Monetary Policy - Diocesan College

... • A saver receives interest of 6% on his savings • Inflation (general rise in prices) is 3% per year • The real rate of return on these savings is only _____%. ...

... • A saver receives interest of 6% on his savings • Inflation (general rise in prices) is 3% per year • The real rate of return on these savings is only _____%. ...

the powerpoint presentation regarding Monetary Policy.

... • Buying/selling Bonds and T-Bills – Bank of Canada buys bonds from Canadian Corporations and the result is an increase in the money supply – Bank of Canada sells bonds to Canadian Corporations and the result is a decrease in the money supply because the $ is out of circulation. ...

... • Buying/selling Bonds and T-Bills – Bank of Canada buys bonds from Canadian Corporations and the result is an increase in the money supply – Bank of Canada sells bonds to Canadian Corporations and the result is a decrease in the money supply because the $ is out of circulation. ...

ch14revanswers

... 3. What are the three principal tools of monetary policy? Explain how they can be used. The Federal Reserve Banks use three principal tools (techniques or instruments) to control the reserves of banks and the size of the money supply. (1) The Federal Reserve can buy or sell government securities in ...

... 3. What are the three principal tools of monetary policy? Explain how they can be used. The Federal Reserve Banks use three principal tools (techniques or instruments) to control the reserves of banks and the size of the money supply. (1) The Federal Reserve can buy or sell government securities in ...

Goal 9 Study Guide

... What happens to the economy during expansion? What happens to the economy during a peak? What happens to the economy during a contraction/recession? What happens to the economy during a trough? What happens if a recession becomes severe enough? What happened in 1929? Who makes up the civilian labor ...

... What happens to the economy during expansion? What happens to the economy during a peak? What happens to the economy during a contraction/recession? What happens to the economy during a trough? What happens if a recession becomes severe enough? What happened in 1929? Who makes up the civilian labor ...

krugman ir macro module 36(72).indd

... Explain that it actually has direct control only over the monetary base, although this control does allow it to influence interest rates. If you have played the money creation game suggested in the previous section, refer to that game. Have students imagine that the Federal Reserve has just purchase ...

... Explain that it actually has direct control only over the monetary base, although this control does allow it to influence interest rates. If you have played the money creation game suggested in the previous section, refer to that game. Have students imagine that the Federal Reserve has just purchase ...

Money and Banking - Elkhorn Public Schools

... • A National Sales Tax is being proposed by some of the candidates for president • Advocates of the so-called "FairTax" claimed a 23 percent national sales tax can replace both the federal income tax and Social Security taxes. • Some opponents claim the actual rate would have to be at least 34 perce ...

... • A National Sales Tax is being proposed by some of the candidates for president • Advocates of the so-called "FairTax" claimed a 23 percent national sales tax can replace both the federal income tax and Social Security taxes. • Some opponents claim the actual rate would have to be at least 34 perce ...

Strategic Interaction between Fiscal and Monetary Policies in an

... Optimal macroeconomic policy design Central bank independence: do we really need it? ...

... Optimal macroeconomic policy design Central bank independence: do we really need it? ...

SECTION 5: The Financial Sector Need to Know

... which funds are borrowed and lent in the federal funds market, plays a key role in modern monetary policy. • Discount Rate is the rate of interest the Fed charges on loans to banks that do not meet their reserve requirements (set 1 percentage point above the federal funds rate – that is why t ...

... which funds are borrowed and lent in the federal funds market, plays a key role in modern monetary policy. • Discount Rate is the rate of interest the Fed charges on loans to banks that do not meet their reserve requirements (set 1 percentage point above the federal funds rate – that is why t ...

File

... 15. In the graph, the year with the highest unemployment rate is 1983. What was the approximate unemployment rate in that year? A) ...

... 15. In the graph, the year with the highest unemployment rate is 1983. What was the approximate unemployment rate in that year? A) ...

Questions

... Since the price (value) of a bond and the current market interest rate are inversely related, as interest rates rise, the value of the bonds will fall (and vice versa). Assuming that they were purchased when the interest rate was 8%, the bond would have had a present discounted value of $10 000. Cur ...

... Since the price (value) of a bond and the current market interest rate are inversely related, as interest rates rise, the value of the bonds will fall (and vice versa). Assuming that they were purchased when the interest rate was 8%, the bond would have had a present discounted value of $10 000. Cur ...

dl1.cuni.cz

... - through open market operations involving the purchase and sale of U.S. Treasury securities - by setting the Discounte rate - interest rate that banks pay on short-term loans from Fed (cost of credit) - by setting Reserve Requirements - amount of physical funds that depository institutions are requ ...

... - through open market operations involving the purchase and sale of U.S. Treasury securities - by setting the Discounte rate - interest rate that banks pay on short-term loans from Fed (cost of credit) - by setting Reserve Requirements - amount of physical funds that depository institutions are requ ...

EconomicHistory(ASRIMarch2016)

... • The Glass-Steagall Act had provided for a strict separation of investment banking and commercial banking • Under the Glass-Steagall Act depositors money could not be used by commercial banks to invest in high risk securities (this would have been the preserve of investment bank who were taking ris ...

... • The Glass-Steagall Act had provided for a strict separation of investment banking and commercial banking • Under the Glass-Steagall Act depositors money could not be used by commercial banks to invest in high risk securities (this would have been the preserve of investment bank who were taking ris ...

Supply and Demand - HKUST HomePage Search

... • Nominal interest rates cannot go below zero – no one will lend money at an interest rate below that of money itself. • In Japan, central bank increased money supply to get the economy out of a recession. Pushed the interest rate to zero. • Once the zero lower bound was reached monetary policy has ...

... • Nominal interest rates cannot go below zero – no one will lend money at an interest rate below that of money itself. • In Japan, central bank increased money supply to get the economy out of a recession. Pushed the interest rate to zero. • Once the zero lower bound was reached monetary policy has ...

FRBSF L CONOMIC

... banks have seen improvement in all of these areas over the past few years. Banks are generally better capitalized, with more liquid assets; earnings have improved; and new loans have increased while pastdue ones have diminished (see FRB San Francisco 2013a). Looking more closely at local conditions, ...

... banks have seen improvement in all of these areas over the past few years. Banks are generally better capitalized, with more liquid assets; earnings have improved; and new loans have increased while pastdue ones have diminished (see FRB San Francisco 2013a). Looking more closely at local conditions, ...

Document

... Board of Executive Directors – reps from 25 countries + WB President Board of Governors – reps from all member-countries Vote shares: ...

... Board of Executive Directors – reps from 25 countries + WB President Board of Governors – reps from all member-countries Vote shares: ...

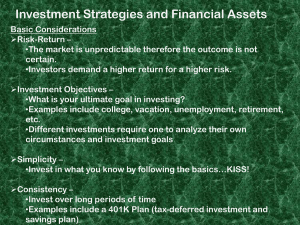

Investment Strategies and Financial Assets

... •Low cost and attractive to small investors •Can be purchased to fit the investor •FDIC insured Corporate Bonds – •Cost depends on supply and demand •Huge source of corporate funds •Investors must consider the risk and length of the bond Municipal Bonds – •Issued by state and local governments •Us ...

... •Low cost and attractive to small investors •Can be purchased to fit the investor •FDIC insured Corporate Bonds – •Cost depends on supply and demand •Huge source of corporate funds •Investors must consider the risk and length of the bond Municipal Bonds – •Issued by state and local governments •Us ...

File

... for banks to borrow, therefore they will likely lend out more. The Fed can use Open Market Operations. They can buy bonds from banks and people. This will increase the amount of reserves and money available to lend out and spend. Each one of these tools is aimed at increasing Aggregate demand, shift ...

... for banks to borrow, therefore they will likely lend out more. The Fed can use Open Market Operations. They can buy bonds from banks and people. This will increase the amount of reserves and money available to lend out and spend. Each one of these tools is aimed at increasing Aggregate demand, shift ...

Illinois Economic Challenge. Practice Test 2 2001

... Suppose a constitutional amendment is adopted which requires the federal government to balance its budget annually. If the budget is currently balanced and now policymakers wish to increase the equilibrium level of the national product by $30 billion, the federal government: A. Would be unable to br ...

... Suppose a constitutional amendment is adopted which requires the federal government to balance its budget annually. If the budget is currently balanced and now policymakers wish to increase the equilibrium level of the national product by $30 billion, the federal government: A. Would be unable to br ...

スライド 1 - Norges Bank

... Risks to a Private Sector Solution Related parties are diverse and the exposure is unforeseeable but could potentially be large Legal risks for the related parties Legal or reputation risks for the public sector Could only be successful when the case is an isolated event ...

... Risks to a Private Sector Solution Related parties are diverse and the exposure is unforeseeable but could potentially be large Legal risks for the related parties Legal or reputation risks for the public sector Could only be successful when the case is an isolated event ...

Money, output and Prices in LR Macro_Module_32 money

... What you will learn in this Module: • The effects of an inappropriate monetary policy • The concept of monetary neutrality and its relationship to the long-term economic effects of monetary policy ...

... What you will learn in this Module: • The effects of an inappropriate monetary policy • The concept of monetary neutrality and its relationship to the long-term economic effects of monetary policy ...

Deflation Fears Are A Distraction

... slight gains in inflation create forecasts of “hyper-inflation,” while slowing or low inflation leads to fears of “deflation.” As we predicted, hyper-inflation never occurred, so, let’s make another forecast – deflationary fears are overblown, too. The world is highly unlikely to have a deflationary ...

... slight gains in inflation create forecasts of “hyper-inflation,” while slowing or low inflation leads to fears of “deflation.” As we predicted, hyper-inflation never occurred, so, let’s make another forecast – deflationary fears are overblown, too. The world is highly unlikely to have a deflationary ...

Chapter 28 - Weber State University

... produced a historic period of economic expansion that was accompanied by a. falling real interest rates. b. high unemployment rates. c. a dramatic increase in the federal government’s budget deficit. d. a reduction in the U.S. trade deficit. e. all of the above. 20. The Federal Reserve chair with th ...

... produced a historic period of economic expansion that was accompanied by a. falling real interest rates. b. high unemployment rates. c. a dramatic increase in the federal government’s budget deficit. d. a reduction in the U.S. trade deficit. e. all of the above. 20. The Federal Reserve chair with th ...

4Q 2012 - Cypress Asset Management

... economic and industry fundamentals and away from policy in 2013. The debt ceiling issue will certainly be closely watched by the market. The need for fiscal reform and the debt problem loom larger each year, but meaningful progress is unlikely in the near term. The year shapes up as likely to mark a ...

... economic and industry fundamentals and away from policy in 2013. The debt ceiling issue will certainly be closely watched by the market. The need for fiscal reform and the debt problem loom larger each year, but meaningful progress is unlikely in the near term. The year shapes up as likely to mark a ...

Why Are Interest Rates Still Low

... be in direct proportion to increases in income, i.e., consumers aren’t going to be as likely to bet on the come. Coupled with the growing federal debt burden and the potential for tax increases, I don’t see real GDP growing much above 3 percent for any extended period over the next several years. Wh ...

... be in direct proportion to increases in income, i.e., consumers aren’t going to be as likely to bet on the come. Coupled with the growing federal debt burden and the potential for tax increases, I don’t see real GDP growing much above 3 percent for any extended period over the next several years. Wh ...

Slide 1

... • Acts as a lender of last resort • Audits private sector banks to ensure “financial health” • Provides check clearing services • The Federal Reserve Bank of New York carries out open-market operations and its president is always on the Board of Governors • The Fed conducts the nations monetary poli ...

... • Acts as a lender of last resort • Audits private sector banks to ensure “financial health” • Provides check clearing services • The Federal Reserve Bank of New York carries out open-market operations and its president is always on the Board of Governors • The Fed conducts the nations monetary poli ...