Defining the new core of a bank

... that banks that can achieve it will be able to win an increased share of wallet (Figure 2). They will also be able to reduce the cost of their operations and better satisfy regulators that they are treating customers fairly. However, achieving it will require reform of banks’ internal systems, proce ...

... that banks that can achieve it will be able to win an increased share of wallet (Figure 2). They will also be able to reduce the cost of their operations and better satisfy regulators that they are treating customers fairly. However, achieving it will require reform of banks’ internal systems, proce ...

the full document

... invests in portfolios of CISs that levy their own charges which could result in a higher fee structure for the fund of funds. A feeder fund is a portfolio that invests in a single portfolio of a CIS, which levies its own charges which could result in a higher fee structure for the feeder fund. Perfo ...

... invests in portfolios of CISs that levy their own charges which could result in a higher fee structure for the fund of funds. A feeder fund is a portfolio that invests in a single portfolio of a CIS, which levies its own charges which could result in a higher fee structure for the feeder fund. Perfo ...

Y376 International Political Economy

... • Globalization brought prosperity to the wealthy democracies of the North. • The export-oriented countries of East Asia have greatly increased their per capita incomes. • Most governments in the South and the formerly communist nations have accepted key aspects of the Washington Consensus. • The po ...

... • Globalization brought prosperity to the wealthy democracies of the North. • The export-oriented countries of East Asia have greatly increased their per capita incomes. • Most governments in the South and the formerly communist nations have accepted key aspects of the Washington Consensus. • The po ...

The Federal Reserve and Its Power

... • The Fed plays a major role in check clearing, particularly in clearing checks drawn on depository institutions which hold reserves or clearing deposit balances with the Fed. • Bank deposits at the Fed can be easily transferred between the accounts of the depository institutions by making appropria ...

... • The Fed plays a major role in check clearing, particularly in clearing checks drawn on depository institutions which hold reserves or clearing deposit balances with the Fed. • Bank deposits at the Fed can be easily transferred between the accounts of the depository institutions by making appropria ...

True/False - Henry County Schools

... its loans. The interest on a 90-day loan for $24,800 at 7.35% to one of Juniper's borrowers is 78. On a corporate financial report, the calculation of income from operations would not include 79. Juwann Clines has a health insurance policy with a $100 cumulative deductible for visits to doctors. The ...

... its loans. The interest on a 90-day loan for $24,800 at 7.35% to one of Juniper's borrowers is 78. On a corporate financial report, the calculation of income from operations would not include 79. Juwann Clines has a health insurance policy with a $100 cumulative deductible for visits to doctors. The ...

What Caused the Wall Street Crash of 1929?

... enabled more money to be put into shares, increasing their value. It is said there were many ‘margin millionaire’ investors. They had made huge profits by buying on the margin and watching share prices rise. But, it left investors very exposed when prices fell. These margin millionaires got wiped ou ...

... enabled more money to be put into shares, increasing their value. It is said there were many ‘margin millionaire’ investors. They had made huge profits by buying on the margin and watching share prices rise. But, it left investors very exposed when prices fell. These margin millionaires got wiped ou ...

February 2003 - McCarthy Asset Management, Inc.

... existing MAM accounts (which on average are about 15% in bonds). Should I increase the bond allocation in existing portfolios? Emotionally that may seem like the correct move given all the uncertainty in the current environment. I hesitate to do this for several reasons. The first is that much of th ...

... existing MAM accounts (which on average are about 15% in bonds). Should I increase the bond allocation in existing portfolios? Emotionally that may seem like the correct move given all the uncertainty in the current environment. I hesitate to do this for several reasons. The first is that much of th ...

Real Estate Finance - PowerPoint presentation - Ch 03

... • The Home Mortgage Disclosure Act requires financial institutions to disclose the number and dollar amount of loans by geographic area. • The 1992 Federal Housing Enterprises, Financial Safety, and Soundness Act requires federal secondary-market agencies to purchase at least 30% of their mortgages ...

... • The Home Mortgage Disclosure Act requires financial institutions to disclose the number and dollar amount of loans by geographic area. • The 1992 Federal Housing Enterprises, Financial Safety, and Soundness Act requires federal secondary-market agencies to purchase at least 30% of their mortgages ...

140410-Inflation-the-Oldest-and-Most-Powerful-Force-in

... February, the ranking of International was hurt by currency movements. Believing that the United States will not adequately address its inflation issue, which should be zero based, I believe on a relative basis the long-term value of the dollar will decline. Thus, at this point in time for long-term ...

... February, the ranking of International was hurt by currency movements. Believing that the United States will not adequately address its inflation issue, which should be zero based, I believe on a relative basis the long-term value of the dollar will decline. Thus, at this point in time for long-term ...

monetary policy

... bank intermediation costs since they are paid market-based interest rates. In March 2006, the Monetary Board began to require banks to keep liquidity reserves in the form of term deposits in the reserve deposit account (RDA) with the BSP instead of government securities bought directly from the BSP. ...

... bank intermediation costs since they are paid market-based interest rates. In March 2006, the Monetary Board began to require banks to keep liquidity reserves in the form of term deposits in the reserve deposit account (RDA) with the BSP instead of government securities bought directly from the BSP. ...

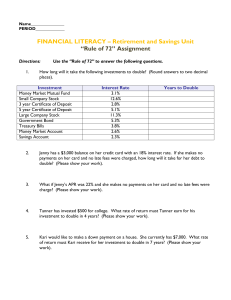

Rule of 72 Assignment

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

Prepare for the Bear, Whenever It Arrives A Study In Succession

... Recently the muni market took another forearm shiver with Puerto Rico’s passage of its Public Corporation Debt Enforcement and Recovery Act, with provisions that differed from certain tools and protections provided under the U.S. Bankruptcy Code. These sorts of situations have kept muni bond yields ...

... Recently the muni market took another forearm shiver with Puerto Rico’s passage of its Public Corporation Debt Enforcement and Recovery Act, with provisions that differed from certain tools and protections provided under the U.S. Bankruptcy Code. These sorts of situations have kept muni bond yields ...

Dollar Cost Averaging – A sound investment strategy to help you

... long-term. Dollar Cost Averaging – A long-term investment strategy to help you stay invested. ...

... long-term. Dollar Cost Averaging – A long-term investment strategy to help you stay invested. ...

Common Stock: Analysis and Strategy - it

... Four broad sectors: – Interest-sensitive stocks, consumer durable stocks, capital goods stocks, and defensive stocks ...

... Four broad sectors: – Interest-sensitive stocks, consumer durable stocks, capital goods stocks, and defensive stocks ...

Federal Reserve Raises Interest Rates

... between fixed-income security prices and interest rates. Then, based on their risk tolerance, investment objectives and return expectations, they can identify and implement an appropriate fixed-income investment strategy. Some investors need a long-term form of stability that fixed income still offe ...

... between fixed-income security prices and interest rates. Then, based on their risk tolerance, investment objectives and return expectations, they can identify and implement an appropriate fixed-income investment strategy. Some investors need a long-term form of stability that fixed income still offe ...

Grading Bonds on Inverted Curve

... an occupied home gets sold, the seller has to buy or rent another house. That sets off a chain reaction that ripples through the housing market. When a vacant home gets sold, the seller doesn't have to do anything. The owners of those unrented, unsold homes bear costs. They have got insurance, the l ...

... an occupied home gets sold, the seller has to buy or rent another house. That sets off a chain reaction that ripples through the housing market. When a vacant home gets sold, the seller doesn't have to do anything. The owners of those unrented, unsold homes bear costs. They have got insurance, the l ...

Financial Institutions and Capital Markets

... markets that are set up to promote efficient exchange of Business Administration is regularly funds from buyers to sellers. Institutions such as banks, recognized as having one of the hedge funds, sovereign wealth funds etc., are key world’s premier teaching faculties players in the capital markets ...

... markets that are set up to promote efficient exchange of Business Administration is regularly funds from buyers to sellers. Institutions such as banks, recognized as having one of the hedge funds, sovereign wealth funds etc., are key world’s premier teaching faculties players in the capital markets ...

Teachable Moment #11: Bubbles, Bank Runs

... Collateralized Debt Obligation (CDO) A type of asset-backed securities and credits, including mortgage-backed securities Reserve requirement/required reserve ratio The amount of depositor money a bank is required to keep as “vault cash” or as a deposit with a Federal Reserve Bank Speculation An inve ...

... Collateralized Debt Obligation (CDO) A type of asset-backed securities and credits, including mortgage-backed securities Reserve requirement/required reserve ratio The amount of depositor money a bank is required to keep as “vault cash” or as a deposit with a Federal Reserve Bank Speculation An inve ...

Finance , Saving, And Investment,

... • A financial institution borrows and lends, so it is exposed to the risk that the net worth becomes negative. To limit that risk, institutions are regulated and a minimum amount of their lending must be backed by ...

... • A financial institution borrows and lends, so it is exposed to the risk that the net worth becomes negative. To limit that risk, institutions are regulated and a minimum amount of their lending must be backed by ...

Section 5 Lecture

... human civilizations. All successful forms of money must serve as a medium of exchange, a store of value, and unit of account. • Two aggregate measures of the money supply are M1 and M2. • M1 is the narrowest definition. You will most often work with this definition. • M2 adds several other assets, k ...

... human civilizations. All successful forms of money must serve as a medium of exchange, a store of value, and unit of account. • Two aggregate measures of the money supply are M1 and M2. • M1 is the narrowest definition. You will most often work with this definition. • M2 adds several other assets, k ...

演讲内容分为三个部分 - Three on the Bund

... Let me talk about cost. When we gave money to big banks, we have their stock. Congress’s panel department valued this transaction. Later, the stock price dropped a lot. Averagely speaking, the value of the shares reduced from 1 dollar to 65 cents. This means, we were cheated and those shares were ov ...

... Let me talk about cost. When we gave money to big banks, we have their stock. Congress’s panel department valued this transaction. Later, the stock price dropped a lot. Averagely speaking, the value of the shares reduced from 1 dollar to 65 cents. This means, we were cheated and those shares were ov ...

「M2+債券型基金」統計數之編製說明

... The newly-modified table will therefore replace the existing table currently known as the Consolidated Assets and Liabilities of Major Financial Institutions. (5) This modification applies to all relevant data for the Financial Statistics Monthly collected since January 1997. ...

... The newly-modified table will therefore replace the existing table currently known as the Consolidated Assets and Liabilities of Major Financial Institutions. (5) This modification applies to all relevant data for the Financial Statistics Monthly collected since January 1997. ...

Chapter 2

... visiting or telephoning an OTC dealer or by using a computer-based electronic trading system linked to the OTC dealer. ...

... visiting or telephoning an OTC dealer or by using a computer-based electronic trading system linked to the OTC dealer. ...

Highlights of Recent Trends in Financial Markets

... reported losses for fiscal year 2000 mainly due to bad loan disposal. They have been issuing new capital in part to strengthen balance sheets ahead of April 2002 when the blanket deposit guarantee ends, but the rise in bad debts has also been an important consideration. Bad loans have increased by s ...

... reported losses for fiscal year 2000 mainly due to bad loan disposal. They have been issuing new capital in part to strengthen balance sheets ahead of April 2002 when the blanket deposit guarantee ends, but the rise in bad debts has also been an important consideration. Bad loans have increased by s ...