* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

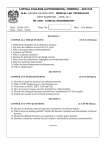

Download Theme 4 A global perspective

Fear of floating wikipedia , lookup

Economic growth wikipedia , lookup

Global financial system wikipedia , lookup

Balance of payments wikipedia , lookup

Balance of trade wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Transformation in economics wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup