invests - University of Oregon Foundation

... The Foundation receives CONTRIBUTIONS from private gifts and INVESTS those funds for the University of Oregon. DISTRIBUTIONS are made available for University spending, according to the donor’s purpose for the gift: to fund student scholarships, faculty support, academic programs, or capital project ...

... The Foundation receives CONTRIBUTIONS from private gifts and INVESTS those funds for the University of Oregon. DISTRIBUTIONS are made available for University spending, according to the donor’s purpose for the gift: to fund student scholarships, faculty support, academic programs, or capital project ...

1Q16 Market Intelligence Book

... corporate bonds and low beta alternatives to bolster portfolio resilience. ...

... corporate bonds and low beta alternatives to bolster portfolio resilience. ...

Can an old bull learn new tricks? (March 2017)

... has been longer periods of economic growth (see Exhibit 1 and 2). The average expansionary phase of the business cycle in the modern era (post WWII) is 60 months. The last three economic expansions dating back to 1982 have been some of the longest in history, including the longest, lasting 120 month ...

... has been longer periods of economic growth (see Exhibit 1 and 2). The average expansionary phase of the business cycle in the modern era (post WWII) is 60 months. The last three economic expansions dating back to 1982 have been some of the longest in history, including the longest, lasting 120 month ...

Publication in ppt format - Irish Congress of Trade Unions

... Why the Infrastructure / Recovery Bond must work 1. Currently 93% of Irish pension Funds are invested abroad 2 Pension Funds need new asset class (Long term liabilities matched by long-lived assets) 3 Recovery Programme based on savings and investment rather than consumption ...

... Why the Infrastructure / Recovery Bond must work 1. Currently 93% of Irish pension Funds are invested abroad 2 Pension Funds need new asset class (Long term liabilities matched by long-lived assets) 3 Recovery Programme based on savings and investment rather than consumption ...

Diapositive 1

... These smaller, fast growing economies, also known as “frontier markets” potentially create the next generation of equity investing. Supported by positive growing demographic trends, relatively young populations, generally attractive factors such as low wage costs, low public and private debt levels ...

... These smaller, fast growing economies, also known as “frontier markets” potentially create the next generation of equity investing. Supported by positive growing demographic trends, relatively young populations, generally attractive factors such as low wage costs, low public and private debt levels ...

Investing - Madeira City Schools

... investment plan Stock or equity financing Equity capital is provided by stockholders who buy shares of a company’s stock. Stockholders are owners and share in the success of the company. A corporation is not required to repay the money obtained from the sale of stock. The corporation is unde ...

... investment plan Stock or equity financing Equity capital is provided by stockholders who buy shares of a company’s stock. Stockholders are owners and share in the success of the company. A corporation is not required to repay the money obtained from the sale of stock. The corporation is unde ...

Ken Goldberg - Experience on Demand

... Ken Goldberg is an innovative product and market strategy leader with keen business instincts and an entrepreneurial nature. He has a passion for developing & executing strategies to expand market opportunities and provide distinct value to shareholders, customers and patients. As an accomplished ch ...

... Ken Goldberg is an innovative product and market strategy leader with keen business instincts and an entrepreneurial nature. He has a passion for developing & executing strategies to expand market opportunities and provide distinct value to shareholders, customers and patients. As an accomplished ch ...

More Information

... domestic product. As of Sept. 30, 2012, these same institutions, which are all TARP recipients and have all since paid back the funds, held $8.7 trillion in assets. This is about 55 percent of the nation’s gross domestic product. In order to reverse this trend, SIGTARP recommends the Treasury and fe ...

... domestic product. As of Sept. 30, 2012, these same institutions, which are all TARP recipients and have all since paid back the funds, held $8.7 trillion in assets. This is about 55 percent of the nation’s gross domestic product. In order to reverse this trend, SIGTARP recommends the Treasury and fe ...

Newsletter December 2014 - Danielson Financial Group

... *Please see the Outlook 2015: In Transit publication for insights on the economy, stock and bond markets, and investments for the year ahead. IMPORTANT DISCLOSURES The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations ...

... *Please see the Outlook 2015: In Transit publication for insights on the economy, stock and bond markets, and investments for the year ahead. IMPORTANT DISCLOSURES The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations ...

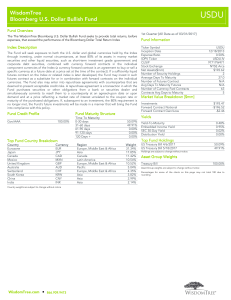

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

Guidelines for Transfers of Registered Plans

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

Performance and Growth - delivering on our commitments

... • EPS growth above peer average (target 10+%) • ROE over 20% • Cost-income ratio comfortably in the 40’s • Inner Tier 1: ...

... • EPS growth above peer average (target 10+%) • ROE over 20% • Cost-income ratio comfortably in the 40’s • Inner Tier 1: ...

B Lab Job Description Position Title: Director of International

... environmental performance standards for companies and funds. GIIRS (the Global Impact Investing Ratings System) a project of B Lab, will provide impact investors with ratings for the social and environmental impact (but not the financial performance) of companies and funds. GIIRS is expected to beco ...

... environmental performance standards for companies and funds. GIIRS (the Global Impact Investing Ratings System) a project of B Lab, will provide impact investors with ratings for the social and environmental impact (but not the financial performance) of companies and funds. GIIRS is expected to beco ...

EUROPEAN ASSETS TRUST NV

... for concern as credit conditions tighten. Hence a reluctance to make full use of the borrowing facilities, at least in the short term. Nevertheless, the changes in the composition of the portfolio made so far this year show that it is still possible to find attractive new investment candidates. The ...

... for concern as credit conditions tighten. Hence a reluctance to make full use of the borrowing facilities, at least in the short term. Nevertheless, the changes in the composition of the portfolio made so far this year show that it is still possible to find attractive new investment candidates. The ...

Problem Set #10 Solutions 1. Using the index model, the alpha of a

... The risk premium for exposure to exchange rates is 5% and the firm has a beta relative to exchanges rates of 0.4. The risk premium for exposure to the consumer price index is -6% and the firm has a beta relative to the CPI of 0.8. If the risk free rate is 3.0%, what is the expected return on this st ...

... The risk premium for exposure to exchange rates is 5% and the firm has a beta relative to exchanges rates of 0.4. The risk premium for exposure to the consumer price index is -6% and the firm has a beta relative to the CPI of 0.8. If the risk free rate is 3.0%, what is the expected return on this st ...

Investments: Analysis and Management

... risk and expected return on risky assets Builds on Markowitz portfolio theory Each investor is assumed to diversify his or her portfolio according to the Markowitz model ...

... risk and expected return on risky assets Builds on Markowitz portfolio theory Each investor is assumed to diversify his or her portfolio according to the Markowitz model ...

inside moving beyond the basics of retirement planning s2 private

... it has a low correlation to equities and bonds, so there’s an important diversification benefit. Second, this asset class offers attractive risk-adjusted returns for multi-asset class funds, so it can enhance returns of these portfolios without materially changing the risk profile. And with daily va ...

... it has a low correlation to equities and bonds, so there’s an important diversification benefit. Second, this asset class offers attractive risk-adjusted returns for multi-asset class funds, so it can enhance returns of these portfolios without materially changing the risk profile. And with daily va ...

Hedge Fund Directive clashes with Irish regulations If the European

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

Lower Returns Likely in the Years Ahead

... to the growth rate in corporate earnings per share. (2) Second, if inflation and interest rates move consistently higher, valuations are likely to soften. If this scenario plays out, investors will earn the corporate earnings growth rate less the valuation decline. (3) Third, if valuations continue ...

... to the growth rate in corporate earnings per share. (2) Second, if inflation and interest rates move consistently higher, valuations are likely to soften. If this scenario plays out, investors will earn the corporate earnings growth rate less the valuation decline. (3) Third, if valuations continue ...

No Slide Title

... working capital- 20% of expenses debt to asset ratio < 40% variance analysis on budgets capital reserve account ...

... working capital- 20% of expenses debt to asset ratio < 40% variance analysis on budgets capital reserve account ...