Is Inflation Around the Corner?

... The Federal Reserve essentially made the mistake outlined above between 2003 and 2005. As economic recovery took hold in the aftermath of the technology bust, September 11th terrorist attacks and corporate accounting scandals, the Fed raised interest rates too slowly. Confidence in the financial sys ...

... The Federal Reserve essentially made the mistake outlined above between 2003 and 2005. As economic recovery took hold in the aftermath of the technology bust, September 11th terrorist attacks and corporate accounting scandals, the Fed raised interest rates too slowly. Confidence in the financial sys ...

SSDA Response to the European Commission consultation: Call for

... legislative reforms are undertaken. Regulation has progressed so quickly after the crisis that it is advisable now to take the opportunity to pause and review. For legislative measures, priority needs to be given to reviews and amendments that aim to improve the coherence, quality and proportionalit ...

... legislative reforms are undertaken. Regulation has progressed so quickly after the crisis that it is advisable now to take the opportunity to pause and review. For legislative measures, priority needs to be given to reviews and amendments that aim to improve the coherence, quality and proportionalit ...

Price Stability - Penleigh and Essendon Grammar School

... 1. The RBA is responding honestly to a flood of data. 2. It had already raised rates three times the year before, without a dent to Consumer and Business Confidenceor Eco activity. 3. More construction activity to take place especially in the resource states. 4. Fuel to inflation added on by employe ...

... 1. The RBA is responding honestly to a flood of data. 2. It had already raised rates three times the year before, without a dent to Consumer and Business Confidenceor Eco activity. 3. More construction activity to take place especially in the resource states. 4. Fuel to inflation added on by employe ...

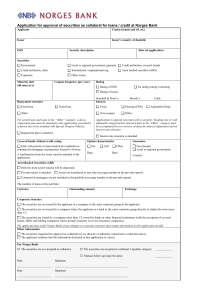

Søknadsskjema for godkjenning av obligasjoner og

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

Chapter 2: The Economic Life Cycle

... Consumers spend less as inflation accelerates and interest rates increase Economy keeps going because of optimistic business men Growth suffers under pressure of accelerating inflation and rising interest rates ...

... Consumers spend less as inflation accelerates and interest rates increase Economy keeps going because of optimistic business men Growth suffers under pressure of accelerating inflation and rising interest rates ...

The Global credit and Financial markets. Gold market

... Central banks and the International Monetary Fund play an important role in the gold price. At the end of 2004 central banks and official organizations held 19 percent of all above-ground gold as official gold reserves.[15] The ten-year Washington Agreement on Gold (WAG), which dates from Septembe ...

... Central banks and the International Monetary Fund play an important role in the gold price. At the end of 2004 central banks and official organizations held 19 percent of all above-ground gold as official gold reserves.[15] The ten-year Washington Agreement on Gold (WAG), which dates from Septembe ...

PRACTICE EXAM 2 1. The need for a barter system diminishes

... 59. If the current market interest rate for loanable funds is below the equilibrium level, then the quantity of loanable funds A) demanded exceeds the quantity of loanable funds supplied and the interest rate will fall. B) demanded exceeds the quantity of loanable funds supplied and the interest ra ...

... 59. If the current market interest rate for loanable funds is below the equilibrium level, then the quantity of loanable funds A) demanded exceeds the quantity of loanable funds supplied and the interest rate will fall. B) demanded exceeds the quantity of loanable funds supplied and the interest ra ...

2007 Q3 Client Newsletter - Oakdale Wealth Management

... In August, a severe credit crunch suddenly occurred as investors in mortgage based securities realized they had been taking on more risk than anticipated. In essence, investment graded securities actually contained a large portion of risky Subprime mortgages. As investors disappeared, mortgage compa ...

... In August, a severe credit crunch suddenly occurred as investors in mortgage based securities realized they had been taking on more risk than anticipated. In essence, investment graded securities actually contained a large portion of risky Subprime mortgages. As investors disappeared, mortgage compa ...

Seix Investment Advisors Perspective

... be the worst quarter for U.S. risk assets since the third quarter of 2011 and the worst quarter for emerging markets since the financial crisis of 2008–2009. In general, the higher the beta of the asset class, the weaker the performance in the third quarter. Flight-to-quality flows led to lower Trea ...

... be the worst quarter for U.S. risk assets since the third quarter of 2011 and the worst quarter for emerging markets since the financial crisis of 2008–2009. In general, the higher the beta of the asset class, the weaker the performance in the third quarter. Flight-to-quality flows led to lower Trea ...

A Letter from the CEO - F.L.Putnam Investment Management Company

... the better part of the last decade. This year, we will continue to monitor global trends for tactical investment opportunities on an international scale. The dollar’s strength will undoubtedly ebb at some point during the course of the New Year; such a pullback could present a good entry point into ...

... the better part of the last decade. This year, we will continue to monitor global trends for tactical investment opportunities on an international scale. The dollar’s strength will undoubtedly ebb at some point during the course of the New Year; such a pullback could present a good entry point into ...

Mini Lecture 8

... A good rule of thumb is to avoid funds with a management fee greater than 1%. 4. Beware of stock price bubbles In the long term, stocks outperform bonds by a significant amount, but in the short term, stock prices are much more volatile than bond prices. This is why one should start to shift out of ...

... A good rule of thumb is to avoid funds with a management fee greater than 1%. 4. Beware of stock price bubbles In the long term, stocks outperform bonds by a significant amount, but in the short term, stock prices are much more volatile than bond prices. This is why one should start to shift out of ...

The Banking System in Turkey

... showed limited recovery in the economic activity in the third quarter. Central Bank of the Republic of Turkey (CBRT) lowered policy rate because the improvement in global capital flows CBRT decided to cut in the one-week repo rate 50 bps because of the adverse impact of exchange rate on annual infla ...

... showed limited recovery in the economic activity in the third quarter. Central Bank of the Republic of Turkey (CBRT) lowered policy rate because the improvement in global capital flows CBRT decided to cut in the one-week repo rate 50 bps because of the adverse impact of exchange rate on annual infla ...

what the dollar`s surge means to investors

... A stronger dollar makes U.S. investments more attractive to overseas buyers, as it can enhance their returns when eventually repatriating those assets to their home market. That means that an influx of foreign capital may boost U.S. stock and bond prices, benefiting U.S. investors (offset though tha ...

... A stronger dollar makes U.S. investments more attractive to overseas buyers, as it can enhance their returns when eventually repatriating those assets to their home market. That means that an influx of foreign capital may boost U.S. stock and bond prices, benefiting U.S. investors (offset though tha ...

Financial Crises and Aggegate Economic Activity

... In emerging market countries government fiscal imbalances may create fears of default on the government debts As a result, the government may have trouble getting people to buy its bonds and it might force banks to purchase them ...

... In emerging market countries government fiscal imbalances may create fears of default on the government debts As a result, the government may have trouble getting people to buy its bonds and it might force banks to purchase them ...

Get cached

... monetary systems. The symbol for the euro is €, just as $ is the symbol for the dollar. By 2002, the euro will have replaced entirely the existing currencies of the 11 participating nations.1 A common currency is expected to bring important benefits to the participants. Politically, many see it as a ...

... monetary systems. The symbol for the euro is €, just as $ is the symbol for the dollar. By 2002, the euro will have replaced entirely the existing currencies of the 11 participating nations.1 A common currency is expected to bring important benefits to the participants. Politically, many see it as a ...

Week One Quiz

... B) bank deposits C) pension funds reserves D) life insurance Answer: C 3) Economists define risk as A) the difference between the interest rate borrowers pay and the interest rate lenders receive. B) the chance that the value of financial assets will change from what you expect. C) the ease with whi ...

... B) bank deposits C) pension funds reserves D) life insurance Answer: C 3) Economists define risk as A) the difference between the interest rate borrowers pay and the interest rate lenders receive. B) the chance that the value of financial assets will change from what you expect. C) the ease with whi ...

Prepare your portfolio for rising interest rates

... and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Institutiona ...

... and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Institutiona ...

Policy Innovations - Decouple the World from the Dollar

... experienced a speedy, V-shaped recovery mainly because the sharp capital account reversals they experienced provided an unambiguous market signal that asset price deflation had hit bottom and overshot, which led to a strong surge in capital inflow and a speedy end to the crisis. The trouble now is t ...

... experienced a speedy, V-shaped recovery mainly because the sharp capital account reversals they experienced provided an unambiguous market signal that asset price deflation had hit bottom and overshot, which led to a strong surge in capital inflow and a speedy end to the crisis. The trouble now is t ...

Unit 3 Teacher

... 2004, Voluntary Regulation – The SEC proposes a system of voluntary regulation under the Consolidated Supervised Entities program, allowing investment banks to hold less capital in reserve and increase leverage. 2007, Subprime Mortgage Crisis – Defaults on subprime loans send shockwaves througho ...

... 2004, Voluntary Regulation – The SEC proposes a system of voluntary regulation under the Consolidated Supervised Entities program, allowing investment banks to hold less capital in reserve and increase leverage. 2007, Subprime Mortgage Crisis – Defaults on subprime loans send shockwaves througho ...

Speech to UCLA Symposium at UC Berkeley Berkeley, California

... interplay of the economic downturn and the credit crunch. Understandably, financial institutions have tightened lending terms, making it more difficult to qualify for a mortgage by requiring higher down payments, higher income-to-payment ratios, and higher FICO scores. Moreover, private-label securi ...

... interplay of the economic downturn and the credit crunch. Understandably, financial institutions have tightened lending terms, making it more difficult to qualify for a mortgage by requiring higher down payments, higher income-to-payment ratios, and higher FICO scores. Moreover, private-label securi ...

THE FED THE FED THE FED

... Summary of the Evolution Phase1 : Efforts to provide short-term funding to the ...

... Summary of the Evolution Phase1 : Efforts to provide short-term funding to the ...

Higher rates after Trump win mean good things for bank loan yields

... Both moves should alleviate pressure on banks’ security and loan portfolios, particularly with the yield curve steepening. The spread between the 2-year and 10-year Treasury yield expanded to as wide as 123 basis points with the recent moves, well above the low point of 76 basis points during the su ...

... Both moves should alleviate pressure on banks’ security and loan portfolios, particularly with the yield curve steepening. The spread between the 2-year and 10-year Treasury yield expanded to as wide as 123 basis points with the recent moves, well above the low point of 76 basis points during the su ...

Lecture 10 Chapter 14 PPT

... • In the years leading up to the financial crisis of 2007-2009, banks in the U.S. and Europe purchased large volumes of mortgage backed securities. – These assets carried (misleadingly) high ratings. – This meant the amount of capital they needed to hold under the risk-weighted capital rules was red ...

... • In the years leading up to the financial crisis of 2007-2009, banks in the U.S. and Europe purchased large volumes of mortgage backed securities. – These assets carried (misleadingly) high ratings. – This meant the amount of capital they needed to hold under the risk-weighted capital rules was red ...

Quarterly Insights July 2016

... billion in March and extending its purchases to include corporate bonds, the ECB has failed its mandate inflation has dropped over the last year from 0.3% to a point of deflation (- 0.1%). B) Negative Interest Rates The ECB Deposit Facility Rate is negative (-0.40%) to push banks to lend money versu ...

... billion in March and extending its purchases to include corporate bonds, the ECB has failed its mandate inflation has dropped over the last year from 0.3% to a point of deflation (- 0.1%). B) Negative Interest Rates The ECB Deposit Facility Rate is negative (-0.40%) to push banks to lend money versu ...

Euro Dollar Yuan and Yen

... Why does China want to sustain our system by purchasing treasury bonds? ...

... Why does China want to sustain our system by purchasing treasury bonds? ...