Unlocking SME finance through market-based debt

... jurisdictions has been impaired as regards quantity, price and distribution of credit. The effects of such malfunctioning are particularly felt by small and medium-sized enterprises (SMEs), especially in Europe. Being heavily reliant on traditional bank lending, SMEs are faced with important financi ...

... jurisdictions has been impaired as regards quantity, price and distribution of credit. The effects of such malfunctioning are particularly felt by small and medium-sized enterprises (SMEs), especially in Europe. Being heavily reliant on traditional bank lending, SMEs are faced with important financi ...

How America Saves 2017 - Pressroom

... funds at year-end 2016, up over 50% compared with year-end 2007. Nearly all Vanguard participants (97%) are in plans offering target-date funds. Seventy-two percent of all participants use target-date funds. Two-thirds of participants owning target-date funds have their entire account invested in a ...

... funds at year-end 2016, up over 50% compared with year-end 2007. Nearly all Vanguard participants (97%) are in plans offering target-date funds. Seventy-two percent of all participants use target-date funds. Two-thirds of participants owning target-date funds have their entire account invested in a ...

Proposed Rule: Money Market Fund Reform

... Money market funds seek to maintain a stable share price by limiting their investments to short-term, high-quality debt securities that fluctuate very little in value under normal market conditions. 5 They also rely on exemptions provided in rule 2a-7 that permit them to value their portfolio securi ...

... Money market funds seek to maintain a stable share price by limiting their investments to short-term, high-quality debt securities that fluctuate very little in value under normal market conditions. 5 They also rely on exemptions provided in rule 2a-7 that permit them to value their portfolio securi ...

Words - Nasdaq`s INTEL Solutions

... continue to pursue an investment strategy focused primarily on investments in middle-market companies in the United States. We expect that our investments will include asset classes in which our external manager has expertise, including investments in senior secured, unitranche, second-lien and mezz ...

... continue to pursue an investment strategy focused primarily on investments in middle-market companies in the United States. We expect that our investments will include asset classes in which our external manager has expertise, including investments in senior secured, unitranche, second-lien and mezz ...

OMNICOM GROUP INC. (Form: DEF 14A, Received

... directors, 10 of whom will be independent. We anticipate continued refreshment of our Board over the next two or three coming years and remain focused on ensuring a smooth Board transition. Director biographies and information about the Committees on which our directors serve is included below in th ...

... directors, 10 of whom will be independent. We anticipate continued refreshment of our Board over the next two or three coming years and remain focused on ensuring a smooth Board transition. Director biographies and information about the Committees on which our directors serve is included below in th ...

Extending the Resource-Based View to Explain Venture Capital

... service. They endured my many questions, helped to guide me, and endured several trying periods of emotional highs and lows. I thank them all for serving on my dissertation committee. Stuart P. Echols, my husband, was always there for me, also. He has been remarkable throughout the eight years we bo ...

... service. They endured my many questions, helped to guide me, and endured several trying periods of emotional highs and lows. I thank them all for serving on my dissertation committee. Stuart P. Echols, my husband, was always there for me, also. He has been remarkable throughout the eight years we bo ...

Analysts` Forecast Dispersion, Analysts` Forecast Bias and Stock

... to 2012, and the asset pricing models fail to explain the negative relation. However, we need to be cautious to interpret this result, because dispersion in analysts’ forecasts is likely to be contaminated by forecast bias. To decompose dispersion into a bias component and an actual disagreement com ...

... to 2012, and the asset pricing models fail to explain the negative relation. However, we need to be cautious to interpret this result, because dispersion in analysts’ forecasts is likely to be contaminated by forecast bias. To decompose dispersion into a bias component and an actual disagreement com ...

Essays on Capital Structure Stability - cerge-ei

... maximization point of view, but also because this decision has a great impact on a firm’s ability to successfully operate in a competitive environment. Current literature has suggested a number of factors that can explain about 30% of the total variation in capital structure. However, Lemmon, Robert ...

... maximization point of view, but also because this decision has a great impact on a firm’s ability to successfully operate in a competitive environment. Current literature has suggested a number of factors that can explain about 30% of the total variation in capital structure. However, Lemmon, Robert ...

Islamic Capital Market

... Development and performance of the financial system is very important in the sustainable economic growth and development (Schoon ,2008, p. 10).Traditionally, a little difference between economic growth and economic development is made .In economics theories these two terms almost used synonymously a ...

... Development and performance of the financial system is very important in the sustainable economic growth and development (Schoon ,2008, p. 10).Traditionally, a little difference between economic growth and economic development is made .In economics theories these two terms almost used synonymously a ...

Oncor Electric Delivery Company LLC

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

BOEING CO (Form: DEF 14A, Received: 03/18/2016 15:08:14)

... Mr. Calhoun has served as Senior Managing Director and Head of Private Equity Portfolio Operations of The Blackstone Group (private equity) since January 2014. Previously, Mr. Calhoun served as Chairman of the Board of Nielsen Holdings plc (marketing and media information) from January 2014 to Janua ...

... Mr. Calhoun has served as Senior Managing Director and Head of Private Equity Portfolio Operations of The Blackstone Group (private equity) since January 2014. Previously, Mr. Calhoun served as Chairman of the Board of Nielsen Holdings plc (marketing and media information) from January 2014 to Janua ...

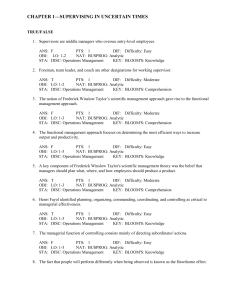

Sample - Test Bank College

... a. Working supervisors make up the first tier of management, while supervisors are considered mid-level managers. b. Supervisors usually manage entry-level employees, while working supervisors manage more experienced employees. c. Working supervisors are not considered part of management. d. Supervi ...

... a. Working supervisors make up the first tier of management, while supervisors are considered mid-level managers. b. Supervisors usually manage entry-level employees, while working supervisors manage more experienced employees. c. Working supervisors are not considered part of management. d. Supervi ...

Equity Risk Premiums (ERP)

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

Defined contribution workplace pension market study revised

... A pension scheme taken out by an individual for their own benefit and to which only they make contributions. ...

... A pension scheme taken out by an individual for their own benefit and to which only they make contributions. ...

Ellington Financial LLC (Form: 10-K, Received: 03/13

... rotating between and allocating among various sectors of the MBS markets and adjusting the extent to which it hedges, Ellington believes that it is able to capitalize on the disparities between these sectors as well as on overall trends in the marketplace, and therefore provide better and more consi ...

... rotating between and allocating among various sectors of the MBS markets and adjusting the extent to which it hedges, Ellington believes that it is able to capitalize on the disparities between these sectors as well as on overall trends in the marketplace, and therefore provide better and more consi ...

OECD Corporate Governance Factbook 2017

... on corporate governance across all OECD, G20 and Financial Stability Board member jurisdictions. It now covers 47 different jurisdictions hosting 95% of all publicly traded corporations in the world as measured by market value. This makes the Factbook a unique source for monitoring implementation of ...

... on corporate governance across all OECD, G20 and Financial Stability Board member jurisdictions. It now covers 47 different jurisdictions hosting 95% of all publicly traded corporations in the world as measured by market value. This makes the Factbook a unique source for monitoring implementation of ...

Global Economic Prospects: Weak Investment in Uncertain Times

... was not created by The World Bank and should not be considered an official World Bank translation. The World Bank shall not be liable for any content or error in this translation. Adaptations—If you create an adaptation of this work, please add the following disclaimer along with the attribution: Th ...

... was not created by The World Bank and should not be considered an official World Bank translation. The World Bank shall not be liable for any content or error in this translation. Adaptations—If you create an adaptation of this work, please add the following disclaimer along with the attribution: Th ...

Global Financial Systems Chapter 4 Liquidity

... Interplay of funding and market liquidity • Funding and market illiquidity often go together 1. Firms encounter unforeseen costs or reduced revenue 2. They sell assets in the securities markets to obtain operating capital 3. Securities prices fall 4. Firms sell more securities than they would have n ...

... Interplay of funding and market liquidity • Funding and market illiquidity often go together 1. Firms encounter unforeseen costs or reduced revenue 2. They sell assets in the securities markets to obtain operating capital 3. Securities prices fall 4. Firms sell more securities than they would have n ...

printmgr file - AnnualReports.com

... Our team has demonstrated its expertise in navigating changing entitlement and other regulatory requirements to get our sites ready for vertical construction. We have also established a strong track record of completing our buildings on time and on budget. We put that expertise to work in 2014, and ...

... Our team has demonstrated its expertise in navigating changing entitlement and other regulatory requirements to get our sites ready for vertical construction. We have also established a strong track record of completing our buildings on time and on budget. We put that expertise to work in 2014, and ...

MSCI ID Sign In

... concentration risk. We delve into the US and Europe cases in greater detail, examining a range of criteria which reflect the risks of these two entities. In our analysis we treat Europe as a single bloc given its integrated economy. While there remains a risk to the continuation of the Euro zone, at ...

... concentration risk. We delve into the US and Europe cases in greater detail, examining a range of criteria which reflect the risks of these two entities. In our analysis we treat Europe as a single bloc given its integrated economy. While there remains a risk to the continuation of the Euro zone, at ...

abuse of structured financial products

... have designed and implemented complex financial structures to take advantage of and, at times, abuse or violate U.S. tax statutes, securities regulations, and accounting rules. 1 This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barcla ...

... have designed and implemented complex financial structures to take advantage of and, at times, abuse or violate U.S. tax statutes, securities regulations, and accounting rules. 1 This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barcla ...