* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 10

Financialization wikipedia , lookup

Private equity wikipedia , lookup

Business valuation wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

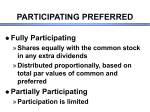

Stock trader wikipedia , lookup

Cornerstones of Financial & Managerial Accounting Rich/Jones/Heitger/Mowen/Hansen Chapter 10 Learning Objectives LO1. Describe the different elements of stockholders’ equity and prepare the stockholders’ equity section of the balance sheet. • There are various elements of equity and the stockholders’ equity section of the balance sheet clearly classifies these elements according to their source: • capital stock—split between preferred and common stock and associated paid-in capital in excess of par; • • retained earnings or deficit; • accumulated other comprehensive income; and • treasury stock. Corporations split their stockholders’ equity into these sections, although most corporations do not have all of these elements. LO2. Distinguish between the different forms of equity and describe their use in raising capital. • Corporations sell both common stock and preferred stock to raise capital. • Preferred stock generally guarantees a regular dividend and receives priority over common stock in the payment of dividends and distribution of assets in liquidation. • Common stock has voting rights and receives all benefits not assigned to the preferred stockholders or creditors. • Selling different classes of stock (with different features) attracts shareholders with diverse risk preferences and tax situations. LO3. Record the issuance of capital stock. • Both preferred and common stock are generally recorded at par or stated value. • Any extra consideration received is recorded as “paid-in capital in excess of par.” LO4. Account for the distribution of assets to stockholders. • • Assets are distributed to stockholders by: • repurchasing their shares of stock, or • paying dividends. Generally the cost of stock repurchases are recorded as a reduction in stock holders’ equity (a debit to “treasury stock”). • Typically the corporation pays dividends with cash. • Stock dividends and stock splits do not represent a payout to stockholders. These transactions have no effect on total stockholders’ equity. • Preferred stock generally has dividend preferences such as being cumulative or participating. LO5. Describe the accounting issues related to retained earnings and accumulated other comprehensive income. • Retained earnings represents the earnings that the corporation elects not to pay out in dividends. • Ending retained earnings is calculated by adding net income and subtracting dividends to beginning retained earnings. • Retained earnings can be restricted, which communicates to stockholders that this portion of retained earnings is not eligible for dividend payout. LO6. Analyze stockholder payout and profitability ratios using information contained in the stockholders’ equity section. • Stockholders are primarily interested in two things: • the creation of value, and • the distribution of value. • Analysis of the stockholders’ equity section of the balance sheet in conjunction with the statement of stockholders’ equity allows stockholders to separate these concepts.