* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Stock Market Simulation Debriefing

Early history of private equity wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Socially responsible investing wikipedia , lookup

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

Investment banking wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

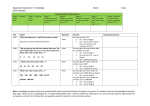

Stock Market Simulation Debriefing Name_________________________ Write a 1-2 page reflection on the stock market simulation that we have been engaged in since late October. Touch upon each of the following questions in your written analysis, creating a new paragraph for each of the bulleted questions. Please write in full sentences, using 10 pt font and double-spacing. The rubric that will be used to evaluate this assignment is on the back of this sheet. Please attach either your green investment log or a print-out of your account activity from the website, Howthemarketworks.com as well as this sheet. This will be due ___________________________________. PARAGRAPH 1: OVERVIEW What was your strategy for selecting your portfolio? Did you do research, listen to tips from other investors, make educated guesses or “throw darts”? Which investment was your “blue chip” or biggest gainer over time? Any theories as to why that is? Who lost the most money for you? Why do you think that was? Choose one of your stocks that you ended the game with and print its “live chart” for the last 3 months. Interpret the graph by analyzing the activity over time. What conclusions or assumptions can you make about the company based off of this information? PARAGRAPH 2: INVESTMENT STRATEGY What were your investment strategies? Did you participate in short selling and day trading or did you let your portfolio ride through the ups and downs of the last 6 weeks on the stock exchange? Did your strategy pay off? What was the worth of your final portfolio in terms of both dollars and percentage of the original investment (e.g. if you ended with $10,232.00, that would be a 2.3% gain from your original investment of $10,000). What place did you end in for the class? If you could start the contest over, what changes would you make to your investment strategy? PARAGRAPH 3: REFLECTION What did you learn from this contest? Do you have a better understanding of how the stock market works and what its purposes and functions are? What questions do you still have? Do you think you will invest in the stock market with real money in the future? What did you see as being the benefits and drawbacks of this form of investment? What could make this contest better in the future? 10/10 All questions are answered thoroughly and with critical thought – graph is included and analyzed Advanced 8.5/10 All or most of the questions are answered with some critical thought – perhaps not as detailed as in 10/10 category. 8.5/10 All or most of the questions are answered with some critical thought – graph is included and analyzed Proficient 7/10 All or some of the questions are answered but lacking in critical reflection. 7/10 All or some of the questions are answered but lacking in critical thought – graph may be missing or included with limited analysis. 7/10 All or some of the questions are answered but lacking in critical thought and analysis of investment strategy. Basic 6/10 Many errors in mechanics, grammar and spelling. 6/10 Some questions are answered but lacking in critical reflective thought. Minimal 10/10 All questions are answered thoroughly and with critical analysis on investment strategy. 8.5/10 All or most of the questions are answered with some critical reflection is evident. 7/10 Some errors in mechanics, grammar and spelling. 6/10 Investment portfolio submitted but has very little evidence of management over time. Overview 10/10 All questions are answered thoroughly and reflective thought is clearly evident. 8.5/10 Very few errors in mechanics, grammar and spelling. 7/10 Investment portfolio is submitted but has spotty evidence of management over time. 6/10 Some questions are answered but lacking in critical thought and analysis. 6/10 Some questions are answered but lacking in critical thought and analysis – graph not present or seriously lacking in critical analysis. Reflection 10/10 Close attention was paid to mechanics, grammar and spelling. Virtually errorfree. 8.5/10 Investment log is submitted and contains evidence of management. over time. Investment Log Investment Strategy Mechanics 10/10 Investment log is submitted and clearly illustrates active management of portfolio. over time. NAME________________________________________ SCORE ___________________/50