creation of money

... fraction of their customers’ deposits as readily available reserves (i.e. cash in vaults and deposits at the central bank). They are not required to maintain 100% backing for all deposits. This practice is safe in general, as depositors generally do not all demand payment at the same time. However, ...

... fraction of their customers’ deposits as readily available reserves (i.e. cash in vaults and deposits at the central bank). They are not required to maintain 100% backing for all deposits. This practice is safe in general, as depositors generally do not all demand payment at the same time. However, ...

- Wasatch Advisors

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

creation of money

... („printing money”). If such situation persists, according to the quantity theory of money it will lead to inflation. No inflation if the overall money supply does not grow (in case of credit contraction). In such case the increase in the monetary base is offset by the decrease of the money multiplie ...

... („printing money”). If such situation persists, according to the quantity theory of money it will lead to inflation. No inflation if the overall money supply does not grow (in case of credit contraction). In such case the increase in the monetary base is offset by the decrease of the money multiplie ...

Highlights from the Central Bank of Iceland Balance Sheet

... The following data are from the Central Bank of Iceland’s Balance Sheet as at the end of October 2003 with comparative figures for the end of December 2002 and changes within the month and from the beginning of 2003. The Central Bank’s foreign reserves increased by 5.4 b.kr. and amounted to 51.7 b.k ...

... The following data are from the Central Bank of Iceland’s Balance Sheet as at the end of October 2003 with comparative figures for the end of December 2002 and changes within the month and from the beginning of 2003. The Central Bank’s foreign reserves increased by 5.4 b.kr. and amounted to 51.7 b.k ...

ECON 3303 Money and Banking Exam 1 Spring 2013

... 3) B 4) A 5) C 6) C 7) B 8) D 9) A 10) B 11) A 12) A 13) C 14) C 15) D 16) C 17) A 18) C 19) A 20) B 21) C 22) C 23) B 24) B 25) D 26) A 27) D 28) B 29) B 30) B 31) A 32) A 33) C 34) A 35) D 36) A 37) B 38) B 39) D 40) D 41) A 42) D 43) B 44) C 45) B 46) A 47) B 48) C ...

... 3) B 4) A 5) C 6) C 7) B 8) D 9) A 10) B 11) A 12) A 13) C 14) C 15) D 16) C 17) A 18) C 19) A 20) B 21) C 22) C 23) B 24) B 25) D 26) A 27) D 28) B 29) B 30) B 31) A 32) A 33) C 34) A 35) D 36) A 37) B 38) B 39) D 40) D 41) A 42) D 43) B 44) C 45) B 46) A 47) B 48) C ...

University of Illinois Department of Economics Econ 103 – Fall 2014

... 5 Which of the following about recessionary gap is true? A) The amount by which aggregate expenditure falls short of the level needed to generate full employment output without inflation. B) The difference between full employment output and equilibrium ...

... 5 Which of the following about recessionary gap is true? A) The amount by which aggregate expenditure falls short of the level needed to generate full employment output without inflation. B) The difference between full employment output and equilibrium ...

5. International Debt Crisis:a

... U.S. federal reserve in 1979 adopts anti inflation monetary policy that helped push the world economy into recession by 1981. U.S. interest rates up and dollar appreciates. Since much developing countries’ debt is denominated in dollars, developing countries’ real value of debt service is up. Expor ...

... U.S. federal reserve in 1979 adopts anti inflation monetary policy that helped push the world economy into recession by 1981. U.S. interest rates up and dollar appreciates. Since much developing countries’ debt is denominated in dollars, developing countries’ real value of debt service is up. Expor ...

EGYPT WEEKLY MARKET REVIEW 12-18 September, 2010 Highlight of the Week NOOZZ.COM

... Further consultations would be required for additional fiscal consolidation measures to pull the deficit down to 4.5 percent, the level required by the EU. ...

... Further consultations would be required for additional fiscal consolidation measures to pull the deficit down to 4.5 percent, the level required by the EU. ...

Monetarism Revisited - Research Showcase @ CMU

... prices and yields until equilibrium is restored. Second, the monetarist adjustment process highlights the role of the relative prices of assets to output. Monetary expansion promptly raises asset prices. Housing and equity prices are examples. Higher asset prices induce an increase in demand for sub ...

... prices and yields until equilibrium is restored. Second, the monetarist adjustment process highlights the role of the relative prices of assets to output. Monetary expansion promptly raises asset prices. Housing and equity prices are examples. Higher asset prices induce an increase in demand for sub ...

Real Money Rob Rikoon Good news for retirees: low

... For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this last month. Bond investors reaped great gains during this long period of rising market pri ...

... For nearly 5 years now, the Federal Reserve Board has suppressed interest rates via its bond buying program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this last month. Bond investors reaped great gains during this long period of rising market pri ...

full report - Profindo International Securities

... mortgage, sent the DJIA from its highest level at that time at 14,198 on October 7, nd 2007 to the very low level at 6,469 on March 2 , 2009. Even, one of the largest investment banks in the U.S., Lehman Brothers, declared bankruptcy in 2008 following the massive exodus of most of its clients, drast ...

... mortgage, sent the DJIA from its highest level at that time at 14,198 on October 7, nd 2007 to the very low level at 6,469 on March 2 , 2009. Even, one of the largest investment banks in the U.S., Lehman Brothers, declared bankruptcy in 2008 following the massive exodus of most of its clients, drast ...

Great Depression

... President Hoover to “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.” “It will purge the rottenness out of the system. High costs of living and high living will ...

... President Hoover to “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.” “It will purge the rottenness out of the system. High costs of living and high living will ...

CH17

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

An Overview of the Great Depression

... panics, gold inflows) rising price level, falling real interest rate and increased spending. • FDR and the New Deal? – Restored confidence in banking system (FDIC) – Early years marked by regulation/reform, little new spending (alphabet programs, e.g., NRA, WPA, PWA, CCC, etc.) – Later years saw i ...

... panics, gold inflows) rising price level, falling real interest rate and increased spending. • FDR and the New Deal? – Restored confidence in banking system (FDIC) – Early years marked by regulation/reform, little new spending (alphabet programs, e.g., NRA, WPA, PWA, CCC, etc.) – Later years saw i ...

Fiscal Policy and Monetary Policy

... • To cover deficit spending the government sells bonds. Every dollar spent on a government bond is one fewer dollar that is available for businesses to borrow and invest. This encroachment on investment in the private sector is known as the crowding-out effect. • The larger the national debt, the mo ...

... • To cover deficit spending the government sells bonds. Every dollar spent on a government bond is one fewer dollar that is available for businesses to borrow and invest. This encroachment on investment in the private sector is known as the crowding-out effect. • The larger the national debt, the mo ...

Chapter 2 Money and the Payments System

... • Commodity Money – Things that have intrinsic value • Fiat Money – Value comes from government decree (or fiat) ...

... • Commodity Money – Things that have intrinsic value • Fiat Money – Value comes from government decree (or fiat) ...

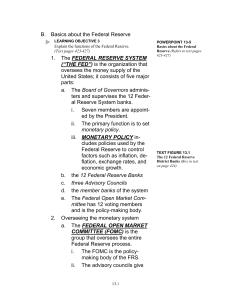

what is management

... is one of the Fed’s most powerful tools. c. When the Fed increases the reserve requirement: i. Banks have less money for loans and make fewer loans, which reduces inflation. ii. The money supply would be reduced and prices would likely fall. d. When the Fed decreases the reserve requirement: i. Bank ...

... is one of the Fed’s most powerful tools. c. When the Fed increases the reserve requirement: i. Banks have less money for loans and make fewer loans, which reduces inflation. ii. The money supply would be reduced and prices would likely fall. d. When the Fed decreases the reserve requirement: i. Bank ...

Chopper Money? - Matthews Asia

... recently, Zimbabwe in 2008 were disastrous. At the risk of over-simplification, the tone of the policies these countries undertook was a drastic increase in the money supply, which led to hyperinflation, and a worthless currency, and ended in a major economic recession and political turmoil. However ...

... recently, Zimbabwe in 2008 were disastrous. At the risk of over-simplification, the tone of the policies these countries undertook was a drastic increase in the money supply, which led to hyperinflation, and a worthless currency, and ended in a major economic recession and political turmoil. However ...

Economics: Semester Post

... 7) What effect does an increase/decrease in federal government spending have on the economy? Consider both the approaches of a balanced budget and deficit spending. 8) Describe the tax types used by the government to raise revenue. What is an example of each? 9) Explain how investment in factories, ...

... 7) What effect does an increase/decrease in federal government spending have on the economy? Consider both the approaches of a balanced budget and deficit spending. 8) Describe the tax types used by the government to raise revenue. What is an example of each? 9) Explain how investment in factories, ...

HOW TO STOP THE DEPRESSION

... ‘Quantitative easing’ is an empty slogan designed to cover up the black hole of zero interest gobbling up the world economy. Consider that the total outstanding debt is in fact perpetual debt, because under the regime of irredeemable currency total debt can only grow but never contract. Even if all ...

... ‘Quantitative easing’ is an empty slogan designed to cover up the black hole of zero interest gobbling up the world economy. Consider that the total outstanding debt is in fact perpetual debt, because under the regime of irredeemable currency total debt can only grow but never contract. Even if all ...

Slide 1

... ◦ Reference to a popular 1992 film where evidence supporting his bullish case was overwhelming and undeniable ...

... ◦ Reference to a popular 1992 film where evidence supporting his bullish case was overwhelming and undeniable ...

File - MS. Hines` Classroom!

... It had the power to set the interest rate for loans issued by banks. ...

... It had the power to set the interest rate for loans issued by banks. ...

Twenty years of inflation targeting 1 Introduction

... risks of failure. However, governments will typically want to renege on this commitment ex post to mitigate bad ...

... risks of failure. However, governments will typically want to renege on this commitment ex post to mitigate bad ...