Finance Glossary

... Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is pai ...

... Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is pai ...

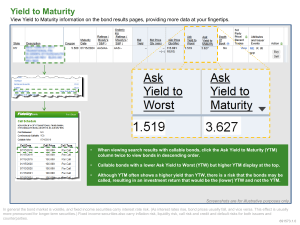

Yield to Maturity

... In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call ...

... In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call ...

Economic History of the US

... Fractional reserve banking allowed banks to increase profits with leverage commercial banks create money…on top of…specie reserve investment banks bought stock/bonds with borrowed $$ ...

... Fractional reserve banking allowed banks to increase profits with leverage commercial banks create money…on top of…specie reserve investment banks bought stock/bonds with borrowed $$ ...

1 - TestbankU

... 16. “In a world without information costs and transaction costs, financial intermediaries would not exist.” Is this statement true, false, or uncertain? Explain your answer. True. If there are no informational or transactions costs, people could make loans to each other at no cost and would thus hav ...

... 16. “In a world without information costs and transaction costs, financial intermediaries would not exist.” Is this statement true, false, or uncertain? Explain your answer. True. If there are no informational or transactions costs, people could make loans to each other at no cost and would thus hav ...

PDF Download

... public funds and a sound framework for restructurhave reduced incentives for restructuring – for ining distressed assets proved decisive. Japan’s experistance, by easing financing constraints for both sound ences suggest a number of important ingredients for and insolvent borrowers, they may have de ...

... public funds and a sound framework for restructurhave reduced incentives for restructuring – for ining distressed assets proved decisive. Japan’s experistance, by easing financing constraints for both sound ences suggest a number of important ingredients for and insolvent borrowers, they may have de ...

Monetary Policy

... present are credited for the future, in other words “it’s used as a standard for specifying future payments for current purchases” (Economic glossary, 2012). Fourth, money must store its value in order to work as a medium of exchange. Since money is commonly accepted, it’s considered more liquid tha ...

... present are credited for the future, in other words “it’s used as a standard for specifying future payments for current purchases” (Economic glossary, 2012). Fourth, money must store its value in order to work as a medium of exchange. Since money is commonly accepted, it’s considered more liquid tha ...

Document

... which will help raise the resilience of individual banking institutions to periods of ...

... which will help raise the resilience of individual banking institutions to periods of ...

Slovakia Czech Republic

... liabilities could not be fully equitable Leaving some assets and liabilities as unresolved ...

... liabilities could not be fully equitable Leaving some assets and liabilities as unresolved ...

The Enigma of Fed Policy and Bond Market Returns

... In a previous research article, “The Enigma of Economic Growth and Stock Market Returns,” we showed that conventional wisdom can be wrong when it’s not based on key principles of how capital markets work. In particular, stock market investors are not compensated for economic growth but for bearing d ...

... In a previous research article, “The Enigma of Economic Growth and Stock Market Returns,” we showed that conventional wisdom can be wrong when it’s not based on key principles of how capital markets work. In particular, stock market investors are not compensated for economic growth but for bearing d ...

Salim Dehmej

... Are all EM concerned? market size/liquidity and entry/exist facilities are important. The paper also highlights some financial stability risks and come out with policy recommendations. ...

... Are all EM concerned? market size/liquidity and entry/exist facilities are important. The paper also highlights some financial stability risks and come out with policy recommendations. ...

MACROECONOMIC ENVIRONMENT

... • Limited on the local market (privatization completed; 85% of bank equity and 96% of bank assets in hands of foreign strategic investors: KBC, ERSTE, SG, HVB, GE etc.) • Market concentrated enough (top 3 players have 75% market share in total bank deposits and 50% in bank loans; the concentration i ...

... • Limited on the local market (privatization completed; 85% of bank equity and 96% of bank assets in hands of foreign strategic investors: KBC, ERSTE, SG, HVB, GE etc.) • Market concentrated enough (top 3 players have 75% market share in total bank deposits and 50% in bank loans; the concentration i ...

Financial services Commission proposes to improve

... However, the Directive’s impact has been limited by the fact that its single licence regime applies only to investments in transferable securities (essentially shares and bonds) listed in a stock exchange or similar regulated market. The Commission is therefore proposing to maintain the basic princ ...

... However, the Directive’s impact has been limited by the fact that its single licence regime applies only to investments in transferable securities (essentially shares and bonds) listed in a stock exchange or similar regulated market. The Commission is therefore proposing to maintain the basic princ ...

please hate the markets

... by asset inflation via leverage and interest rate correlation. The “new normal” with massive ...

... by asset inflation via leverage and interest rate correlation. The “new normal” with massive ...

Opening Remarks: The Economic Outlook

... quantity and mix of financial assets held by the public. Specifically, the Fed’s strategy relies on the presumption that different financial assets are not perfect substitutes in investors’ portfolios, so that changes in the net supply of an asset available to investors affect its yield and those of ...

... quantity and mix of financial assets held by the public. Specifically, the Fed’s strategy relies on the presumption that different financial assets are not perfect substitutes in investors’ portfolios, so that changes in the net supply of an asset available to investors affect its yield and those of ...

Capital

... South Objected To The Excise Tax On Alcohol Used To Finance The Bank’s Interest Payments On States’ Debts • Whiskey Was “A Necessity of Southern Life” • Controversy Led To Shay’s Rebellion (“The Whiskey Rebellion”) in 1794 ...

... South Objected To The Excise Tax On Alcohol Used To Finance The Bank’s Interest Payments On States’ Debts • Whiskey Was “A Necessity of Southern Life” • Controversy Led To Shay’s Rebellion (“The Whiskey Rebellion”) in 1794 ...

Document

... Poor underwriting standards for mortgage loans; Weak regulation and supervision of banking sector; and Many international banks had exposure to the sub-prime ...

... Poor underwriting standards for mortgage loans; Weak regulation and supervision of banking sector; and Many international banks had exposure to the sub-prime ...

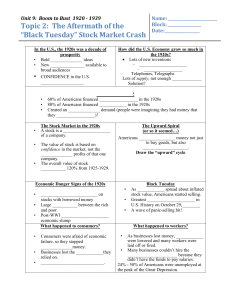

Crash and Great Depression Notes

... couldn’t afford to pay their ___________________. • Banks foreclosed on _____________. • Homeowners became _____________. ...

... couldn’t afford to pay their ___________________. • Banks foreclosed on _____________. • Homeowners became _____________. ...

techteaching_lubin_presentation

... to protect themselves from catastrophic losses and to anticipate potential risk problems. ...

... to protect themselves from catastrophic losses and to anticipate potential risk problems. ...

It`s Different This Time

... of saving actually results in an increase in purchasing power even without receiving any interest. To the extent that individuals do save, will they pull money out of banks and money market funds in favor of stashing piles of cash in safe deposit boxes? Banks make their money by lending at a higher ...

... of saving actually results in an increase in purchasing power even without receiving any interest. To the extent that individuals do save, will they pull money out of banks and money market funds in favor of stashing piles of cash in safe deposit boxes? Banks make their money by lending at a higher ...

Carmel Cahill, Volatility in agricultural commodity markets: Towards some policy responses

... Multiple factors affecting multiple actors in very different ways An incomplete understanding of the past and much uncertainty about the future Known needs can only be met by a resilient and responsive sector exposed to market signals ...

... Multiple factors affecting multiple actors in very different ways An incomplete understanding of the past and much uncertainty about the future Known needs can only be met by a resilient and responsive sector exposed to market signals ...

Opening Statement - Department of Finance ( 4 June 2014)

... the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees capital buffers as the least effective way to achieve the goal of mitigating run ...

... the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees capital buffers as the least effective way to achieve the goal of mitigating run ...

When US rates rise

... for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties. This communication is not directed at, and must not be acted on by persons inside the United States and is oth ...

... for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties. This communication is not directed at, and must not be acted on by persons inside the United States and is oth ...