CURRENT STATE OF EQUITY MARKET IN INDIA

... • Manage liquidity actively so that the credit demand of the Government is met while ensuring the flow of credit to the private sector at viable rates. • Keep a vigil on the trends and signals of inflation, and be prepared to respond quickly and effectively through policy adjustments. • Maintain a m ...

... • Manage liquidity actively so that the credit demand of the Government is met while ensuring the flow of credit to the private sector at viable rates. • Keep a vigil on the trends and signals of inflation, and be prepared to respond quickly and effectively through policy adjustments. • Maintain a m ...

Will Guarding Against Deflation Now Lead to an Inflation

... tional reserve banking, banks lend out all but a small portion of the deposits they receive from the public. As banks lend out their excess reserves, these loans become deposits for other financial institutions. This process then carries on down the line. However, if there is an increase in reserves ...

... tional reserve banking, banks lend out all but a small portion of the deposits they receive from the public. As banks lend out their excess reserves, these loans become deposits for other financial institutions. This process then carries on down the line. However, if there is an increase in reserves ...

Reconciling the Cambridge and Wall Street

... Godley, are the likely locus of some form of post-Keynesian consensus in macroeconomics, as it allows to entertain both monetary and real issues within a single model. ...

... Godley, are the likely locus of some form of post-Keynesian consensus in macroeconomics, as it allows to entertain both monetary and real issues within a single model. ...

Kick-Off Briefing

... o Although access to funding from parent banks may decline, failure of subsidiaries is unlikely to occur unless significant losses occur o Large current liquidity (liquidity rate of 31% as of October 2008) and capital buffers (CAR of 26% as of October 2008) • Actions since the crisis to safeguard th ...

... o Although access to funding from parent banks may decline, failure of subsidiaries is unlikely to occur unless significant losses occur o Large current liquidity (liquidity rate of 31% as of October 2008) and capital buffers (CAR of 26% as of October 2008) • Actions since the crisis to safeguard th ...

FRBSF L CONOMIC

... 2010 meeting of the Federal Open Market Committee (FOMC). The FOMC also said it would continue to reinvest principal payments on its holdings of these longer-term assets, a policy announced in August 2010. Collectively, these actions, partially offset by earlier redemptions and MBS principal payment ...

... 2010 meeting of the Federal Open Market Committee (FOMC). The FOMC also said it would continue to reinvest principal payments on its holdings of these longer-term assets, a policy announced in August 2010. Collectively, these actions, partially offset by earlier redemptions and MBS principal payment ...

monetary policy force effect by means of banks money creation

... its portfolio. The banking system low risk approach will adversely affect any intention of the central bank to raise money supply in circulation through the banking sector. 4. Conclusions and recommendations Propulsion effect of monetary policy by means of banks money creation can be used as an info ...

... its portfolio. The banking system low risk approach will adversely affect any intention of the central bank to raise money supply in circulation through the banking sector. 4. Conclusions and recommendations Propulsion effect of monetary policy by means of banks money creation can be used as an info ...

What market features reduce uncertainty?

... Investigate the behavior of alternative market structures and suggest new market initiatives. Predicting the impact of introducing stock index futures ...

... Investigate the behavior of alternative market structures and suggest new market initiatives. Predicting the impact of introducing stock index futures ...

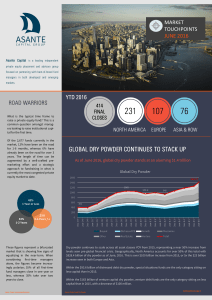

global dry powder continues to stack up

... for the highest percentage ever recorded. As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin ...

... for the highest percentage ever recorded. As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin ...

Are We Stuck Pushing on Strings?

... these reserves within the Fed’s coffers (Keister and McAndrews 2009). This means that the banks are earning profits through a pattern whereby they borrow at a zero percent rate on the federal funds market, then collect a 0.25 guaranteed return by depositing these funds with the Federal Reserve. The ...

... these reserves within the Fed’s coffers (Keister and McAndrews 2009). This means that the banks are earning profits through a pattern whereby they borrow at a zero percent rate on the federal funds market, then collect a 0.25 guaranteed return by depositing these funds with the Federal Reserve. The ...

commentary - Nvest Wealth Strategies

... duly rewarded for their commitment, as most investors are avoiding stocks in favor of perceived safety in bonds. When they return to stocks, they will have missed much of the return due to their late arrival. Investors are chasing yield. They desire lower risk (less volatility) because unemployment ...

... duly rewarded for their commitment, as most investors are avoiding stocks in favor of perceived safety in bonds. When they return to stocks, they will have missed much of the return due to their late arrival. Investors are chasing yield. They desire lower risk (less volatility) because unemployment ...

The Mortgage Crisis and Credit Crunch: From Housing Losses to

... to also rise and because many of the the loans were adjustable, banks were able to raise interest rates on those loans, causing mortgage payments to be unaffordable. 4 III. SIV Story SIV‘s, or structured investment vehicles are a major story: A pool of investment assets that attempts to profit from ...

... to also rise and because many of the the loans were adjustable, banks were able to raise interest rates on those loans, causing mortgage payments to be unaffordable. 4 III. SIV Story SIV‘s, or structured investment vehicles are a major story: A pool of investment assets that attempts to profit from ...

Trade, capital flows and credit growth in CEE

... Percentage contribution to the annual growth rate of private sector credit; average for 2003–05 (for Slovakia, 2004–05). Based on monthly data. Sources: Central banks; author’s estimates. ...

... Percentage contribution to the annual growth rate of private sector credit; average for 2003–05 (for Slovakia, 2004–05). Based on monthly data. Sources: Central banks; author’s estimates. ...

FDR and the Banks - Constitutional Rights Foundation

... in New York City. Thus when banks began failing outside New York, the Fed failed to loan money to help the troubled banks. The Fed concluded it could stop the banking crisis by just making loans to the Wall Street banks. This policy worked on Wall Street, but banks continued to fail all over the cou ...

... in New York City. Thus when banks began failing outside New York, the Fed failed to loan money to help the troubled banks. The Fed concluded it could stop the banking crisis by just making loans to the Wall Street banks. This policy worked on Wall Street, but banks continued to fail all over the cou ...

Liquidity Measurement and Management

... • Loan to Deposit Ratio – This ratio has long been used as a measurement of liquidity. However, when this ratio was first introduced, investment alterna-tives were typically limited to U.S. Governments. At the same time, the only source of funding for community banks was local deposits. Therefore, i ...

... • Loan to Deposit Ratio – This ratio has long been used as a measurement of liquidity. However, when this ratio was first introduced, investment alterna-tives were typically limited to U.S. Governments. At the same time, the only source of funding for community banks was local deposits. Therefore, i ...

Document

... discount rate is reduced That is, if business prospects look poor and if banks view lending as risky, then even a lower discount rate may not entice banks to borrow from the Fed As a result, the Fed uses the discount rate more as a signal to financial markets about its monetary policy than as a tool ...

... discount rate is reduced That is, if business prospects look poor and if banks view lending as risky, then even a lower discount rate may not entice banks to borrow from the Fed As a result, the Fed uses the discount rate more as a signal to financial markets about its monetary policy than as a tool ...

Word

... uncertain situation in the economy and little optimism especially regarding the investment. Credit to businesses grew year-on-year only by 0.9 % after +5.1 % in 2011, loans to households by 4 % (the least since year 1998). Together the credit to businesses and households increased year-on-year by 2. ...

... uncertain situation in the economy and little optimism especially regarding the investment. Credit to businesses grew year-on-year only by 0.9 % after +5.1 % in 2011, loans to households by 4 % (the least since year 1998). Together the credit to businesses and households increased year-on-year by 2. ...

Read More - FPA of Minnesota

... Crystal Ball Gazing: Factors That Could Impact Your Finances in 2016 Some things in your financial life you can control, like your spending habits, how much money you put aside toward retirement, having a financial plan and sticking to it, etc. But your finances also are impacted by factors largely ...

... Crystal Ball Gazing: Factors That Could Impact Your Finances in 2016 Some things in your financial life you can control, like your spending habits, how much money you put aside toward retirement, having a financial plan and sticking to it, etc. But your finances also are impacted by factors largely ...

Fall 2016 - Plimoth Investment Advisors

... is not to say the Fed will not hike rates in December; they certainly may. We simply do not believe a hike is warranted given the underlying strength of the economy. Credit spreads tightened over the course of the quarter and the year, leading to strong performance across the corporate bond credit s ...

... is not to say the Fed will not hike rates in December; they certainly may. We simply do not believe a hike is warranted given the underlying strength of the economy. Credit spreads tightened over the course of the quarter and the year, leading to strong performance across the corporate bond credit s ...

Speech to the Silicon Valley Chapter of Financial Executives International

... Third, on the liability side, many financial institutions have relied heavily on short-term debt to fund their operations, making them vulnerable to “runs.” Investment banks, for example, commonly used very short-term—often overnight—repurchase agreements, and SIVs and conduits issued asset-backed c ...

... Third, on the liability side, many financial institutions have relied heavily on short-term debt to fund their operations, making them vulnerable to “runs.” Investment banks, for example, commonly used very short-term—often overnight—repurchase agreements, and SIVs and conduits issued asset-backed c ...

Operationalizing the Selection and Application of Macroprudential Instruments

... the real economy § Macroprudential policy focuses on the interactions between financial institutions, markets, infrastructure and the real economy § While microprudential policy takes the rest of the financial system and the economy as given in assessing the risk of individual institutions, macr ...

... the real economy § Macroprudential policy focuses on the interactions between financial institutions, markets, infrastructure and the real economy § While microprudential policy takes the rest of the financial system and the economy as given in assessing the risk of individual institutions, macr ...

Regulatory reform and returns in banking

... This will change banks’ costs. Being too big to fail, the implicit taxpayer subsidy, reduced large banks’ borrowing costs in relation to their smaller brethren. As we make it more and more possible for a big bank to fail – like any other company – without having to be bailed out by the taxpayer, cre ...

... This will change banks’ costs. Being too big to fail, the implicit taxpayer subsidy, reduced large banks’ borrowing costs in relation to their smaller brethren. As we make it more and more possible for a big bank to fail – like any other company – without having to be bailed out by the taxpayer, cre ...

February 1, 2o17 - John Dessauer`s Outlook

... go together. It will take sustained growth above 3% before the velocity of money rises much above today’s record low. That alone says inflation will stay low this year and next. The first thing economists and investors think of when it comes to fighting inflation is high interest rates. The reason c ...

... go together. It will take sustained growth above 3% before the velocity of money rises much above today’s record low. That alone says inflation will stay low this year and next. The first thing economists and investors think of when it comes to fighting inflation is high interest rates. The reason c ...

169_186_CC_A_RSPC1_C12_662330.indd

... monthly if the initial deposit is $1000 and the money is left in the account for 5 years. ...

... monthly if the initial deposit is $1000 and the money is left in the account for 5 years. ...

Real capital - McGraw Hill Higher Education

... • The interest earned on municipal bonds is exempted from the federal income tax. – The interest earned on federal government bonds, by contrast, is fully taxable, as is the interest on bonds issued by corporations. ...

... • The interest earned on municipal bonds is exempted from the federal income tax. – The interest earned on federal government bonds, by contrast, is fully taxable, as is the interest on bonds issued by corporations. ...

Northern Rock - Bruce Packard

... volatile going forward, and he would have preferred to ‘tuck away’ provisions when times were good). ...

... volatile going forward, and he would have preferred to ‘tuck away’ provisions when times were good). ...