Essays on international capital flows and macroeconomic stability

... standing of the transmission channel from global risk factors to domestic credit and saving. We estimate the time varying effects of risk on portfolio flows to South Africa, we estimate the transmission of portfolio flows to credit, and lastly we incorporate our empirical findings in a two-country D ...

... standing of the transmission channel from global risk factors to domestic credit and saving. We estimate the time varying effects of risk on portfolio flows to South Africa, we estimate the transmission of portfolio flows to credit, and lastly we incorporate our empirical findings in a two-country D ...

Full Text - Harvard University

... reinvestment of earnings, other long-term capital, and short-term capital as shown in the balance of payments. The World Bank defines foreign direct investment (net inflows in the reporting economy, in current US$) as investment that is made to acquire a lasting management interest (usually 10 perce ...

... reinvestment of earnings, other long-term capital, and short-term capital as shown in the balance of payments. The World Bank defines foreign direct investment (net inflows in the reporting economy, in current US$) as investment that is made to acquire a lasting management interest (usually 10 perce ...

Investor Presentation

... The covered bonds have full recourse to the issuer (Sparebanken Sør Boligkreditt), which is a whollyowned subsidiary of Sparebanken Sør Sparebanken Sør Boligkreditt has established a revolving credit facility with Sparebanken Sør which secures the refinancing risk The cover pool consists 100 % ...

... The covered bonds have full recourse to the issuer (Sparebanken Sør Boligkreditt), which is a whollyowned subsidiary of Sparebanken Sør Sparebanken Sør Boligkreditt has established a revolving credit facility with Sparebanken Sør which secures the refinancing risk The cover pool consists 100 % ...

download

... the by now well-known manufacturer of personal digital assistants, which at some point during this period had higher valuations than its parent company 3Com by as much as $23 billion, a glaring violation of the law of one price that underlies any rational asset pricing model based on fundamental val ...

... the by now well-known manufacturer of personal digital assistants, which at some point during this period had higher valuations than its parent company 3Com by as much as $23 billion, a glaring violation of the law of one price that underlies any rational asset pricing model based on fundamental val ...

- amtek holdings berhad

... The Board of Directors shall review the term of office and performance of the Audit Committee and each of its members at least once every three years to ensure that the Audit Committee and its members have carried out its duties in accordance with the terms of reference. ...

... The Board of Directors shall review the term of office and performance of the Audit Committee and each of its members at least once every three years to ensure that the Audit Committee and its members have carried out its duties in accordance with the terms of reference. ...

clicking here

... In this time of uncertainty, there is increasingly greater scrutiny on investment decisions and strategies. In this inaugural issue of the Australian Real Estate Trends report, we provide data-driven insights into the opportunities for investment into the Australian commercial real estate market. Au ...

... In this time of uncertainty, there is increasingly greater scrutiny on investment decisions and strategies. In this inaugural issue of the Australian Real Estate Trends report, we provide data-driven insights into the opportunities for investment into the Australian commercial real estate market. Au ...

Ralph C. Bryant CRR WP 2005-16 Released: December 2005

... capital-output ratio is lower and, arguably, the rate of return to capital may be higher. Such an outcome could be mutually beneficial, permitting asset owners in the North to earn higher returns on their savings than would otherwise be possible and simultaneously permitting investment within the So ...

... capital-output ratio is lower and, arguably, the rate of return to capital may be higher. Such an outcome could be mutually beneficial, permitting asset owners in the North to earn higher returns on their savings than would otherwise be possible and simultaneously permitting investment within the So ...

Types Of Activism - Association of Corporate Counsel

... shareholder proposals from their proxy statements based on the fact that such proposals concern matters “relating to the company’s ordinary business operations.”25 After an adverse ruling by the D.C. Circuit in a case related to a shareholder proposal about Dow Chemical Company’s manufacture of napa ...

... shareholder proposals from their proxy statements based on the fact that such proposals concern matters “relating to the company’s ordinary business operations.”25 After an adverse ruling by the D.C. Circuit in a case related to a shareholder proposal about Dow Chemical Company’s manufacture of napa ...

Vanguard Presentation

... to pool their money together with a predetermined investment objective. The mutual fund will have a fund manager who is responsible for investing the pooled money into specific securities (usually stocks or bonds).” • First started in 1924 by 3 Boston executives ...

... to pool their money together with a predetermined investment objective. The mutual fund will have a fund manager who is responsible for investing the pooled money into specific securities (usually stocks or bonds).” • First started in 1924 by 3 Boston executives ...

Financial Innovation, Collateral and Investment. Ana Fostel John Geanakoplos August 6, 2015

... between the CDS-economy and the Arrow Debreu economy. Another way of understanding these results is as follows. When agents post collateral to back promises they are effectively tranching the collateral cash flows. By dividing up the collateral payoffs into two different kinds of assets, attractive ...

... between the CDS-economy and the Arrow Debreu economy. Another way of understanding these results is as follows. When agents post collateral to back promises they are effectively tranching the collateral cash flows. By dividing up the collateral payoffs into two different kinds of assets, attractive ...

Macroeconomic Factors and the Correlation of Stock and Bond

... macroeconomic factors and the comovement of stock and bond returns using three formulations, each in succession allowing for greater flexibility in modeling the dynamics of stock and bond returns, and taking us one step further into the cause of their comovement. The first formulation uses a linear ...

... macroeconomic factors and the comovement of stock and bond returns using three formulations, each in succession allowing for greater flexibility in modeling the dynamics of stock and bond returns, and taking us one step further into the cause of their comovement. The first formulation uses a linear ...

the benefits of sell-side research

... became more valuable and in greater demand when company financials provided weaker signals about future cash flows (an example of ‘bad times’) 32. Overall, during difficult market conditions, it became almost impossible for uninformed traders to assess the prospects of stock, and even informed trade ...

... became more valuable and in greater demand when company financials provided weaker signals about future cash flows (an example of ‘bad times’) 32. Overall, during difficult market conditions, it became almost impossible for uninformed traders to assess the prospects of stock, and even informed trade ...

Reporting Standard ARS 720.5 ABS/RBA Equity Securities Held

... APRA may, by notice in writing, change the reporting periods, or specified reporting periods, for a particular ADI or RFC, to require it to provide the information required by this Reporting Standard more frequently, or less frequently, having regard to: ...

... APRA may, by notice in writing, change the reporting periods, or specified reporting periods, for a particular ADI or RFC, to require it to provide the information required by this Reporting Standard more frequently, or less frequently, having regard to: ...

MSCI ESG BUSINESS INVOLVEMENT SCREENING RESEARCH

... For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative ...

... For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative ...

This PDF is a selection from a published volume from... Economic Research

... with the exception of Chinn and Ito (2007a).2 In this investigation encompassing a sample of eighty-nine countries over the 1971 to 2004 period, we found that more financial development leads to higher saving for countries with underdevelopment institutions and closed financial markets, which includ ...

... with the exception of Chinn and Ito (2007a).2 In this investigation encompassing a sample of eighty-nine countries over the 1971 to 2004 period, we found that more financial development leads to higher saving for countries with underdevelopment institutions and closed financial markets, which includ ...

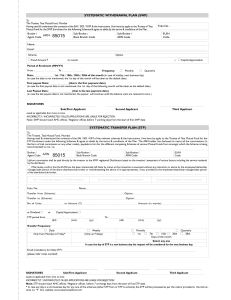

STP Form - Shreem Wealth Creators

... investors availing of the transfer of capital appreciation, where in any week, month or quarter, there is no appreciation or the appreciation is less than ` 500/- switch as mentioned above will not be carried out. d. Dividend amount / Dividend sweep: Dividend sweep is possible only if the investor h ...

... investors availing of the transfer of capital appreciation, where in any week, month or quarter, there is no appreciation or the appreciation is less than ` 500/- switch as mentioned above will not be carried out. d. Dividend amount / Dividend sweep: Dividend sweep is possible only if the investor h ...

Promoting Competitive Markets: The Role of Public Procurement

... provide across-the-board data on buying organizations’ existing portfolio of bought-in products and services. However as is discussed below, there are other requirements that will not automatically be delivered. (e.g., market intelligence on potential new suppliers, or sourcing options in new market ...

... provide across-the-board data on buying organizations’ existing portfolio of bought-in products and services. However as is discussed below, there are other requirements that will not automatically be delivered. (e.g., market intelligence on potential new suppliers, or sourcing options in new market ...

5 A larger current account deficit with a very

... smaller outflow of dividends sent abroad from Colombia. This drop will equal the fall observed in foreign direct investment in 2015, but will be sharper in 2016, as the recovery of other tradable sectors and major infrastructure projects will involve the inflow of stable funding from abroad that wil ...

... smaller outflow of dividends sent abroad from Colombia. This drop will equal the fall observed in foreign direct investment in 2015, but will be sharper in 2016, as the recovery of other tradable sectors and major infrastructure projects will involve the inflow of stable funding from abroad that wil ...

Chapter 6

... In general, the IRR rule works for a stand-alone project if all of the project’s negative cash flows precede its positive cash flows. whenever the cost of capital is below the IRR of 14%, the project has a positive NPV and you should undertake the investment. ...

... In general, the IRR rule works for a stand-alone project if all of the project’s negative cash flows precede its positive cash flows. whenever the cost of capital is below the IRR of 14%, the project has a positive NPV and you should undertake the investment. ...

Treasury Bill Yields: Overlooked Information

... the excess returns of holding Treasury bonds over the next one year, exrt,t+1y , in which riskfree short interest rates are estimated as one-year T-bond yields. Since Fama and Bliss (1987), it has been a norm to use annual excess returns for the test of risk premium factors’ forecastability. The exc ...

... the excess returns of holding Treasury bonds over the next one year, exrt,t+1y , in which riskfree short interest rates are estimated as one-year T-bond yields. Since Fama and Bliss (1987), it has been a norm to use annual excess returns for the test of risk premium factors’ forecastability. The exc ...

View PDF - CiteSeerX

... We provide in Section 4.1 a general representation for all coherent risk measures in terms of “generalized scenarios” by applying a consequence of the separation theorem for convex sets already in the mathematics literature. We give conditions for extending into a coherent risk measure a measurement ...

... We provide in Section 4.1 a general representation for all coherent risk measures in terms of “generalized scenarios” by applying a consequence of the separation theorem for convex sets already in the mathematics literature. We give conditions for extending into a coherent risk measure a measurement ...

Coherent Measures of Risk

... We provide in Section 4.1 a general representation for all coherent risk measures in terms of “generalized scenarios” by applying a consequence of the separation theorem for convex sets already in the mathematics literature. We give conditions for extending into a coherent risk measure a measurement ...

... We provide in Section 4.1 a general representation for all coherent risk measures in terms of “generalized scenarios” by applying a consequence of the separation theorem for convex sets already in the mathematics literature. We give conditions for extending into a coherent risk measure a measurement ...

“Accounting Dictionary”

... PAYOUT RATIO is dividends paid divided by company earnings over some period of time, expressed as a percentage. PAYROLL, dependent upon usage, can mean a. the total amount of money paid in wages; b. a list of employees and their salaries; or, c. the department that determines the amounts of wage or ...

... PAYOUT RATIO is dividends paid divided by company earnings over some period of time, expressed as a percentage. PAYROLL, dependent upon usage, can mean a. the total amount of money paid in wages; b. a list of employees and their salaries; or, c. the department that determines the amounts of wage or ...