US Subprime Credit Crisis

... Housing prices down 10.4% in Dec. 07 vs. year-ago Sales of new homes dropped by 26.4% in 07 vs. 06 By Jan. 2008, the inventory of unsold new homes stood at 9.8 months, the highest level since 1981. Two million families will be evicted from their homes ...

... Housing prices down 10.4% in Dec. 07 vs. year-ago Sales of new homes dropped by 26.4% in 07 vs. 06 By Jan. 2008, the inventory of unsold new homes stood at 9.8 months, the highest level since 1981. Two million families will be evicted from their homes ...

Voya Financial Advisors, Inc

... an effort to rein in the zero rate policy effect well before it takes action. This has seemed to come out of nowhere but the data on inflation and unemployment have surprised the Fed. GDP has been another surprise: take the second quarter GDP report at 4%, add 2.1% inflation (CPI) and then U.S. nomi ...

... an effort to rein in the zero rate policy effect well before it takes action. This has seemed to come out of nowhere but the data on inflation and unemployment have surprised the Fed. GDP has been another surprise: take the second quarter GDP report at 4%, add 2.1% inflation (CPI) and then U.S. nomi ...

85 reasons why investors avoided the stock market:Layout 1.qxd

... rapidly, in response to changes in company fundamentals, economic and/or market conditions. Stocks may decline in value even during periods when the market is rising or may underperform other securities or benchmarks on a relative basis. The shorter the investing time horizon the greater the risk th ...

... rapidly, in response to changes in company fundamentals, economic and/or market conditions. Stocks may decline in value even during periods when the market is rising or may underperform other securities or benchmarks on a relative basis. The shorter the investing time horizon the greater the risk th ...

Presentation to Town Hall Los Angeles Los Angeles, California

... view of the economic outlook. In effect, the public is doing some of the work of stabilizing the economy. For example, if prospects for reaching a 6½ percent unemployment rate were to move further away in time, then people would most likely expect the Fed to keep its benchmark rate low for longer. M ...

... view of the economic outlook. In effect, the public is doing some of the work of stabilizing the economy. For example, if prospects for reaching a 6½ percent unemployment rate were to move further away in time, then people would most likely expect the Fed to keep its benchmark rate low for longer. M ...

ARM 7-6 Term Sheet

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

Economic Insight The Market is Full of Sound and Fury

... September 19 – October 17, the market fell about 7%, but by Halloween it had reversed course and jumped 7%. The same percentage move but in half the time.” (Zacks Investment Management, 15’) In this particular example, investors that sold stock or withdrew funds for fear of further downside volatili ...

... September 19 – October 17, the market fell about 7%, but by Halloween it had reversed course and jumped 7%. The same percentage move but in half the time.” (Zacks Investment Management, 15’) In this particular example, investors that sold stock or withdrew funds for fear of further downside volatili ...

need for financial diversification: development of a debt market in

... While the primary market of TFCs has made some progress, the secondary market is quite illiquid. This is due to a number of factors including small issue volumes, a certain reluctance among holders of instruments (due to inexperience in trading debt instruments), lack of competition), and a lack of ...

... While the primary market of TFCs has made some progress, the secondary market is quite illiquid. This is due to a number of factors including small issue volumes, a certain reluctance among holders of instruments (due to inexperience in trading debt instruments), lack of competition), and a lack of ...

disinformation on government debt accumulation

... long-term funds for largely non-specific intangible purposes, at over 16% interest rate. Instructively, the Spanish economy in spite of its travails “auctioned bonds maturing in January 2015 at an average of 2.89%..., while bonds due in October 2016 yielded 4.319% and securities maturing October 202 ...

... long-term funds for largely non-specific intangible purposes, at over 16% interest rate. Instructively, the Spanish economy in spite of its travails “auctioned bonds maturing in January 2015 at an average of 2.89%..., while bonds due in October 2016 yielded 4.319% and securities maturing October 202 ...

Third Quarter 2014 Market Commentary

... for several months—even though the Fed isn’t expected to increase its benchmark Federal Funds Rate above the zero level until mid-2015 at the earliest. (Continued) ...

... for several months—even though the Fed isn’t expected to increase its benchmark Federal Funds Rate above the zero level until mid-2015 at the earliest. (Continued) ...

Lecture Notes - School of Cooperative Individualism

... this portion of their business. The other major innovation was a group of mortgage products that allowed for periodic adjustment in the rate of interest, tied to U.S. Treasury debt and other indices. For consumers, the benefits depended on how and when rates could adjust and whether they had the inc ...

... this portion of their business. The other major innovation was a group of mortgage products that allowed for periodic adjustment in the rate of interest, tied to U.S. Treasury debt and other indices. For consumers, the benefits depended on how and when rates could adjust and whether they had the inc ...

Unit 16 - Suffolk Public Schools Blog

... Federal Reserve’s power to set interest rates enables it to control the nation’s money supply. If the Federal Reserve Board believes the American economy is slowing down, it will cut interest rates and thereby encourage borrowing. On the other hand, if the Federal Reserve Board believes the economy ...

... Federal Reserve’s power to set interest rates enables it to control the nation’s money supply. If the Federal Reserve Board believes the American economy is slowing down, it will cut interest rates and thereby encourage borrowing. On the other hand, if the Federal Reserve Board believes the economy ...

Monetary Policy: A Primer

... include required cash and/ or liquidity reserve ratios, directed credit and administered interest rates. Cash reserve ratio (CRR) determines the level of reserves (central bank money or cash) banks need to hold against their liabilities. Similarly, liquidity reserve ratio requires banks to maintain ...

... include required cash and/ or liquidity reserve ratios, directed credit and administered interest rates. Cash reserve ratio (CRR) determines the level of reserves (central bank money or cash) banks need to hold against their liabilities. Similarly, liquidity reserve ratio requires banks to maintain ...

The 10-Year Yield Is A Whopping 4 Standard

... past the average length of most growth cycles. Interest rates fall during down cycles. 3) Geopolitical unrest makes U.S. Treasuries an attractive "safe haven" for foreign capital flows. 4) Global economic weakness (China, Euro-zone and Japan) will likely drive buying of U.S. Treasuries. 5) Upcoming ...

... past the average length of most growth cycles. Interest rates fall during down cycles. 3) Geopolitical unrest makes U.S. Treasuries an attractive "safe haven" for foreign capital flows. 4) Global economic weakness (China, Euro-zone and Japan) will likely drive buying of U.S. Treasuries. 5) Upcoming ...

... The Course of Consumer Margins in Turkey In an economy, turning points of the consumer loan margins should be analyzed in conjunction with the events shaping the economic climate of the country (See chart). In Turkey, it can be observed that margins jumped sharply after the 2008 global crisis mainly ...

pages 471–472

... the rest in monthly installments. Paying off installment debts left little money to purchase other goods. ...

... the rest in monthly installments. Paying off installment debts left little money to purchase other goods. ...

Systematic and Unsystematic Risks

... rate of return (for example return on U.S. treasury bonds), adjusted for inflation rate expectation, and with the specific risk premium. The risk premium is peculiar to each investment and includes, country risk, exchange rate risk and other international investment associated risks, in addition to ...

... rate of return (for example return on U.S. treasury bonds), adjusted for inflation rate expectation, and with the specific risk premium. The risk premium is peculiar to each investment and includes, country risk, exchange rate risk and other international investment associated risks, in addition to ...

Market for Loanable Funds

... Higher Interest rates will cause some investment to be ‘crowded out’ by the government’s demand for loadable funds. ...

... Higher Interest rates will cause some investment to be ‘crowded out’ by the government’s demand for loadable funds. ...

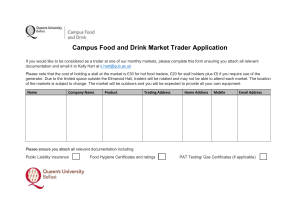

trader application form

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

MarketUpdatefortheMonthEndingJanuary312016

... Historically, the dollar has actually started to decline as interest rates have begun to increase, but the policy divergence in January suggests that this time things might be different. If so, the headwinds for the U.S. economy could actually strengthen, even as other systemic risks increase. With ...

... Historically, the dollar has actually started to decline as interest rates have begun to increase, but the policy divergence in January suggests that this time things might be different. If so, the headwinds for the U.S. economy could actually strengthen, even as other systemic risks increase. With ...

NPL resolution - World Bank Group

... Generally, we believe a faster resolution of NPLs is clearly desirable, but if not properly managed it can prove harmful to a banking system’s stability. In more vulnerable countries, such as Romania, Hungary and Latvia, an abrupt write-down might cause significant capital shortages, with CAR fallin ...

... Generally, we believe a faster resolution of NPLs is clearly desirable, but if not properly managed it can prove harmful to a banking system’s stability. In more vulnerable countries, such as Romania, Hungary and Latvia, an abrupt write-down might cause significant capital shortages, with CAR fallin ...

press release - Central Bank of Sri Lanka

... Granted by Banks One of the policy measures proposed in the Road Map: Monetary and Financial Sector Policies for 2007 and Beyond announced by the Central Bank on January 2, 2007 is to issue new prudential requirements on single borrower limit of licensed banks with the objective of mitigating the ba ...

... Granted by Banks One of the policy measures proposed in the Road Map: Monetary and Financial Sector Policies for 2007 and Beyond announced by the Central Bank on January 2, 2007 is to issue new prudential requirements on single borrower limit of licensed banks with the objective of mitigating the ba ...

CFA Outlook 4Q15

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

The Money Line - Kansas Rural Water Association

... Even though the cost of borrowing has recently increased, it’s still a good time to borrow funds. Interest rates are still below their historical averages, but will probably rise in the future. For investors we recommend laddering investments that meet the liquidity needs of your system. The above o ...

... Even though the cost of borrowing has recently increased, it’s still a good time to borrow funds. Interest rates are still below their historical averages, but will probably rise in the future. For investors we recommend laddering investments that meet the liquidity needs of your system. The above o ...

Perspectives on Strengthening Local Markets: The Indian Experience

... “Social benefits” of banking took precedence over commercial objectives ...

... “Social benefits” of banking took precedence over commercial objectives ...