Chapter 14 – Credit and Financial Crises

... not held (stored spending power) and is therefore not endogenous to the business cycle. Changes in the money supply have no effect on the long-run values of real variables such as real GDP. Real GDP is determined by resources and technology. Changes in the money supply do determine nominal income an ...

... not held (stored spending power) and is therefore not endogenous to the business cycle. Changes in the money supply have no effect on the long-run values of real variables such as real GDP. Real GDP is determined by resources and technology. Changes in the money supply do determine nominal income an ...

Week One Quiz

... A) borrowers can use savers' funds until the savers themselves need the funds. B) money is put into circulation. C) the government puts into operation its plans for the economy. D) business firms distribute their goods. Answer: A 2) Which of the following forms the largest share of household holding ...

... A) borrowers can use savers' funds until the savers themselves need the funds. B) money is put into circulation. C) the government puts into operation its plans for the economy. D) business firms distribute their goods. Answer: A 2) Which of the following forms the largest share of household holding ...

Chapter 10 Federal Reserve System

... Bond Prices are inversely related to the current interest rate. If current interest rates are higher than the bond’s rate then the bond will sell below face value If interest rates fall, bond prices rise ...

... Bond Prices are inversely related to the current interest rate. If current interest rates are higher than the bond’s rate then the bond will sell below face value If interest rates fall, bond prices rise ...

CH 18-Monetary and Fiscal Policy

... Obama Plans Major Shifts in Spending To Pay for Health Care, Obama Looks to Taxes on Affluent Reports Show More Signs of Downturn Preparing for a Flood of Energy Efficiency ...

... Obama Plans Major Shifts in Spending To Pay for Health Care, Obama Looks to Taxes on Affluent Reports Show More Signs of Downturn Preparing for a Flood of Energy Efficiency ...

Salim Dehmej

... facilities are important. The paper also highlights some financial stability risks and come out with policy recommendations. ...

... facilities are important. The paper also highlights some financial stability risks and come out with policy recommendations. ...

It`s Not About Liquidity - University of Colorado Boulder

... – The new issue market is especially troubling for financial firms, which have about $145 billion in fixed- and floating rate debt maturing in the rest of 2008, according to JPMorgan data. – Overall corporate bond spreads have hit record highs , closing on October 2 at 339 basis points, up from 317 ...

... – The new issue market is especially troubling for financial firms, which have about $145 billion in fixed- and floating rate debt maturing in the rest of 2008, according to JPMorgan data. – Overall corporate bond spreads have hit record highs , closing on October 2 at 339 basis points, up from 317 ...

Fall 2007

... 6) Looking at the numbers in the table above, what would be the best conclusion to draw about the change in direction of macroeconomic policy between 2009 and 2010. a) Fiscal policy is becoming less expansionary. b) Fiscal policy is becoming more expansionary. c) Monetary policy is becoming less exp ...

... 6) Looking at the numbers in the table above, what would be the best conclusion to draw about the change in direction of macroeconomic policy between 2009 and 2010. a) Fiscal policy is becoming less expansionary. b) Fiscal policy is becoming more expansionary. c) Monetary policy is becoming less exp ...

Slide 1

... agreement to provide a credit line to pay off investors if they want out. If the bank is forced to extend the credit, it looks as if bank credit has expanded. Firms may also be turning to banks because newer, more innovative financing has dried up. Third, there’s a squeeze on credit cards, there hav ...

... agreement to provide a credit line to pay off investors if they want out. If the bank is forced to extend the credit, it looks as if bank credit has expanded. Firms may also be turning to banks because newer, more innovative financing has dried up. Third, there’s a squeeze on credit cards, there hav ...

Our investment approach in the current market environment

... This programme is currently buying around 40 percent of all newly issued government bonds. In addition, the possibility of an initial rise in key lending rates has been put forward for the year 2015 or 2016. By then, the US Federal Reserve is planning to withdraw entirely as a buyer. This should lea ...

... This programme is currently buying around 40 percent of all newly issued government bonds. In addition, the possibility of an initial rise in key lending rates has been put forward for the year 2015 or 2016. By then, the US Federal Reserve is planning to withdraw entirely as a buyer. This should lea ...

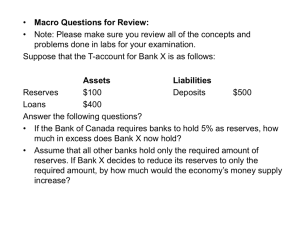

Quiz 5 Answers

... This statement is false in all its parts. Reserves are a liability of the Central Bank and an asset of private banks in the economy. To see it clearly consider that reserves are vault cash and deposits by private banks at the central bank. ...

... This statement is false in all its parts. Reserves are a liability of the Central Bank and an asset of private banks in the economy. To see it clearly consider that reserves are vault cash and deposits by private banks at the central bank. ...

Rate Increase - MidWestOne Investment Services

... Dear Valued Investor: The Federal Reserve’s (Fed) policy-making arm, the Federal Open Market Committee (FOMC), raised its target for the federal funds rate by 0.25% (25 basis points) yesterday as expected at the conclusion of its two-day meeting. By raising this key overnight borrowing rate, the Fed ...

... Dear Valued Investor: The Federal Reserve’s (Fed) policy-making arm, the Federal Open Market Committee (FOMC), raised its target for the federal funds rate by 0.25% (25 basis points) yesterday as expected at the conclusion of its two-day meeting. By raising this key overnight borrowing rate, the Fed ...

Rational Expectations

... debt monetization as well: when it buys bonds (through open market operations) it may print the money to do so or treat the bonds as a credit – in which case, the Treasury Department is credited, but must still pay back the Fed one day. 1) What is monetizing the debt/deficit? ...

... debt monetization as well: when it buys bonds (through open market operations) it may print the money to do so or treat the bonds as a credit – in which case, the Treasury Department is credited, but must still pay back the Fed one day. 1) What is monetizing the debt/deficit? ...

chapter_06_ - Homework Market

... members/participants of the Fed. ◦ Local banks are not. Independent of govt and private sector ◦ Board of Governors have 14 year terms ◦ Fed does not cater to pressure from banks (say to lower interest rates or push for deregulation) ◦ Extremely profitable (avg earnings of $40 bil a year!) ...

... members/participants of the Fed. ◦ Local banks are not. Independent of govt and private sector ◦ Board of Governors have 14 year terms ◦ Fed does not cater to pressure from banks (say to lower interest rates or push for deregulation) ◦ Extremely profitable (avg earnings of $40 bil a year!) ...

Macro - Unit 4

... 12. Aggregate demand & aggregate supply analysis suggests that, in the short run, an expansionary monetary policy will result in A. A shift in the aggregate demand curve to the left B. A shift in the aggregate supply curve to the left C. An increase in real GDP without much inflation when the econom ...

... 12. Aggregate demand & aggregate supply analysis suggests that, in the short run, an expansionary monetary policy will result in A. A shift in the aggregate demand curve to the left B. A shift in the aggregate supply curve to the left C. An increase in real GDP without much inflation when the econom ...

liquidity trap - Princeton University Press

... manipulate money supply through open market operations that affect the monetary base—for example, buying or selling government bonds. As long as banks are legally required to maintain a certain level of reserves, either as vault cash or on deposit with the central bank, a one-unit change in the mone ...

... manipulate money supply through open market operations that affect the monetary base—for example, buying or selling government bonds. As long as banks are legally required to maintain a certain level of reserves, either as vault cash or on deposit with the central bank, a one-unit change in the mone ...

NATIONAL BANK OF SERBIA Governor`s opening remarks at the

... I would like to begin just as I will conclude – by summing up last year. Namely, 2016 ended with yearon-year inflation of 1.6%, the fiscal deficit of 1.4%, the current account deficit of 4%, the NPL level of 17%, foreign direct investment of EUR 1.9 bln and the customary inflow of remittances of 2.6 ...

... I would like to begin just as I will conclude – by summing up last year. Namely, 2016 ended with yearon-year inflation of 1.6%, the fiscal deficit of 1.4%, the current account deficit of 4%, the NPL level of 17%, foreign direct investment of EUR 1.9 bln and the customary inflow of remittances of 2.6 ...

Carmen Reinhart is Professor of the International Financial System

... This seems a distant memory after the steady decline in prices in Greece since 2013, alongside a debt crisis and collapse in output. The Swiss National Bank, for its part, has been battling with the deflationary effects of the franc’s dramatic appreciation over the past few years. The deflationary ...

... This seems a distant memory after the steady decline in prices in Greece since 2013, alongside a debt crisis and collapse in output. The Swiss National Bank, for its part, has been battling with the deflationary effects of the franc’s dramatic appreciation over the past few years. The deflationary ...

Abenomics”: Can Japan’s “Honest Abe” Emancipate Japan from the

... We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments, and that we will not target exchange rates. …" ...

... We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments, and that we will not target exchange rates. …" ...

AP Macro Week 7 Practice Quiz: L – M, #31

... (B) signal participants in financial markets that a recession is coming. (C) signal participants in financial markets that an inflationary period is coming. (D) lower prices in the economy. (E) encourage borrowing by depository institutions so that the money supply may expand. 14. Assume that the Fe ...

... (B) signal participants in financial markets that a recession is coming. (C) signal participants in financial markets that an inflationary period is coming. (D) lower prices in the economy. (E) encourage borrowing by depository institutions so that the money supply may expand. 14. Assume that the Fe ...

Chapter 36 Key Question Solutions

... according to the monetarist perspective? Velocity = 3.5 or 336/96. They will cut back on their spending to try to restore their desired ratio of money to other items of wealth. Nominal GDP will fall to $266 billion (= $76 billion remaining money supply x 3.5) to restore equilibrium. (Key Question) U ...

... according to the monetarist perspective? Velocity = 3.5 or 336/96. They will cut back on their spending to try to restore their desired ratio of money to other items of wealth. Nominal GDP will fall to $266 billion (= $76 billion remaining money supply x 3.5) to restore equilibrium. (Key Question) U ...