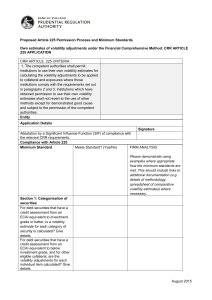

Proposed Article 225 Permission Process and

... length of the effective observation period is at least one year. The data sets and calculated volatility adjustments are updated at least once every three months. Data sets are also reassessed whenever market prices are subject to material changes. Indicate whether intend to use an internal model fo ...

... length of the effective observation period is at least one year. The data sets and calculated volatility adjustments are updated at least once every three months. Data sets are also reassessed whenever market prices are subject to material changes. Indicate whether intend to use an internal model fo ...

Establishing resolution arrangements for investment banks

... The world economy continues to feel the effects of the most severe financial crisis in over 60 years. Over the last two years, governments around the world have taken unprecedented steps to stabilise the financial system, and limit the wider economic fallout from the crisis. There is now a general c ...

... The world economy continues to feel the effects of the most severe financial crisis in over 60 years. Over the last two years, governments around the world have taken unprecedented steps to stabilise the financial system, and limit the wider economic fallout from the crisis. There is now a general c ...

NBER WORKING PAPER SERIES Hanno Lustig

... and dividend growth (e.g., Bansal and Yaron (2004) and Hansen, Heaton and Li (2005)). This turns out to be very useful for matching smooth consumption data and volatile returns. However, it is hard to distinguish between i.i.d. consumption growth and a specification that includes a small, predictabl ...

... and dividend growth (e.g., Bansal and Yaron (2004) and Hansen, Heaton and Li (2005)). This turns out to be very useful for matching smooth consumption data and volatile returns. However, it is hard to distinguish between i.i.d. consumption growth and a specification that includes a small, predictabl ...

Spiceland, Chapter 3

... Reports the cash effects of transactions that enter into the determination of net income. The direct method and indirect method are two different approaches to report cash flows from operations. Each has its advantages and disadvantages, but each reconciles to the same number for total cash flows fr ...

... Reports the cash effects of transactions that enter into the determination of net income. The direct method and indirect method are two different approaches to report cash flows from operations. Each has its advantages and disadvantages, but each reconciles to the same number for total cash flows fr ...

Equity and Bond Ownership in America, 2008

... a much broader range of households than it did in earlier decades. Understanding the patterns of ownership across households and time, recognizing the factors that affect ownership, and analyzing the goals, strategies, and plans of the investor population have never been more essential. The analysis ...

... a much broader range of households than it did in earlier decades. Understanding the patterns of ownership across households and time, recognizing the factors that affect ownership, and analyzing the goals, strategies, and plans of the investor population have never been more essential. The analysis ...

Financial distress, reorganization and corporate performance

... sion (ASIC) 1998). Growth in use of VA presents significant opportunities and challenges for accounting professionals, and it is important that accountants understand the operation of the legislation and its suitability for particular clients. For example, timely recommendation to initiate VA by pro ...

... sion (ASIC) 1998). Growth in use of VA presents significant opportunities and challenges for accounting professionals, and it is important that accountants understand the operation of the legislation and its suitability for particular clients. For example, timely recommendation to initiate VA by pro ...

Size Premia in the Canadian Equity Market

... equity returns of public firms are higher for small firms than for large firms. This phenomenon is known as the “small firm effect”.2 Some tests also find that smaller firms consistently generate returns that are above their expected returns predicted by the Capital Asset Pricing Model (“CAPM”)3. Th ...

... equity returns of public firms are higher for small firms than for large firms. This phenomenon is known as the “small firm effect”.2 Some tests also find that smaller firms consistently generate returns that are above their expected returns predicted by the Capital Asset Pricing Model (“CAPM”)3. Th ...

SCHEDULE 14A (RULE 14A-101) INFORMATION REQUIRED IN

... and outstanding. Every stockholder is entitled to one vote for each share of common stock held. -------------------------------------------------------------------------------Q: ...

... and outstanding. Every stockholder is entitled to one vote for each share of common stock held. -------------------------------------------------------------------------------Q: ...

Managers` Discussion of Competition in the 10

... competing in that environment is a critical component of standard equity valuation models (Healy and Palepu 2007, Lundholm and Sloan 2007, Penman 2009). Li, Lundholm and Minnis (2013) provide evidence that greater managerial perceived competition, measured based on firms’ disclosures in 10-K filings ...

... competing in that environment is a critical component of standard equity valuation models (Healy and Palepu 2007, Lundholm and Sloan 2007, Penman 2009). Li, Lundholm and Minnis (2013) provide evidence that greater managerial perceived competition, measured based on firms’ disclosures in 10-K filings ...

Forensic Economics - Dartmouth College

... returns be uncorrelated with information that was public on grant day, assuming that was really when the decision was made. The correlation between grants and future returns suggests two possibilities: (1) executives were granting options when their private information suggested their stock was unde ...

... returns be uncorrelated with information that was public on grant day, assuming that was really when the decision was made. The correlation between grants and future returns suggests two possibilities: (1) executives were granting options when their private information suggested their stock was unde ...

Saudi Capital Market Overview

... Capital Market which would contribute to market stability and reduce high volatility in prices through attracting the expertise of specialized foreign investors, with long term investment goals in the local market. 2. Transfer the knowledge and expertise to the local investors and financial institut ...

... Capital Market which would contribute to market stability and reduce high volatility in prices through attracting the expertise of specialized foreign investors, with long term investment goals in the local market. 2. Transfer the knowledge and expertise to the local investors and financial institut ...

Corporate Governance and Enterprise Reform in

... generate expectations among investors that they are engaging in lowrisk investments. As a result, investors have few incentives to assess companies’ fundamentals carefully or to demand good corporate governance. In the case of transformed small and medium enterprises, unrealistic valuation of assets ...

... generate expectations among investors that they are engaging in lowrisk investments. As a result, investors have few incentives to assess companies’ fundamentals carefully or to demand good corporate governance. In the case of transformed small and medium enterprises, unrealistic valuation of assets ...

Shadow Fed Funds Rate

... combines elements of both strategies mentioned above. It is a favored strategy for investors without a strong interest rate view, especially when the yield curve is positively sloped, ...

... combines elements of both strategies mentioned above. It is a favored strategy for investors without a strong interest rate view, especially when the yield curve is positively sloped, ...

Insurance market report 2015

... liabilities from life insurance contracts must be secured by means of tied assets, whereby the total target amount in liabilities from such contracts, plus a one-percent safety margin, must be fully covered at all times. Covering the liabilities arising from insurance contracts takes precedence o ...

... liabilities from life insurance contracts must be secured by means of tied assets, whereby the total target amount in liabilities from such contracts, plus a one-percent safety margin, must be fully covered at all times. Covering the liabilities arising from insurance contracts takes precedence o ...

Cambodia Industrial Development Policy 2015 – 2025

... a guide for driving the development of the industrial sector in the country, which can contribute toward maintaining a sustainable and inclusive high economic growth. Moreover, the policy will become the “New Economic Growth Strategy” which stresses importantly on economic diversification, competiti ...

... a guide for driving the development of the industrial sector in the country, which can contribute toward maintaining a sustainable and inclusive high economic growth. Moreover, the policy will become the “New Economic Growth Strategy” which stresses importantly on economic diversification, competiti ...

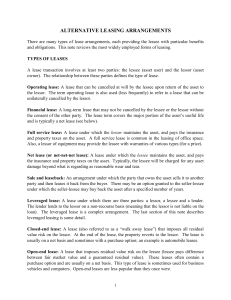

alternative leasing arrangements

... closed-end basis for three years. With lease, if you no longer need the asset during the three-year period (say next year), you could return it to the lessor but you will owe a large termination fee (perhaps equal to all remaining lease rental payments). This means that, with lease, the cost of the ...

... closed-end basis for three years. With lease, if you no longer need the asset during the three-year period (say next year), you could return it to the lessor but you will owe a large termination fee (perhaps equal to all remaining lease rental payments). This means that, with lease, the cost of the ...

CEIOPS` Resolutions on Comments Received

... documentation requirements in this area may be challenging however this is appropriate if management are to take credit for a particular management action in valuing their technical provisions. The documentation would need to demonstrate that any judgment is based on sound and rational argument and ...

... documentation requirements in this area may be challenging however this is appropriate if management are to take credit for a particular management action in valuing their technical provisions. The documentation would need to demonstrate that any judgment is based on sound and rational argument and ...

1. Macroeconomic developments across the euro area

... 1992 and 1996 (Graph 1.2). However, in the subsequent two years before the creation of the euro area, during which the economies pursued different fiscal and monetary policies in order to meet the Maastricht criteria, a divergence in growth rates emerged as shown by a rising standard deviation. GDP ...

... 1992 and 1996 (Graph 1.2). However, in the subsequent two years before the creation of the euro area, during which the economies pursued different fiscal and monetary policies in order to meet the Maastricht criteria, a divergence in growth rates emerged as shown by a rising standard deviation. GDP ...

International Diversification Versus Domestic Diversification: Mean

... largely dominated by domestic assets. International investors’ preference for domestic stocks remains a subject of controversy, since many studies indicate that greater profits can be made by diversifying internationally. This paper applies the mean-variance portfolio optimization (PO) approach and ...

... largely dominated by domestic assets. International investors’ preference for domestic stocks remains a subject of controversy, since many studies indicate that greater profits can be made by diversifying internationally. This paper applies the mean-variance portfolio optimization (PO) approach and ...

View the presentation.

... U.S. asset manager organizes a fund outside the U.S. Fund is sold primarily to non-U.S. investors and Fund sales force is located outside the U.S.; some investors (less than a majority) have moved to the U.S. and are "U.S. persons" Fund managed by non-U.S. affiliate that has personnel with pri ...

... U.S. asset manager organizes a fund outside the U.S. Fund is sold primarily to non-U.S. investors and Fund sales force is located outside the U.S.; some investors (less than a majority) have moved to the U.S. and are "U.S. persons" Fund managed by non-U.S. affiliate that has personnel with pri ...

Strategic Informed Trades, Diversification, and Expected Returns*

... limit orders as in Kyle 1989).2 The informed trader plays two roles in our model: she exploits private information and provides liquidity to noise traders in order to capture the systematic risk premium. Risk neutrality maximizes the informed trader’s incentive for information-based trades, but also ...

... limit orders as in Kyle 1989).2 The informed trader plays two roles in our model: she exploits private information and provides liquidity to noise traders in order to capture the systematic risk premium. Risk neutrality maximizes the informed trader’s incentive for information-based trades, but also ...

Return Expectations from Venture Capital Deals in Europe

... Return Expectations from Venture Capital Deals in Europe: A Comparative Study Maximilien Feider, Etienne Krieger, and Karim Medjad Abstract The present comparative study is based on a survey conducted among the venture capital professionals of three major European countries, namely Germany, France, ...

... Return Expectations from Venture Capital Deals in Europe: A Comparative Study Maximilien Feider, Etienne Krieger, and Karim Medjad Abstract The present comparative study is based on a survey conducted among the venture capital professionals of three major European countries, namely Germany, France, ...

Dover Corporation (NYSE:DOV) Memo

... DOV is a good, stable company trading at a significant discount to its intrinsic value – Although DOV is not a company that often makes the headlines with innovative products or impressive growt ...

... DOV is a good, stable company trading at a significant discount to its intrinsic value – Although DOV is not a company that often makes the headlines with innovative products or impressive growt ...