The Causes of the Japanese Lost Decade: An Extension of

... dismantled, interest rates on deposits deregulated and new financial institutions were in place. As banks lost large firms to the international capital markets and domestic securities markets, they found alternative lending prospects in small and medium sized firms. ...

... dismantled, interest rates on deposits deregulated and new financial institutions were in place. As banks lost large firms to the international capital markets and domestic securities markets, they found alternative lending prospects in small and medium sized firms. ...

Make your dollars stretch farther in tighter times

... Lynn Tostado is passionate about spending her money wisely. One strategy: She and her husband use credit cards that will help them reach their financial goals. They earned $3,500 toward a $10,000 Chevy Cavalier by using a GM rewards credit card. By shopping with an L.L. Bean credit card, they got al ...

... Lynn Tostado is passionate about spending her money wisely. One strategy: She and her husband use credit cards that will help them reach their financial goals. They earned $3,500 toward a $10,000 Chevy Cavalier by using a GM rewards credit card. By shopping with an L.L. Bean credit card, they got al ...

Economics Web Newsletter - McGraw Hill Higher Education

... to add or subtract reserves into the banking system to set the short-term interest rate called the federal funds rate. In fact, that is how the Fed generally states its monetary policy—by stating how it will change the federal funds rate. Return to article. 2. A bond trader purchases bonds to earn a ...

... to add or subtract reserves into the banking system to set the short-term interest rate called the federal funds rate. In fact, that is how the Fed generally states its monetary policy—by stating how it will change the federal funds rate. Return to article. 2. A bond trader purchases bonds to earn a ...

1st Quarter 2015 Market Commentary

... rate hike may look like to the markets, the Fed will most likely remain cautious and communicative throughout the process. Counterbalancing future Fed policy is the fact that global inflation and interest rates remain low while the general stance among the major central banks is of e ...

... rate hike may look like to the markets, the Fed will most likely remain cautious and communicative throughout the process. Counterbalancing future Fed policy is the fact that global inflation and interest rates remain low while the general stance among the major central banks is of e ...

Who are the end-users in the OTC derivatives market?

... 2014).* NFCs often use raw materials for their production or produce these materials themselves. The fact that NFC end-users aim to hedge their exposures to price changes in crude oil, natural gas, precious metals as well as agricultural commodities and even livestock largely explains their active r ...

... 2014).* NFCs often use raw materials for their production or produce these materials themselves. The fact that NFC end-users aim to hedge their exposures to price changes in crude oil, natural gas, precious metals as well as agricultural commodities and even livestock largely explains their active r ...

Bernanke, Fed Surprise Markets; QE3 to Continue

... bond purchases until unemployment was at 6.5% or inflation was at 2.5%. Neither metric has been reached as unemployment was 7.2% in August and inflation for 2013 is expected to be around 1.5%. Federal Reserve Bank of St. Louis President James Bullard disclosed the decision not to taper was “borderli ...

... bond purchases until unemployment was at 6.5% or inflation was at 2.5%. Neither metric has been reached as unemployment was 7.2% in August and inflation for 2013 is expected to be around 1.5%. Federal Reserve Bank of St. Louis President James Bullard disclosed the decision not to taper was “borderli ...

outlook - Janus Capital Group

... tighter risk spreads dominating the long-term trend. There have been dramatic reversals as with the Lehman Brothers collapse, the Asia/dot-com crisis around the turn of the century, and of course 1987’s one-day crash, but each reversal was met with a new and increasingly innovative monetary policy i ...

... tighter risk spreads dominating the long-term trend. There have been dramatic reversals as with the Lehman Brothers collapse, the Asia/dot-com crisis around the turn of the century, and of course 1987’s one-day crash, but each reversal was met with a new and increasingly innovative monetary policy i ...

Investing in Consumer Notes: Higher Returns in Fixed

... – 3-Year Term, Fully Amortized – Automated monthly debit from borrowers’ accounts, credit to investors accounts ...

... – 3-Year Term, Fully Amortized – Automated monthly debit from borrowers’ accounts, credit to investors accounts ...

It is not appropriate to discount the cash flows of a bond by the yield

... If E(z)s are not equal forward rates then total returns are not equal for all investment strategies spanning an investment horizon. Conditioned on E(z)s and decision maker’s risk tolerance, a decision maker may select a strategy that produces an interest rate risk exposure if the expected return fr ...

... If E(z)s are not equal forward rates then total returns are not equal for all investment strategies spanning an investment horizon. Conditioned on E(z)s and decision maker’s risk tolerance, a decision maker may select a strategy that produces an interest rate risk exposure if the expected return fr ...

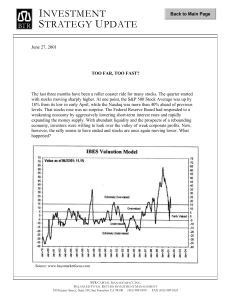

INVESTMENT STRATEGY UPDATE

... The last three months have been a roller coaster ride for many stocks. The quarter started with stocks moving sharply higher. At one point, the S&P 500 Stock Average was up by 18% from its low in early April, while the Nasdaq was more than 40% ahead of previous levels. That stocks rose was no surpri ...

... The last three months have been a roller coaster ride for many stocks. The quarter started with stocks moving sharply higher. At one point, the S&P 500 Stock Average was up by 18% from its low in early April, while the Nasdaq was more than 40% ahead of previous levels. That stocks rose was no surpri ...

Luc Laeven

... Increase in leverage prior to crisis: more so in Europe Leverage (A/E) of largest US BHCs and European 1/ banks, banks 1994-2011 ...

... Increase in leverage prior to crisis: more so in Europe Leverage (A/E) of largest US BHCs and European 1/ banks, banks 1994-2011 ...

DOC - Europa.eu

... the Benelux and Nordic countries. Consolidation in the banking sector can be motivated by a number of factors, but one of the most potent is the desire to increase market power. The risks associated with market power are well known: higher prices, control of networks to prevent smaller competitors f ...

... the Benelux and Nordic countries. Consolidation in the banking sector can be motivated by a number of factors, but one of the most potent is the desire to increase market power. The risks associated with market power are well known: higher prices, control of networks to prevent smaller competitors f ...

SU12_2630_SGForFinal..

... 8. Suppose the Fed purchases $1,000 in bonds. How much will the money supply change if the reserve-deposit ratio is 0.10 assuming the public holds no extra currency? If the Fed purchases $1,000 from the public, reserves will initially increase by $1,000. Bank deposits will ultimately be = $1,000/0.1 ...

... 8. Suppose the Fed purchases $1,000 in bonds. How much will the money supply change if the reserve-deposit ratio is 0.10 assuming the public holds no extra currency? If the Fed purchases $1,000 from the public, reserves will initially increase by $1,000. Bank deposits will ultimately be = $1,000/0.1 ...

Does Size Matter? The Effects of Bank Mergers on Small Firm

... dissatisfied customers to choose other banks. Also with respect to small business lending, the knowledge and information used by loan officers and bank managers is very important. Thus, while increasing portfolio diversification, tapping into new areas also means additional work that can be very co ...

... dissatisfied customers to choose other banks. Also with respect to small business lending, the knowledge and information used by loan officers and bank managers is very important. Thus, while increasing portfolio diversification, tapping into new areas also means additional work that can be very co ...

The future of corporate bond market liquidity

... liquidity and volatility The Volcker Rule is an important part of the Dodd-Frank legislation (Wall Street Reform and Consumer Protection Act), and it is intended to lower the risk of financial firms by limiting proprietary trading. Given the complexity of the topic, and difficulty in defining what i ...

... liquidity and volatility The Volcker Rule is an important part of the Dodd-Frank legislation (Wall Street Reform and Consumer Protection Act), and it is intended to lower the risk of financial firms by limiting proprietary trading. Given the complexity of the topic, and difficulty in defining what i ...

Code of Practice for Banks - Guernsey Financial Services Commission

... or otherwise posing special risks are subject to approval by the bank’s board of directors; ensure that banks have procedures in place to prevent persons benefiting from loans and guarantees being part of the loan assessment or decision process; other than for money market placements, set limits for ...

... or otherwise posing special risks are subject to approval by the bank’s board of directors; ensure that banks have procedures in place to prevent persons benefiting from loans and guarantees being part of the loan assessment or decision process; other than for money market placements, set limits for ...

Fig. 1: Annual* Inflation and Depreciation in Israel, 1958

... * In foreign currency and linked to exchange rate ...

... * In foreign currency and linked to exchange rate ...

Monetary policy outline: - International Policy Fellowships

... reflected by the improvement of the country’s rating, which was also connected with an inflow of foreign capital. The situation required relatively intensive central bank intervention in the foreign exchange rate market, backed by a 1.5 percentage point cut in the key NBS interest rate. In line with ...

... reflected by the improvement of the country’s rating, which was also connected with an inflow of foreign capital. The situation required relatively intensive central bank intervention in the foreign exchange rate market, backed by a 1.5 percentage point cut in the key NBS interest rate. In line with ...

Topic Outline - Matthew H. Shapiro

... M2: M1+Savings Deposits, Small Time deposits, Monet Market, Mutual funds). Also MZM, several others. Liquidity: ...

... M2: M1+Savings Deposits, Small Time deposits, Monet Market, Mutual funds). Also MZM, several others. Liquidity: ...

Speech to Community Leaders Luncheon Portland, Oregon

... But markets remain very fragile. For example, credit-default-swap spreads for many financial institutions are again on the rise, the debt ratings for several important bond insurers have been cut, and stock prices for financial institutions have plummeted. There is further evidence that financial ma ...

... But markets remain very fragile. For example, credit-default-swap spreads for many financial institutions are again on the rise, the debt ratings for several important bond insurers have been cut, and stock prices for financial institutions have plummeted. There is further evidence that financial ma ...

Ph - Edelweiss Financial Services

... instruments till maturity getting a fixed rate of return. Thus FMP can manage to get a specific interest on these instruments and investors have a fair idea about it. This helps investors tailor their investments as per their future cash requirements • They primarily invest in AAA, P1+ or such kind ...

... instruments till maturity getting a fixed rate of return. Thus FMP can manage to get a specific interest on these instruments and investors have a fair idea about it. This helps investors tailor their investments as per their future cash requirements • They primarily invest in AAA, P1+ or such kind ...

Interest rates: are investors in for a nasty shock?

... All this shows that there have been numerous periods where interest rates have risen significantly over short periods of time. The origins of such a tightening of policy generally lie in either a sharp rise in inflation, pressure on the exchange rate, or sometimes a combination of the two. Developed ...

... All this shows that there have been numerous periods where interest rates have risen significantly over short periods of time. The origins of such a tightening of policy generally lie in either a sharp rise in inflation, pressure on the exchange rate, or sometimes a combination of the two. Developed ...

Appendix 1B Monetary Policy Tools

... rate change on the money supply is often uncertain. Second, because of its “signaling” importance, a discount rate change often has great effects on the financial markets. For example, the unexpected decrease in the Fed’s discount rate (to 0.50 percent) on December 16, 2008, resulted in a 359.61 poi ...

... rate change on the money supply is often uncertain. Second, because of its “signaling” importance, a discount rate change often has great effects on the financial markets. For example, the unexpected decrease in the Fed’s discount rate (to 0.50 percent) on December 16, 2008, resulted in a 359.61 poi ...