ECONOMIC OPPORTUNITY COST OF CAPITAL (a)

... greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rejected on the grounds that the investment resources of the country could be put to better use elsewhere. ...

... greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rejected on the grounds that the investment resources of the country could be put to better use elsewhere. ...

Wave 7 - BetterInvesting

... stock mutual funds and seem to be in this for the long-term, they do express ongoing concern about the economy and stock market. ...

... stock mutual funds and seem to be in this for the long-term, they do express ongoing concern about the economy and stock market. ...

liberty high yield fund

... Each of the interest rate securities acquired by the Fund will be purchased by the Responsible Entity at market value. Where the Fund acquires interest rate securities from a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the a ...

... Each of the interest rate securities acquired by the Fund will be purchased by the Responsible Entity at market value. Where the Fund acquires interest rate securities from a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the a ...

Cellectar Biosciences, Inc. (Form: SC 13D, Received

... mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. Mr. Marxe, Mr. Greenhouse and Mr. Stettner are citizens of the United States. Item 3. Source and Amount of Funds or Other Consideration. Each Fund utilized its own available net asse ...

... mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. Mr. Marxe, Mr. Greenhouse and Mr. Stettner are citizens of the United States. Item 3. Source and Amount of Funds or Other Consideration. Each Fund utilized its own available net asse ...

Mosaic Global Fund - Premier Asset Development Services

... Mosaic Global Fund Disclaimer This document is intended for well informed investors and financial advisers. It is for informational purposes only. It is not an offer to sell or a solicitation to buy any financial product. This document is not directed at or intended for use by the general public. P ...

... Mosaic Global Fund Disclaimer This document is intended for well informed investors and financial advisers. It is for informational purposes only. It is not an offer to sell or a solicitation to buy any financial product. This document is not directed at or intended for use by the general public. P ...

Schwab PowerPoint template

... 2. 2016 is a preliminary Schwab estimate assuming 2016 RIA market growth was in line with ASI asset growth. 3. Excludes dividend yield. Metrics Source: 2016 RIA Benchmarking Study from Charles Schwab. 1. Median results for all firms with $250M or more in AUM, unless otherwise noted. 2016 RIA Benchma ...

... 2. 2016 is a preliminary Schwab estimate assuming 2016 RIA market growth was in line with ASI asset growth. 3. Excludes dividend yield. Metrics Source: 2016 RIA Benchmarking Study from Charles Schwab. 1. Median results for all firms with $250M or more in AUM, unless otherwise noted. 2016 RIA Benchma ...

1. The primary operating goal of a publicly

... the bank would charge the firm. The lower the company's EBITDA coverage ratio, other things held constant, the lower the interest rate the bank would charge the firm. Other things held constant, the lower the current asset ratio, the lower the interest rate the bank would charge the firm. Other thin ...

... the bank would charge the firm. The lower the company's EBITDA coverage ratio, other things held constant, the lower the interest rate the bank would charge the firm. Other things held constant, the lower the current asset ratio, the lower the interest rate the bank would charge the firm. Other thin ...

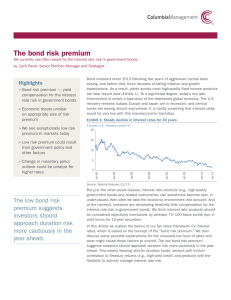

The bond risk premium

... equity risk premium. Equities are a relatively risky asset class, with high volatility and a high correlation with the business cycle — that is, they tend to perform poorly in recessions. Historically, however, investors have been rewarded for this additional risk in equities. The excess return of U ...

... equity risk premium. Equities are a relatively risky asset class, with high volatility and a high correlation with the business cycle — that is, they tend to perform poorly in recessions. Historically, however, investors have been rewarded for this additional risk in equities. The excess return of U ...

stock market extremes - Towneley Capital Management

... Professor Seyhun studied return and risk data for an index of U.S. stocks. Return was measured as total return with dividends reinvested. Risk was measured by calculating the standard deviation of the total returns. Two periods were examined: 1926-2004 and 1963-2004. The first period covers the full ...

... Professor Seyhun studied return and risk data for an index of U.S. stocks. Return was measured as total return with dividends reinvested. Risk was measured by calculating the standard deviation of the total returns. Two periods were examined: 1926-2004 and 1963-2004. The first period covers the full ...

PPT

... The grasshopper (G) wants to consume now. The ant (A) wants to wait. But each is happy to invest. A prefers to invest 14%, moving up the red arrow, rather than at the 7% interest rate. G invests and then borrows at 7%, thereby transforming $100 into $106.54 of immediate consumption. Because of the i ...

... The grasshopper (G) wants to consume now. The ant (A) wants to wait. But each is happy to invest. A prefers to invest 14%, moving up the red arrow, rather than at the 7% interest rate. G invests and then borrows at 7%, thereby transforming $100 into $106.54 of immediate consumption. Because of the i ...

NP 2012 COC 1 Q.

... feasible portfolio proportions (X1, … XN) into feasible combinations of: (i) expected return and variance of return; or (ii) expected return and standard deviation of return. Figure I shows one such feasible set of Ep, SDp, combinations. Consider portfolio A shown in Figure I. Rational Markowitz mea ...

... feasible portfolio proportions (X1, … XN) into feasible combinations of: (i) expected return and variance of return; or (ii) expected return and standard deviation of return. Figure I shows one such feasible set of Ep, SDp, combinations. Consider portfolio A shown in Figure I. Rational Markowitz mea ...

U.S. Corporate Pension Liability Hedging Views at 6/30/2015.

... Realized core inflation has been low over the past two years, and remains low in the developed world. The large declines in the oil price will keep headline inflation low in the near term and is also likely to have some spillover effects in core inflation. This will ease the pressure on central ...

... Realized core inflation has been low over the past two years, and remains low in the developed world. The large declines in the oil price will keep headline inflation low in the near term and is also likely to have some spillover effects in core inflation. This will ease the pressure on central ...

Strategy enhancement - nab asset management

... outcomes to achieve the portfolios’ real return objectives. That’s why a manager such as Ruffer has a higher allocation in these portfolios than in MLC Horizon portfolios. In the MLC Horizon portfolios we focus more on bringing together very different investment managers in each mainstream asset cla ...

... outcomes to achieve the portfolios’ real return objectives. That’s why a manager such as Ruffer has a higher allocation in these portfolios than in MLC Horizon portfolios. In the MLC Horizon portfolios we focus more on bringing together very different investment managers in each mainstream asset cla ...

Leadership is the art of delegation: the impact on

... the staff, so that no stone unturned in achieving the set objectives. Without motivation, no participation would be happened in the decision making process, which would turn out to be pseudo-participation and non-ownership by the people, resulting from half-hearted working. In that case workers will ...

... the staff, so that no stone unturned in achieving the set objectives. Without motivation, no participation would be happened in the decision making process, which would turn out to be pseudo-participation and non-ownership by the people, resulting from half-hearted working. In that case workers will ...

SPECULATIVE BUBBLES – A BEHAVIORAL APPROACH

... Behavioral finance suggests that stock market bubbles occur because of the irrational behavior the positive feedback trading, other behavioral biases. According to Johnsson, Lindblom and Platan (2002), the factors forming speculative bubbles may be grouped into three main ...

... Behavioral finance suggests that stock market bubbles occur because of the irrational behavior the positive feedback trading, other behavioral biases. According to Johnsson, Lindblom and Platan (2002), the factors forming speculative bubbles may be grouped into three main ...

For-profit/Nonprofit Exam Review

... state tax exemption. And, furthermore, are not required to pay taxes on any property owned by the company. a.True b.False ...

... state tax exemption. And, furthermore, are not required to pay taxes on any property owned by the company. a.True b.False ...

Denarius Capital Advisors Inc. d/b/a Money Intelligence

... objectives, time horizon, and risk tolerance of each client. DCA creates an Investment Policy Statement for each client, which outlines the client’s current situation (income, tax levels, and risk tolerance levels) and then constructs a plan to aid in the selection of a portfolio that matches each c ...

... objectives, time horizon, and risk tolerance of each client. DCA creates an Investment Policy Statement for each client, which outlines the client’s current situation (income, tax levels, and risk tolerance levels) and then constructs a plan to aid in the selection of a portfolio that matches each c ...

Our Two Cents - RFM Financial Solutions, LLC

... if "the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall." If you've missed a distribution or didn't take as much of an RMD as you should have, you'll need to fill out an IRS form. You'll also have to submit a letter detailing w ...

... if "the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall." If you've missed a distribution or didn't take as much of an RMD as you should have, you'll need to fill out an IRS form. You'll also have to submit a letter detailing w ...

Large American Banks and Economic Recovery

... he worked with me one on one to create a plan of action for my continued success. Melissa, Jessica, and Carlene, my loving sisters, always pushed me to be the best that I can be and to strive for perfection as they gave words of encouragement throughout my undergraduate career. And my final thank yo ...

... he worked with me one on one to create a plan of action for my continued success. Melissa, Jessica, and Carlene, my loving sisters, always pushed me to be the best that I can be and to strive for perfection as they gave words of encouragement throughout my undergraduate career. And my final thank yo ...

M*Ware™ TMN Solutions Overview

... Vertel’s in-depth knowledge and commitment to industry standards, combined with experience of working with many different equipment types, creates high performance solutions that enable customers to quickly cross technological barriers. Vertel’s mission is to make its customers successful by enablin ...

... Vertel’s in-depth knowledge and commitment to industry standards, combined with experience of working with many different equipment types, creates high performance solutions that enable customers to quickly cross technological barriers. Vertel’s mission is to make its customers successful by enablin ...

Why Does Everyone Experience Such Different Retirement Income

... large drops in wealth accumulations that may follow wealth peaks, explaining how some individuals might unwittingly just miss their opportunity to reach their wealth target after thirty years, and subsequently may find that working for much longer does not get them back to where they had hoped to be ...

... large drops in wealth accumulations that may follow wealth peaks, explaining how some individuals might unwittingly just miss their opportunity to reach their wealth target after thirty years, and subsequently may find that working for much longer does not get them back to where they had hoped to be ...

FIGURES IN MILLIONS OF PESOS

... Operating Flows defined as operating and amortization and (+/-) fair value of the investment properties summed $653.6 Million MXP, which is 6.9% more than in the 1Q13. ...

... Operating Flows defined as operating and amortization and (+/-) fair value of the investment properties summed $653.6 Million MXP, which is 6.9% more than in the 1Q13. ...