Extending Factor Models of Equity Risk to Credit Risk and Default Correlation

... « Statistically significant difference in means for every time period tested ...

... « Statistically significant difference in means for every time period tested ...

Preparing for the Worst. Incorporating Downside Risk in Stock Market

... explaining how to incorporate it into investment decisions. Highlighting this asymmetry of the stock market, the authors describe how existing theories miss the downside and follow with explanations of how it can be included. Various techniques for calculating downside risk are demonstrated. This bo ...

... explaining how to incorporate it into investment decisions. Highlighting this asymmetry of the stock market, the authors describe how existing theories miss the downside and follow with explanations of how it can be included. Various techniques for calculating downside risk are demonstrated. This bo ...

marvin c - WORKPHIL.COM

... Processes the settlements and documentation of Philippine stock and bond trades for foreign clients, held by HSBC as custodian. Prepares daily and weekly repatriation reports to the Bangko Sentral ng Pilipinas. ...

... Processes the settlements and documentation of Philippine stock and bond trades for foreign clients, held by HSBC as custodian. Prepares daily and weekly repatriation reports to the Bangko Sentral ng Pilipinas. ...

A better perspective - Allianz Global Investors

... However, to achieve real change the roles and approaches of all stakeholders in the investment chain need to be considered. Consultants, for instance, should be encouraged to also take a longer term view and question fund turnover and agency effects to a greater extent. Some do, but it is not yet co ...

... However, to achieve real change the roles and approaches of all stakeholders in the investment chain need to be considered. Consultants, for instance, should be encouraged to also take a longer term view and question fund turnover and agency effects to a greater extent. Some do, but it is not yet co ...

PDF

... • Since the establishment of modern Australia, the country has in a sense always relied upon foreign investment due to a small population, large size, abundance of natural resources and distance from international capital markets . • Due to historical ties prior to the Second World War the majority ...

... • Since the establishment of modern Australia, the country has in a sense always relied upon foreign investment due to a small population, large size, abundance of natural resources and distance from international capital markets . • Due to historical ties prior to the Second World War the majority ...

Press release - Groupe Caisse des Dépôts

... relates to the launch of a new fund, Qualium Fund II, which Caisse des Dépôts will sponsor. With Qualium Fund II, Qualium Investissement will continue to pursue the investment strategy it has been implementing for almost 20 years, supporting French SMEs in their expansion and transformation projects ...

... relates to the launch of a new fund, Qualium Fund II, which Caisse des Dépôts will sponsor. With Qualium Fund II, Qualium Investissement will continue to pursue the investment strategy it has been implementing for almost 20 years, supporting French SMEs in their expansion and transformation projects ...

Basel II

... Basel II has resulted in the evolution of a number of strategies to allow banks to make risky investments, such as the subprime mortgage market. Higher risks assets are moved to unregulated parts of holding companies. Alternatively, the risk can be transferred directly to investors by securitization ...

... Basel II has resulted in the evolution of a number of strategies to allow banks to make risky investments, such as the subprime mortgage market. Higher risks assets are moved to unregulated parts of holding companies. Alternatively, the risk can be transferred directly to investors by securitization ...

Does Information System Simulate Intellectual Capital? Experience from IT Industries of Dhaka Stock Exchange, Bangladesh

... It is a matter of great depression that developing countries like Bangladesh has still zero knowledge about such important value making element for their corporations. As a result any research work or their results cannot be incorporated here for the findings of previous lacking of research and scop ...

... It is a matter of great depression that developing countries like Bangladesh has still zero knowledge about such important value making element for their corporations. As a result any research work or their results cannot be incorporated here for the findings of previous lacking of research and scop ...

Dividend increase to EUR 1.05 approved by large majority of

... Dividend increase to EUR 1.05 approved by large majority of shareholders at Deutsche Post AG Annual General Meeting Bochum/Bonn, April 28, 2017: At the Annual General Meeting of Deutsche Post AG held in the RuhrCongress in Bochum, Germany, around 900 shareholders approved the resolutions proposed by ...

... Dividend increase to EUR 1.05 approved by large majority of shareholders at Deutsche Post AG Annual General Meeting Bochum/Bonn, April 28, 2017: At the Annual General Meeting of Deutsche Post AG held in the RuhrCongress in Bochum, Germany, around 900 shareholders approved the resolutions proposed by ...

Fund Summary Sheet TMLS Singapore Cash Fund

... not necessarily indicative of the future performance. Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds ...

... not necessarily indicative of the future performance. Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds ...

Financial Mathematics and Applied Probability Seminars 2001-2002

... March, 5:30 University of Waterloo, Canada pm Asset Allocation using Quasi Monte Carlo Abstract: The asset allocation decision is an important one for investment managers of pension plans, mutual funds and other financial institutions. In recent years many institutions have increasingly passed this ...

... March, 5:30 University of Waterloo, Canada pm Asset Allocation using Quasi Monte Carlo Abstract: The asset allocation decision is an important one for investment managers of pension plans, mutual funds and other financial institutions. In recent years many institutions have increasingly passed this ...

SAST - VCP Value Portfolio Summary Prospectus

... average daily net assets of the Portfolio’s Class 1 and Class 3 shares, respectively. For purposes of the Expense Limitation Agreement, “Total Annual Portfolio Operating Expenses” shall not include extraordinary expenses (i.e., expenses that are unusual in nature and/or infrequent in occurrence, suc ...

... average daily net assets of the Portfolio’s Class 1 and Class 3 shares, respectively. For purposes of the Expense Limitation Agreement, “Total Annual Portfolio Operating Expenses” shall not include extraordinary expenses (i.e., expenses that are unusual in nature and/or infrequent in occurrence, suc ...

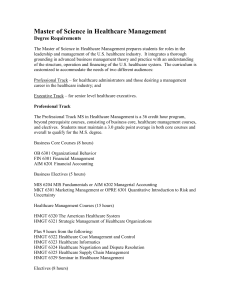

PART I. STRATEGIC MANAGEMENT INPUTS

... Partnerships created by mergers and acquisitions, joint ventures, alliances ...

... Partnerships created by mergers and acquisitions, joint ventures, alliances ...

Introduction to Non-Interest Banking

... Islamic financial institutions are required to have a Shariah Supervisory organ appointed by the Board as part of its corporate structure to ensure that all business activities are Shariah compliant. There is Shariah audit in addition to financial audit ...

... Islamic financial institutions are required to have a Shariah Supervisory organ appointed by the Board as part of its corporate structure to ensure that all business activities are Shariah compliant. There is Shariah audit in addition to financial audit ...

Real estate has a place in a well-diversified investment

... properties. All of them have trade-offs. REITS offer daily liquidity but are also the most volatile, since their pricing is subject to investor sentiment. Open-end commingled funds have an infinite life, offer quarterly liquidity and are a common vehicle for similar investors to pool their interests ...

... properties. All of them have trade-offs. REITS offer daily liquidity but are also the most volatile, since their pricing is subject to investor sentiment. Open-end commingled funds have an infinite life, offer quarterly liquidity and are a common vehicle for similar investors to pool their interests ...

Chapter 11 Introduction to Investment Concepts

... Introduction to Cash Flow Analysis What we mean by direct and indirect real estate investment Returns on labor versus returns on investments Sources of real estate risk Measuring real estate risk Investment alternatives within the real estate asset class Creative advantages of partners ...

... Introduction to Cash Flow Analysis What we mean by direct and indirect real estate investment Returns on labor versus returns on investments Sources of real estate risk Measuring real estate risk Investment alternatives within the real estate asset class Creative advantages of partners ...

Presentation

... extensive independent research before making your investment decisions. Global Forex Trading is merely providing this presentation for your general information. This presentation and its information does not take into account any particular individual’s investment objectives, financial situation, or ...

... extensive independent research before making your investment decisions. Global Forex Trading is merely providing this presentation for your general information. This presentation and its information does not take into account any particular individual’s investment objectives, financial situation, or ...

Ch 4

... correlated. Otherwise, the stock portfolio would have the same expected return as the single stock (15 percent) but a lower standard deviation. If the correlation coefficient (r) between each pair of stocks was negative one, the portfolio would be virtually riskless. Because r for stocks is generall ...

... correlated. Otherwise, the stock portfolio would have the same expected return as the single stock (15 percent) but a lower standard deviation. If the correlation coefficient (r) between each pair of stocks was negative one, the portfolio would be virtually riskless. Because r for stocks is generall ...

FREE Sample Here

... 21. Firms that specialize in helping companies raise capital by selling securities are called ________. A. chartered banks B. investment banks C. trust companies D. credit unions E. all of these. An important role of investment banks is to act as middle men in helping firms place new issues in the m ...

... 21. Firms that specialize in helping companies raise capital by selling securities are called ________. A. chartered banks B. investment banks C. trust companies D. credit unions E. all of these. An important role of investment banks is to act as middle men in helping firms place new issues in the m ...

smart beta in the limelight

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

evidence session summary document

... Related to the issue of accounting, David Newbery noted the current accounting practices make under-investing look cheaper than it actually is. This is because the public sector does not account for the depreciation of the asset value of existing stock of assets. The direct implication of this is ve ...

... Related to the issue of accounting, David Newbery noted the current accounting practices make under-investing look cheaper than it actually is. This is because the public sector does not account for the depreciation of the asset value of existing stock of assets. The direct implication of this is ve ...