market IS-LM Model Showing Effects of Stock Market Crash ...

... affect the internal financing of the business and hamper its growth contributing to low economic activity in the market IS-LM Model Showing Effects of Stock Market Crash ...

Twenty years of inflation targeting 1 Introduction

... to the global macroeconomic crisis was the boom and subsequent bust of the US housing market. The boom was associated with the development of new financial securities often backed by housing mortgages. These securities facilitated an increase in mortgage debt by US households, and enabled financial ...

... to the global macroeconomic crisis was the boom and subsequent bust of the US housing market. The boom was associated with the development of new financial securities often backed by housing mortgages. These securities facilitated an increase in mortgage debt by US households, and enabled financial ...

Lecture 11

... interference • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Financial cycle – prolonged QE and low interest rates may sow the seeds for the next asset bubble • Excess reserves – during crisis and due to QE banks hold large excess reserves in ...

... interference • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Financial cycle – prolonged QE and low interest rates may sow the seeds for the next asset bubble • Excess reserves – during crisis and due to QE banks hold large excess reserves in ...

Document

... • Inflation is the increase of asset price. • In a high inflation environment, asset price increases rapidly. For those asset rich entities, high inflation means their asset value increase rapidly. Hence their share price should increase instead of decreasing. • Why inflation is generally considered ...

... • Inflation is the increase of asset price. • In a high inflation environment, asset price increases rapidly. For those asset rich entities, high inflation means their asset value increase rapidly. Hence their share price should increase instead of decreasing. • Why inflation is generally considered ...

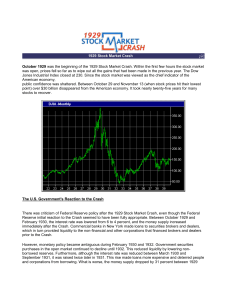

1929 Stock Market Crash ¡@ October 1929 was the beginning of the

... At this time there were no effective legal guidelines on the buying and selling of stock. Free from legal guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on credit. Confident that a given st ...

... At this time there were no effective legal guidelines on the buying and selling of stock. Free from legal guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on credit. Confident that a given st ...

FIN 331 Chapter 1

... throughout their entire market, operate depository facilities in certain neighborhoods, and collect data about lending habits to be periodically reported to federal supervisory agencies. These agencies use CRA ratings when evaluating applications for mergers and ...

... throughout their entire market, operate depository facilities in certain neighborhoods, and collect data about lending habits to be periodically reported to federal supervisory agencies. These agencies use CRA ratings when evaluating applications for mergers and ...

Should the Fed React to the Stock Market?

... market directly influenced the conduct of U.S. monetary policy. In one notable instance (February 1994), the transcripts suggest that FOMC members were worried that raising the funds rate by 50 basis points might trigger a crash in the stock market, which was thought to be overvalued at the time. In ...

... market directly influenced the conduct of U.S. monetary policy. In one notable instance (February 1994), the transcripts suggest that FOMC members were worried that raising the funds rate by 50 basis points might trigger a crash in the stock market, which was thought to be overvalued at the time. In ...

Niroshan Senavirathne.pmd

... (bulk of the core deposits) would have been a possible contributing factor for the higher spreads of interests. Theoretically, changes in the T-bill rate are passed on to the deposit and lending rates of the banks. Greater the inelasticity of deposits, the less compelled a bank would be to pass on t ...

... (bulk of the core deposits) would have been a possible contributing factor for the higher spreads of interests. Theoretically, changes in the T-bill rate are passed on to the deposit and lending rates of the banks. Greater the inelasticity of deposits, the less compelled a bank would be to pass on t ...

Financial system

... Municipal bonds (issued by city/local) Govt savings bonds Treasury bonds (30-yr maturity) ...

... Municipal bonds (issued by city/local) Govt savings bonds Treasury bonds (30-yr maturity) ...

Q1 2017 Newsletter FINAL

... hikes remain the same and have since reacted as though the Fed had cut rates. This is not surprising as inflation has been almost nonexistent for years as the U.S. economy has been dogged by low productivity, worsening demographics and decreased demand worldwide. A certain amount of skepticism may b ...

... hikes remain the same and have since reacted as though the Fed had cut rates. This is not surprising as inflation has been almost nonexistent for years as the U.S. economy has been dogged by low productivity, worsening demographics and decreased demand worldwide. A certain amount of skepticism may b ...

Market making in the UK Power Market Dear all I am writing

... have confined our response solely to the issue of how to inject greater liquidity into the UK power market. We, like OFGEM, recognise that the low level of liquidity in the UK power market has to be addressed as a matter of urgency. We would, however, urge OFGEM to consider the option of a market ma ...

... have confined our response solely to the issue of how to inject greater liquidity into the UK power market. We, like OFGEM, recognise that the low level of liquidity in the UK power market has to be addressed as a matter of urgency. We would, however, urge OFGEM to consider the option of a market ma ...

`Tis Only My Opinion

... markets around the world were seizing up and the 1 month LIBOR-OIS spread had begun to go parabolic. The commercial paper market was in dire straits and had seized. When AIG went down, the financial system was in serious trouble. Within days, Washington Mutual and Wachovia were on the ropes and Trea ...

... markets around the world were seizing up and the 1 month LIBOR-OIS spread had begun to go parabolic. The commercial paper market was in dire straits and had seized. When AIG went down, the financial system was in serious trouble. Within days, Washington Mutual and Wachovia were on the ropes and Trea ...

BR Business Review Focus on the real estate market 21.11.2012

... -Distress market start to appear (willing buyer/willing seller) -Market in Euro (real estate, cars, bills for telephony) ...

... -Distress market start to appear (willing buyer/willing seller) -Market in Euro (real estate, cars, bills for telephony) ...

Factors That Affect the Rate of Return on an Investment

... Factors That Affect the T009-04.04 Rate of Return on an Investment • Risk - Chance of loss. • Rate of Return (yield) – Amount of money the investment earns. – Compounding frequency is the interest computed on the amount saved plus the interest previously earned. ...

... Factors That Affect the T009-04.04 Rate of Return on an Investment • Risk - Chance of loss. • Rate of Return (yield) – Amount of money the investment earns. – Compounding frequency is the interest computed on the amount saved plus the interest previously earned. ...

Do financial crashes have anything in common?

... Federal Reserve started buying bonds to move money into the economy. Eventually, panic started to spread and by February 1933 banks across the country began closing their doors. Interior banks of the Midwest started calling on Eastern banks to retrieve their deposits. This stripped the Eastern banks ...

... Federal Reserve started buying bonds to move money into the economy. Eventually, panic started to spread and by February 1933 banks across the country began closing their doors. Interior banks of the Midwest started calling on Eastern banks to retrieve their deposits. This stripped the Eastern banks ...

Financial Intermediation Services Indirectly Measured (FISIM)

... which is the effect that large intrabank flows have on the reference rate. As London is a major financial centre, there are sizeable intrabank loans and deposits, which are often just used for liquidity/cash flow management purposes, rather than reflecting true funding. The associated interest does ...

... which is the effect that large intrabank flows have on the reference rate. As London is a major financial centre, there are sizeable intrabank loans and deposits, which are often just used for liquidity/cash flow management purposes, rather than reflecting true funding. The associated interest does ...

Financial Crises & Impact on Indian Banks

... rather than trading products Complex synthetic derivative not permitted; will be introduced as & when effective Risk Management set up in place ...

... rather than trading products Complex synthetic derivative not permitted; will be introduced as & when effective Risk Management set up in place ...

Chapter 1 and Chapter 2 Notes

... Securities = stocks and bonds – claim to future income or assets Stocks = ownership, share in profits and losses Bonds = bond holders are creditors (lenders to) of the bond issuers. Interest rates = the cost of money Foreign exchange market = when entities (buyers and sellers) from different countri ...

... Securities = stocks and bonds – claim to future income or assets Stocks = ownership, share in profits and losses Bonds = bond holders are creditors (lenders to) of the bond issuers. Interest rates = the cost of money Foreign exchange market = when entities (buyers and sellers) from different countri ...

Credit Crunch 2007-2008

... important to fail and structured a $150 billion deal (originally set at $85 billion and increased two weeks later to $123 billion), consisting of $60 billion of loans, $40 billion of preferred stock investment, and $50 billion of capital that will enable AIG to meet collateral and other cash obligat ...

... important to fail and structured a $150 billion deal (originally set at $85 billion and increased two weeks later to $123 billion), consisting of $60 billion of loans, $40 billion of preferred stock investment, and $50 billion of capital that will enable AIG to meet collateral and other cash obligat ...

Download pdf | 5989 KB |

... loans due to regulatory restricLons b. RestricLons on real estate loans falls short of meeLng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

... loans due to regulatory restricLons b. RestricLons on real estate loans falls short of meeLng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

The Role and functions of a stock exchange

... Short-Term Debt and the Money Market Commercial Paper Short-term debt instruments, usually unsecured, issued by corporations. Involve credit risk because the financial health of a corporation can deteriorate and jeopardize the repayment of the amount borrowed. – Sold at a discount from their face v ...

... Short-Term Debt and the Money Market Commercial Paper Short-term debt instruments, usually unsecured, issued by corporations. Involve credit risk because the financial health of a corporation can deteriorate and jeopardize the repayment of the amount borrowed. – Sold at a discount from their face v ...