Beyond Shareholder Value: Normative Standards for Sustainable

... corporate directors is considered next, particularly vis-A-vis shareholders, from an interdisciplinary perspective, analyzing case law as well as legal, management, and finance literature. Recent trends suggest that the major role of large, publicly-traded corporations is not so much to maximize the ...

... corporate directors is considered next, particularly vis-A-vis shareholders, from an interdisciplinary perspective, analyzing case law as well as legal, management, and finance literature. Recent trends suggest that the major role of large, publicly-traded corporations is not so much to maximize the ...

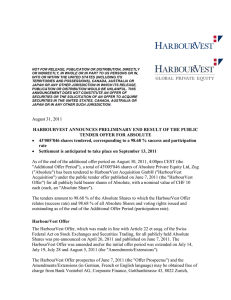

not for release, publication or distribution, directly or indirectly

... Netherlands Authority for the Financial Markets. HVPE is designed to offer shareholders long-term capital appreciation by investing in a private equity portfolio diversified by geography, by stage of investment, by vintage year, and by industry. It invests in and alongside HarbourVest-managed funds ...

... Netherlands Authority for the Financial Markets. HVPE is designed to offer shareholders long-term capital appreciation by investing in a private equity portfolio diversified by geography, by stage of investment, by vintage year, and by industry. It invests in and alongside HarbourVest-managed funds ...

International Investment Forum 2013 “Invest in Moldova”

... mCham Moldova Launched uild the Capacity of siness Associations to ticipate in Governance" ...

... mCham Moldova Launched uild the Capacity of siness Associations to ticipate in Governance" ...

discussion paper no 657

... movement in the pay-performance sensitivity over time. Contrary to the prediction that pay was over-sensitive to short-term profits, we find that although pay in the financial services sector is high, the pay-performance sensitivity of banks and financial firms is not significantly higher than in ot ...

... movement in the pay-performance sensitivity over time. Contrary to the prediction that pay was over-sensitive to short-term profits, we find that although pay in the financial services sector is high, the pay-performance sensitivity of banks and financial firms is not significantly higher than in ot ...

inflation-protected bonds: a look at the new i bond series

... holders are free to redeem their bonds. I bonds thus provide “downside” protection to their holders. The downside to these bonds is that holders forego opportunities to have price gains and high returns if market interest rates were unexpectedly to fall. In addition, the yields are on average lower ...

... holders are free to redeem their bonds. I bonds thus provide “downside” protection to their holders. The downside to these bonds is that holders forego opportunities to have price gains and high returns if market interest rates were unexpectedly to fall. In addition, the yields are on average lower ...

When do Investors Exhibit Stronger Behavioral Biases?

... theoretical predictions. However, those studies do not directly measure investor overconfidence and, as a result, their findings are open to alternative interpretations. In contrast, because I measure investors’ behavioral biases directly using their portfolio holdings and trades, my findings are relat ...

... theoretical predictions. However, those studies do not directly measure investor overconfidence and, as a result, their findings are open to alternative interpretations. In contrast, because I measure investors’ behavioral biases directly using their portfolio holdings and trades, my findings are relat ...

Notes to the - Old Chang Kee

... up to further moderate the demand for foreign workers with the view that the foreign share of the total workforce be kept to around one-third in the long term. Foreign workers levies will be increased in six-monthly intervals up to July 2013. Labour costs will increase and the Group expects that thi ...

... up to further moderate the demand for foreign workers with the view that the foreign share of the total workforce be kept to around one-third in the long term. Foreign workers levies will be increased in six-monthly intervals up to July 2013. Labour costs will increase and the Group expects that thi ...

Expropriation of foreign direct investments: sectoral patterns from 1993 to 2006

... (ii) breaches of contract (such as forced renegotiation of the contract terms) under which it is no longer profitable for the firm to continue operations, (iii) extra-legal interventions or transfers of ownership effected by private agents and not resolved by government, and (iv) the forced sale of ...

... (ii) breaches of contract (such as forced renegotiation of the contract terms) under which it is no longer profitable for the firm to continue operations, (iii) extra-legal interventions or transfers of ownership effected by private agents and not resolved by government, and (iv) the forced sale of ...

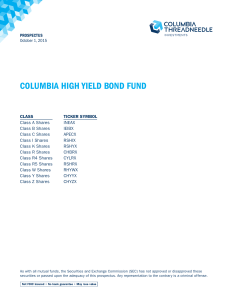

columbia high yield bond fund

... agencies assign credit ratings to certain loans and fixed-income securities to indicate their credit risk. Lower quality or unrated securities held by the Fund may present increased credit risk as compared to higher-rated securities. Noninvestment grade loans or fixed-income securities (commonly cal ...

... agencies assign credit ratings to certain loans and fixed-income securities to indicate their credit risk. Lower quality or unrated securities held by the Fund may present increased credit risk as compared to higher-rated securities. Noninvestment grade loans or fixed-income securities (commonly cal ...

English - Vanguard Global sites

... The Board of Directors (the “Directors”) whose names appear under the heading “Directory” jointly accept responsibility for the information contained in this Prospectus. To the best of the knowledge and belief of the Directors (who have taken all reasonable care to ensure that such is the case), the ...

... The Board of Directors (the “Directors”) whose names appear under the heading “Directory” jointly accept responsibility for the information contained in this Prospectus. To the best of the knowledge and belief of the Directors (who have taken all reasonable care to ensure that such is the case), the ...

Explaining the Disconnection between China`s Economic

... bank demand deposits (in real terms) with very low nominal interest rates over the same period, and much lower than that of 5-year deposits (Figure 5). In order to explain the poor performance of the stock market and its divergence from the overall economic growth, we focus on two related aspects of ...

... bank demand deposits (in real terms) with very low nominal interest rates over the same period, and much lower than that of 5-year deposits (Figure 5). In order to explain the poor performance of the stock market and its divergence from the overall economic growth, we focus on two related aspects of ...

Alexandria Sinnet and B Malcom

... they saw and pursued. Each of the farmers started with a farm that could be improved and stocked more heavily, but their financial situation limited what they could do and how quickly they could act. Profit Profit and net cash flow of the three farms that expanded, indicated the businesses would be ...

... they saw and pursued. Each of the farmers started with a farm that could be improved and stocked more heavily, but their financial situation limited what they could do and how quickly they could act. Profit Profit and net cash flow of the three farms that expanded, indicated the businesses would be ...

ECONOMIC ANALYSIS OF FOREIGN MARKET ENTRY

... that other US genetically altered products imported to EU markets were labeled and shipped separately from conventionally produced crops. Labeling and additionally required health and environmental tests increase the cost of US exports (Weyerbrock and Xia, 2000). US soybeans exports to Europe droppe ...

... that other US genetically altered products imported to EU markets were labeled and shipped separately from conventionally produced crops. Labeling and additionally required health and environmental tests increase the cost of US exports (Weyerbrock and Xia, 2000). US soybeans exports to Europe droppe ...

Using Financial Derivatives to Hedge Against Market

... are previously known. We assume all model-parameters to be constant over the ...

... are previously known. We assume all model-parameters to be constant over the ...

In this paper, we develop a theory for the time varying takeover

... optimism regarding stocks outperforming bonds with quite moderate stock return expectations per se. Rather than uncovering realistic estimates of mean-reversion implied by these expectations, we found it impossible to reconcile the moderate return expectations with a high degree of confidence in st ...

... optimism regarding stocks outperforming bonds with quite moderate stock return expectations per se. Rather than uncovering realistic estimates of mean-reversion implied by these expectations, we found it impossible to reconcile the moderate return expectations with a high degree of confidence in st ...

Financing Durable Assets

... can default and divert cash flows and a fraction of durable assets and cannot be excluded from markets following default as in Rampini and Viswanathan (2010, 2013, 2015).3 For this class of economies, they show that the optimal dynamic contract can be implemented with one-period ahead complete marke ...

... can default and divert cash flows and a fraction of durable assets and cannot be excluded from markets following default as in Rampini and Viswanathan (2010, 2013, 2015).3 For this class of economies, they show that the optimal dynamic contract can be implemented with one-period ahead complete marke ...

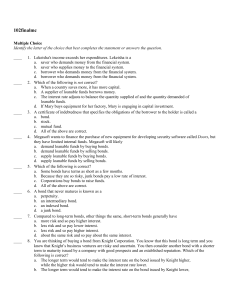

102finalmc

... a. each symbol identifies a variable. b. the right-hand and left-hand sides are equal. c. the equality holds due to the way the variables are defined. d. None of the above is correct. Consider T-G and Y-T-C. a. Each one of these is equal to national saving. b. Each one of these is equal to public sa ...

... a. each symbol identifies a variable. b. the right-hand and left-hand sides are equal. c. the equality holds due to the way the variables are defined. d. None of the above is correct. Consider T-G and Y-T-C. a. Each one of these is equal to national saving. b. Each one of these is equal to public sa ...

Intermediate Accounting

... • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included in this category, an asset must have three characteristics: • The asset must be ...

... • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included in this category, an asset must have three characteristics: • The asset must be ...

The Role of Private Investment in Meeting U.S. Transportation

... or through public borrowing—debt which must be repaid with interest with public funds generated by future tax or fee collections. The private sector must meet the same public interest test and also find projects that provide an adequate return on investment—a profit. P3s do not provide project fundi ...

... or through public borrowing—debt which must be repaid with interest with public funds generated by future tax or fee collections. The private sector must meet the same public interest test and also find projects that provide an adequate return on investment—a profit. P3s do not provide project fundi ...

Revisiting Asset Pricing under Habit Formation in an Overlapping

... and Prescott (1985) model propose alternative assumptions about preference (Constantinides 1990; Abel 1990; Epstein and Zin 1991; Meyer and Meyer 2005; Giordani and Söderlind 2006), disaster states and survivorship bias (Reitz 1988; Brown, Goetzmann and Ross 1995; Barro 2006), incomplete markets (Co ...

... and Prescott (1985) model propose alternative assumptions about preference (Constantinides 1990; Abel 1990; Epstein and Zin 1991; Meyer and Meyer 2005; Giordani and Söderlind 2006), disaster states and survivorship bias (Reitz 1988; Brown, Goetzmann and Ross 1995; Barro 2006), incomplete markets (Co ...