Section 2

... Increasing Reserve Requirements – The process also works in reverse – Even a slight increase in the RRR would force banks to hold more money in reserves – This would cause the money supply to contract, or shrink – Although changing reserve requirements can be an effective means of changing the money ...

... Increasing Reserve Requirements – The process also works in reverse – Even a slight increase in the RRR would force banks to hold more money in reserves – This would cause the money supply to contract, or shrink – Although changing reserve requirements can be an effective means of changing the money ...

Great Depression Great Recession

... Deflation and Wage cuts Great Railroad Strike in 1877 Long Depression 1873-1896 ...

... Deflation and Wage cuts Great Railroad Strike in 1877 Long Depression 1873-1896 ...

UK Households - Economics Today

... • In the UK homeowners that lose their jobs can claim a government benefit called support for mortgage interest for two years. This benefit prevents homeowners that do not have savings or redundancy protection insurance from losing their homes in a repossession. Explain how this benefit affect a. t ...

... • In the UK homeowners that lose their jobs can claim a government benefit called support for mortgage interest for two years. This benefit prevents homeowners that do not have savings or redundancy protection insurance from losing their homes in a repossession. Explain how this benefit affect a. t ...

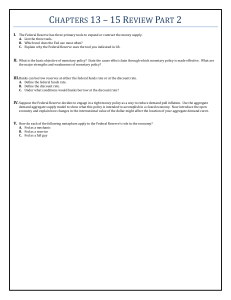

chapters 13 – 15 review part 2

... The unemployment rate is 6% and the CPI is increasing at a 9% rate. The federal government raises personal income taxes and cuts spending. The Federal Reserve sells bonds on the open market. What happens to GDPR, PL, unemployment, interest rates and Ig? Explain. ...

... The unemployment rate is 6% and the CPI is increasing at a 9% rate. The federal government raises personal income taxes and cuts spending. The Federal Reserve sells bonds on the open market. What happens to GDPR, PL, unemployment, interest rates and Ig? Explain. ...

20100427 worst economy since the great depression

... he found the Governor and Deputy Governor who for the sake of secrecy had no clerks there, and they began counting out the Bills for him. 'I hope this won't overset you my young man', said one of them, 'to see the Governor and Deputy Governor of the Bank [of England] acting as your two clerks. – He ...

... he found the Governor and Deputy Governor who for the sake of secrecy had no clerks there, and they began counting out the Bills for him. 'I hope this won't overset you my young man', said one of them, 'to see the Governor and Deputy Governor of the Bank [of England] acting as your two clerks. – He ...

Interest Rates - McGraw Hill Higher Education

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls ...

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls ...

Financial Sector Reading Guide – Chapters 13, 14 and 15 Chapter

... 14. What is the money multiplier formula? Explain how it is used to find the maximum amount of new checkable deposit money that can be created by the banking system. ...

... 14. What is the money multiplier formula? Explain how it is used to find the maximum amount of new checkable deposit money that can be created by the banking system. ...

Economics 157b Economic History, Policy, and

... • Major movement away from proposal to target inflation (ECB and many inflation hawks. ...

... • Major movement away from proposal to target inflation (ECB and many inflation hawks. ...

Beta, decay and how to prepare for a rising rate environment

... Beta and decay levels are forward looking and need to be fluid to changing market conditions. ...

... Beta and decay levels are forward looking and need to be fluid to changing market conditions. ...

Interest Rates - Cloudfront.net

... Discount rate was a passive tool Term auction facility is new • Guaranteed amount lent by the Fed • Anonymous ...

... Discount rate was a passive tool Term auction facility is new • Guaranteed amount lent by the Fed • Anonymous ...

Chapter 27

... interest rates. Monetary policy is maintained through actions such as increasing the interest rate, or changing the amount of money banks need to keep in the vault (bank reserves). ...

... interest rates. Monetary policy is maintained through actions such as increasing the interest rate, or changing the amount of money banks need to keep in the vault (bank reserves). ...

WORLD

... weaker dollar, not prolonged prosperity, are the likely outcomes of QE3. Breaking promises to holders of U.S. debt—via inflation—is not a recipe for attracting foreign investment or for harmonious relations. Keeping real interest rates artificially low to spur development underprices risk and misall ...

... weaker dollar, not prolonged prosperity, are the likely outcomes of QE3. Breaking promises to holders of U.S. debt—via inflation—is not a recipe for attracting foreign investment or for harmonious relations. Keeping real interest rates artificially low to spur development underprices risk and misall ...

Fiscal policy is carried out primarily by:

... A) loans are made. B) checks written on one bank are deposited in another bank. C) loans are repaid. D) the net worth of the banking system declines. 17. When a commercial bank has excess reserves: A) it is in a position to make additional loans. B) its actual reserves are less than its required res ...

... A) loans are made. B) checks written on one bank are deposited in another bank. C) loans are repaid. D) the net worth of the banking system declines. 17. When a commercial bank has excess reserves: A) it is in a position to make additional loans. B) its actual reserves are less than its required res ...

interest rate credit card financed by the Federal Reserve System and

... are used to pay 90 to 95% of all debts, both public and private. [Digital money is neither lawful nor legal tender - its acceptance is based entirely on faith and trust in the redemption of the negotiable instruments for real money. Checks and electronic money are also supposed to be convertable int ...

... are used to pay 90 to 95% of all debts, both public and private. [Digital money is neither lawful nor legal tender - its acceptance is based entirely on faith and trust in the redemption of the negotiable instruments for real money. Checks and electronic money are also supposed to be convertable int ...

Godley economics - University of Ottawa

... Portfolio decisions with standard adding-up constraints ...

... Portfolio decisions with standard adding-up constraints ...

Chapter 14

... actions during the recent financial crisis and the severe recession Critics contend the Fed contributed to the crisis by keeping the Federal funds rate too low for too long ...

... actions during the recent financial crisis and the severe recession Critics contend the Fed contributed to the crisis by keeping the Federal funds rate too low for too long ...

Macro policies and stock market, May 2010

... During a normal recession, the Fed, ECB and other central banks responded with non conventional monetary policies by buying short-term government/quality (except for Greek junks) debt from banks ...

... During a normal recession, the Fed, ECB and other central banks responded with non conventional monetary policies by buying short-term government/quality (except for Greek junks) debt from banks ...

Macro policies and stock market, May 2010

... During a normal recession, the Fed, ECB and other central banks responded with non conventional monetary policies by buying short-term government/quality (except for Greek junks) debt from banks ...

... During a normal recession, the Fed, ECB and other central banks responded with non conventional monetary policies by buying short-term government/quality (except for Greek junks) debt from banks ...

Name: Ivan Bakubi Section: 2020 E

... is naturally at AD* but finds itself at AD2, as seen in the graph on the previous page. Briefly explain how each of these policies would work to correct the situation. (12pts) Who does fiscal policy: A fiscal policy is a tool which is used by national governments to influence the direction of the ec ...

... is naturally at AD* but finds itself at AD2, as seen in the graph on the previous page. Briefly explain how each of these policies would work to correct the situation. (12pts) Who does fiscal policy: A fiscal policy is a tool which is used by national governments to influence the direction of the ec ...

Quiz for Chapters 8-12 - Porterville College Home

... 10. The ratio of reserves to checkable deposits banks are required to maintain is called the: A) federal reserve ratio. B) legal reserve ratio. C) excess reserve ratio. D) required reserve ratio. ...

... 10. The ratio of reserves to checkable deposits banks are required to maintain is called the: A) federal reserve ratio. B) legal reserve ratio. C) excess reserve ratio. D) required reserve ratio. ...

22-Nov-2012 - Public Banking

... Cheap credit lines to state and local government agencies. Low-interest loans for designated local projects. Redirects credit away from speculation toward local lending; mandate to serve the public interest. • Underwrites municipal bonds, avoiding high cost of fees, “insurance” (swaps), and bond mar ...

... Cheap credit lines to state and local government agencies. Low-interest loans for designated local projects. Redirects credit away from speculation toward local lending; mandate to serve the public interest. • Underwrites municipal bonds, avoiding high cost of fees, “insurance” (swaps), and bond mar ...

Take-Home Quiz

... d. A (used) Coach purse bought at a consignment shop _____9. Which of the following is not a way the CPI is used to measure the performance of the economy? a. To index payments b. To determine profits c. To translate from nominal to real values d. As a policy target (gauge inflation) _____10. Suppos ...

... d. A (used) Coach purse bought at a consignment shop _____9. Which of the following is not a way the CPI is used to measure the performance of the economy? a. To index payments b. To determine profits c. To translate from nominal to real values d. As a policy target (gauge inflation) _____10. Suppos ...

Lender of last resort

... The Fed should have learned from the experience of the quantitative easing programs that its purchases of securities did little or nothing to increase the quantity of bank credit actually supplied to the general economy. ...

... The Fed should have learned from the experience of the quantitative easing programs that its purchases of securities did little or nothing to increase the quantity of bank credit actually supplied to the general economy. ...