Regulatory Capital Requirements under FTK and

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

Regulatory Capital Disclosures

... As required under the Federal Reserve Board’s regulations, the adequacy of our capital is primarily measured using risk-based capital ratios, which compare measures of capital to RWAs, and a leverage ratio, a non-risk-based capital measure, which compares capital to average adjusted total assets. Th ...

... As required under the Federal Reserve Board’s regulations, the adequacy of our capital is primarily measured using risk-based capital ratios, which compare measures of capital to RWAs, and a leverage ratio, a non-risk-based capital measure, which compares capital to average adjusted total assets. Th ...

Climate Change Scenarios – Implications for Strategic Asset

... with climate change, while retaining similar returns, is to increase exposure to those assets that have a higher sensitivity to climate change “TIP™” factors. The analysis suggests that under certain scenarios, a typical portfolio seeking a 7% return could manage the risk of climate change by ensuri ...

... with climate change, while retaining similar returns, is to increase exposure to those assets that have a higher sensitivity to climate change “TIP™” factors. The analysis suggests that under certain scenarios, a typical portfolio seeking a 7% return could manage the risk of climate change by ensuri ...

Montenegro Development Directions 2015

... negative external influences, but also the internal constraints i.e. vulnerabilities of fiscal, banking and real sectors of the economy. By realizing the largest number of investment/development measures significant results were achieved, with effects to be completely visible in the medium or long r ...

... negative external influences, but also the internal constraints i.e. vulnerabilities of fiscal, banking and real sectors of the economy. By realizing the largest number of investment/development measures significant results were achieved, with effects to be completely visible in the medium or long r ...

2016 Report on Corporate Governance and Ownership Structure

... Shareholders, based on the provisions of the Bylaws and current laws. On 7 November 2013 the Board of Directors amended the Bylaws by introducing the principle that, in accordance with the law, the members of the Board of Directors should ensure equal representation of both genders. Members of the B ...

... Shareholders, based on the provisions of the Bylaws and current laws. On 7 November 2013 the Board of Directors amended the Bylaws by introducing the principle that, in accordance with the law, the members of the Board of Directors should ensure equal representation of both genders. Members of the B ...

stress testing by large financial institutions

... events occur too rarely to be captured by empirically driven statistical models. Furthermore, observed correlation patterns between various financial prices (and thus the correlations that would be estimated using data from ordinary times) tend to change when the price movements themselves are large ...

... events occur too rarely to be captured by empirically driven statistical models. Furthermore, observed correlation patterns between various financial prices (and thus the correlations that would be estimated using data from ordinary times) tend to change when the price movements themselves are large ...

Speculative Retail Trading and Asset Prices

... high because of the high resale option value due to large disagreement among investors. Barberis and Huang (2008) show that stocks with high skewness should earn low average returns, because investors with cumulative prospect theory utility overweight tiny probabilities of large gains. Barberis and ...

... high because of the high resale option value due to large disagreement among investors. Barberis and Huang (2008) show that stocks with high skewness should earn low average returns, because investors with cumulative prospect theory utility overweight tiny probabilities of large gains. Barberis and ...

Mindtree Limited Balance sheet Rs in million Note As at June 30

... when reasonably dependable estimates of the revenues and costs applicable to various elements of the contract can be made. Key factors that are reviewed in estimating the future costs to complete include estimates of future labor costs and productivity efficiencies. Because the financial reporting o ...

... when reasonably dependable estimates of the revenues and costs applicable to various elements of the contract can be made. Key factors that are reviewed in estimating the future costs to complete include estimates of future labor costs and productivity efficiencies. Because the financial reporting o ...

Reservation bid and ask prices for options and covered

... in Germany, Amsterdam, Italy, Switzerland, Sweden, Spain, Luxembourg, Australia and London (see Bartram & Fehle (2006)).3 Key features which distinguish covered warrants from exchange-traded options include the fact that they cannot be held short by the retail investors to whom they are generally is ...

... in Germany, Amsterdam, Italy, Switzerland, Sweden, Spain, Luxembourg, Australia and London (see Bartram & Fehle (2006)).3 Key features which distinguish covered warrants from exchange-traded options include the fact that they cannot be held short by the retail investors to whom they are generally is ...

Corporate Diversification and the Cost of Capital

... implications of coinsurance for corporate finance in general. Our study also complements the literature on corporate diversification and firm value (Lang and Stulz (1994) and Berger and Ofek (1995)) by exploring an important dimension that thus far has received little attention, namely, cost of capi ...

... implications of coinsurance for corporate finance in general. Our study also complements the literature on corporate diversification and firm value (Lang and Stulz (1994) and Berger and Ofek (1995)) by exploring an important dimension that thus far has received little attention, namely, cost of capi ...

financial development and real growth: deciding the chicken and

... sentiments or emotions but based on hard facts. There are issues of whether the investor/borrower is capable of executing the project he wants to use the fund for efficiently, there is the question of the level of returns that will come from that particular project relative to other projects. There ...

... sentiments or emotions but based on hard facts. There are issues of whether the investor/borrower is capable of executing the project he wants to use the fund for efficiently, there is the question of the level of returns that will come from that particular project relative to other projects. There ...

Estimating Firm Value

... can be sustained in perpetuity, allowing you to estimate the value of all cash flows beyond that point as a terminal value. The key question that you confront in this chapter is the estimation of when and how this transition to stable growth will occur for the firm that you are valuing. Will the gro ...

... can be sustained in perpetuity, allowing you to estimate the value of all cash flows beyond that point as a terminal value. The key question that you confront in this chapter is the estimation of when and how this transition to stable growth will occur for the firm that you are valuing. Will the gro ...

Stock market booms and real economic activity: Is this time different?

... expected cash flows). Section 3 presents tests for the predictability of stock returns by the dividend yield and the term spread (expected returns variation) and the predictability of these variables in combination with the variables used in Section 2. The results are summarized in the concluding Se ...

... expected cash flows). Section 3 presents tests for the predictability of stock returns by the dividend yield and the term spread (expected returns variation) and the predictability of these variables in combination with the variables used in Section 2. The results are summarized in the concluding Se ...

Private Placement Memorandum

... shares, with respect to some subscriptions. We may call the deferred subscription amount from time to time, or at one time in full, for six months and the investor will purchase the shares at the Determined Share Value in effect on the date of the subscription. We contribute the proceeds of the offe ...

... shares, with respect to some subscriptions. We may call the deferred subscription amount from time to time, or at one time in full, for six months and the investor will purchase the shares at the Determined Share Value in effect on the date of the subscription. We contribute the proceeds of the offe ...

The Impact of the Split-share Structure Reform on Compensation

... compensation structure, excessive company-paid consumption and over-emphasis on cash incentive and neglect of reputation incentive (Ji Xianqing, 2007), the mechanism has been gradually deepened after all. Equity incentives plan for executives was put into practice in 2006③. Quite a few scholars have ...

... compensation structure, excessive company-paid consumption and over-emphasis on cash incentive and neglect of reputation incentive (Ji Xianqing, 2007), the mechanism has been gradually deepened after all. Equity incentives plan for executives was put into practice in 2006③. Quite a few scholars have ...

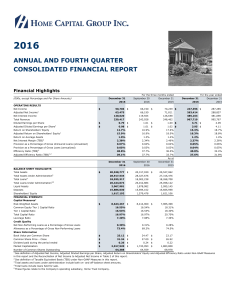

2016 Q4 Report - Home Capital Group

... the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in connection with business objectives and targets, Company strategies, operations, anticipated financial results and t ...

... the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in connection with business objectives and targets, Company strategies, operations, anticipated financial results and t ...

NABERS Energy Office Market Analysis Period Ending December

... The IPD / Department of Industry NABERS Energy Office Market Analysis presents the latest key findings on the investment performance of NABERS Energy rated office assets. The aim of the analysis is to assess what impact, if any, NABERS Energy ratings have on investment performance, and whether inves ...

... The IPD / Department of Industry NABERS Energy Office Market Analysis presents the latest key findings on the investment performance of NABERS Energy rated office assets. The aim of the analysis is to assess what impact, if any, NABERS Energy ratings have on investment performance, and whether inves ...

Growth Expectations, Dividend Yields, and Future Stock Returns

... such relative out-of-sample performance. We find that stock yield produces an out-of-sample R2 consistently above 2% for monthly forecasts in our sample period. According to the calculation in Campbell and Thompson (2008), an out-of-sample R2 of 2% translates to return enhancement of 8% per year fo ...

... such relative out-of-sample performance. We find that stock yield produces an out-of-sample R2 consistently above 2% for monthly forecasts in our sample period. According to the calculation in Campbell and Thompson (2008), an out-of-sample R2 of 2% translates to return enhancement of 8% per year fo ...

The Role of Inventories In the Business Cycle

... merely to uncover the facts about inventories and the business cycle. Their primary goal is to explain these findings. Before we may begin to understand why firms change their holdings of inventories over the business cycle, we must have an understanding of why firms hold inventories at all. For eco ...

... merely to uncover the facts about inventories and the business cycle. Their primary goal is to explain these findings. Before we may begin to understand why firms change their holdings of inventories over the business cycle, we must have an understanding of why firms hold inventories at all. For eco ...

SUP-MULTI-0115 ALLIANCEBERNSTEIN ALL MARKET GROWTH

... are financial contracts whose value depend on, or is derived from, the value of an underlying asset, reference rate or index. These assets, rates, and indices may include bonds, stocks, mortgages, commodities, interest rates, currency exchange rates, bond indices, and stock indices. There are four ...

... are financial contracts whose value depend on, or is derived from, the value of an underlying asset, reference rate or index. These assets, rates, and indices may include bonds, stocks, mortgages, commodities, interest rates, currency exchange rates, bond indices, and stock indices. There are four ...

A Fair and Substantial Contribution by the Financial Sector

... This report responds to the request of the G-20 leaders for the IMF to: “...prepare a report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for ...

... This report responds to the request of the G-20 leaders for the IMF to: “...prepare a report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for ...