FINANCIAL MELTDOWN AND ITS RECOVERIES: A CASE STUDY

... Subprime mortgage market: This market includes the business of subprime mortgages, subprime auto loans and subprime credit cards, as well as various securitization products that use subprime debt as collateral7. The Shadow Banking System: A major player in the Collateralized Mortgage Obligation (CMO ...

... Subprime mortgage market: This market includes the business of subprime mortgages, subprime auto loans and subprime credit cards, as well as various securitization products that use subprime debt as collateral7. The Shadow Banking System: A major player in the Collateralized Mortgage Obligation (CMO ...

Market Synopsis â April 2015

... anyone’s guess. We are hence not trying to insinuate that we “were right” in calling a change in the trend the USD/ EUR exchange rate over the short-term. On the contrary, we rather wish to reiterate that we believe that the USD has appreciated too far, too soon on the market’s expectation of immine ...

... anyone’s guess. We are hence not trying to insinuate that we “were right” in calling a change in the trend the USD/ EUR exchange rate over the short-term. On the contrary, we rather wish to reiterate that we believe that the USD has appreciated too far, too soon on the market’s expectation of immine ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: The Risk of Economic Crisis

... the institutional setting-FDIC guarantees for depositors and low capital requirements-to give inadequate attention to these risks. These same conditions encouraged excessive risk taking in other countries as well where explicit or implicit government protection of depositors substituted for the form ...

... the institutional setting-FDIC guarantees for depositors and low capital requirements-to give inadequate attention to these risks. These same conditions encouraged excessive risk taking in other countries as well where explicit or implicit government protection of depositors substituted for the form ...

Slides 2

... • The ratio of non-performing assets to total assets in the banking system exceeded 10 percent; • The cost of the rescue operation was at least 2 percent of GDP; • The episode involved a large scale nationalization of banks • Extensive bank runs took place or emergency measures such as deposit freez ...

... • The ratio of non-performing assets to total assets in the banking system exceeded 10 percent; • The cost of the rescue operation was at least 2 percent of GDP; • The episode involved a large scale nationalization of banks • Extensive bank runs took place or emergency measures such as deposit freez ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... External finance premium equation is inserted from another modelling environment with different assumptions (BGG 2000). Potential problems: 1. Even BGG 2000 do not prove contract optimality from scratch 2. Costly state verification may not be the only issue. House (2000) gets different results under ...

... External finance premium equation is inserted from another modelling environment with different assumptions (BGG 2000). Potential problems: 1. Even BGG 2000 do not prove contract optimality from scratch 2. Costly state verification may not be the only issue. House (2000) gets different results under ...

Flltext - Brunel University Research Archive

... is a great deal of “path dependence” in housing finance and therefore radical innovations from elsewhere are not always easily adopted. The scope of government involvement in the US for example was mainly developed during the Great Depression and are firmly rooted in practice. Covered bonds that are ...

... is a great deal of “path dependence” in housing finance and therefore radical innovations from elsewhere are not always easily adopted. The scope of government involvement in the US for example was mainly developed during the Great Depression and are firmly rooted in practice. Covered bonds that are ...

Bank of England Inflation Report February 2007

... Sources: IMF, Thomson Financial Datastream and Bank of England calculations. (a) Annual growth in the stock of broad money less annual growth in nominal GDP. Country-level data have been aggregated using IMF purchasing power parity (PPP) exchange rates. (b) Data to 2005 on the stock of broad money f ...

... Sources: IMF, Thomson Financial Datastream and Bank of England calculations. (a) Annual growth in the stock of broad money less annual growth in nominal GDP. Country-level data have been aggregated using IMF purchasing power parity (PPP) exchange rates. (b) Data to 2005 on the stock of broad money f ...

Are We in a Recession? What Will It Look Like If We Have One?

... The Federal Reserve—stuck between a rock and a hard place Doesn't want to lose its price-stability credibility by cutting interest rates too far too fast and igniting inflation both through a misjudgment of domestic demand and because cutting interest rates means a weaker dollar, higher dollar price ...

... The Federal Reserve—stuck between a rock and a hard place Doesn't want to lose its price-stability credibility by cutting interest rates too far too fast and igniting inflation both through a misjudgment of domestic demand and because cutting interest rates means a weaker dollar, higher dollar price ...

CIO Investment spotlight

... Japan, along with modest growth in debt outside of the government sector. The deflationary and deleveraging forces of the GFC live on, but there are signs these are fading. The simple message is if the Fed needs to tighten financial conditions there is still quite a bit of work to do. ...

... Japan, along with modest growth in debt outside of the government sector. The deflationary and deleveraging forces of the GFC live on, but there are signs these are fading. The simple message is if the Fed needs to tighten financial conditions there is still quite a bit of work to do. ...

Download attachment

... Malaysian Shariah bankers yesterday dismissed as impractical a proposed Islamic pricing benchmark, highlighting the financing industry's struggle to replace conventional interest rates as a pricing tool. Despite the Shariah's ban on usury, Islamic financial products are routinely priced using conven ...

... Malaysian Shariah bankers yesterday dismissed as impractical a proposed Islamic pricing benchmark, highlighting the financing industry's struggle to replace conventional interest rates as a pricing tool. Despite the Shariah's ban on usury, Islamic financial products are routinely priced using conven ...

Turkey’s Experience with Macroprudential Policy Central Bank of Turkey Hakan Kara

... *Short-term capital movements are sum of banking and real sectors' short term net credit and deposits in banks. Long-term capital movements are sum of banking and real sectors’ long term net credit and bonds issued by banks and the Treasury. Source: CBRT. ...

... *Short-term capital movements are sum of banking and real sectors' short term net credit and deposits in banks. Long-term capital movements are sum of banking and real sectors’ long term net credit and bonds issued by banks and the Treasury. Source: CBRT. ...

US High Yield Fund

... portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public credit research. It invests primarily in high yield corporate bonds that have been rated below in ...

... portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public credit research. It invests primarily in high yield corporate bonds that have been rated below in ...

PL6 - African Development Bank

... A minimum of a Master’s degree (or its equivalent) in Finance, Economics, Mathematics or Statistics and preferably with a Chartered Financial Analyst (CFA) certification or any other relevant discipline. A minimum of four (4) years of relevant and practical experience in International Capital Ma ...

... A minimum of a Master’s degree (or its equivalent) in Finance, Economics, Mathematics or Statistics and preferably with a Chartered Financial Analyst (CFA) certification or any other relevant discipline. A minimum of four (4) years of relevant and practical experience in International Capital Ma ...

Monetary Policy and Financial Stability Eric S. Rosengren

... Federal Reserve Bank of Boston The Business and Industry Association of New Hampshire and the New Hampshire ...

... Federal Reserve Bank of Boston The Business and Industry Association of New Hampshire and the New Hampshire ...

1 - JustAnswer

... The opening of new international markets to the U.S. can be attributed to: a. acceptance of a free market system by third world countries. b. regulation of U.S. industries. c. increase in information technology. d. a and c. e. all of the above. ...

... The opening of new international markets to the U.S. can be attributed to: a. acceptance of a free market system by third world countries. b. regulation of U.S. industries. c. increase in information technology. d. a and c. e. all of the above. ...

Damascus looks to investment banks | Special Report | MEED

... office in Damascus with a prominent local partner and start up a Syrian private equity fund. Second, it signals that the authorities really want the big fish to set up shop – the credible players comfortably able to cough up more than $400m in minimum capital. “The move suggests that the government ...

... office in Damascus with a prominent local partner and start up a Syrian private equity fund. Second, it signals that the authorities really want the big fish to set up shop – the credible players comfortably able to cough up more than $400m in minimum capital. “The move suggests that the government ...

Credit Risk Transfer

... Most of the estimated variables such as the Islamic banks total lending to asset ratio (TL/A), equity capital to assets ratio (CAP/A), liquidity to assets ratio (LIQ/A), profitability ratio (ROA), and credit risk transfer (CRI) proxy by dummy variables, Gross Domestic Product (GDP) and the exchange ...

... Most of the estimated variables such as the Islamic banks total lending to asset ratio (TL/A), equity capital to assets ratio (CAP/A), liquidity to assets ratio (LIQ/A), profitability ratio (ROA), and credit risk transfer (CRI) proxy by dummy variables, Gross Domestic Product (GDP) and the exchange ...

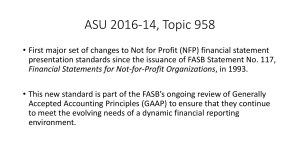

Slides - AWSCPA Houston

... The Board of Directors of XYZ Organization has several standing board policies that affect the presentation of board designations on net assets. Bequests without donor restrictions are $3,700, designated for longterm investment (quasi-endowment). The quasi-endowment balance totaled $3,500 at Decembe ...

... The Board of Directors of XYZ Organization has several standing board policies that affect the presentation of board designations on net assets. Bequests without donor restrictions are $3,700, designated for longterm investment (quasi-endowment). The quasi-endowment balance totaled $3,500 at Decembe ...

investment policy - University of Arkansas at Pine Bluff

... The primary objective of our cash management system is to provide for day-to-day funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made ...

... The primary objective of our cash management system is to provide for day-to-day funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made ...

Tools for a New Economy

... other high-risk activities, but they had to steer clear of the commercial banks. Similar regulations were imposed on Savings & Loans (S&Ls) in 1932, and continued to operate through the 1970s. In particular, under the old regulatory regime, mortgage loans in the United States could be issued only by ...

... other high-risk activities, but they had to steer clear of the commercial banks. Similar regulations were imposed on Savings & Loans (S&Ls) in 1932, and continued to operate through the 1970s. In particular, under the old regulatory regime, mortgage loans in the United States could be issued only by ...

52111imp - Aberdeenshire Council

... risk. The majority of borrowing is in the form of fixed rate loans as this leads to greater stability in overall borrowing costs. Some exposure to variable rate loans may be beneficial in a period of projected falling interest rates. Exposure to longer term variable rate loans and temporary loans to ...

... risk. The majority of borrowing is in the form of fixed rate loans as this leads to greater stability in overall borrowing costs. Some exposure to variable rate loans may be beneficial in a period of projected falling interest rates. Exposure to longer term variable rate loans and temporary loans to ...

PDF Download

... once the debt-to-equity swaps were concluded. In other words, which investor would not be willing to lend money to sound and solvent banks? 4. Banks’ cost of capital would rise. How can the cost of capital for well-capitalised banks be higher than for banks with a thin equity buffer? Are investors i ...

... once the debt-to-equity swaps were concluded. In other words, which investor would not be willing to lend money to sound and solvent banks? 4. Banks’ cost of capital would rise. How can the cost of capital for well-capitalised banks be higher than for banks with a thin equity buffer? Are investors i ...

Navellier`s Full Commentary Here

... second half of 2013 as companies with global markets will be getting paid in appreciating currencies. As a result, the earnings growth rate for the S&P 500 should rise. A weaker dollar also causes commodity prices to rise. On Friday, the Labor Department reported that the Producer Price Index (PPI) ...

... second half of 2013 as companies with global markets will be getting paid in appreciating currencies. As a result, the earnings growth rate for the S&P 500 should rise. A weaker dollar also causes commodity prices to rise. On Friday, the Labor Department reported that the Producer Price Index (PPI) ...

CH17

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

FridayMarch28thMeeting - Sites at Lafayette

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...