reserve requirment

... moving again or to address inflation **Congressional Responsibility Monetary Policy = a central bank’s control over the money supply and interest rates ** no government involvement ...

... moving again or to address inflation **Congressional Responsibility Monetary Policy = a central bank’s control over the money supply and interest rates ** no government involvement ...

*Turn in your *measuring the economy* processing assignment

... *bills and coins in use, as well as traveler’s checks and money in bank checking accounts. *The bank can then loan the portion of your deposit that is not required to remain in reserve to someone else. *In this sense, the bank has “created” money by making a loan. *The money used to pay off the loa ...

... *bills and coins in use, as well as traveler’s checks and money in bank checking accounts. *The bank can then loan the portion of your deposit that is not required to remain in reserve to someone else. *In this sense, the bank has “created” money by making a loan. *The money used to pay off the loa ...

Money

... Banks can actually create money. • Annie puts $10,000 in the bank, and the bank can then loan out 9,000 of it. ($1000 on reserve) • Henry gets a loan for $9,000, and puts it in his bank, which can loan out 8,100 of it. • Peggy gets a loan for $8,100 and puts it in her bank, which can loan out 7,300 ...

... Banks can actually create money. • Annie puts $10,000 in the bank, and the bank can then loan out 9,000 of it. ($1000 on reserve) • Henry gets a loan for $9,000, and puts it in his bank, which can loan out 8,100 of it. • Peggy gets a loan for $8,100 and puts it in her bank, which can loan out 7,300 ...

SIUDY_SESSION_4_PresentationSouth_Bank

... What is at stake? • Finance mega infrastructure and agrofuels? • Same volume of capital or more capital more power? • One dollar- one vote? • Immunity for bank officials and private docs.; • Bonds; IFIs; other banks and governments. ...

... What is at stake? • Finance mega infrastructure and agrofuels? • Same volume of capital or more capital more power? • One dollar- one vote? • Immunity for bank officials and private docs.; • Bonds; IFIs; other banks and governments. ...

LESSON 3 Tools of Monetary Policy

... • There are several monetary policy tools available to achieve these ends: increasing interest rates by fiat; reducing the monetary base; and increasingreserve requirements. All have the effect of contracting the money supply; and, if reversed, expand the money supply. Since the 1970s, monetary pol ...

... • There are several monetary policy tools available to achieve these ends: increasing interest rates by fiat; reducing the monetary base; and increasingreserve requirements. All have the effect of contracting the money supply; and, if reversed, expand the money supply. Since the 1970s, monetary pol ...

HW4 - IS MU

... c) Draw a graph of the money market to illustrate this effect of this open-market operation. Show the resulting change in interest rate. d) Draw a graph similar to the one in part a) to show the effect of open-market operation on output and the price level. 2. Suppose economists observe that an incr ...

... c) Draw a graph of the money market to illustrate this effect of this open-market operation. Show the resulting change in interest rate. d) Draw a graph similar to the one in part a) to show the effect of open-market operation on output and the price level. 2. Suppose economists observe that an incr ...

The financial crisis - World Economy & Finance Research

... What is a bubble? • Loosely, « prices are too high » • However, too high prices can be rational • Price deviates from the fundamental because prices high in the future • Asset held even though bubble may rationally be expected to burst • In this case, it rises even more quickly ...

... What is a bubble? • Loosely, « prices are too high » • However, too high prices can be rational • Price deviates from the fundamental because prices high in the future • Asset held even though bubble may rationally be expected to burst • In this case, it rises even more quickly ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... in our District, especially smaller ones, have increased their longer-term asset holdings in a “reach for yield.” All else being equal, longer-term assets tend to deliver higher rates of return, and banks are looking to offset lower earnings from the narrow interest spread. There was a slight rise i ...

... in our District, especially smaller ones, have increased their longer-term asset holdings in a “reach for yield.” All else being equal, longer-term assets tend to deliver higher rates of return, and banks are looking to offset lower earnings from the narrow interest spread. There was a slight rise i ...

Unit 4 Review Q`s PP - South Hills High School

... d) Rarely used in a free market system e) All of the above ...

... d) Rarely used in a free market system e) All of the above ...

Discussion: Financial Crises, Bank Risk Exposure and Government Financial Policy by

... 1. A fall in the price of bank assets due to the bursting of a real estate bubble - This seems to be have been very important in the recent crisis and is very often a cause of financial crises 2. A fall in the price of bank assets due to an increase in interest rates - This is arguably one of the ...

... 1. A fall in the price of bank assets due to the bursting of a real estate bubble - This seems to be have been very important in the recent crisis and is very often a cause of financial crises 2. A fall in the price of bank assets due to an increase in interest rates - This is arguably one of the ...

Hamiltons Financial Plan and the Whiskey Rebellion

... National Debt Debt/Output Debt/Population (Percentage) ($ per person) ...

... National Debt Debt/Output Debt/Population (Percentage) ($ per person) ...

Chapter 8

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

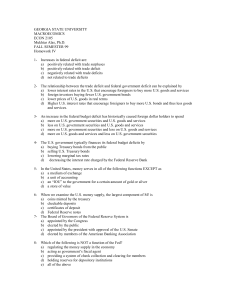

Homework IV - Georgia State University

... d) Corporate bond 10- The Federal Open Market Committee (FOMC) a) determines the tax policy of the government b) influences the future growth of the money supply c) oversees all transactions on the stock market d) lends to the least credit-worthy customers 11- The opportunity cost of holding money i ...

... d) Corporate bond 10- The Federal Open Market Committee (FOMC) a) determines the tax policy of the government b) influences the future growth of the money supply c) oversees all transactions on the stock market d) lends to the least credit-worthy customers 11- The opportunity cost of holding money i ...

Key

... this module to test your responses to the questions below. Suppose that the Federal Reserve Bank of the United States policy is to tighten the money supply. What does that mean the Fed wants to do to the money supply? Explain. Other things being equal, what impact will this policy have on interest r ...

... this module to test your responses to the questions below. Suppose that the Federal Reserve Bank of the United States policy is to tighten the money supply. What does that mean the Fed wants to do to the money supply? Explain. Other things being equal, what impact will this policy have on interest r ...

Advanced Placement Annual Conference, 2011 San Francisco, CA

... b) Suppose in a different part of the world, the real interest rate in Canada increases relative to that in Mexico. (i) Using a correctly labeled graph of the foreign exchange market for the Canadian dollar, show the effect of the change in real interest rate in Canada on the international value of ...

... b) Suppose in a different part of the world, the real interest rate in Canada increases relative to that in Mexico. (i) Using a correctly labeled graph of the foreign exchange market for the Canadian dollar, show the effect of the change in real interest rate in Canada on the international value of ...

The essentials of T

... • If the Government is in deficit, then the surplus fiat currency in the private sector is accumulated as cash, bank reserves, or as Treasury Bonds (deposits offered by the CB). • The taxes are scrapped (as the CB wipes off liabilities from its balance sheet). • Logically, taxes cannot finance spend ...

... • If the Government is in deficit, then the surplus fiat currency in the private sector is accumulated as cash, bank reserves, or as Treasury Bonds (deposits offered by the CB). • The taxes are scrapped (as the CB wipes off liabilities from its balance sheet). • Logically, taxes cannot finance spend ...

Fed Focus: A Community Conference

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

CLTC 2016 Economic Summit Power Point Presentation by Dr. Mark

... estate from Russian, Canada and Mexico. • Anti-corruption policy in China could reduce Chinese purchases of US real estate • New federal transparency rules on cash purchases will reduce foreign buying demand in the US ...

... estate from Russian, Canada and Mexico. • Anti-corruption policy in China could reduce Chinese purchases of US real estate • New federal transparency rules on cash purchases will reduce foreign buying demand in the US ...

Practice Test questions for Spring, 2012 Fiscal/Monetary 1. Fiscal

... A) applied the unemployment compensation program to intrastate workers. B) agreed to subsidize unemployed workers to the extent of 50 percent of their average incomes. C) committed itself to accept some degree of responsibility for the general levels of employment and prices. D) agreed to hire, thro ...

... A) applied the unemployment compensation program to intrastate workers. B) agreed to subsidize unemployed workers to the extent of 50 percent of their average incomes. C) committed itself to accept some degree of responsibility for the general levels of employment and prices. D) agreed to hire, thro ...

Presentation to business and community leaders at a breakfast meeting... Federal Reserve Bank of San Francisco and the Greater Arizona...

... In light of all this, and in light of our low-inflation environment, ...

... In light of all this, and in light of our low-inflation environment, ...

Handout on the U.S. Federal Reserve and the mechanics of

... (C) In what two forms can a bank hold the new required reserves? _______________________________ Orf/Purpura ...

... (C) In what two forms can a bank hold the new required reserves? _______________________________ Orf/Purpura ...

Fed Focus: A Community Conference Dixie Center, St. George, Utah

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

Chapter 15 Monetary Policy

... (inflation), it’s the job of the Fed to take away the punch bowl.” ...

... (inflation), it’s the job of the Fed to take away the punch bowl.” ...