Our responsible growth strategy is delivering strong, consistent, high

... a 99 percent retention rate in this program. We have more than 33 million online customers, and nearly 22 million mobile banking users. You can learn more about how we are redefining the retail financial services experience in the comments from Dean Athanasia and Thong Nguyen, the co-heads of our Co ...

... a 99 percent retention rate in this program. We have more than 33 million online customers, and nearly 22 million mobile banking users. You can learn more about how we are redefining the retail financial services experience in the comments from Dean Athanasia and Thong Nguyen, the co-heads of our Co ...

417KB

... IT Planning Department and IT Business Strategy Planning Department will be merged into a new IT Planning Department with a new IT Business Strategy Planning Department and a new Consolidated Data Management Department established within. By centralizing and consolidating the planning and management ...

... IT Planning Department and IT Business Strategy Planning Department will be merged into a new IT Planning Department with a new IT Business Strategy Planning Department and a new Consolidated Data Management Department established within. By centralizing and consolidating the planning and management ...

Local Markets Compendium 2014

... In this third edition of the Local Markets Compendium, we continue our coverage of 41 markets across our footprint of Asia, Africa and the Middle East, as well as the key markets of Brazil and Mexico. The typical view of emerging local-currency bond markets is shaped by index inclusion, but as we sh ...

... In this third edition of the Local Markets Compendium, we continue our coverage of 41 markets across our footprint of Asia, Africa and the Middle East, as well as the key markets of Brazil and Mexico. The typical view of emerging local-currency bond markets is shaped by index inclusion, but as we sh ...

Chapter 01 Accounting: Information for Decision

... 66. The auditor's report on the published financial statements of a large corporation should be viewed as: A. The opinion of independent experts as to the overall fairness of the statements. B. The opinion of the corporation's chief accountant as to the overall fairness of the statements. C. A guara ...

... 66. The auditor's report on the published financial statements of a large corporation should be viewed as: A. The opinion of independent experts as to the overall fairness of the statements. B. The opinion of the corporation's chief accountant as to the overall fairness of the statements. C. A guara ...

as a PDF

... Corporate saving in the NIPAs is the undistributed profits of corporations (that is, after-tax profits less dividends paid to shareholders) plus an inventory valuation adjustment applied to the book value of inventories and a capital consumption adjustment applied to the book value of plant and equi ...

... Corporate saving in the NIPAs is the undistributed profits of corporations (that is, after-tax profits less dividends paid to shareholders) plus an inventory valuation adjustment applied to the book value of inventories and a capital consumption adjustment applied to the book value of plant and equi ...

Assignment 1 is compulsory and due

... new goodwill = cost of remaining investment’s shares from profits and reserves of the interest of the shares that are left IF FULL GOODWILL METHOD USED THEN INCLUDES THE NCI GOODWILL! Amount received for the shares must be at fair value Remaining investment must be measured at FAIR VALUE at the DISP ...

... new goodwill = cost of remaining investment’s shares from profits and reserves of the interest of the shares that are left IF FULL GOODWILL METHOD USED THEN INCLUDES THE NCI GOODWILL! Amount received for the shares must be at fair value Remaining investment must be measured at FAIR VALUE at the DISP ...

0001193125-15-370428 - Investor Relations

... opinion of management, these financial statements reflect all adjustments consisting of normal recurring items considered necessary for a fair presentation under U.S. GAAP. The results of operations for any interim period are not necessarily indicative of results for the full year. These consolidate ...

... opinion of management, these financial statements reflect all adjustments consisting of normal recurring items considered necessary for a fair presentation under U.S. GAAP. The results of operations for any interim period are not necessarily indicative of results for the full year. These consolidate ...

ACCOUNTING FOR MANAGERIAL DECISIONS 2023 UNIVERSITY OF CALICUT

... etc. The organizational status or position of a management accountant varies from concern to concern. His position in the organization determines his function as line function of staff function. If he participates in planning and execution of policies, he is equal to other functional managers and hi ...

... etc. The organizational status or position of a management accountant varies from concern to concern. His position in the organization determines his function as line function of staff function. If he participates in planning and execution of policies, he is equal to other functional managers and hi ...

Venture capital and the financial crisis

... be too broad of a scope. Therefore, this research focuses on the financial crisis in relation with specific aspects of the venture capital industry that have not been investigated by a plurality of researchers. These specific aspects explored are the syndicate size and the different types of venture ...

... be too broad of a scope. Therefore, this research focuses on the financial crisis in relation with specific aspects of the venture capital industry that have not been investigated by a plurality of researchers. These specific aspects explored are the syndicate size and the different types of venture ...

A Theory of Repurchase Agreements, Collateral Re-use

... where markets are Walrasian, but where collateral has uncertain payoff. One limitation of the works mentioned above is that the borrower chooses to sell repo if he can obtain more cash than in a spot sale of the asset, that is if the haircut is negative. Our analysis rationalizes the use of repos w ...

... where markets are Walrasian, but where collateral has uncertain payoff. One limitation of the works mentioned above is that the borrower chooses to sell repo if he can obtain more cash than in a spot sale of the asset, that is if the haircut is negative. Our analysis rationalizes the use of repos w ...

Knowingly taking risk Investment decision making in real estate

... Now my PhD thesis has been published, the real estate development sector is suffering the effects of the credit crunch. Markets are on the downturn and companies are facing the consequences of the risks they have taken. This makes research in risk management more relevant and timely than ever before ...

... Now my PhD thesis has been published, the real estate development sector is suffering the effects of the credit crunch. Markets are on the downturn and companies are facing the consequences of the risks they have taken. This makes research in risk management more relevant and timely than ever before ...

Mount Diablo USD 2010 Election, Series G POS

... Estimates and Forecasts. When used in this Official Statement and in any continuing disclosure by the District in any press release and in any oral statement made with the approval of an authorized officer of the District or any other entity describe ...

... Estimates and Forecasts. When used in this Official Statement and in any continuing disclosure by the District in any press release and in any oral statement made with the approval of an authorized officer of the District or any other entity describe ...

29305000 trustees of the california state university systemwide

... CUSIP® is a registered trademark of the American Bankers Association. CUSIP Global Services (CGS) is managed on behalf of the American Bankers Association by S&P Capital IQ. Copyright© 2015 CUSIP Global Services. All rights reserved. CUSIP® data herein is provided by CUSIP Global Services. This data ...

... CUSIP® is a registered trademark of the American Bankers Association. CUSIP Global Services (CGS) is managed on behalf of the American Bankers Association by S&P Capital IQ. Copyright© 2015 CUSIP Global Services. All rights reserved. CUSIP® data herein is provided by CUSIP Global Services. This data ...

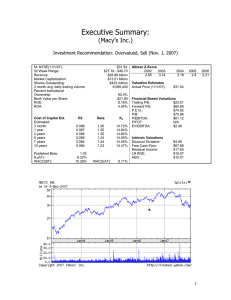

Macy's Inc. - Mark E. Moore

... We found that Macy’s liquidity, when compared to their competitors, is disappointing. Macy’s liquidity ratios such as: current ratio, quick asset ratio, and working capital turnover were either below the industrial average or in decline. However, after computing Macy’s profitability ratios, we disco ...

... We found that Macy’s liquidity, when compared to their competitors, is disappointing. Macy’s liquidity ratios such as: current ratio, quick asset ratio, and working capital turnover were either below the industrial average or in decline. However, after computing Macy’s profitability ratios, we disco ...

Private Pensions/Les pensions privées

... A form of financial contract mostly sold by life insurance companies that guarantees a fixed or variable payment of income benefit (monthly, quarterly, half-yearly, or yearly) for the life of a person(s) (the annuitant) or for a specified period of time. It is different than a life insurance contrac ...

... A form of financial contract mostly sold by life insurance companies that guarantees a fixed or variable payment of income benefit (monthly, quarterly, half-yearly, or yearly) for the life of a person(s) (the annuitant) or for a specified period of time. It is different than a life insurance contrac ...

Planning for Retirement Terrance K Martin Jr.* and Michael Finke

... retirement planning decisions in the hands of workers who may or may not possess the skill set and financial knowledge to make optimal decisions. Campbell (2006) identifies areas of some ...

... retirement planning decisions in the hands of workers who may or may not possess the skill set and financial knowledge to make optimal decisions. Campbell (2006) identifies areas of some ...

Annual Consolidated Compliance Report 2016

... IIROC’s ongoing efforts to strengthen the culture of compliance among Dealer Members, set high standards of conduct and strengthen market integrity benefit Canadian capital markets and all stakeholders. As a public interest regulator, we will continue to oversee IIROCregulated Dealer Members proacti ...

... IIROC’s ongoing efforts to strengthen the culture of compliance among Dealer Members, set high standards of conduct and strengthen market integrity benefit Canadian capital markets and all stakeholders. As a public interest regulator, we will continue to oversee IIROCregulated Dealer Members proacti ...

Transparency and Disclosure

... While the Standard & Poor’s T&D study focuses on disclosure, it does not endeavor to assess the quality of the information provided. Furthermore, the study cannot control the accuracy of disclosure and it is not meant to identify forensically any disclosure that may be incorrect or fraudulent. This ...

... While the Standard & Poor’s T&D study focuses on disclosure, it does not endeavor to assess the quality of the information provided. Furthermore, the study cannot control the accuracy of disclosure and it is not meant to identify forensically any disclosure that may be incorrect or fraudulent. This ...

Pension Savings: The Real Return

... Our experience and findings clearly confirm that capital market performances have unfortunately very little to do with the performances of the actual savings products distributed to the EU citizens. And this is particularly true for long term and pension savings. The main reason is indeed that most ...

... Our experience and findings clearly confirm that capital market performances have unfortunately very little to do with the performances of the actual savings products distributed to the EU citizens. And this is particularly true for long term and pension savings. The main reason is indeed that most ...

The European Commission`s Push to Consolidate and Expand ISDS

... The purpose of this paper is to evaluate the European Commission’s approach to investorstate dispute settlement (ISDS) in the proposed CETA with Canada and FTA with Singapore. The text on ISDS in both agreements is evaluated according to general criteria of independence, fairness, openness, and bala ...

... The purpose of this paper is to evaluate the European Commission’s approach to investorstate dispute settlement (ISDS) in the proposed CETA with Canada and FTA with Singapore. The text on ISDS in both agreements is evaluated according to general criteria of independence, fairness, openness, and bala ...

Since upgrades are rare, bonds issuers have stronger incentives to

... other firms within the same broad rating category. In addition, among firms near a rating change, those with higher financing needs smooth earnings to a larger extent than others. Finally, we find a negative (positive) relation between an increase in earnings smoothness and the likelihood of a subse ...

... other firms within the same broad rating category. In addition, among firms near a rating change, those with higher financing needs smooth earnings to a larger extent than others. Finally, we find a negative (positive) relation between an increase in earnings smoothness and the likelihood of a subse ...

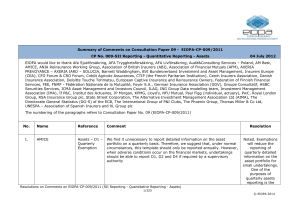

Comments Template QRT Assets final - eiopa

... Insurance Association, Deloitte Touche Tohmatsu, European Captive Insurance and Reinsurance Owners, Federation of Finnish Financial Services, FEE, FNMF - Fédération Nationale de la Mutualité, Foyer S.A., German Insurance Association (GDV), Groupe Consultatif, HSBC Securities Services, ICMA Asset Man ...

... Insurance Association, Deloitte Touche Tohmatsu, European Captive Insurance and Reinsurance Owners, Federation of Finnish Financial Services, FEE, FNMF - Fédération Nationale de la Mutualité, Foyer S.A., German Insurance Association (GDV), Groupe Consultatif, HSBC Securities Services, ICMA Asset Man ...