Standard Deviation - College for Financial Planning

... • For normally distributed returns, calculate the standard deviation range, add and subtract the standard deviation amount from the mean return. Example: Mean return of 10%, Std deviation of 15% ...

... • For normally distributed returns, calculate the standard deviation range, add and subtract the standard deviation amount from the mean return. Example: Mean return of 10%, Std deviation of 15% ...

Growth Stocks: New Opportunities in a Trump Economy?

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...

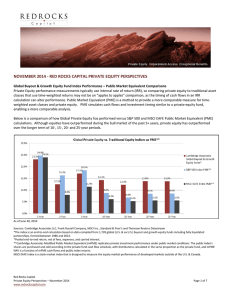

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment. There are inherent risks in investing in private equity companies, which encomp ...

... derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment. There are inherent risks in investing in private equity companies, which encomp ...

Current Trends and Issues in Financial Planning

... – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...

... – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...

Ch22e-EquityPortfoli..

... • What stock characteristics differentiate valueoriented and growth-oriented investment styles? • What is style analysis and what does it indicate about a manager’s investment performance? • What techniques are used by active managers in an attempt to outperform their benchmark? Copyright © 2000 by ...

... • What stock characteristics differentiate valueoriented and growth-oriented investment styles? • What is style analysis and what does it indicate about a manager’s investment performance? • What techniques are used by active managers in an attempt to outperform their benchmark? Copyright © 2000 by ...

personal finance - Gen i Revolution

... Rule of 72 illustrates how compound interest works. In using the Rule of 72, divide 72 by the interest rate paid to determine how many years it will take for a saved amount to double when the interest is compounded. Example: 72 / 8% = 9 years for a saved amount to double. ...

... Rule of 72 illustrates how compound interest works. In using the Rule of 72, divide 72 by the interest rate paid to determine how many years it will take for a saved amount to double when the interest is compounded. Example: 72 / 8% = 9 years for a saved amount to double. ...

Title 1 (Arial Bold 30 pt)

... currencies). * EM Currencies is represented by the JPM ELMI+, an index of emerging market currencies, including Argentina, Brazil, Chile, China, Czech Republic, Egypt, Greece, Hong Kong, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Philippines, Poland, Russia, Singapore, Slovak Republ ...

... currencies). * EM Currencies is represented by the JPM ELMI+, an index of emerging market currencies, including Argentina, Brazil, Chile, China, Czech Republic, Egypt, Greece, Hong Kong, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Philippines, Poland, Russia, Singapore, Slovak Republ ...

management - Relocation Directors Council

... Mobility, HomeSteps, Fannie Mae, etc. Interact with Managers and Agents regarding relocation matters on a continuing basis Create an atmosphere of cooperation and mutual respect among agents, managers, and the relocation department ...

... Mobility, HomeSteps, Fannie Mae, etc. Interact with Managers and Agents regarding relocation matters on a continuing basis Create an atmosphere of cooperation and mutual respect among agents, managers, and the relocation department ...

Schroder Real Estate Investment Management Limited

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

Sayonara Deflation: Japan Turns to “Q-Squared”

... Company Pty Ltd ABN 41 117 767 923 is the holder of the Australian Financial Services Licence 303160. Western Asset Management Company Pte. Ltd. Co. Reg. No. 200007692R is a holder of a Capital Markets Services Licence for fund management and regulated by the Monetary Authority of Singapore. Western ...

... Company Pty Ltd ABN 41 117 767 923 is the holder of the Australian Financial Services Licence 303160. Western Asset Management Company Pte. Ltd. Co. Reg. No. 200007692R is a holder of a Capital Markets Services Licence for fund management and regulated by the Monetary Authority of Singapore. Western ...

Can mutual funds successfully adopt factor investing strategies?

... Our results also indicate that the excess returns earned by funds that have engaged in factor investing strategies are sustainable and do not disappear after the public dissemination of the anomalies. This implies that investors do not have to worry that the added value of incorporating new knowledg ...

... Our results also indicate that the excess returns earned by funds that have engaged in factor investing strategies are sustainable and do not disappear after the public dissemination of the anomalies. This implies that investors do not have to worry that the added value of incorporating new knowledg ...

The Learning Journey Passport To Success CIM – Certified

... CIM Part 2 builds on the knowledge and experience from CIM Part 1 and is designed to create a team of DHL Express Managers who are inspired and capable of delivering 21st Century Leadership and driving the highest levels of performance and results across the business. ...

... CIM Part 2 builds on the knowledge and experience from CIM Part 1 and is designed to create a team of DHL Express Managers who are inspired and capable of delivering 21st Century Leadership and driving the highest levels of performance and results across the business. ...

A Model-Based Approach to Constructing Corporate Bond Portfolios

... The quantitative tools supporting our model-based approach are Moody’s Analytics’ EDF (Expected Default Frequency) credit measures and Fair-value Spread (FVS) valuation framework. The EDF credit measure is calculated using a structural framework conceptually similar to the Black-Scholes-Merton (BSM) ...

... The quantitative tools supporting our model-based approach are Moody’s Analytics’ EDF (Expected Default Frequency) credit measures and Fair-value Spread (FVS) valuation framework. The EDF credit measure is calculated using a structural framework conceptually similar to the Black-Scholes-Merton (BSM) ...

Questions from Chapter 3 - Purdue Agricultural Economics

... c. return on equity investments. d. the one year return on investments in stocks or bonds. 19. Interest rates and stock prices move: a. randomly exhibiting no causal relationship. b. in opposite directions. c. up and down together. d. none of the above 20. Interest rates are set by: a. the forces of ...

... c. return on equity investments. d. the one year return on investments in stocks or bonds. 19. Interest rates and stock prices move: a. randomly exhibiting no causal relationship. b. in opposite directions. c. up and down together. d. none of the above 20. Interest rates are set by: a. the forces of ...

Winning the Credibility War

... experienced in their respective fields than their clients. Indeed, clients seek out, rely upon and pay for professional advice. Accordingly, clients are perceived as vulnerable and reliant upon the better-educated, knowledgeable and experienced advisors. That’s why courts and regulators tend to view ...

... experienced in their respective fields than their clients. Indeed, clients seek out, rely upon and pay for professional advice. Accordingly, clients are perceived as vulnerable and reliant upon the better-educated, knowledgeable and experienced advisors. That’s why courts and regulators tend to view ...

FINANCING WORKING CAPITAL The financing of working capital is

... company has sufficient profits, they can decide to pay dividends. They may even decide to retain their earnings to finance future requirements. But the cost of financing through equity would be higher as they are not allowed as an expense for tax purposes. Companies adopting hedging approach would o ...

... company has sufficient profits, they can decide to pay dividends. They may even decide to retain their earnings to finance future requirements. But the cost of financing through equity would be higher as they are not allowed as an expense for tax purposes. Companies adopting hedging approach would o ...

Bull Market Anniversary: What`s Changed in 7 Years?

... The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI ...

... The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI ...

Institutional Suitability Certificate

... In connection with any recommended2 transaction or investment strategy by a registered broker-dealer, the undersigned acknowledges on behalf of the Institution named below that: I. It is an Institutional Account as defined in FINRA Rule 4512(c)3; II. It (1) is capable of evaluating investment risks ...

... In connection with any recommended2 transaction or investment strategy by a registered broker-dealer, the undersigned acknowledges on behalf of the Institution named below that: I. It is an Institutional Account as defined in FINRA Rule 4512(c)3; II. It (1) is capable of evaluating investment risks ...

Week One Quiz

... A) borrowers can use savers' funds until the savers themselves need the funds. B) money is put into circulation. C) the government puts into operation its plans for the economy. D) business firms distribute their goods. Answer: A 2) Which of the following forms the largest share of household holding ...

... A) borrowers can use savers' funds until the savers themselves need the funds. B) money is put into circulation. C) the government puts into operation its plans for the economy. D) business firms distribute their goods. Answer: A 2) Which of the following forms the largest share of household holding ...

The Central Bank Report on the Financial System

... Private-sector funding has been driven by placements by companies abroad. The credit risk indicators betray a slight impairment Overall, non-financial private-sector borrowing to June 2014 rose by a real annual rate of 8.5%, sustained by debt raised from abroad (which grew at a real annual rate of 2 ...

... Private-sector funding has been driven by placements by companies abroad. The credit risk indicators betray a slight impairment Overall, non-financial private-sector borrowing to June 2014 rose by a real annual rate of 8.5%, sustained by debt raised from abroad (which grew at a real annual rate of 2 ...

January 25 INR SA Conference - National Foreign Trade Council

... more than twice that in Russia). Between l984 and 1992, of the 440 US companies in the country 334 withdrew during sanctions, leaving only about 106 US subsidiaries in the country, many of them very modest in size. Of those that withdrew, fewer that 100 have returned. Obviously, some companies went ...

... more than twice that in Russia). Between l984 and 1992, of the 440 US companies in the country 334 withdrew during sanctions, leaving only about 106 US subsidiaries in the country, many of them very modest in size. Of those that withdrew, fewer that 100 have returned. Obviously, some companies went ...