Model Special Purpose Financial Statements

... content to be disclosed, but it expects that many businesses will make additional disclosures. These disclosures are expected to be included either in an entity’s general purpose financial statements or a ‘taxes paid’ report. The BoT expects the TTC to be in operation in time for the reporting perio ...

... content to be disclosed, but it expects that many businesses will make additional disclosures. These disclosures are expected to be included either in an entity’s general purpose financial statements or a ‘taxes paid’ report. The BoT expects the TTC to be in operation in time for the reporting perio ...

PDF

... The question that has to be asked of any set of capital assets, produced or natural, is what economic returns, what flow of net economic benefits, the assets are providing to society through time. In the case of capture fishery resources, as with other forms of natural capital, these net economic be ...

... The question that has to be asked of any set of capital assets, produced or natural, is what economic returns, what flow of net economic benefits, the assets are providing to society through time. In the case of capture fishery resources, as with other forms of natural capital, these net economic be ...

UNITED STATES SECURITIES AND EXCHANGE

... and 2014 and the corresponding notes, which are included under "Item 18. Financial Statements" of this annual report, were prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). We use accounting practices adop ...

... and 2014 and the corresponding notes, which are included under "Item 18. Financial Statements" of this annual report, were prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). We use accounting practices adop ...

University of Groningen An evaluation of the accounting rate of

... The performance of a firm is often assessed by means of the accounting rate of return (ARR). Economists need measures of business performance for a variety of purposes, including as guides to antitrust policy and in controlling of private sector monopolies. Economic performance can be understood as ...

... The performance of a firm is often assessed by means of the accounting rate of return (ARR). Economists need measures of business performance for a variety of purposes, including as guides to antitrust policy and in controlling of private sector monopolies. Economic performance can be understood as ...

ACE Limited - cloudfront.net

... those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares and are also invited to attend the Annual General Meeting. However, since you are not the shareholder of record, you may only vote these shares ...

... those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares and are also invited to attend the Annual General Meeting. However, since you are not the shareholder of record, you may only vote these shares ...

capital budgeting

... • Step three, planning the capital budget: The company must organize the profitable proposals into a coordinated whole that fits within the company’s overall strategies, and it also must consider the projects’ timing. Some projects that look good when considered in isolation may be undesirable strat ...

... • Step three, planning the capital budget: The company must organize the profitable proposals into a coordinated whole that fits within the company’s overall strategies, and it also must consider the projects’ timing. Some projects that look good when considered in isolation may be undesirable strat ...

VAULT FINANCE INTERVIEWS PRACTICE GUIDE

... Because the answers to these types of questions will vary depending on the person, we’ve focused on answers to technical questions in this guide. However, you will find some sample answers to behavioral questions later in this guide. We do suggest that you write out answers to at least some of the a ...

... Because the answers to these types of questions will vary depending on the person, we’ve focused on answers to technical questions in this guide. However, you will find some sample answers to behavioral questions later in this guide. We do suggest that you write out answers to at least some of the a ...

Predicting Market Returns Using Aggregate Implied Cost of Capital

... the present value of its expected future free cash flows where, empirically, the free cash flows are estimated using a combination of short-term analyst earnings forecasts, long-term growth rates projected from the short-term forecasts, and historical payout ratios.2 If markets are efficient, the IC ...

... the present value of its expected future free cash flows where, empirically, the free cash flows are estimated using a combination of short-term analyst earnings forecasts, long-term growth rates projected from the short-term forecasts, and historical payout ratios.2 If markets are efficient, the IC ...

BANCOLOMBIA SA

... the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anti ...

... the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anti ...

BlackBerry Receives Investment of U.S. $1 Billion from Fairfax

... by this group of preeminent, long-term investors," said Barbara Stymiest, Chair of BlackBerry's Board. "The BlackBerry Board conducted a thorough review of strategic alternatives and pursued the course of action that it concluded is in the best interests of BlackBerry and its constituents, including ...

... by this group of preeminent, long-term investors," said Barbara Stymiest, Chair of BlackBerry's Board. "The BlackBerry Board conducted a thorough review of strategic alternatives and pursued the course of action that it concluded is in the best interests of BlackBerry and its constituents, including ...

Documento de Trabajo Nº 73 BACK TO THE STATE

... set up to administer worker contributions accumulated in individual accounts and invested in a portfolio of instruments including state bonds, equities and bank deposits. A definedcontribution (DC) system replaced the existing defined-benefit (DB) model, and future benefits no longer depended on fin ...

... set up to administer worker contributions accumulated in individual accounts and invested in a portfolio of instruments including state bonds, equities and bank deposits. A definedcontribution (DC) system replaced the existing defined-benefit (DB) model, and future benefits no longer depended on fin ...

Measuring Swedish Investor Sentiment Stock Market Response to

... profit, but may undertake an identical investment if it is offered in terms of the risk of the possible losses. Investors may also segregate investment decisions by way of mental accounting. For example, an investor may take on a lot of risk in one investment account, while taking a very risk-averse ...

... profit, but may undertake an identical investment if it is offered in terms of the risk of the possible losses. Investors may also segregate investment decisions by way of mental accounting. For example, an investor may take on a lot of risk in one investment account, while taking a very risk-averse ...

Financial review Capital and risk management

... other factors, both external and relating to the RBS Group and the Group’s strategy or operations, which may result in the Group being unable to achieve the current targets, predictions, expectations and other anticipated outcomes expressed or implied by such forward-looking statements. In addition ...

... other factors, both external and relating to the RBS Group and the Group’s strategy or operations, which may result in the Group being unable to achieve the current targets, predictions, expectations and other anticipated outcomes expressed or implied by such forward-looking statements. In addition ...

D E C E M B E R 2 0 1 6

... public. The conclusions and recommendations of any Brookings publication are solely those of its author(s), and do not reflect the views of the Institution, its management, or its other scholars. The Global Commission on the Economy and Climate, and its flagship project The New Climate Economy, were ...

... public. The conclusions and recommendations of any Brookings publication are solely those of its author(s), and do not reflect the views of the Institution, its management, or its other scholars. The Global Commission on the Economy and Climate, and its flagship project The New Climate Economy, were ...

Financial Report

... periods beginning on or after 1 July 2010 – endorsed by EC starting from 1 July 2010). This interpretation provides for explanation on the accounting treatment of transactions related to settlement, in full or in part, of financial liabilities to creditors through the issue of equity instruments by ...

... periods beginning on or after 1 July 2010 – endorsed by EC starting from 1 July 2010). This interpretation provides for explanation on the accounting treatment of transactions related to settlement, in full or in part, of financial liabilities to creditors through the issue of equity instruments by ...

The Going-Public Decision and the Product Market

... Our analysis of the dynamic pattern of firm performance before and after the IPO indicates that total factor productivity (TFP) increases steadily in the five years prior to the IPO, reaches a peak in the IPO year, and declines steadily in the years subsequent to the IPO (i.e., TFP exhibits an inver ...

... Our analysis of the dynamic pattern of firm performance before and after the IPO indicates that total factor productivity (TFP) increases steadily in the five years prior to the IPO, reaches a peak in the IPO year, and declines steadily in the years subsequent to the IPO (i.e., TFP exhibits an inver ...

chimera investment corporation - Morningstar Document Research

... In this Annual Report on Form 10-K, references to “we,” “us,” “our” or “the Company” refer to Chimera Investment Corporation and its subsidiaries unless specifically stated otherwise or the context otherwise indicates. The following defines certain of the commonly used terms in this Annual Report o ...

... In this Annual Report on Form 10-K, references to “we,” “us,” “our” or “the Company” refer to Chimera Investment Corporation and its subsidiaries unless specifically stated otherwise or the context otherwise indicates. The following defines certain of the commonly used terms in this Annual Report o ...

Aalborg Universitet Major Determinants and Hindrances of FDI inflow in Bangladesh

... (Sinha, 2007). After opening up their economy towards FDI, these countries emerged as „Asian Tigers‟ and witnessed rapid economic developed within a relatively short period of time. In recent years, many countries have introduced open door policy to attract FDI with a view to increase investment, e ...

... (Sinha, 2007). After opening up their economy towards FDI, these countries emerged as „Asian Tigers‟ and witnessed rapid economic developed within a relatively short period of time. In recent years, many countries have introduced open door policy to attract FDI with a view to increase investment, e ...

UNICREDIT INTERNATIONAL BANK (LUXEMBOURG) S.A.

... volumes and the market share of the Issuer, the Guarantor or the Group are either derived from, or are based on, internal data or publicly available data from various independent sources. Although the Issuer and the Guarantor believe that the external sources used are reliable, the Issuer and the Gu ...

... volumes and the market share of the Issuer, the Guarantor or the Group are either derived from, or are based on, internal data or publicly available data from various independent sources. Although the Issuer and the Guarantor believe that the external sources used are reliable, the Issuer and the Gu ...

FORM 10-Q - Morningstar Document Research

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

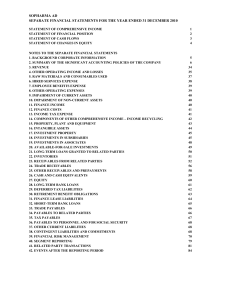

notes to the financial statements

... Basis of Preparation The financial statements of the Group and of the Company are prepared in accordance with the provisions of the Companies Act, 1965 and comply with the Financial Reporting Standards (FRS) issued by the Malaysian Accounting Standards Board (MASB). The financial statements have bee ...

... Basis of Preparation The financial statements of the Group and of the Company are prepared in accordance with the provisions of the Companies Act, 1965 and comply with the Financial Reporting Standards (FRS) issued by the Malaysian Accounting Standards Board (MASB). The financial statements have bee ...

ipg photonics corporation

... At this year's meeting, you will be asked to elect nine directors to our Board of Directors for a term of one year, to ratify the appointment of our independent registered public accounting firm for 2016 and to transact any other business properly brought before the meeting. Our Board of Directors r ...

... At this year's meeting, you will be asked to elect nine directors to our Board of Directors for a term of one year, to ratify the appointment of our independent registered public accounting firm for 2016 and to transact any other business properly brought before the meeting. Our Board of Directors r ...