PDF

... Wickens (2011) that examined the relationship between credit default risk and macroeconomic shocks (such as monetary policy shocks and fiscal policy) and showed that the credit default risk is affected by macroeconomic shocks and it influence real variables and prices level of the economy. Lown and ...

... Wickens (2011) that examined the relationship between credit default risk and macroeconomic shocks (such as monetary policy shocks and fiscal policy) and showed that the credit default risk is affected by macroeconomic shocks and it influence real variables and prices level of the economy. Lown and ...

Europe under Threat: The Political Dynamics of Brexit

... many banks in the Eurozone suffered from legacy problems at the time the Banking Union was planned. These problems include insufficient capital, non-performing loans, risky derivatives, excess holding of national government securities, as well as inadequate business models and corporate governance. ...

... many banks in the Eurozone suffered from legacy problems at the time the Banking Union was planned. These problems include insufficient capital, non-performing loans, risky derivatives, excess holding of national government securities, as well as inadequate business models and corporate governance. ...

Municipal Fixed Income Commentary

... win this game.” Yogi calls for a pinch hitter to come to the plate to hit from the left side since the opposing pitcher is right handed. This pinch hitter has the opposing team befuddled since there is little data to review. The batting average is low so the catcher is going to call for straight pit ...

... win this game.” Yogi calls for a pinch hitter to come to the plate to hit from the left side since the opposing pitcher is right handed. This pinch hitter has the opposing team befuddled since there is little data to review. The batting average is low so the catcher is going to call for straight pit ...

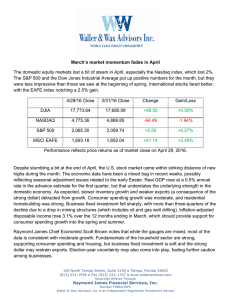

March`s market momentum fades in April The domestic equity

... MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and eco ...

... MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and eco ...

paper - Institute for New Economic Thinking

... used to preserve the stable, high rate of investment and growth. And if there is substantial excess capacity as well as out of average capital-output ratios this suggests that the banks are primarily engaged in Ponzi financing in which the service on the lending is being created by additional borrow ...

... used to preserve the stable, high rate of investment and growth. And if there is substantial excess capacity as well as out of average capital-output ratios this suggests that the banks are primarily engaged in Ponzi financing in which the service on the lending is being created by additional borrow ...

Steady as she goes?

... chance to hear from central bankers and academics about hot topics in monetary policy. As you can imagine, when central bankers talk, investors listen. This year’s theme was “Designing Resilient Monetary Policy Frameworks for the Future.” Most participants argued that negative rates can be effective ...

... chance to hear from central bankers and academics about hot topics in monetary policy. As you can imagine, when central bankers talk, investors listen. This year’s theme was “Designing Resilient Monetary Policy Frameworks for the Future.” Most participants argued that negative rates can be effective ...

Monetary Policy - India schools, colleges, education

... or base money, by varying CRR, RBI can reduce or add to the bank’s required reserves and thus affect bank’s ability to lend. ...

... or base money, by varying CRR, RBI can reduce or add to the bank’s required reserves and thus affect bank’s ability to lend. ...

Oiling the wheels

... of this expanding trade corridor, but also for the banks on each side of the trade. Such arrangements can even provide local banks with liquidity and capital assistance, enabling them to reduce their borrowing requirements and continue lending. Additionally, global banks can also provide expertise t ...

... of this expanding trade corridor, but also for the banks on each side of the trade. Such arrangements can even provide local banks with liquidity and capital assistance, enabling them to reduce their borrowing requirements and continue lending. Additionally, global banks can also provide expertise t ...

alephblog.com

... lower exchange rate than consumers would, and they have more political clout. Works in the short run because of a surplus of ...

... lower exchange rate than consumers would, and they have more political clout. Works in the short run because of a surplus of ...

To the Point: New rules may affect how entities classify and

... not preclude entities from classifying their investments in money market funds as cash equivalents because fluctuations in the amount of cash received upon redemption would likely be small3 and would be consistent with the concept of a “known” amount of cash. The SEC has also said that, under normal ...

... not preclude entities from classifying their investments in money market funds as cash equivalents because fluctuations in the amount of cash received upon redemption would likely be small3 and would be consistent with the concept of a “known” amount of cash. The SEC has also said that, under normal ...

Weekly Commentary 02-10-14 PAA

... it affected you! The report found, from 2007 through 2012, households in the United Kingdom and the United States: “…together lost $630 billion in net interest income, although the impact varies across groups. Younger households that are net borrowers have benefited, while older households with sign ...

... it affected you! The report found, from 2007 through 2012, households in the United Kingdom and the United States: “…together lost $630 billion in net interest income, although the impact varies across groups. Younger households that are net borrowers have benefited, while older households with sign ...

Updates to the HealthEquity investment lineup

... savings. In an effort to increase fee transparency and reduce investment costs, we are improving our mutual fund lineup by eliminating certain offerings and adding others. These changes also address new regulations from the U.S. Department of Labor. If you currently invest your HSA, there are a few ...

... savings. In an effort to increase fee transparency and reduce investment costs, we are improving our mutual fund lineup by eliminating certain offerings and adding others. These changes also address new regulations from the U.S. Department of Labor. If you currently invest your HSA, there are a few ...

The Great Depression and the Great Recession

... and 1928. In other words, the “scarcity of quality loans” meant that the investor had to accept a 10 percent decline in nominal yield. In 1925 the average risk premium for issues of foreign bonds, 30 percent of which subsequently proved to be of bad quality, was 2.18 percent. In 1928 a crop of forei ...

... and 1928. In other words, the “scarcity of quality loans” meant that the investor had to accept a 10 percent decline in nominal yield. In 1925 the average risk premium for issues of foreign bonds, 30 percent of which subsequently proved to be of bad quality, was 2.18 percent. In 1928 a crop of forei ...

Manulife Financial — the best 5-Year GIC rates in the industry

... Basic Account (½ year terms) - Earn higher rates by simply adding 6 months to a standard length term.1 Laddered Account - Diversify your GIC portfolio by ensuring that a portion matures each year and is reinvested at attractive long-term rates. One attractive rate is given for all your initial 1 ...

... Basic Account (½ year terms) - Earn higher rates by simply adding 6 months to a standard length term.1 Laddered Account - Diversify your GIC portfolio by ensuring that a portion matures each year and is reinvested at attractive long-term rates. One attractive rate is given for all your initial 1 ...

Management Information Strategy and Project Oscar

... • HMT will work closely with the LGA to look at issues both as part of the consultation and arising from the consultation; • This model may reconcile some of the price and scrutiny issues not currently addressed. ...

... • HMT will work closely with the LGA to look at issues both as part of the consultation and arising from the consultation; • This model may reconcile some of the price and scrutiny issues not currently addressed. ...

Slides

... Note: Carnegie is now owned by the Swedish National Debt Office and the Riksbank’s liquidity assistance has been repaid ...

... Note: Carnegie is now owned by the Swedish National Debt Office and the Riksbank’s liquidity assistance has been repaid ...

Banking Policy Review: Did Dodd–Frank End `Too Big to Fail`?

... access to public debt markets — also give large nonfinancial firms a funding advantage over smaller nonfinancial firms. However, there is no reason to expect government bailouts in most nonfinancial industries because they do not have the extensive interconnectedness and systemic footprint that the ...

... access to public debt markets — also give large nonfinancial firms a funding advantage over smaller nonfinancial firms. However, there is no reason to expect government bailouts in most nonfinancial industries because they do not have the extensive interconnectedness and systemic footprint that the ...

Introduction to Money and the Financial System

... general rule, if you are more than 10 minutes late, you should not enter the classroom. If you arrive late, but need to see the instructor or pick up lecture notes, please return at the end of the ...

... general rule, if you are more than 10 minutes late, you should not enter the classroom. If you arrive late, but need to see the instructor or pick up lecture notes, please return at the end of the ...

Krajowe Stowarzyszenie Funduszy Poręczeniowych

... 2) Lack of ability to repay the debt and the restructuring of the company within the meaning of the Community guidelines on State aid for rescuing and restructuring firms (firms in difficulty) excludes the possibility of sponsoring. 3) The funds provide guarantees for companies classified in the cat ...

... 2) Lack of ability to repay the debt and the restructuring of the company within the meaning of the Community guidelines on State aid for rescuing and restructuring firms (firms in difficulty) excludes the possibility of sponsoring. 3) The funds provide guarantees for companies classified in the cat ...

Chapter 1: Introduction to Money and Banking

... Because long-term loans tend to be riskier and are held longer, their rates need to be higher to incentivize the loan process. The difference between short and long term rates is an indicator of the state of the economy. ...

... Because long-term loans tend to be riskier and are held longer, their rates need to be higher to incentivize the loan process. The difference between short and long term rates is an indicator of the state of the economy. ...

Financial Crises: Mechanisms, Prevention, and Management

... Second, the volatility of a price process can vary over time. A sharp price decline may signal that we are about to enter more volatile times. Consequently, margins and haircuts should be larger and lending should be reduced after such a price decline. An extreme example was the situation in August ...

... Second, the volatility of a price process can vary over time. A sharp price decline may signal that we are about to enter more volatile times. Consequently, margins and haircuts should be larger and lending should be reduced after such a price decline. An extreme example was the situation in August ...

Commodity money

... • Institutions involved in money creation - Central Bank (e.g. the Federal Reserve in the US): Monetary institution that has the legal authority to issue bills and coins. Among other functions it regulates the banking system and is the lender of last resort. ...

... • Institutions involved in money creation - Central Bank (e.g. the Federal Reserve in the US): Monetary institution that has the legal authority to issue bills and coins. Among other functions it regulates the banking system and is the lender of last resort. ...

Weekly Market Review - Franklin Templeton India

... Global equity markets exhibited divergent trends amidst mixed economic and earnings newsflow. The MSCI AC World index was almost unchanged during the week as declines in Japan and UK offset gains in the US & Latin America. For the month as a whole the index was up 3.53% and China was the top gainer ...

... Global equity markets exhibited divergent trends amidst mixed economic and earnings newsflow. The MSCI AC World index was almost unchanged during the week as declines in Japan and UK offset gains in the US & Latin America. For the month as a whole the index was up 3.53% and China was the top gainer ...

Bank System Stabilisations - Corporate Restructuring Summit

... Participation is mandatory for 17 Eurozone countries and optional for the other EU member states. Banks deemed “significant” will be supervised directly by the ECB and will comprise more than 80% (more than €25 trillion) of the Eurozone’s banking assets. The Supervisory Board will consist of 23 repr ...

... Participation is mandatory for 17 Eurozone countries and optional for the other EU member states. Banks deemed “significant” will be supervised directly by the ECB and will comprise more than 80% (more than €25 trillion) of the Eurozone’s banking assets. The Supervisory Board will consist of 23 repr ...

Definition 1 Government bonds Bonds issued by public authorities

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...