Chapter 9

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

Econ 306

... 1. (12 points) As of February 2008 one-year dollar denominated bonds had a rate of return of 4% and Turkish government bonds with the same marurity had a 17.5 % interest rate. Due to liquidity crises worldwide FED cut interest rate by 0.75% and the Central Bank of Turkey followed the trend and cut t ...

... 1. (12 points) As of February 2008 one-year dollar denominated bonds had a rate of return of 4% and Turkish government bonds with the same marurity had a 17.5 % interest rate. Due to liquidity crises worldwide FED cut interest rate by 0.75% and the Central Bank of Turkey followed the trend and cut t ...

Market comment for the week of March 3, 2017 Beware the Ides…?

... rate increase by the Fed. The bond market’s muted response—the benchmark 10-year Treasury yield up from a week-ago low, but to just a two-week high of 2.48%—may have been due to skepticism over the economy’s current strength and outlook, plus more likely subdued inflation expectations and stepped-up ...

... rate increase by the Fed. The bond market’s muted response—the benchmark 10-year Treasury yield up from a week-ago low, but to just a two-week high of 2.48%—may have been due to skepticism over the economy’s current strength and outlook, plus more likely subdued inflation expectations and stepped-up ...

NSE DGs pronouncement today may determine market direction

... Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the capital market. The outcome of the assessment will help investors kn ...

... Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the capital market. The outcome of the assessment will help investors kn ...

Press Release

... increases. That is, over the long term there is a high correlation between business activity and bank results. The Israeli economy is an open economy—in terms of both real and financial activity—and thus it is affected not only by domestic developments but also by the global environment, and banks a ...

... increases. That is, over the long term there is a high correlation between business activity and bank results. The Israeli economy is an open economy—in terms of both real and financial activity—and thus it is affected not only by domestic developments but also by the global environment, and banks a ...

Interest rate

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

CBML Expert Group 4th Meeting Summary Minutes

... The expert group split up to discuss by subgroup the findings of the previous discussions, identify the work needs and next steps for their respective chapters, as well as allocate tasks. The Chair asked the subgroups to think about ways to approach the recommendations and agree on working methods. ...

... The expert group split up to discuss by subgroup the findings of the previous discussions, identify the work needs and next steps for their respective chapters, as well as allocate tasks. The Chair asked the subgroups to think about ways to approach the recommendations and agree on working methods. ...

MARKET COMMENTARY April, 2008

... global financial system. There were three interest rate reductions in the quarter; the Fed funds target rate was cut in half from 4.5% to 2.25% through three successive cuts, which included an unscheduled cut made after the long weekend following the “SocGen” trading loss. There were several liquidi ...

... global financial system. There were three interest rate reductions in the quarter; the Fed funds target rate was cut in half from 4.5% to 2.25% through three successive cuts, which included an unscheduled cut made after the long weekend following the “SocGen” trading loss. There were several liquidi ...

June 2002 - Roof Advisory Group

... Markets are driven by both economic and psychological factors, and not necessarily in that order. The current market’s bearish behavior is being influenced by the latter, specifically fear and a lack of investor confidence. No wonder. Consider the recent litany of bad news on the political front; on ...

... Markets are driven by both economic and psychological factors, and not necessarily in that order. The current market’s bearish behavior is being influenced by the latter, specifically fear and a lack of investor confidence. No wonder. Consider the recent litany of bad news on the political front; on ...

Credit Markets

... EUR – emergency repairs The measures • Greece receives EUR110bn financing package • Eurozone establishes European Financial Stablisation Mechanism and combined with IMF resources creates a EUR750bn back stop • ECB buys peripheral debt in secondary market • ECB cuts collateral requirements for Greek ...

... EUR – emergency repairs The measures • Greece receives EUR110bn financing package • Eurozone establishes European Financial Stablisation Mechanism and combined with IMF resources creates a EUR750bn back stop • ECB buys peripheral debt in secondary market • ECB cuts collateral requirements for Greek ...

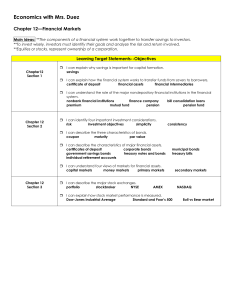

government - Humble ISD

... Economics with Mrs. Duez Chapter 12—Financial Markets Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a co ...

... Economics with Mrs. Duez Chapter 12—Financial Markets Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a co ...

The financial Crisis Powerpoint

... • To encourage more home ownership, particularly to low income people, the government reduced regulations on who could make mortgages and the rules for Qualifying for mortgages. • After All, the more homes that are owned in neighborhoods, the nicer the neighborhoods. Homeowners have an incentive to ...

... • To encourage more home ownership, particularly to low income people, the government reduced regulations on who could make mortgages and the rules for Qualifying for mortgages. • After All, the more homes that are owned in neighborhoods, the nicer the neighborhoods. Homeowners have an incentive to ...

An Introduction to Money and the Banking System

... Deposit Insurance: the Federal Deposit Insurance Corporation (FDIC) insures up to $100,000 (Congress recently & temporarily upped this amount to $250,000) in deposits for each individual holding account at the bank, regardless of what happens to the bank. Began in1933 after lots of bank failures. – ...

... Deposit Insurance: the Federal Deposit Insurance Corporation (FDIC) insures up to $100,000 (Congress recently & temporarily upped this amount to $250,000) in deposits for each individual holding account at the bank, regardless of what happens to the bank. Began in1933 after lots of bank failures. – ...

'Clear and Present Challenges to the Chinese Economy' (pdf)

... loans due to regulatory restricLons b. RestricLons on real estate loans falls short of meeLng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

... loans due to regulatory restricLons b. RestricLons on real estate loans falls short of meeLng local gvt financing plarorm and demand in real estate (only through trust loans ) c. Chinese households demanding higher required return than deposit interest rates d. Banks have to meet LTD by rai ...

EC381: Financial and Capital Markets

... Assess the view that financial innovation is more about evading regulation and increasing profit than it is about raising social welfare. There should be an overview of what innovation means and how it can give any firm some competitive advantage. There should be an assessment of some of the main in ...

... Assess the view that financial innovation is more about evading regulation and increasing profit than it is about raising social welfare. There should be an overview of what innovation means and how it can give any firm some competitive advantage. There should be an assessment of some of the main in ...

Midterm Exam

... (5 points) Your boss would like you to predict next year’s short-term interest rates in Hong Kong by noon today. You only have access to information from today’s financial markets. Describe two ways to predict the interest rate next year. Be as specific as possible. i. ...

... (5 points) Your boss would like you to predict next year’s short-term interest rates in Hong Kong by noon today. You only have access to information from today’s financial markets. Describe two ways to predict the interest rate next year. Be as specific as possible. i. ...

April - sibstc

... operations. Such operations have the added advantage that sale of securities does not require the financial system to take the market risk involved in such purchase of securities. Further, the access to this facility is at the discretion of market participants enabling them to undertake their own li ...

... operations. Such operations have the added advantage that sale of securities does not require the financial system to take the market risk involved in such purchase of securities. Further, the access to this facility is at the discretion of market participants enabling them to undertake their own li ...

Download attachment

... 6. A number of government actions/policies/regulations, some of which had successful track records, contributed to the current crisis. For example, Ginnie Mae, Fannie Mae (“Fannie”) and Freddie Mac (“Freddie”) were vital players in extending affordable financing to middle and lower income home buyer ...

... 6. A number of government actions/policies/regulations, some of which had successful track records, contributed to the current crisis. For example, Ginnie Mae, Fannie Mae (“Fannie”) and Freddie Mac (“Freddie”) were vital players in extending affordable financing to middle and lower income home buyer ...

Bank of Israel

... The Bank of Israel today published the semi-annual report on the stability of the domestic financial system, and its analyses relate to events that took place until the end of December 2016. The publication of the Financial Stability Report is anchored in the definition of the Bank of Israel’s funct ...

... The Bank of Israel today published the semi-annual report on the stability of the domestic financial system, and its analyses relate to events that took place until the end of December 2016. The publication of the Financial Stability Report is anchored in the definition of the Bank of Israel’s funct ...

Rose

... The Control Mechanism to Regulate Incoming Funds is the Price of Funds Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved. ...

... The Control Mechanism to Regulate Incoming Funds is the Price of Funds Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved. ...

Mutual Funds - McDonaldMath

... -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...

... -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...

Update Credit Crisis Jan 09

... becomes bank, gets Federal money. • Jaguar (was owned by Ford) requests bail out in England. • Infineon spin-off bailed out in Germany. • Ireland bails out its major banks. ...

... becomes bank, gets Federal money. • Jaguar (was owned by Ford) requests bail out in England. • Infineon spin-off bailed out in Germany. • Ireland bails out its major banks. ...

Text 2 - 05 banking international article +ex

... “IF SOMEBODY wants to pay, the bank is going to try to help them,” beams the fresh-faced manager of a big lender’s branch in Rio Rosas, an upmarket neighbourhood of Madrid. His branch is a busy place, even though it extended not one mortgage last year. A big part of its business now is focused on cu ...

... “IF SOMEBODY wants to pay, the bank is going to try to help them,” beams the fresh-faced manager of a big lender’s branch in Rio Rosas, an upmarket neighbourhood of Madrid. His branch is a busy place, even though it extended not one mortgage last year. A big part of its business now is focused on cu ...

What is the Federal Reserve?

... Bank Reserves • So far we have been assuming that banks hold the entire amount of their deposits in reserve. • Clearly this is a false assumption as banks rarely ever have enough currency in their vaults (or on reserve at the Fed) to cover all deposits made with them. • The banking system operates ...

... Bank Reserves • So far we have been assuming that banks hold the entire amount of their deposits in reserve. • Clearly this is a false assumption as banks rarely ever have enough currency in their vaults (or on reserve at the Fed) to cover all deposits made with them. • The banking system operates ...

Non-performing loans: Peripheral countries finally on

... consistently positive for these countries but lowest in France. In contrast to the more robust countries, many banks in the peripheral economies already suffered from a significantly higher level of NPLs at the onset of the recession in 2009. From this weaker starting point, and despite the establis ...

... consistently positive for these countries but lowest in France. In contrast to the more robust countries, many banks in the peripheral economies already suffered from a significantly higher level of NPLs at the onset of the recession in 2009. From this weaker starting point, and despite the establis ...