Document

... future inflation, the saving curve does not move. This implies that for a given level of GDP level (which determines the position of the saving curve), a rightward shift of the investment results in a higher equilibrium nominal interest rate. In other words, the IS curve moves up for every GDP level ...

... future inflation, the saving curve does not move. This implies that for a given level of GDP level (which determines the position of the saving curve), a rightward shift of the investment results in a higher equilibrium nominal interest rate. In other words, the IS curve moves up for every GDP level ...

Mirae Asset Securities (USA) Inc.

... the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the n ...

... the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the n ...

Financing Infrastructure for Economic Transformation

... TRANSFORMATION AGENDA The Priority Areas of the T/A are: i. Physical Infrastructure ii. Human Capital Development iii. Governance iv. Real Sector Development The Objectives of the Agenda are: i. Job Creation ii. Strong and Inclusive Growth iii. Well-being of Nigerians ...

... TRANSFORMATION AGENDA The Priority Areas of the T/A are: i. Physical Infrastructure ii. Human Capital Development iii. Governance iv. Real Sector Development The Objectives of the Agenda are: i. Job Creation ii. Strong and Inclusive Growth iii. Well-being of Nigerians ...

Notice Concerning Operating Forecast for the fiscal period ending

... It is assumed that law, tax law, accounting standard, regulations of the listing, and regulations of The Investment Trusts Association, Japan that may impact the forecast above will not be revised. ...

... It is assumed that law, tax law, accounting standard, regulations of the listing, and regulations of The Investment Trusts Association, Japan that may impact the forecast above will not be revised. ...

HRM604 Topic 5

... about what they are planning in the context of their organization and within the framework of a recognized body of knowledge, and they have to perform effectively in the sense of delivering advice, guidance and services that will help the organization to achieve its strategic goals. ...

... about what they are planning in the context of their organization and within the framework of a recognized body of knowledge, and they have to perform effectively in the sense of delivering advice, guidance and services that will help the organization to achieve its strategic goals. ...

Public sector investment failures: Theoretical contributions from new

... these factors, the frameworks may be argued to be more sensitive to the realities of decision-making within different institutional and organizational contexts. In regards to the issue of organizing the investment function, the two frameworks are particularly helpful in providing insight into whethe ...

... these factors, the frameworks may be argued to be more sensitive to the realities of decision-making within different institutional and organizational contexts. In regards to the issue of organizing the investment function, the two frameworks are particularly helpful in providing insight into whethe ...

The Public Market Equivalent and Private Equity Performance

... One complication that arises when evaluating the performance of private equity (“PE”) funds (such as buyout or venture capital funds) is that these funds generate streams of cash flows but don’t have regularly quoted financial returns. Such funds predominantly own privately-held companies, without ...

... One complication that arises when evaluating the performance of private equity (“PE”) funds (such as buyout or venture capital funds) is that these funds generate streams of cash flows but don’t have regularly quoted financial returns. Such funds predominantly own privately-held companies, without ...

Seix Investment Advisors Perspective

... The third quarter was a classic risk-off environment that witnessed a multitude of macroeconomic themes impacting trading. Market volatility kicked off in July with Greece and its European partners negotiating yet another bailout after a referendum against additional austerity passed, threatening to ...

... The third quarter was a classic risk-off environment that witnessed a multitude of macroeconomic themes impacting trading. Market volatility kicked off in July with Greece and its European partners negotiating yet another bailout after a referendum against additional austerity passed, threatening to ...

Upcoming Deadline for Form SHC - Holdings of Foreign Securities

... Short-Term Debt Securities: Short-term debt securities include bills, commercial paper and other money market instruments of a foreign issuer with an original maturity of one year or less that give the holder unconditional right to financial assets. ...

... Short-Term Debt Securities: Short-term debt securities include bills, commercial paper and other money market instruments of a foreign issuer with an original maturity of one year or less that give the holder unconditional right to financial assets. ...

Development of Investment Cases for Measles and Rubella

... Similar to 3.2, the information in this section may lead to iteration and adjustment of the options identified in 3.1 or reduction in the set of alternatives carried forward throughout the remainder of section 3. The analysis should carefully consider the timelines required for any efforts to build ...

... Similar to 3.2, the information in this section may lead to iteration and adjustment of the options identified in 3.1 or reduction in the set of alternatives carried forward throughout the remainder of section 3. The analysis should carefully consider the timelines required for any efforts to build ...

ECN 111 Chapter 9 Lecture Notes

... a. A bond is a promise to pay specified sums of money on specified dates and is a debt for the issuer of the bond. b. A bond market is a financial market in which bonds issued by firms and governments are traded. 3. Short-Term Securities Markets a. Short-term securities are debt instruments, such as ...

... a. A bond is a promise to pay specified sums of money on specified dates and is a debt for the issuer of the bond. b. A bond market is a financial market in which bonds issued by firms and governments are traded. 3. Short-Term Securities Markets a. Short-term securities are debt instruments, such as ...

Slide 1

... – Provides for actions that deters and detects money laundering and terrorism financing – Provides for the freezing, seizure and forfeiture of proceeds derived from ML/TF activities • Regional participation: Malaysia is a member of the Asia/Pacific Group on Money Laundering, the Egmont Group of Fina ...

... – Provides for actions that deters and detects money laundering and terrorism financing – Provides for the freezing, seizure and forfeiture of proceeds derived from ML/TF activities • Regional participation: Malaysia is a member of the Asia/Pacific Group on Money Laundering, the Egmont Group of Fina ...

General Fund

... – Revenues STAND ALONE. – Revenues are not “earned” as in the private sector. – The delivery of services requires expenditures—but delivery does not “generate” revenues. ...

... – Revenues STAND ALONE. – Revenues are not “earned” as in the private sector. – The delivery of services requires expenditures—but delivery does not “generate” revenues. ...

Plan Investments in Bank Collective Investment Funds

... international equity, domestic fixed income, international fixed income, stock/bond blend, target date funds, and short term investment funds. CIFs may have investment guidelines under which funds can invest in derivatives and alternative investments, such as hedge funds, private equity funds, or si ...

... international equity, domestic fixed income, international fixed income, stock/bond blend, target date funds, and short term investment funds. CIFs may have investment guidelines under which funds can invest in derivatives and alternative investments, such as hedge funds, private equity funds, or si ...

Trump Portfolios

... required by the direct approach. It must also be pointed out that the direct approach does not take into consideration dynamic effects that may emanate from the policy changes being contemplated. The lower tax rates will result in an economic expansion and, all else the same, the firm that experienc ...

... required by the direct approach. It must also be pointed out that the direct approach does not take into consideration dynamic effects that may emanate from the policy changes being contemplated. The lower tax rates will result in an economic expansion and, all else the same, the firm that experienc ...

Equity Risk, Credit Risk, Default Correlation, and Corporate Sustainability

... Statistically significant difference in means for every time period tested ...

... Statistically significant difference in means for every time period tested ...

Investment Provisions in Trade and Investment

... with new anti-corruption rules.15 It will be very difficult if not impossible to assess the impacts of these threats because they relate to decision-making and possible negotiations off the public record. Yet, the warnings illustrate the bargaining option that ISDS gives to major companies. Table 1 ...

... with new anti-corruption rules.15 It will be very difficult if not impossible to assess the impacts of these threats because they relate to decision-making and possible negotiations off the public record. Yet, the warnings illustrate the bargaining option that ISDS gives to major companies. Table 1 ...

OUTLOOK

... question as to whether investors are still sufficiently rewarded for the risks they take, especially in this world of low growth and low inflation. One is inclined to wonder whether all that policymakers around the globe can do is argue about re-dividing the pie or whether they have the tools to ens ...

... question as to whether investors are still sufficiently rewarded for the risks they take, especially in this world of low growth and low inflation. One is inclined to wonder whether all that policymakers around the globe can do is argue about re-dividing the pie or whether they have the tools to ens ...

Chapter 2 International Human Resource Management

... number of advantages and disadvantages to each of the approaches and as suggested by HRM in practice 2.1 these can vary significantly between MNCs. For those companies adopting an ethnocentric approach the obvious advantage is the ability to retain tight control over overseas subsidiaries, especiall ...

... number of advantages and disadvantages to each of the approaches and as suggested by HRM in practice 2.1 these can vary significantly between MNCs. For those companies adopting an ethnocentric approach the obvious advantage is the ability to retain tight control over overseas subsidiaries, especiall ...

L`essentiel en un clin d`oeil

... This document is intended exclusively for professional or institutional clients and counterparties. It is therefore not intended to be distributed to, or used by, any private client, person or entity who/which is a national of, is resident in or located in any place, State, country or other jurisdic ...

... This document is intended exclusively for professional or institutional clients and counterparties. It is therefore not intended to be distributed to, or used by, any private client, person or entity who/which is a national of, is resident in or located in any place, State, country or other jurisdic ...

- Miller Capital Management

... surprise. Analysts have been factoring slower growth into their calculations for some time. U.S. rate hikes are highly anticipated and, even though some fear they could tip the American economy into recession (and argue recent stock price movement supports the claim), relatively strong economic data ...

... surprise. Analysts have been factoring slower growth into their calculations for some time. U.S. rate hikes are highly anticipated and, even though some fear they could tip the American economy into recession (and argue recent stock price movement supports the claim), relatively strong economic data ...

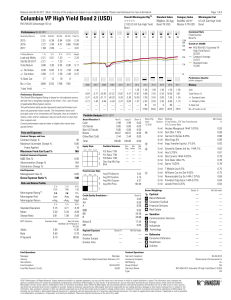

Columbia VP High Yield Bond 2 (USD)

... contract. An annuity is a tax-deferred investment structured to convert a sum of money into a series of payments over time. Variable annuity policies have limitations and are not viewed as short-term liquid investments. An insurance company's fulfillment of a commitment to pay a minimum death benefi ...

... contract. An annuity is a tax-deferred investment structured to convert a sum of money into a series of payments over time. Variable annuity policies have limitations and are not viewed as short-term liquid investments. An insurance company's fulfillment of a commitment to pay a minimum death benefi ...