Post-Monetarism and the New World Order: Executive Summary

... Global LLC. This is an approach to central banking in which “commercial bank leverage and balance sheets are controlled by direct government regulation rather than ...

... Global LLC. This is an approach to central banking in which “commercial bank leverage and balance sheets are controlled by direct government regulation rather than ...

PPT

... Japan’s economic system became obsolete (?) Aging population and associated problems (pension, medical care, dissaving, etc) • Snowballing fiscal debt • People’s lack of confidence in the future • The China challenge (vs. “return to Japan”) Lack of political leadership to propose solutions, convin ...

... Japan’s economic system became obsolete (?) Aging population and associated problems (pension, medical care, dissaving, etc) • Snowballing fiscal debt • People’s lack of confidence in the future • The China challenge (vs. “return to Japan”) Lack of political leadership to propose solutions, convin ...

Jamie Arimany

... (or higher) 1yr interest next year, then go for option A. If you believe that the market will not offer interest rates as high as 9.04% then fix your money in for 2 years at 7% with option B. Examples with the Forward Rate ...

... (or higher) 1yr interest next year, then go for option A. If you believe that the market will not offer interest rates as high as 9.04% then fix your money in for 2 years at 7% with option B. Examples with the Forward Rate ...

The Stock Market Crash, the Great Depression, and the New Deal

... The United States emerged from World War I as a global power. Since American business was booming during the early twenties, great optimism existed about the future of the American economy and a stock market boom resulted. These factors led to an excessive (too much) expansion of credit, which in tu ...

... The United States emerged from World War I as a global power. Since American business was booming during the early twenties, great optimism existed about the future of the American economy and a stock market boom resulted. These factors led to an excessive (too much) expansion of credit, which in tu ...

Stylized facts from recent worldwide experience

... should be with tradable/bankable instruments, not vague IOUs consistent with safe-and-sound banking ...

... should be with tradable/bankable instruments, not vague IOUs consistent with safe-and-sound banking ...

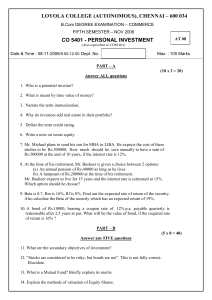

CO 5401 - Loyola College

... 10. A bond of Rs.10000, bearing a coupon rate of 12% p.a. payable quarterly is redeemable after 2.5 years at par. What will be the value of bond, if the required rate of return is 16% ? PART – B (5 x 8 = 40) Answer any FIVE questions 11. What are the secondary objectives of investment? 12. “Stocks a ...

... 10. A bond of Rs.10000, bearing a coupon rate of 12% p.a. payable quarterly is redeemable after 2.5 years at par. What will be the value of bond, if the required rate of return is 16% ? PART – B (5 x 8 = 40) Answer any FIVE questions 11. What are the secondary objectives of investment? 12. “Stocks a ...

The Bull Market

... – Bonds - Governments, states, corporations and many other types of institutions sell bonds. It is a promise to repay the principal or cost price along with the interest on a specified or maturity date. ...

... – Bonds - Governments, states, corporations and many other types of institutions sell bonds. It is a promise to repay the principal or cost price along with the interest on a specified or maturity date. ...

MONETARY POLICY IN THE US BEFORE AND AFTER THE CRISIS

... Many depository institutions borrow or lend in bank funding markets, such as the federal funds market. Those transactions move funds from the lender's Federal Reserve account to the borrower's account but do not change the total amount of balances that the banking system holds at the Federal Reserv ...

... Many depository institutions borrow or lend in bank funding markets, such as the federal funds market. Those transactions move funds from the lender's Federal Reserve account to the borrower's account but do not change the total amount of balances that the banking system holds at the Federal Reserv ...

In search of Yield - Insight Investment

... regulation are opening up new avenues for cash investors that have historically not been available. By working with asset managers to disintermediate banks, treasurers have been given the opportunity to transact directly with non-bank counterparties, often for the first time. This is particularly pr ...

... regulation are opening up new avenues for cash investors that have historically not been available. By working with asset managers to disintermediate banks, treasurers have been given the opportunity to transact directly with non-bank counterparties, often for the first time. This is particularly pr ...

China - BCRA

... loans due to regulatory restricSons b. RestricSons on real estate loans falls short of meeSng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

... loans due to regulatory restricSons b. RestricSons on real estate loans falls short of meeSng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

Open

... some correction and at the end DSEX closed at 4326.6 points with lower investors’ activity. Turnover decreased and stood at BDT 5.5 bn which is 7.1% higher than yesterday. Among the prominent sectors Ceramics, Mutual Funds, Service & Real Estate, Miscellaneous, ...

... some correction and at the end DSEX closed at 4326.6 points with lower investors’ activity. Turnover decreased and stood at BDT 5.5 bn which is 7.1% higher than yesterday. Among the prominent sectors Ceramics, Mutual Funds, Service & Real Estate, Miscellaneous, ...

Debt Market Monitor

... Musings on longer-term inflation and interest rates After nearly exhausting the topic of a potential interest rate increase, the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate inc ...

... Musings on longer-term inflation and interest rates After nearly exhausting the topic of a potential interest rate increase, the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate inc ...

→ Market Summary → International Markets → Market and Sector

... quarter 2013. Result: gross domestic Product has clearly rebounded, climbing of 0.5% after a decline of 0.2% during the first three months of the year. It comes to the strongest progression since the first quarter 2011. This increase holds, particularly at rebound in consumption of households, which ...

... quarter 2013. Result: gross domestic Product has clearly rebounded, climbing of 0.5% after a decline of 0.2% during the first three months of the year. It comes to the strongest progression since the first quarter 2011. This increase holds, particularly at rebound in consumption of households, which ...

May 27, 2016

... Myriam El Khomri, relaxes stifling labor rules regarding the 35-hour work week and lowers protections for workers from layoffs that employers maintain make them uncompetitive on the world market. China’s central bank weakened its currency fixing to the lowest since March 2011 as the dollar strengthe ...

... Myriam El Khomri, relaxes stifling labor rules regarding the 35-hour work week and lowers protections for workers from layoffs that employers maintain make them uncompetitive on the world market. China’s central bank weakened its currency fixing to the lowest since March 2011 as the dollar strengthe ...

July 2016 Market Overview The markets provided some pre July 4

... If people were going to buy Swiss francs aggressively, then the Swiss National Bank was going to sell them aggressively. So they created a bunch of francs and then traded them for Euros. What is interesting is that it isn’t just Euros’ they have been buying. According to its latest 13-F form (a pub ...

... If people were going to buy Swiss francs aggressively, then the Swiss National Bank was going to sell them aggressively. So they created a bunch of francs and then traded them for Euros. What is interesting is that it isn’t just Euros’ they have been buying. According to its latest 13-F form (a pub ...

2010 - Impact Real Estate

... interest rates down for now, as capital from there flows into the U.S. The Fed has been purchasing mortgage-backed securities ($1.25 trillion last year), which has helped to keep a lid on rising interest rates. Now the Fed is in a quandary: “how to unload $1.25 trillion without sabotaging home price ...

... interest rates down for now, as capital from there flows into the U.S. The Fed has been purchasing mortgage-backed securities ($1.25 trillion last year), which has helped to keep a lid on rising interest rates. Now the Fed is in a quandary: “how to unload $1.25 trillion without sabotaging home price ...

Financial innovation has greatly changed the busi-

... theory, good securitization candidates are less information-intensive assets, such as mortgages and credit card receivables, but not the more information-intensive assets, which include most business loans. Thus, this self-selection of loans for securitization leaves the bank’s balance sheet with a ...

... theory, good securitization candidates are less information-intensive assets, such as mortgages and credit card receivables, but not the more information-intensive assets, which include most business loans. Thus, this self-selection of loans for securitization leaves the bank’s balance sheet with a ...

Chris Diaz Commentary - Snowden Lane Partners

... Mutual fund investing involves market risk. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results. The views expressed are those of the portfolio manager(s) and do not necessarily reflect the views of others in ...

... Mutual fund investing involves market risk. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results. The views expressed are those of the portfolio manager(s) and do not necessarily reflect the views of others in ...

Case Study: Barclays Bank

... future. All banks like to keep shareholders happy in order to see that the shareholders do not withdraw their stocks. For these reasons, regulators and banks themselves have to constantly evaluate their performance. The main objective of my assignment is also evaluating the bank performance by point ...

... future. All banks like to keep shareholders happy in order to see that the shareholders do not withdraw their stocks. For these reasons, regulators and banks themselves have to constantly evaluate their performance. The main objective of my assignment is also evaluating the bank performance by point ...

Policy Implementation with a Large Central Bank Balance Sheet

... Absent frictions, all money market rates would be equal to the IOER There are three main frictions: Banks face convex balance sheet costs: Explains why money market rates are below IOER Market for reserves may not be perfectly competitive Banks face convex interbank monitoring costs (reser ...

... Absent frictions, all money market rates would be equal to the IOER There are three main frictions: Banks face convex balance sheet costs: Explains why money market rates are below IOER Market for reserves may not be perfectly competitive Banks face convex interbank monitoring costs (reser ...

Monthly strategy report february 2015

... movement or behaviour of things we do not know how will act in the very near future, where they will move completely randomly, but we will be able to predict how they will act over longer periods, since the sum of these small moments of chaos must approach zero. This idea is very useful for many thi ...

... movement or behaviour of things we do not know how will act in the very near future, where they will move completely randomly, but we will be able to predict how they will act over longer periods, since the sum of these small moments of chaos must approach zero. This idea is very useful for many thi ...

Y BRIEFS MPDD POLIC

... Although the guidelines from the Federal Reserve indicate that monetary tightening would likely be gradual, what remains to be seen is the actual pace and sequence of the normalization, and whether this differs from market expectations. In recent years, a mismatch between actual and anticipated anno ...

... Although the guidelines from the Federal Reserve indicate that monetary tightening would likely be gradual, what remains to be seen is the actual pace and sequence of the normalization, and whether this differs from market expectations. In recent years, a mismatch between actual and anticipated anno ...

netw rks

... Many jobs might have been saved if American manufacturers had sold more goods in other countries. During the bull market of the 1920s, however, U.S. banks made loans to speculators. They did this instead of making loans to foreign companies. Loans from U.S. banks had helped European nations make war ...

... Many jobs might have been saved if American manufacturers had sold more goods in other countries. During the bull market of the 1920s, however, U.S. banks made loans to speculators. They did this instead of making loans to foreign companies. Loans from U.S. banks had helped European nations make war ...