the great depression - Northwest ISD Moodle

... bank failures in late 1920s (farmers) many had small reserves low margins encouraged speculative investment by banks, corporations, and individual investors ...

... bank failures in late 1920s (farmers) many had small reserves low margins encouraged speculative investment by banks, corporations, and individual investors ...

New Logo Newsletter 114.pub - Lodestar Investment Counsel

... ranking as the seventh longest since 1928. Stock market bulls argue the following: valuations, while elevated, are not in the stratosphere, state and federal government deficits are shrinking, consumer balance sheets are on the mend, and the nation is on the road to energy independence. Bears counte ...

... ranking as the seventh longest since 1928. Stock market bulls argue the following: valuations, while elevated, are not in the stratosphere, state and federal government deficits are shrinking, consumer balance sheets are on the mend, and the nation is on the road to energy independence. Bears counte ...

q1 2017 global market update

... Brexit, the US presidential election result, or even Leicester City winning the Premier League? Our investment philosophy relies on what we know, not on what we think we know. What we know is that the US stock market has averaged an annual rate of return of 8.38% for the 20-year period between 1996 ...

... Brexit, the US presidential election result, or even Leicester City winning the Premier League? Our investment philosophy relies on what we know, not on what we think we know. What we know is that the US stock market has averaged an annual rate of return of 8.38% for the 20-year period between 1996 ...

Money and Monetary Policy

... increase borrowing costs • Lower Interest Rates to increase borrowing costs ...

... increase borrowing costs • Lower Interest Rates to increase borrowing costs ...

LCwasR47_en.pdf

... More importantly, markets themselves are more international, with technology making it easy to trade across asset classes and across continents. According to Authers, it makes less sense to talk about coupled markets than to refer to one homogeneous market. The U.S. still has the world’ s largest ec ...

... More importantly, markets themselves are more international, with technology making it easy to trade across asset classes and across continents. According to Authers, it makes less sense to talk about coupled markets than to refer to one homogeneous market. The U.S. still has the world’ s largest ec ...

Investment Perspectives

... and therefore the constraints to loosen policy are too tight, otherwise policymakers’ risk exploding the financial system. The debt China has incurred is mainly because savings need to be transformed into investment. Therefore, a country with a high domestic savings rate probably also has a high deb ...

... and therefore the constraints to loosen policy are too tight, otherwise policymakers’ risk exploding the financial system. The debt China has incurred is mainly because savings need to be transformed into investment. Therefore, a country with a high domestic savings rate probably also has a high deb ...

The Impact of the Asian Crisis on the Hong Kong banking sector

... Kong is one of the few markets where it is possible to do so. This will have the benefit, from the local banks’ point of view, that it will push up lending margins; and over time this will attract more banks back into the market and encourage them to lend. But the appetite for new lending is likely ...

... Kong is one of the few markets where it is possible to do so. This will have the benefit, from the local banks’ point of view, that it will push up lending margins; and over time this will attract more banks back into the market and encourage them to lend. But the appetite for new lending is likely ...

Note

... Chunghwa Post Corporation, and money market mutual funds, but do not comprise OBUs (offshore banking units). Net Foreign Assets are based on book value net of claims on and liabilities to nonresidents. Claims on Central Bank consist of all deposits, required reserves and redeposits placed with the C ...

... Chunghwa Post Corporation, and money market mutual funds, but do not comprise OBUs (offshore banking units). Net Foreign Assets are based on book value net of claims on and liabilities to nonresidents. Claims on Central Bank consist of all deposits, required reserves and redeposits placed with the C ...

SWISS MONETARY POLICY AND THE CRISIS

... • First, it substantially expanded its balance sheet (quantitative easing, QE), which tripled by May 2010. Second, it changed the composition of central bank assets (credit easing, CE). Both measures were aimed at affecting relative prices of financial assets, either indirectly through QE or directl ...

... • First, it substantially expanded its balance sheet (quantitative easing, QE), which tripled by May 2010. Second, it changed the composition of central bank assets (credit easing, CE). Both measures were aimed at affecting relative prices of financial assets, either indirectly through QE or directl ...

To view this press release as a file

... markedly accommodative in most major markets, and became even more accommodative in most of them. Conversely, the US Federal Reserve decided in December to raise its benchmark rate to 0.5–0.75 percent. According to the median estimate among members of the FOMC, the pace of rate-hiking will be slight ...

... markedly accommodative in most major markets, and became even more accommodative in most of them. Conversely, the US Federal Reserve decided in December to raise its benchmark rate to 0.5–0.75 percent. According to the median estimate among members of the FOMC, the pace of rate-hiking will be slight ...

October means Halloween, but we needn`t fear market uncertainty

... to be inching upward on the heels of negotiations between OPEC members to reduce output. If oil prices don’t send shivers up your spine, there always is the specter of the Chinese economy, although some recent indicators have shown improving growth outlook for the Chinese markets. That may be so — f ...

... to be inching upward on the heels of negotiations between OPEC members to reduce output. If oil prices don’t send shivers up your spine, there always is the specter of the Chinese economy, although some recent indicators have shown improving growth outlook for the Chinese markets. That may be so — f ...

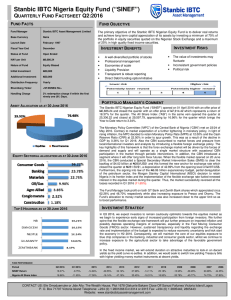

Nigerian Equity Fund - Stanbic IBTC Asset Management

... Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this f ...

... Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this f ...

No Slide Title - AmCham Romania

... The large budget deficit (around 5% of GDP) and the downward pressures on the public revenues limit the capacity of government to expand public spending in order to offset the slowdown in private aggregate demand Financing a large budget deficit is also difficult (and costly) due to the financing co ...

... The large budget deficit (around 5% of GDP) and the downward pressures on the public revenues limit the capacity of government to expand public spending in order to offset the slowdown in private aggregate demand Financing a large budget deficit is also difficult (and costly) due to the financing co ...

Market discipline, disclosure and moral hazard in banking

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

Monetary Policy

... The Principal Liability is Federal Reserve Notes Outstanding These nearly balance because the bonds were acquired putting the dollars into circulation The Fed’s available stock of bonds could be used to remove the dollars from circulation Bonds expire – dollars don’t ...

... The Principal Liability is Federal Reserve Notes Outstanding These nearly balance because the bonds were acquired putting the dollars into circulation The Fed’s available stock of bonds could be used to remove the dollars from circulation Bonds expire – dollars don’t ...

Presentation to the Phoenix Chapter of Lambda Alpha International Phoenix, AZ

... Financial conditions have improved markedly in some respects, but many financial institutions are still hobbled with bad loans. The outlook for consumer spending is in doubt because households remain burdened with debt, and they have taken enormous hits to their wealth from declines in house and sto ...

... Financial conditions have improved markedly in some respects, but many financial institutions are still hobbled with bad loans. The outlook for consumer spending is in doubt because households remain burdened with debt, and they have taken enormous hits to their wealth from declines in house and sto ...

chap008-- - MCST-CS

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

Exam practice answers 9

... less likely to borrow in order to buy big-ticket items such as cars. People will also find they have to pay more for their mortgages, so there is less money left over to spend on consumer goods and services. Firms are also less likely to borrow less to invest because the return made on investment wo ...

... less likely to borrow in order to buy big-ticket items such as cars. People will also find they have to pay more for their mortgages, so there is less money left over to spend on consumer goods and services. Firms are also less likely to borrow less to invest because the return made on investment wo ...

Chapter 8: Monetary Theory and Policy Summary of Key Lessons

... government increases the interest rate and reduces borrowing by households and businesses. Monetizing the Debt • Increasing the money supply by the Federal Reserve to accommodate federal ...

... government increases the interest rate and reduces borrowing by households and businesses. Monetizing the Debt • Increasing the money supply by the Federal Reserve to accommodate federal ...

Thoughts on the Federal Reserve System`s Exit Strategy

... A second concern is the risk inherent to using short-term claims to fund long-term investments. When long-term investments are backed by shorter-term debts that have to be rolled over—that is, they mature, and the borrower has to seek a new loan—there is real potential that the borrower will not fin ...

... A second concern is the risk inherent to using short-term claims to fund long-term investments. When long-term investments are backed by shorter-term debts that have to be rolled over—that is, they mature, and the borrower has to seek a new loan—there is real potential that the borrower will not fin ...

Risk transfer mechanisms

... – Enhancing yields: Decline in interest rates across the board in combination with lower supply of sovereigns have increased end-investors’ demand for new instruments. – Return on Capital: Deploy capital more efficiently - obtain higher risk adjusted returns. ...

... – Enhancing yields: Decline in interest rates across the board in combination with lower supply of sovereigns have increased end-investors’ demand for new instruments. – Return on Capital: Deploy capital more efficiently - obtain higher risk adjusted returns. ...

2014-09-Navigator Report.indd - Clark Capital Management Group

... strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed h ...

... strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed h ...