* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download UK Economic Forecast Q4 2015 BUSINESS WITH CONFIDENCE icaew.com/ukeconomicforecast

Fiscal multiplier wikipedia , lookup

Business cycle wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Steady-state economy wikipedia , lookup

Non-monetary economy wikipedia , lookup

Chinese economic reform wikipedia , lookup

Economic growth wikipedia , lookup

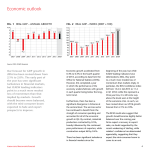

UK Economic Forecast Q4 2015 BUSINESS WITH CONFIDENCE icaew.com/ukeconomicforecast icaew.com/ukeconomicforecast 2 Introduction Welcome to the Q4 2015 ICAEW Economic Forecast, based on the views of the people running UK plc; ICAEW Chartered Accountants working in businesses of all types, across every economic sector and in all regions of the UK, surveyed through the quarterly ICAEW/Grant Thornton UK Business Confidence Monitor (BCM). Key findings this quarter. • Economic growth is expected to slow to 2.4% this year and 2.1% in 2016. We have revised down our forecasts for 2015 and 2016 amid a challenging environment for exports and declining business confidence. • Business investment growth is expected to decline from 5.5% in 2015 to 4.9% next year. With the exception of the energy, water and mining industry, which saw a sharp decline in capital spending this year, all major sectors of the economy expect investment growth to slow or remain unchanged over the next 12 months. • The labour market has picked up after a brief period of rising unemployment. ICAEW expects the unemployment rate to decline further and average at just 4.5% in 2016, as the economy continues to expand, albeit at a slower pace than last year. • Skills shortages are translating into high rates of pay growth in sectors such as construction – here, total earnings in Q3 2015 were 6% higher than a year ago, double the rate of earnings growth across the economy as a whole (which we expect to stand at 2.6% this year and 2.7% in 2016). • The Bank of England is likely to err on the side of caution and keep interest rates on hold until the middle of next year – a subdued environment for inflation gives the Bank room to wait and see how the global economy develops after a tumultuous 2015. The best word to describe the UK economy at present is ‘mixed’. Look beneath the headline growth figures and there are wide variations in economic performance across industry sectors, across regions and across segments of society. The economy remains overwhelmingly services-led, with the production sector of the economy struggling as a weak global outlook curbs export demand. BCM shows confidence for this sector dipping into negative territory in Q4 2015. A lopsided growth profile leaves the UK vulnerable if the sectors and regions driving the economy start to stumble. Uncertainty over the UK’s future membership of the EU and a possible ‘Brexit’ could undermine the country’s role as a global financial and business services centre and as a gateway to Europe. The consumer-led recovery could also easily unravel if there is a premature interest rate rise from the Bank of England, or a surprise sharp increase in inflation. Overall, the UK is continuing to perform well compared with many other major advanced economies, but it undoubtedly has some significant vulnerabilities. icaew.com icaew.com/ukeconomicforecast 3 Economic outlook FIG. 1 REAL GDP – ANNUAL GROWTH FIG. 2 REAL GDP – INDEX (2007 = 100) %4 110 3 2.9 2.6 2 1.5 2.2 2.0 2.4 2.1 1.2 1 108 106 102 -0.5 100 -2 98 -3 96 -4 94 -5 -6 -4.2 2007 2008 2009 105.1 104 0 -1 109.8 107.5 102.1 100 99.5 98.7 99.9 96.8 95.4 92 2010 2011 2012 2013 2014 2015f 2016f 90 2007 2008 2009 2010 2011 2012 2013 2014 2015f 2016f Source: ONS, ICAEW forecasts UK GDP is expected to grow by 2.4% in 2015. Our forecast for economic growth in 2016 has been revised down from 2.6% to 2.1% as ICAEW leading indicators point to a slowdown. The UK economy slowed in the third quarter of 2015, with quarterly GDP growth standing at 0.5%, down from the 0.7% in Q2 2015, according to data from the Office for National Statistics (ONS). Furthermore, the latest data show a worrying divide in economic activity at the sector level. Services continue to account for most of the growth seen in the economy – here, output expanded by 0.7% in Q3 2015. In contrast, economic output actually declined by 0.4% in manufacturing and 2.2% in construction. While there is clearly an economic recovery taking place, as evidenced by continued GDP growth, declining unemployment and rising earnings, it’s clear that not all are benefiting. Some sectors are in decline, huge regional disparities remain and while icaew.com/ukeconomicforecast UK consumers are continuing to spend more money, net trade is acting as a drag on growth as exports are failing to keep pace with imports. The outlook for the UK economy has undoubtedly worsened in recent months, and ICAEW has revised down its 2016 growth forecast from 2.6% to 2.1%, primarily reflecting the negative impact of the deterioration in the global outlook on both business investment and exports. This quarter, the BCM Confidence Index fell to +15.6. This is down from +22.4 in Q3 2015 and is the lowest level of business confidence since the start of 2013. A range of financial performance indicators have weakened, with businesses reporting lower rates of growth for domestic sales, exports and capital spending in the final quarter of the year. 4 Business investment FIG. 3 REAL BUSINESS INVESTMENT – ANNUAL GROWTH % 15 10 9.7 6.0 5 0 -0.7 -16.2 2008 2009 4.9 5.1 2.3 4.6 5.5 4.9 2015f 2016f -5 -10 -15 -20 2007 2010 2011 2012 2013 2014 Source: ONS, ICAEW forecasts Investment intentions weaken as businesses become less confident. We have revised down our forecasts of business investment growth in 2015 and 2016 to 5.5% and 4.9% respectively – down from previous forecasts of 7.4% and 5.9%. This is a reflection of the impact of declining business confidence on investment, with companies reining in spending plans amid uncertainty in the UK and further afield. It has been argued that the National Living Wage, due to be introduced next year, will encourage businesses to invest to make their staff more productive, helping to preserve profit margins in the face of higher wage bills. However, this is not reflected in BCM this quarter. Expected capital spending growth over the next 12 months is lower than at the start of the year. BCM also shows that businesses expect a slower rate of growth in staff development budgets icaew.com/ukeconomicforecast in 2016 than in 2015, casting doubt on the notion that the National Living Wage will lead to higher levels of investment in staff. With the exception of the energy, water and mining industry, which saw a decline in capital spending this year following sharp falls in global commodity prices, all major sectors of the economy expect investment growth to slow or remain unchanged over the next 12 months, which could have a negative impact on productivity. Expected growth rates are very mixed across industries, with BCM suggesting that the property and transport and storage sectors will see the fastest rates of investment growth. In contrast, capital spending will rise only very modestly for manufacturing and engineering, while the energy, water and mining sector will see no growth at all in investment. 5 Labour market FIG. 4 AVERAGE EARNINGS – ANNUAL GROWTH %6 5 4 % 8.5 8.0 4.9 7.9 8.1 8.0 7.6 7.0 2.3 2 2.7 2.6 1.3 1 -1 7.6 7.5 3.5 3 0 FIG. 5 UNEMPLOYMENT RATE 2.7 6.5 6.2 6.0 1.3 1.1 5.5 5.7 5.3 5.0 -0.2 2007 2008 2009 2010 2011 2012 2013 2014 2015f 2016f 4.5 4.5 4.0 2007 2008 2009 2010 2011 2012 2013 2014 2015f 2016f Source: ONS, ICAEW forecasts Source: ONS, ICAEW forecasts After a summer blip, the UK labour market has posted more strong data, with the employment rate standing at a record high. After ticking up slightly in Q2 2015, the unemployment rate declined again in Q3 to stand at just 5.3%. This is down from 5.6% in Q2 and is the lowest rate of unemployment since the first half of 2008. The employment rate for those aged 16–64 stood at 73.7%, the highest since comparable records began in 1971. ICAEW expects the unemployment rate to decline further and average just 4.5% in 2016, as the economy continues to expand, albeit at a slower pace than last year. This is lower than our previous forecast of 4.7%. The decline in unemployment will ensure that wages continue to grow at a solid rate over the coming year. We expect average earnings to rise by 2.7% in 2016, marginally up from a 2015 estimate of 2.6% and icaew.com/ukeconomicforecast 5.4 comfortably above inflation which is likely to remain below 2% on the consumer price index (CPI) measure until 2017 or late 2016. The National Living Wage will also support wage growth over the coming years, though at the expense of slower rates of job creation as the cost of hiring staff rises. Skills shortages appear to be leading to quite drastic rates of wage growth in several parts of the economy. According to BCM, skills shortages are particularly acute in the construction sector. Data from the ONS show that, for the three months to September, total average earnings in the sector were 6% higher than a year ago, double the rate of pay growth seen across the economy as a whole. 6 Focus on: monetary and fiscal policy in 2016 FIG. 6 BANK OF ENGLAND BANK RATE, % FIG. 7 PUBLIC SECTOR NET BORROWING, £BN 7 180 6 160 OBR July 2015 140 OBR November 2015 5 120 4 100 3 60 80 40 2 20 1 0 0 Dec 2005 Dec 2006 Dec 2007 Dec 2008 Dec 2009 Dec 2010 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Dec 2015 -20 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Source: Bank of England, Office for Budget Responsibility Despite global concerns, an interest rate rise might not occur until halfway through 2016. As we approach 2016, there is a growing focus on when monetary policy will start to be normalised across the developed world. The US Federal Reserve looks set to tighten policy very shortly, off the back of strong job creation data. On the other hand, the European Central Bank (ECB) may actually loosen policy further to support the eurozone’s ailing economy. The ECB has given strong indications that an expansion of its quantitative easing programme is on the cards for 2016. The UK sits between these two economies. It is more exposed to the current global economic turmoil than the US, which has a greater degree of self-sufficiency, yet its economy is performing considerably better than the eurozone. On balance, a Bank of England rate rise around the middle of 2016 looks fairly likely at present. icaew.com/ukeconomicforecast Bank Governor Mark Carney has suggested that rates will remain unchanged ‘for some time’. Minutes from the Bank of England Monetary Policy Committee’s November meeting revealed just one of the committee’s nine members – Ian McCafferty – voted for a rate rise. It could be a while before others are on board with him. Global commodity prices are expected to remain subdued amid weak demand and rising supply in areas such as oil, meaning inflation should be contained over the medium term even with low rates. An interest rate rise would lead to an appreciation of sterling, making UK exporters, who are already struggling, less cost competitive. An early rate rise could also lead to a dramatic downturn in parts of the property market that are arguably overvalued 7 Focus on: monetary and fiscal policy in 2016 – such as London. If property market bubbles need to be contained, this should be done in a managed way, preferably using macroprudential tools (such as mortgage restrictions) rather than interest rate rises. Overall, the balance of arguments continues to lean in favour of keeping rates on hold for now. 2016 should also be an interesting year for fiscal policy. In November’s Autumn Statement, the Chancellor revealed public borrowing projections that were broadly unchanged from July, despite a U-turn on proposed tax credit cuts and a significant increase in spending on housing. This reflects in part a more optimistic assessment of economic growth by the Office for Budget Responsibility (OBR) compared with July. The Chancellor also imposed a new tax on buy-to-let investors, with a higher rate of stamp duty for properties purchased. This comes on top of July’s Budget move to reduce tax reliefs associated with buy-to-let. icaew.com/ukeconomicforecast (continued) Many believe that the OBR economic growth forecasts are too optimistic beyond this year. ICAEW, for example, believes the economy will expand by 2.1% in 2016, compared with the OBR forecast of 2.4%. The OBR seems particularly optimistic on the outlook for business investment growth next year, anticipating an acceleration in contrast to our forecast of a deceleration. ICAEW business survey data show little appetite to ramp up capital spending at the moment. The Chancellor made sure that the borrowing figures in the Autumn Statement continued to show the deficit being eliminated by the end of this parliament. But this depends on solid economic growth. If the economy slows after this year, the Chancellor will be forced to adjust his borrowing targets, cut spending further or raise taxes – or some combination of the three. What he chooses is up to him. 8 Forecasting methodology Headline economic forecasts 2007 2008 2009 2010 2011 2012 2013 2014 2015f 2016f Real GDP – annual growth % +2.6 -0.5 -4.2 +1.5 +2.0 +1.2 +2.2 +2.9 +2.4 +2.1 Real business investment – annual growth % +9.7 -0.7 -16.2 +6.0 +4.9 +5.1 +2.3 +4.6 +5.5 +4.9 2007 2008 2009 2010 2011 2012 2013 2014 2015f 2016f Earnings (total pay) – annual growth % +4.9 +3.5 -0.2 +2.3 +2.7 +1.3 +1.3 +1.1 +2.6 +2.7 Employment – annual growth % +0.8 +0.9 -1.6 +0.2 +0.5 +1.1 +1.2 +2.3 +1.3 +1.4 Unemployment rate % +5.3 +5.7 +7.6 +7.9 +8.1 +8.0 +7.6 +6.2 +5.4 +4.5 Labour market forecasts ICAEW’s forecasts for economic growth, business investment and the outlook for the labour market are based on the correlation between ICAEW/Grant Thornton Business Confidence Monitor (BCM) indicators and official economic data. BCM contains data – from a survey of 1,000 UK businesses – on business confidence, financial performance, challenges and expectations. BCM indicators provide a useful and unique steer on future developments in the UK economy. icaew.com/ukeconomicforecast 9 About Cebr Centre for Economics and Business Research is an independent consultancy with a reputation for sound business advice based on thorough and insightful research. Since 1992, Cebr has been at the forefront of business and public interest research. They provide analysis, forecasts and strategic advice to major UK and multinational companies, financial institutions, government departments and agencies and trade bodies. For further information about Cebr please visit www.cebr.com ICAEW is a world leading professional membership organisation that promotes, develops and supports over 144,000 chartered accountants worldwide. We provide qualifications and professional development, share our knowledge, insight and technical expertise, and protect the quality and integrity of the accountancy and finance profession. As leaders in accountancy, finance and business our members have the knowledge, skills and commitment to maintain the highest professional standards and integrity. Together we contribute to the success of individuals, organisations, communities and economies around the world. Because of us, people can do business with confidence. ICAEW is a founder member of Chartered Accountants Worldwide and the Global Accounting Alliance. www.charteredaccountantsworldwide.com www.globalaccountingalliance.com ICAEW Chartered Accountants’ Hall Moorgate Place London EC2R 6EA UK T +44 (0)20 7920 8705 E [email protected] icaew.com/ukeconomicforecast linkedin.com – find ICAEW twitter.com/icaew facebook.com/icaew © ICAEW 2015 MKTDIG14613 12/15