Slavery National banks - Teaching American History in South Carolina

... nabled banks to increase their lending capacity so that they ould extend more loans ...

... nabled banks to increase their lending capacity so that they ould extend more loans ...

Chapter 16 Government and the Economy

... – The setting of interest on loans to member banks • Open market operations – The buying and selling of government securities • Reserve requirements – The amount of liquid assets and ready cash that banks are required to hold to ...

... – The setting of interest on loans to member banks • Open market operations – The buying and selling of government securities • Reserve requirements – The amount of liquid assets and ready cash that banks are required to hold to ...

stance of monetary policy

... Eventually, after further monetary base expansions, when inflation did move a bit higher, the BoJ promptly increased interest rates, proving traders more or less right as the higher rates implied the bank was unhappy by the increase in spending betokened by the higher inflation. The central bank is ...

... Eventually, after further monetary base expansions, when inflation did move a bit higher, the BoJ promptly increased interest rates, proving traders more or less right as the higher rates implied the bank was unhappy by the increase in spending betokened by the higher inflation. The central bank is ...

Weekly Market Commentary November 25, 2013

... dream, according to The Economist. Years ago, Friedman suggested the Federal Reserve be abolished and replaced by an automated system that would increase money supply at a steady, pre-set rate. He believed such a system would better control inflation, making spending and investment decisions more ce ...

... dream, according to The Economist. Years ago, Friedman suggested the Federal Reserve be abolished and replaced by an automated system that would increase money supply at a steady, pre-set rate. He believed such a system would better control inflation, making spending and investment decisions more ce ...

Macro Issues for the GHSGT

... The amount of deposits that banks are required to keep on hand Discount Rate The interest rate at which the Fed loans money to member banks Federal Funds Rate The interest rate at which the Fed requires banks to charge EACH OTHER for loans ...

... The amount of deposits that banks are required to keep on hand Discount Rate The interest rate at which the Fed loans money to member banks Federal Funds Rate The interest rate at which the Fed requires banks to charge EACH OTHER for loans ...

Stocks Rebound on Bernanke Comments

... Ben Bernanke said the central bank will remain vigilant should inflation accelerate, but also said the Fed would remain open to interest rate cuts to help the economy. Stocks fluctuated and then moved higher after the release of Bernanke's prepared comments for an appearance before lawmakers on Capi ...

... Ben Bernanke said the central bank will remain vigilant should inflation accelerate, but also said the Fed would remain open to interest rate cuts to help the economy. Stocks fluctuated and then moved higher after the release of Bernanke's prepared comments for an appearance before lawmakers on Capi ...

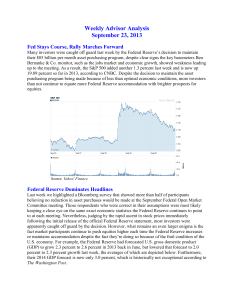

Weekly Advisor Analysis 09-23-13 PAA

... * Quantitative Easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased l ...

... * Quantitative Easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased l ...

Low interest rates provide a stimulus but can also create risks

... volume of euro-denominated bonds issued by high-risk corporations in Europe has already grown to around EUR 250 billion,[2] or about 25% of the corporate bond stock (Chart 3). Low interest rates and investor hunger for yield have maintained demand for these products, and risk premia have been declin ...

... volume of euro-denominated bonds issued by high-risk corporations in Europe has already grown to around EUR 250 billion,[2] or about 25% of the corporate bond stock (Chart 3). Low interest rates and investor hunger for yield have maintained demand for these products, and risk premia have been declin ...

Money, What it was & what it has become

... all the currency and credit needed to satisfy the spending power of the government and the buying power of the consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government's greatest creative opportunity. By the adoption of these ...

... all the currency and credit needed to satisfy the spending power of the government and the buying power of the consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government's greatest creative opportunity. By the adoption of these ...

Richard W Fisher: The limits of the powers of central banks

... Reserve, the 19-person forum known as the Federal Open Market Committee, or FOMC. I have an MBA, not a PhD. I am an autodidact when it comes to monetary theory. On the other hand, I am the only participant in our policy deliberations who has been both a banker and a professional money manager – the ...

... Reserve, the 19-person forum known as the Federal Open Market Committee, or FOMC. I have an MBA, not a PhD. I am an autodidact when it comes to monetary theory. On the other hand, I am the only participant in our policy deliberations who has been both a banker and a professional money manager – the ...

the fed, fiscal, monetary policy, keynes

... Keynes believed that two things needed to happen to end the Great Depression Consumers need to spend more money Keynes thought that the spender should be the government. According to his theory, the government should buy goods and ...

... Keynes believed that two things needed to happen to end the Great Depression Consumers need to spend more money Keynes thought that the spender should be the government. According to his theory, the government should buy goods and ...

Search for Recovery C.P. Chandrasekhar

... rates in the developed countries. This is forcing emerging markets to maintain high and rising interest rates in the hope that they can withstand the hit from what Brazil’s central bank governor, Alexandre Tombini, has termed the “vacuum cleaner”—high developed country interest rates that would suck ...

... rates in the developed countries. This is forcing emerging markets to maintain high and rising interest rates in the hope that they can withstand the hit from what Brazil’s central bank governor, Alexandre Tombini, has termed the “vacuum cleaner”—high developed country interest rates that would suck ...

Document

... Monetary policy is the policy of influencing the economy through changes in the banking system’s reserves that affect the money supply In the AS/AD model, expansionary monetary policy works as follows: ↑M → i↓ → ↑I → ↑Y Contractionary monetary policy works as follows: ↓ M → ↑i → ↓I → ↓Y In ...

... Monetary policy is the policy of influencing the economy through changes in the banking system’s reserves that affect the money supply In the AS/AD model, expansionary monetary policy works as follows: ↑M → i↓ → ↑I → ↑Y Contractionary monetary policy works as follows: ↓ M → ↑i → ↓I → ↓Y In ...

Why Study Money, Banking, and Financial Markets?

... • To examine how financial markets such as bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

... • To examine how financial markets such as bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

How To collapse the U.S. economy

... out of the U.S.economy. Inflation does not produce a recession.Left to its own devices. the inflation-ridden U.S. would eventually break through the political barriers designed by her British "allies" and cure the ...

... out of the U.S.economy. Inflation does not produce a recession.Left to its own devices. the inflation-ridden U.S. would eventually break through the political barriers designed by her British "allies" and cure the ...

Global Financial Crisis: The Aftermath

... Prices of complex financial securities that were created by Wall Street to underwrite the housing market collapsed Institutions that issued these assets along with the investors that bought them suffered huge losses in many cases exceeding the capital of these firms Losses along with collapse ...

... Prices of complex financial securities that were created by Wall Street to underwrite the housing market collapsed Institutions that issued these assets along with the investors that bought them suffered huge losses in many cases exceeding the capital of these firms Losses along with collapse ...

Re-regulating finance: Using Minsky to Learn from the crisis JAN KREGEL

... “The general argument that the monetary authorities can increase aggregate demand and prices, even if the nominal interest rate is zero, is as follows: Money, unlike other forms of government debt, pays zero interest and has infinite maturity. The monetary authorities can issue as much money as they ...

... “The general argument that the monetary authorities can increase aggregate demand and prices, even if the nominal interest rate is zero, is as follows: Money, unlike other forms of government debt, pays zero interest and has infinite maturity. The monetary authorities can issue as much money as they ...

20 20 20 20 40 40 40 40 60 60 60 60 80 80 80 80 100 100 100 100

... Is the least used tool of monetary policy ...

... Is the least used tool of monetary policy ...

Monetary Policy and Financial Stability Eric S. Rosengren

... Potential that inflation or inflation expectations could rise too quickly Federal Reserve balance sheet expanded significantly in 2008, and almost five years later, PCE inflation is 1.2 percent – well below 2 percent target This provides the Fed the ability to take monetary policy actions to e ...

... Potential that inflation or inflation expectations could rise too quickly Federal Reserve balance sheet expanded significantly in 2008, and almost five years later, PCE inflation is 1.2 percent – well below 2 percent target This provides the Fed the ability to take monetary policy actions to e ...

The Federal Reserve System

... A commodity-backed money is a medium of exchange with no intrinsic value whose ultimate value is guaranteed by a promise that it can be converted into valuable goods or it can be the commodity itself (gold, silver). Fiat money is a medium of exchange whose value derives entirely from its official ...

... A commodity-backed money is a medium of exchange with no intrinsic value whose ultimate value is guaranteed by a promise that it can be converted into valuable goods or it can be the commodity itself (gold, silver). Fiat money is a medium of exchange whose value derives entirely from its official ...

February 1, 2o17 - John Dessauer`s Outlook

... go together. It will take sustained growth above 3% before the velocity of money rises much above today’s record low. That alone says inflation will stay low this year and next. The first thing economists and investors think of when it comes to fighting inflation is high interest rates. The reason c ...

... go together. It will take sustained growth above 3% before the velocity of money rises much above today’s record low. That alone says inflation will stay low this year and next. The first thing economists and investors think of when it comes to fighting inflation is high interest rates. The reason c ...

Y 1

... As real income rises, Households purchase more goods and services, so demand for money increases. Households sell bonds to increase money holdings Increase in IR increases cost of holding money. Therefore, quantity of money demanded decreases. Decreasing IR decreases cost of holding money, so money ...

... As real income rises, Households purchase more goods and services, so demand for money increases. Households sell bonds to increase money holdings Increase in IR increases cost of holding money. Therefore, quantity of money demanded decreases. Decreasing IR decreases cost of holding money, so money ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... the European Central Bank, and for those that have but that are planning now how to unwind policy stimulus. Quantitative easing potentially works on both sides of a central bank’s balance sheet in the manner described by Bernanke and Reinhart (2004). 1. The large provision of reserves may induce ban ...

... the European Central Bank, and for those that have but that are planning now how to unwind policy stimulus. Quantitative easing potentially works on both sides of a central bank’s balance sheet in the manner described by Bernanke and Reinhart (2004). 1. The large provision of reserves may induce ban ...