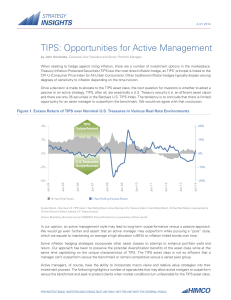

TIPS: Opportunities for Active Management

... These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data contained in this is from sources deemed to be reliable, but cannot be guaranteed as to accuracy or completeness. Hartford Investment Management Company is a registered in ...

... These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data contained in this is from sources deemed to be reliable, but cannot be guaranteed as to accuracy or completeness. Hartford Investment Management Company is a registered in ...

Overview of Insurance Companies

... Financial guarantee insurance Credit insurance (for short-term trade receivables) Private mortgage guaranty insurance (PMI) Reinsurance Catastrophe bonds Weather-related derivatives and insurance Life Insurance Companies In 1988: 2,300 life insurance companies with aggregate assets o ...

... Financial guarantee insurance Credit insurance (for short-term trade receivables) Private mortgage guaranty insurance (PMI) Reinsurance Catastrophe bonds Weather-related derivatives and insurance Life Insurance Companies In 1988: 2,300 life insurance companies with aggregate assets o ...

Roll out the red carpet and they will come: Investment promotion and

... investment promotion agencies receive twice as much FDI in the post-targeting period relative to the pre-targeting period and non-targeted sectors. Importantly, the effect is not driven by promising industries being targeted.2 The magnitude of the effect is plausible, since the median sector-level ...

... investment promotion agencies receive twice as much FDI in the post-targeting period relative to the pre-targeting period and non-targeted sectors. Importantly, the effect is not driven by promising industries being targeted.2 The magnitude of the effect is plausible, since the median sector-level ...

ROYALTY, THE COLOMBIAN DEVELOPMENT FOR ALL

... rather, has atomized into small projects of little impact, difficult to track and even more to measure. It is in those moments when we wonder specifically, what were invested 40.2 billion dollars of royalties drawn between 1994 and 2009? Do those funds have really promoted the development of departm ...

... rather, has atomized into small projects of little impact, difficult to track and even more to measure. It is in those moments when we wonder specifically, what were invested 40.2 billion dollars of royalties drawn between 1994 and 2009? Do those funds have really promoted the development of departm ...

High Return on Investment - Center for High Impact Philanthropy

... return of some kind, in addition to the original amount allocated. The return on investment, or ROI, is a common performance measure used to evaluate and compare the efficiency of financial investments. Early childhood programs cost money, of course, but studies show that the benefits associated wit ...

... return of some kind, in addition to the original amount allocated. The return on investment, or ROI, is a common performance measure used to evaluate and compare the efficiency of financial investments. Early childhood programs cost money, of course, but studies show that the benefits associated wit ...

Investing in Energy Efficiency and Renewable Energy

... All forward-looking statements have been compiled on a best efforts basis, taking into account multiple variables which may be subject to change, including, without limitation, exchange rates, general developments in banking markets and regulations, interest rate benchmarks, and others. Actual devel ...

... All forward-looking statements have been compiled on a best efforts basis, taking into account multiple variables which may be subject to change, including, without limitation, exchange rates, general developments in banking markets and regulations, interest rate benchmarks, and others. Actual devel ...

Prospectus SEB Green Bond Fund

... The Fund is managed on behalf of the Unitholders by the Management Company, SEB Investment Management AB as a consequence of the merger by absorption of SEB Asset Management S.A. by SEB Investment Management AB. The Management Company was established on 19 May 1978 in the form of a Swedish limited l ...

... The Fund is managed on behalf of the Unitholders by the Management Company, SEB Investment Management AB as a consequence of the merger by absorption of SEB Asset Management S.A. by SEB Investment Management AB. The Management Company was established on 19 May 1978 in the form of a Swedish limited l ...

Revisiting the Global Credit Cycle

... However, European economic growth remains challenged with a projected rate for 2017 of just above 1.0%—albeit a notable uptick from several years ago. European companies have generally been less aggressive than their U.S. counterparts to increase financial leverage, partly due to an uncertain econom ...

... However, European economic growth remains challenged with a projected rate for 2017 of just above 1.0%—albeit a notable uptick from several years ago. European companies have generally been less aggressive than their U.S. counterparts to increase financial leverage, partly due to an uncertain econom ...

Expand Into Value Added Services

... investment and fund management services, investment banking, financial trading (including foreign exchange, securities and derivatives). Captive insurance or reinsurance management services, reinsurance underwriting, actuarial services, insurance claims management, hedge fund administration, and any ...

... investment and fund management services, investment banking, financial trading (including foreign exchange, securities and derivatives). Captive insurance or reinsurance management services, reinsurance underwriting, actuarial services, insurance claims management, hedge fund administration, and any ...

INVESTORLIT Research Private Equity vs. Public Equity

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

PL00142-1055_Exact Market Cash Fund PDS

... considered investment guidelines. To manage counter-party risk associated with the use of a swap agreement, we will either deal only with counter-parties that have appropriate ratings from a recognised rating agency or, as is the case at present where the counter-party is not rated, we have obtained ...

... considered investment guidelines. To manage counter-party risk associated with the use of a swap agreement, we will either deal only with counter-parties that have appropriate ratings from a recognised rating agency or, as is the case at present where the counter-party is not rated, we have obtained ...

doc

... Where traditional management envisions society outside the ecosystem placing demands on the production of goods, ecosystem management envisions society as part of the ecosystem, interacting with biological resources in multiple ways. A fundamental goal of ecosystem management is to make these intera ...

... Where traditional management envisions society outside the ecosystem placing demands on the production of goods, ecosystem management envisions society as part of the ecosystem, interacting with biological resources in multiple ways. A fundamental goal of ecosystem management is to make these intera ...

OPIC Presentation

... markets – markets where private sector finance or insurance is not available to American investors • Over the agency’s 37-year history, OPIC has supported $180 billion worth of investments, including more than $800 million to U.S. investors in Nigeria in 37 ...

... markets – markets where private sector finance or insurance is not available to American investors • Over the agency’s 37-year history, OPIC has supported $180 billion worth of investments, including more than $800 million to U.S. investors in Nigeria in 37 ...

Letter of Appointment for Independent Directors

... (ii) facilitate Company’s adherence to high standards of ethics and corporate behavior; (iii) guide the Board in monitoring the effectiveness of the Company’s governance practices and to recommend changes, required if any; (iv) guide the Board in monitoring and managing potential conflicts of intere ...

... (ii) facilitate Company’s adherence to high standards of ethics and corporate behavior; (iii) guide the Board in monitoring the effectiveness of the Company’s governance practices and to recommend changes, required if any; (iv) guide the Board in monitoring and managing potential conflicts of intere ...

Altrius Global Absolute Return Strategy

... that this income stream has not only reduced the risk of our portfolio, but also provided a large part of the total return thereby leading to our performance success over this past tumultuous decade plus. We believe that dividends allow our investors to “get paid to wait” while patiently working thr ...

... that this income stream has not only reduced the risk of our portfolio, but also provided a large part of the total return thereby leading to our performance success over this past tumultuous decade plus. We believe that dividends allow our investors to “get paid to wait” while patiently working thr ...

Banco Centroamericano de Integración Económica

... Includes a number of mechanisms to identify, manage, implement, monitor, evaluate and measure the impact of its programs and projects. Reduces the cost of granting and managing resources for donors which do not have a strong presence in the Region. ...

... Includes a number of mechanisms to identify, manage, implement, monitor, evaluate and measure the impact of its programs and projects. Reduces the cost of granting and managing resources for donors which do not have a strong presence in the Region. ...

Boom and Bust of Equity Portfolio Flows to Emerging Markets A

... It is widely documented in the literature that factors that play a role in attracting FDI inflows are quite different to those that encourage portfolio flows. For this reason, as well as the fact that South Africa’s capital inflows are predominantly in the form of portfolio inflows, this paper focu ...

... It is widely documented in the literature that factors that play a role in attracting FDI inflows are quite different to those that encourage portfolio flows. For this reason, as well as the fact that South Africa’s capital inflows are predominantly in the form of portfolio inflows, this paper focu ...

Fixed Income Letter, Fourth Quarter 2016

... Centerpoint Advisors, LLC is an investment advisor registered with the Securities and Exchange Commission. Centerpoint Advisors, LLC provides fundamental investment management services to investors. The views expressed contain certain forward-looking statements. Centerpoint Advisors believe these f ...

... Centerpoint Advisors, LLC is an investment advisor registered with the Securities and Exchange Commission. Centerpoint Advisors, LLC provides fundamental investment management services to investors. The views expressed contain certain forward-looking statements. Centerpoint Advisors believe these f ...

Mutal Funds - BYU Personal Finance

... • Always compare funds with the same objective • Compare them to a relevant index. Some funds are not willing to be compared to an index as it shows their poor performance. • Evaluate the fund’s long-term performance versus peers and the relevant index • Try to make sure they haven’t inflated return ...

... • Always compare funds with the same objective • Compare them to a relevant index. Some funds are not willing to be compared to an index as it shows their poor performance. • Evaluate the fund’s long-term performance versus peers and the relevant index • Try to make sure they haven’t inflated return ...

Audited Financial Statements June 30, 2010

... the Statement of Activities, are presented to display information about the Corporation as a whole and are prepared using the economic resources measurement focus and the accrual basis of accounting, similar to the accounting used by most private-sector companies. Revenues are recorded when earned a ...

... the Statement of Activities, are presented to display information about the Corporation as a whole and are prepared using the economic resources measurement focus and the accrual basis of accounting, similar to the accounting used by most private-sector companies. Revenues are recorded when earned a ...

Extending Factor Models of Equity Risk to Credit Risk, Default Correlation, and Corporate Sustainability

... th t cause higher equity valuations We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as m ...

... th t cause higher equity valuations We propose “revenue weighted” expected average life as a measure of systemic stress on an economy By revenue weighting we capture the stress in the real economy Avoids bias of cap weighting since failing firm’s have small market capitalization and don’t count as m ...

draft - American Bar Association

... The Secured Party hereby originates an entitlement order or instruction directing the Bank to continue, at the end of each investment period of the Sweep Investment, to re-deposit in the Deposit Account funds that were withdrawn by the Bank from the Deposit Account and invested in the Sweep Investme ...

... The Secured Party hereby originates an entitlement order or instruction directing the Bank to continue, at the end of each investment period of the Sweep Investment, to re-deposit in the Deposit Account funds that were withdrawn by the Bank from the Deposit Account and invested in the Sweep Investme ...