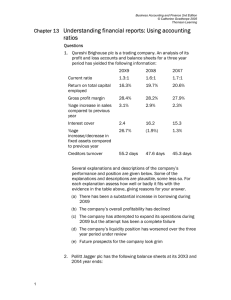

Chapter 13 Understanding financial reports: Using accounting ratios

... All of the companies are profitable, but there are some important differences between them. We can see from the vertical analysis that Clancy plc appears to be the best company at generating profits: its gross profit and operating profit margins are far superior to the other two companies. However, ...

... All of the companies are profitable, but there are some important differences between them. We can see from the vertical analysis that Clancy plc appears to be the best company at generating profits: its gross profit and operating profit margins are far superior to the other two companies. However, ...

Thailand - Green Climate Fund

... 1.1 One of the roles and responsibilities of the focal point/NDA is the implementation of the no‐objection procedure. This activity will provide support for the establishment of the no-objection procedure for Thailand as per the Fund’s Initial no‐objection Procedure. This activity will also develop ...

... 1.1 One of the roles and responsibilities of the focal point/NDA is the implementation of the no‐objection procedure. This activity will provide support for the establishment of the no-objection procedure for Thailand as per the Fund’s Initial no‐objection Procedure. This activity will also develop ...

Eun 7e Sample Chapter - McGraw Hill Higher Education

... of the financial manager’s job. International Financial Management is designed to provide today’s financial managers with an understanding of the fundamental concepts and the tools necessary to be effective global managers. Throughout, the text emphasizes how to deal with exchange risk and market im ...

... of the financial manager’s job. International Financial Management is designed to provide today’s financial managers with an understanding of the fundamental concepts and the tools necessary to be effective global managers. Throughout, the text emphasizes how to deal with exchange risk and market im ...

Chapter 13

... Earnings quality refers to the usefulness of current earnings for predicting future earnings. Earnings quality is high if there is a close relationship between current and future earnings. Earnings quality is low if the relationship between current and future earnings is not close. Managers can lowe ...

... Earnings quality refers to the usefulness of current earnings for predicting future earnings. Earnings quality is high if there is a close relationship between current and future earnings. Earnings quality is low if the relationship between current and future earnings is not close. Managers can lowe ...

Contents of this Attachment:

... Recognition of Gains and Losses on Disposal of Non-Current Assets Treatment of Transfers of Assets and Liabilities Disclosure of Commitments Contingent Liabilities Definition and Recognition Criteria Contingent Assets Treatment of Events After the Reporting Date ...

... Recognition of Gains and Losses on Disposal of Non-Current Assets Treatment of Transfers of Assets and Liabilities Disclosure of Commitments Contingent Liabilities Definition and Recognition Criteria Contingent Assets Treatment of Events After the Reporting Date ...

Four Strategies to Inspire and Mobilise Your Talent

... We recognise that there is some truth to this notion. Recent events with leading financial institutions have revealed misbalances between the benefits gained by one group of stakeholders at the expense of other groups of stakeholders. Improving these fundamental aspects of the global financial syste ...

... We recognise that there is some truth to this notion. Recent events with leading financial institutions have revealed misbalances between the benefits gained by one group of stakeholders at the expense of other groups of stakeholders. Improving these fundamental aspects of the global financial syste ...

NBER WORKING PAPER SERIES THE VALUATION OF LONG-DATED ASSETS Ian Martin

... or may not be true; typically, in fact, it is not, and when it is not, X∞ = 0.1 I provide a variance criterion that dictates whether an asset is “typical” in this sense. Where, then, do such assets get their long-run value—their EXt = 1—from? I show that when X∞ = 0, Xt occasionally experiences enor ...

... or may not be true; typically, in fact, it is not, and when it is not, X∞ = 0.1 I provide a variance criterion that dictates whether an asset is “typical” in this sense. Where, then, do such assets get their long-run value—their EXt = 1—from? I show that when X∞ = 0, Xt occasionally experiences enor ...

Octagon Investment Partners XIV Ltd./Octagon

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

Chapter 2 -- The Business, Tax, and Financial Environments

... Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. ...

... Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. ...

Westerville City Schools COURSE OF STUDY BUXXX: Personal Finance

... a house, insurance, mutual funds, stock market, real estate investments, taxes, and estate planning are covered. Students will be able to write a basic personal financial plan. This is dual credit course and the content delivered is Finance Management 1101 taught through Columbus State Community Col ...

... a house, insurance, mutual funds, stock market, real estate investments, taxes, and estate planning are covered. Students will be able to write a basic personal financial plan. This is dual credit course and the content delivered is Finance Management 1101 taught through Columbus State Community Col ...

ALLOCATING FOR IMPACT - Global social impact investment

... level of financial return, which is usually set by the outcomes-payer). Over time, however, it is possible that SIBs prove to be an investment opportunity capable of delivering predictable and competitive risk-adjusted financial returns. If so, given the return drivers of many SIBs (an investor’s fi ...

... level of financial return, which is usually set by the outcomes-payer). Over time, however, it is possible that SIBs prove to be an investment opportunity capable of delivering predictable and competitive risk-adjusted financial returns. If so, given the return drivers of many SIBs (an investor’s fi ...

teaching variability through stock market contexts

... Stock Variability vs Portfolio Variability • Stock variability can be accommodated in a well diversified portfolio (not all eggs ….) • More variable investments tend to be those with higher returns on average • A diversified portfolio of variable stocks can produce stable returns ...

... Stock Variability vs Portfolio Variability • Stock variability can be accommodated in a well diversified portfolio (not all eggs ….) • More variable investments tend to be those with higher returns on average • A diversified portfolio of variable stocks can produce stable returns ...

2013 Archived Documents

... indexes. The manufacturing sector also grew during 2012 despite moving back and forth across the 50% mark over the second half of the year. We note that although the economy has been expanding for approximately 3.5 years, the rate of expansion is extremely low, particularly considering the very low ...

... indexes. The manufacturing sector also grew during 2012 despite moving back and forth across the 50% mark over the second half of the year. We note that although the economy has been expanding for approximately 3.5 years, the rate of expansion is extremely low, particularly considering the very low ...

11-1 Low-Risk Choices - St. Pius X High School

... • Growth Funds: Invest in companies that are expected to grow in the long run • Income Funds: Invest in bonds and stocks that produce steady and reliable dividend and interest payments • Index Funds: Invest in securities to match a market index with the goal of having returns similar to those of tha ...

... • Growth Funds: Invest in companies that are expected to grow in the long run • Income Funds: Invest in bonds and stocks that produce steady and reliable dividend and interest payments • Index Funds: Invest in securities to match a market index with the goal of having returns similar to those of tha ...

Understand how IT asset management works for you: A best

... Inventory discovery—a vital component of ITAM Inventory discovery is broadly classified as physical and automated. For more accurate findings, using both these methods is recommended: Physical and virtual inventory discovery Equipment can be discovered through physical audits or by using existing in ...

... Inventory discovery—a vital component of ITAM Inventory discovery is broadly classified as physical and automated. For more accurate findings, using both these methods is recommended: Physical and virtual inventory discovery Equipment can be discovered through physical audits or by using existing in ...

Ratio Analysis , PowerPoint Show

... What are some potential problems and limitations of financial ratio analysis? Comparison with industry averages is difficult if the firm operates many different divisions. “Average” performance is not necessarily good. ...

... What are some potential problems and limitations of financial ratio analysis? Comparison with industry averages is difficult if the firm operates many different divisions. “Average” performance is not necessarily good. ...

Benefits of Private Equity for the European Economy

... The analysis compared the number of employees at the time of investment to the current number or the number at the time of exit (if the company meanwhile has left the portfolio). The aggregated numbers indicate that the surveyed private equity funds have increased staff at their companies by an ave ...

... The analysis compared the number of employees at the time of investment to the current number or the number at the time of exit (if the company meanwhile has left the portfolio). The aggregated numbers indicate that the surveyed private equity funds have increased staff at their companies by an ave ...

DECA`s Competitive Events List

... management functions and tasks focusing on high-level financial and business planning, including collection and organization of data, development and use of reports, and analysis of data to make business decisions. Concepts include understanding the source and purpose of financial statements, the im ...

... management functions and tasks focusing on high-level financial and business planning, including collection and organization of data, development and use of reports, and analysis of data to make business decisions. Concepts include understanding the source and purpose of financial statements, the im ...

Working Capital

... money to commercial banks is controlled by a state’s central bank. If rates are high, there is less demand since not many parties want to incur high costs. Likewise low rates increase demand. Another way for companies to raise money is to sell partial rights over their assets to investors in the for ...

... money to commercial banks is controlled by a state’s central bank. If rates are high, there is less demand since not many parties want to incur high costs. Likewise low rates increase demand. Another way for companies to raise money is to sell partial rights over their assets to investors in the for ...

DECA`s Competitive Events List

... management functions and tasks focusing on high-level financial and business planning, including collection and organization of data, development and use of reports, and analysis of data to make business decisions. Concepts include understanding the source and purpose of financial statements, the im ...

... management functions and tasks focusing on high-level financial and business planning, including collection and organization of data, development and use of reports, and analysis of data to make business decisions. Concepts include understanding the source and purpose of financial statements, the im ...

the wizard of bubbleland

... overseas or mutual funds that invest in non-dollar economies. Unlike investors, hedge funds do not buy bonds to hold, but to speculate on the effect of interest-rate trends on bond prices by going long or short on bonds of different maturity, financed by repos. As with other financial markets, repo ...

... overseas or mutual funds that invest in non-dollar economies. Unlike investors, hedge funds do not buy bonds to hold, but to speculate on the effect of interest-rate trends on bond prices by going long or short on bonds of different maturity, financed by repos. As with other financial markets, repo ...

Schilling Ch 7

... rises above the exercise price, the value of the call rises with the value of the stock, dollar for dollar (thus the 45-degree angle) ...

... rises above the exercise price, the value of the call rises with the value of the stock, dollar for dollar (thus the 45-degree angle) ...