* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 19

Degrees of freedom (statistics) wikipedia , lookup

History of statistics wikipedia , lookup

Bootstrapping (statistics) wikipedia , lookup

German tank problem wikipedia , lookup

Resampling (statistics) wikipedia , lookup

Misuse of statistics wikipedia , lookup

Taylor's law wikipedia , lookup

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

MORE ON VARIATION

AND DECISION MAKING

UNDER RISK

1

19. Learning Objectives

1. Understand certainty and risk.

2. Examine variables and distributions.

3. Relate to the context of random

variables.

4. Estimate expected value and standard

deviation from sampling.

5. Understand and apply Monte Carlo

techniques and simulation to

engineering economy problems.

2

19.1 Certainty, Risk, and Uncertainty

It is said, “There is nothing certain in

this world other than death and taxes.”

Situations and the passage of time

create change, variation, instability.

Engineering economy deals with

aspects of a very uncertain future.

3

19.1 A Parable worth remembering

Yesterday is history…

today is “now”…

and tomorrow is a mystery.

Putting this into perspective:

Accountants deal with yesterday.

Engineers deal with tomorrow…

when it comes to engineering economy.

So, how can we deal with the

uncertainties of future estimation?

4

19.1 Certainty

Most of the chapters in this text have

presented problems where values were

given:

Assume certainty of occurrence;

Sorry, the real world is not like that!

About the only “certain” or near-certain

parameter in a problem might be the

purchase price of an asset; the rest of

the parameters will vary with time.

5

19.1 Decision Making under Risk

Risk is associated with knowing the

following about a parameter:

1. The number of observable values

and,

2. The probability of each value

occurring.

3. We know the “state of nature” of the

process at hand.

Decision making under risk

6

19.1 Decision Making under Uncertainty

We will have two or more observable

values;

However, we find it most difficult to

assign the probability of occurrence of

the possible outcomes;

At times, no one is even willing to try to

assign probabilities to the possible

outcomes.

7

19.1 Discrete vs. Continuous Outcomes

If a parameter is “discrete,” then there

are a finite number of occurrences that

can occur, and we attempt to assign a

probability for each outcome.

If a parameter is continuous in nature,

then it can take on an infinite number of

values between two set limits, and we

would have to deal with continuous

functions.

8

19.1 Example 19.1

Two individuals assessing wedding

costs: (Charles and Sue)

Charles’ estimates are (subjective)

Estimated Costs

Prob(Cost)

$3,000

0.65

$5,000

0.25

$10,000

0.10

9

19.1 Ex. 19.1 Histogram Plot: Charles

Output produced

by Palisade’s

RiskView Excel

add-in software.

Note the mean

value for

Charles:

$4,200 for the

wedding

costs.

10

19.1 Example 19.1

Sue, on the other hand, estimates the

following estimated costs for the

Estimated Costs

Prob(Cost)

$8,000

0.333

$10,000

0.333

$15,000

0.333

You should feel sorry for Sue’s father:

He will have to pay for the wedding!

11

19.1 Sue’s Probability Distribution

Sue’s mean

value for the

wedding is

$11,000.

12

19.1 The Merged PDF Plots for Charles and Sue

After discussion, they

agree that the wedding

should cost from

$7,500 to no more than

$10,000 with equal

probability.

The agreed-to distribution

uniform from

7,500 to 10,000

with equal

probability.

13

19.1 Before a Study Is Started:

Must decide the following:

Analysis under certainty (point estimates);

Analysis under risk:

Assign probability values or distributions

to the specified parameters;

Account for variances;

Which of the parameters are to be

probabilistic and which are to be treated

as “certain” to occur?

14

19.1 Two Ways to Account for Risk

1. Expected Value Analysis

1. Discrete or continuous?

2. Must assign or assume

probabilities/probability distributions.

2. Simulation Analysis

1. Assign relevant probability distributions:

2. Generate simulated data by applying

sampling techniques from the assumed

distributions.

15

19.1 Analysis under Uncertainty

This is the “worst” situation to be in.

Here, the states of nature may or may

not be known, or;

States of nature may be defined, but

assignment of probability distributions is at

best “a shot in the dark.”

What do you do?

Try to move from a degree to an improved

level of acceptable risk. (Hereon, we assume

decision making under risk.)

16

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

19.2

ELEMENTS IMPORTANT TO DECISION

MAKING UNDER RISK

17

19.2 Basic Probability and Statistics

RANDOM VARIABLE

A rule that assigns a numerical outcome to a

sample space.

Describes a parameter that can assume any

one of several values over some range.

Random Variables (RV’s) can be:

Discrete or,

Continuous.

18

19.2 Two Types

Discrete – assumes only

finite values.

Continuous –

can assume an infinite

number of values over

a defined range.

19

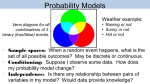

19.2 Probability

A number between 0 and 1.

Represents a “chance” of some event

occurring.

Notations:

P(Xi),

P(X = Xi): read as: “The probability that the

random variable, X, assumes a value of, say,

Xi”

20

19.2 Probability

For a given event and all of that event’s

possible outcomes:

The summation of the probabilities for all

possible outcomes must sum to 1.00.

A probability assignment of “0” means that

the event is impossible to occur.

21

19.2 Probability Distributions

A function that defines

how probability is

distributed over the

different values a random

variable can assume.

22

19.2 Probability Distributions

Individual probability values are stated as:

P(Xi) = probability that X = Xi

[19.1]

“X” represents the random variable or rule (math

function, for example)

Xi represents a specific value generated from the random

variable, X.

Remember, the random variable, X, is most likely a rule or

function that assigns probabilities.

23

19.2 Probability Distributions

Probabilities are developed two ways:

1. Listing the outcome and the

associated probability:

2. From a mathematical function that is

a proper probability function.

24

19.2 Cumulative Probability Distribution

Cumulative Probability Distribution, or

CDF – Cumulative distribution function:

Represents the accumulation for

probability over all values of the

variable.

Notation: F(Xi)

25

19.2 The CDF General Form

F(Xi)= P(X

Xi) for all i in the domain of X.

26

19.2 Example 19.2 Data

No of

Treatments Per

Day

0

Prob. of

Infection

Reduction

0.07

1

0.08

2

0.10

3

0.12

4

0.13

5

0.25

6

0.25

Discrete data with

seven possible

outcomes. The

probabilities were

most likely developed

from experimental

observations.

27

19.2 Example 19.2 CDF Computed

No. of

Treatments Per

Day

0

Prob. of

Infection

Reduction

0.07

Cumulative

Probability

1

0.08

0.15

2

0.10

0.25

3

0.12

0.37

4

0.13

0.50

5

0.25

0.75

6

0.25

1.00

0.07

28

19.2 Discrete Probability Distributions

PDF and CDF from Example 19.2

29

19.2 Continuous Distribution: Uniform

If the distribution in question

represents outcomes that can assume

a continuous range of values, then:

The model is described by some

assignment of fitted continuous-type

distribution.

One common type of distribution is the:

UNIFORM DISTRIBUTION

30

19.2 Uniform Distribution

Discrete or continuous:

For the continuous case, new notation:

Let f(X) denote the PDF of the

random variable;

F(X) denotes the cumulative

density function (CDF) of the

random variable.

31

19.2 Equal Probability

For the uniform distribution:

All of the values from A to B are considered

equally likely to occur.

Thus, all values from A to B have the same

probability of occurring.

See example 19.3 for cash-flow

modeling.

32

19.2 Example 19.3 – Cash-Flow Modeling

Client 1

Estimated low cash flow: $10,000

Estimated high cash flow: $15,000

Distributed uniformly between $10,000 and

$15,000.

The cash flow is assumed to be best

described as a uniformly distributed

random variable between $10,000 and

$15,000.

33

19.2 Example 19.2: Client 1 Distribution

PDF –

Uniform{10k

–

15k}

CDF

from the PDF

34

19.2 Parameters for the Uniform

Density f(X):

1

1

f (X )

Max Min B A

Cumulative Density, F(X):

x min

x A

F(X )

Max Min B A

35

19.2 Uniform Distribution

Mean:

Min Max A B

2

2

Variance:

( Max Min)

( B A)

Var ( )

12

12

2

2

2

X

36

19.2 Client 1: Question

What is the probability that the

monthly cash flow will be no more than

$12,000?

P(X 12,000) = F(12,000);

A = 10,000; B = 15,000

f(X) = 1/(15 – 10) = 1/5 = 0.200

F(12) = Cumulative of “12”;

= (12 – 10)/5 = 4/5 = 0.80:

80% chance that the CF will be $12,000

or less!

37

19.2 Example 19.3: Client 2

Parameters for Client 2:

Assumed Distribution – Triangular

Parameters:

Low =

Most Likely:

High:

20 ($ x 1000)

28 ($ x 1000)

30 ($ x 1000).

The triangular distribution is used to

model Client 2’s cash flow.

38

19.2 Triangular Distribution

Typical Triangular pdf and cdf:

PDF – Client 2

CDF – Client 2

39

19.2 Parameters for a Triangular

L = low value;

M = most likely;

H = High value.

f(X) is in two parts:

2( X L)

f ( x)

if L X M

( M L)( H L)

or,

2( M X )

f(x) =

if M X H

( M L)( H M )

40

19.2 Example 19.2: Client 2, P(X 25,000)

“M” is the mode of the distribution;

Mode is the most frequently occurring

value.

For the Triangular:

f(mode) = f(M) = 2/(H-L);

(19.5)

Cumulative F(M) = (M-L)/(H-L)

(19.6)

f(28) = 2/(30-20)= 0.2 = 20%

The breakpoint is at the mode, M = 28;

F(28) = P(X 28) = (28-20)/30-20) = 0.8

41

19.2 Example 19.3: Client 2 Analysis

Given the CDF, F(X) one

locates 25 on the xaxis, projects up to the

curve and over to read

off 0.3125.

42

19.3 Random Samples

Assume an economic parameter can be

described by a random variable – X.

We assume that the random variable,

X, possesses a true mean and variance

denoted by:

- the parameter’s true (but possibly

unknown) mean value and;

2 – the parameter’s true (but possibly

unknown) variance.

43

19.3 Random Samples – Population

A population is defined as a collection of

objects, elements, or all of the possible

outcomes a variable can assume.

A population may be:

Infinite in number, or

Finite.

A population is characterized numerically

by the population parameters.

44

19.3 Random Samples: Population Parameters

Just as a random variable, a population

possesses (numerically) a:

Mean ,

Variance 2.

In practice, we can define the

population, but probably do not know

the true mean and variance of the

population.

45

19.3 Random Samples: Inference

In the area of applied statistics, one

usually samples from the defined

population in order to make inferences

concerning the population.

There is always uncertainty present

when one samples from a parent

population.

This is why the area of probability is

usually studied before one studies

statistics.

46

19.3 Random Samples: Key Relationships

The diagram below presents an

overview of the relations between:

Populations, probability, a sample, and

statistics.

Probability

Sample

Population

Statistics

Ref: Probability and Statistics for Engineering and the Sciences, 4th Edition, Jay

Devore (Duxbury), p. 3.

47

19.3 Random Sample: Point Estimate

In many cases we assume certainty.

We supply a point estimate of the

parameter in question.

A point estimate is a sample of size 1

taken from the specified population.

An analysis under “certainty” is

essentially applying a point estimate,

which is a sample of size 1.

48

19.3 Random Sample

If we research the parameter of

interest and make another estimate,

then we have:

The original estimate and,

A second estimate:

So that we now have a sample of size 2.

A point estimate is then:

The most likely value we perceive at the

time of the estimate, or a mean value

estimate.

49

19.3 Random Sample

A population is comprised of two or

more outcomes (values).

The population mean,

, is:

N

x

i 1

N

i

Often, we attempt

to estimate from

a sample drawn

from the

population.

50

19.3 Random Sample

A random sample of size n is the

selection – in a random fashion – of n

values from the specified population.

Random means the sampling procedure

assumes or requires that every element

in the population has an equally likely

chance of being in the sample.

51

19.3 Random Sample: Variability

We assume that the values that make

up a population are not all the same

value.

The values perhaps are all different, or

mostly so.

Thus, a population possesses a concept

termed:

Variance

52

19.3 Variance of a Population

Variance of a population is a measure

of the dispersion of every element in the

population from the mean value of the

population.

If all of the values in the population are

numerically “close,” then the variance

will be “small.”

If the values are not all close, then the

associated variance will be “larger.”

53

19.3 Variance – Defined for a Population

Variance of a population – denoted as

Var(X) computationally, is:

N

2

(x

)

i

2

i=1

N

Squaring the term in ( ) removes the effects of negative

signs in the summation.

54

19.3 Population Variance

N

2

(x

i

)

2

i=1

N

The variance is the sum of the squared

deviations about the population mean. Small

deviations generate a smaller variance: Large

deviations generate a larger variance.

55

19.3 Concept of Variance and Sampling

We sample to learn something about

the specified population.

We can use sample results (mean,

variance,…) as estimates of the random

variable in question.

Large sample sizes (say 30 or more)

yield more precision in an estimate as

opposed to small samples (under 30).

56

19.3 Random Sample: Simulation

One “samples” from a population to

either draw inferences about the

population, or:

To simulate the population.

Simulation is the art and science of

generating artificial data from one or more

random variables using statistical sampling

techniques.

57

19.3 Sampling and Variability

If a population possesses a high degree

of variance among its members, then:

Samples drawn from that population will

likely possess high variance:

High variance inhibits precise estimates;

The higher the variability of a population

the less reliable sample estimates will be.

Variability is a key factor is estimation.

58

19.3 Reviewing the Uniform Distribution

Assume a uniform distribution where A

= 0 and B = 1.

The mean of

the {0,1}

uniform is

0.5

59

19.3 Generating Uniform {0,1} Random Numbers

The Uniform Distribution – U{0,1} – is,

by far, the most widely used distribution

in all of statistics.

Numerous software programs in a

variety of languages have been written

to generate random numbers from

0 to 1.

Excel supports a random number

function generator.

60

19.3 Random Sample

Excel’s RAND Function

RAND( )

Remarks

To generate a random real number between a and b,

use: RAND()*(b-a)+a

If you want to use RAND to generate a random number,

but don't want the numbers to change every time the cell

is calculated, you can enter =RAND() in the formula bar,

and then press F9 to change the formula to a random

number. Ref. Microsoft’s Excel Help Data base.

61

19.3 Excel’s RAND Function

By marking and dragging the top

cell down, Excel will generate a

different random number in each cell.

62

19.3 Random Numbers Other Than {0,1}

Excel supports the RANDBETWEEN

function.

RANDBETWEEN(bottom,top)

Bottom is the smallest integer

RANDBETWEEN will return.

Top is the largest integer RANDBETWEEN

will return.

63

19.3 RANDBETWEEN Function

Formula Description:

(Result)=RANDBETWEEN (1,100)

Returns a uniformly distributed number

between 1 and 100

64

19.3 RANDBETWEEN Function

Formula Description:

(Result)=RANDBETWEEN (1,100)

Returns a uniformly distributed

number between 1 and 100

65

19.3 RANDBETWEEN Function – Example

66

19.3 Sampling from a Discrete Distribution

Our objective is to initiate simulating

outcomes from a discrete probability

distribution.

We apply a process known as the:

Inverse Transform Method.

This is part of a process known as:

Monte Carlo Sampling

Derived from the development of the atomic

bomb in 1943 – 45 in the U.S.

67

19.3 Simulating from a Discrete Process

First, one defines the probability

distribution set: Use Example 19.4

Given a discrete probability set with

three possible outcomes:

{ 24, 30, and 36).

0.20 N = 24

P( X Ni ) 0.50 N = 30

0.30 N = 36

68

19.3 Example 19.4: Step 1

Generate the pdf and cdf.

PDF

CDF

69

19.3 Example 19.4: Step 2

Using the CDF, fix a sample size.

Assume “n” = 10.

Generate 10 U{0,1} random numbers.

Assume the 10 numbers are as shown

in Example 19.4

70

19.3 Example 19.4: 10 Uniform RN’s

Sample

No.

Random

Number

1

45

2

44

3

79

4

29

5

81

6

58

7

66

8

70

9

24

10

82

• Next, “map” the RN onto

the CDF to observe the

outcome for that random

number.

• The RN is located on the

y-axis: Project over to the

CDF curve, then down to

the x-axis and read the

associated outcome. This

is called the inverse

transform method.

71

19.3 Example 19.4: First RN = 45

First RN = 45

(Assume 0.45)

Observe the

outcome as N =

30 months

72

19.3 Example 19.4: Continue With Other RN’s

73

19.3 Summary of Outcomes for n = 10

From example 19.4, the 10

“simulated” outcomes are

shown on the next slide.

74

19.3 Summary of Outcomes for n = 10

Sample

No.

Random

Number

Simulated

Outcome

1

45

30

2

44

30

3

79

36

4

29

30

5

81

36

6

58

30

7

66

30

8

70

36

9

24

30

10

82

36

The simulated

outcomes are

proportional to

the originally

assigned

probabilities.

75

19.3 Sample Size Questions

A sample of size 10 is not sufficient to

perform a reasonable simulation

analysis for a real-world problem.

In simulation modeling of cash flows,

sample size is a critical issue.

Obviously, larger sample sizes are

better (provide more information and

better approximate the situation being

evaluated).

76

19.3 Sample Statistics for n = 10: Example 19.4

Sample

No.

1

2

3

4

5

6

7

8

9

10

Mean

Var

Std-Dev

Outcome

30

30

36

30

36

30

30

36

30

36

32.40

9.60

3.10

From a sample of size 10, the

sample mean is 32.40 with an

associated variance of 9.60.

77

19.3 Continuous Process

If the process under study is

considered “continuous,” then the

associated pdf and cdf must be

generated.

Assume a continuous uniform

distribution to illustrate.

Use Example19.3, Client 1’s data.

Est. low cash flow:

$10,000

Est. high value:

$15,000

Mean = (10 + 15)/2 = 12.5 ($12,500)

78

19.3 Sampling from a Continuous Uniform

Graphical Approach:

Fix the sample size (use 10 again).

Generate 10 U(0,1) random numbers.

Generate the CDF for the uniform and

plot.

Similar Procedure as the discrete case.

The pdf and cdf for the uniform are

presented on the next slide.

79

19.3 PDF and CDF for the Uniform (10,15)

We “sample” always from the CDF!

“Map” the RN over

to the CDF curve.

Generate a U{0,1}

random number.

Project down

to x-axis for

the outcome.

80

19.3 For Example 19.4: Client 1

Assume the RN is “45.”

This can be interpreted as 0.45.

Locate 0.45 on the y-axis;

Project to the right to intersect the CDF

curve;

Then project down to the x-axis to read

the associated outcome for y = 0.45.

81

19.3 Example 19.4: Using the Uniform CDF

RN = 0.45

outcome given

RN = 0.45

is

X = 12.5.

This would be

the first outcome

for the first

sample.

Repeat for all

other RN,s.

82

19.3 Random Number Generation

Excel and all other simulation software

support the generation of uniform

random numbers.

A U(0,1) random number generator

(software program) will generate a

sequence or stream of random numbers

between 0 and 0.99999.

“0” and “1” cannot be generated due to

software and floating point arithmetic

associated with digital computers.

83

19.3 Question of Sample Size

For simulation of cash flows using

computer software, the sample size can

be virtually as large as the analyst

desires (10,000 or more is not

uncommon).

Sampling is based upon:

The Law of Large Numbers, and

The Central Limit Theorem of statistics.

84

19.3 Sample Sizes

Small samples – less than 30

Apply the t-distribution from statistics.

Large Sample sizes – 30 or more.

Simulation studies – 1,000 to 20,000 per run

are not uncommon and take very little

computer time.

Obviously, the larger the sample the

greater the reliability of the use of the

values.

85

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

19.4

EXPECTED VALUE COMPUTATIONS

FOR ALTERNATIVES

86

19.4 Expected Value

Given a random variable – X.

Two important properties:

Expected Value of X; denoted E(X).

Variance of X. denoted Var(X).

IF the entire population was known

and available, then all parameters could

be calculated directly!

87

19.4 Why Sample?

One samples from a population in an

attempt to estimate some property or

value of a true but unknown population

parameter.

Thus, random samples are drawn or

generated from the population in

question to estimate, say, a population

parameter.

88

19.4 Common Estimators

Given a population with population

parameters:

– the population’s mean value;

2 – the population’s variance.

We focus on estimating the mean

value – – of a population.

89

19.4 Notation Concerns

We focus on two sets of notation:

Set 1: Population Parameters

Denoted by Greek symbols

- Population mean;

2 - population variance;

- population standard deviation.

Set 2: Sample Estimators

X

Mean of a sample of size “n.”

s2 – Sample variance

s – Sample standard deviation

90

19.4 Expected Value (Operation)

Expected Value is the long-run

expected average if the variable is

samples from a large number of times.

Estimating a population mean – .

X i P( X i ) if X a discrete random variable.

E ( x)

91

19.4 Mean of a Sample of Size “n”

Sample mean

Take or extract a sample of size “n”

from a population.

We require that the sample be

“random” – every element in the

population has an equally likely chance

of being selected:

If not, the sample is “biased.”

Compute the sample mean value…

92

19.4 Sample Mean Value: X-bar

The mean of a sample of size “n” is:

n

X

x

i

i

n

93

19.4 The Sample Mean

Measure of central tendency of a set of

values.

The sample mean X is termed an

unbiased estimator of the population

mean – ..

Unbiased means:

E( X )

94

19.4 Sample Mean

Thus, a sample of sufficient size is

taken, say 30 or more:

The sample mean is calculated from the

sample data:

The sample mean, X, is then used as a

point estimate of the true but unknown

population mean value, .

95

19.4 Unbiased Estimator

An estimator or the process of

calculating the estimate should:

Provide a numerical result that is close to

the population parameter being estimated.

Not “biased” in any way.

The mean of a sample of size n is termed an

unbiased estimator of the population mean.

This is why a sample mean is often used as a

reliable “point” estimator.

96

19.4 Other Measures of Central Tendency

Mean – already been discussed.

Mode:

The value that most frequently occurs in a

population or in a sample.

The mode is a biased estimator of the

population mean.

Median:

The value where 50% of the observations

occur below the median value and 50%

occur above the median value (biased

estimator).

97

19.4 Measures of Variability

Variance of a population:

N

2

(x

)

i

2

i=1

N

98

19.4 Standard Deviation of a Population

The standard deviation of a population;

Denoted as is:

N

(x

i

)

2

i=1

N

99

19.4 Variance: Notes

2 = Var(X);

X Var(X)

2

X

100

19.4 Sample Variance and Standard Deviation

Sample of size “n.”

s

2

(

X

X

)

i

s s

n 1

2

101

19.4 Computational Form of the Variance

An alternative form for computations of

a sample variance is:

s

2

X

2

n

2

X

n 1 n 1

i

102

19.4 Sample Variance and Standard Deviation

Sample of size “n.”

s

2

(

X

X

)

i

n 1

Note: The variance is the sum of the squared distances

2

(deviations) that each variable in the sample is from the

mean value of the set. The divisor (n-1), is required to

permit s2 to be an unbiased estimator of 2 .

s s

103

19.4 Combining the Mean and the Variance

It is customary to refer to the following

values above and below a mean value.

X (t )( s)

Where “t” is usually equal to { 1, 2, 3 }

104

19.4 t = 1, 2, 3:

In most engineering economy applications

we will find:

Virtually all of the sample values in the sample

will be within 3 standard deviations of the

mean value of the sample.

For the normal distribution (Example

19.10) we will find that well over 99% of

the normally distributed values will be

within 3 standard deviations of the mean

value of the sample.

105

19.4 Sample Distributions

Different means and standard

deviations illustrated.

106

19.4 Example 19.5

Utility bills from two different

populations (North American Data)

Sample

No.

1

2

3

4

5

6

7

Mean

X

40

66

75

92

107

159

275

116.29

(x-xbar)

-76.29

-50.29

-41.29

-24.29

-9.29

42.71

158.71

Sum

Sq'd

Dev.

5819.51

2528.65

1704.51

589.80

86.22

1824.51

25190.22

37743.43

107

19.4 Example 19.5

Utility Bills from two different

populations (Asian Data)

Sample

No.

1

2

3

4

5

Mean

X

84

90

104

187

190

131.00

(x-xbar)

-32.29

-26.29

-12.29

70.71

73.71

Sum

Sq'd

Dev.

1042.37

690.94

150.94

5000.51

5433.80

12318.55

108

19.4 Comparisons…

The dispersion of the data for the Asian

sample is smaller that that of the North

American sample.

Analysis from Excel is shown on the

next slide…

109

19.4 Comparing the Two Samples

North American

Sample

X

No.

1

40

2

66

3

75

4

92

5

107

6

159

7

275

Mean

116.29

Var

6,290.57

StdDev

79.313123

Max

275

Min

40

Range

235

• The variance of the

NA sample is larger

than the variance of

the Asian sample.

• Note: The Range

(Max – Min) for the

NA sample is also

higher.

• The NA sample

contains more

variability than the

Asian sample.

Asian

Sample

No.

1

2

3

4

5

Mean

Var

StdDev

Max

Min

Range

X

84

90

104

187

190

131.00

2,809.00

53

190

84

106

110

19.4 Deviation Ranges for Example 19.4

Examine:

(1)(s) and (2)(s) “bands” for the NA data.

Standard deviation for NA: 79.31

Sample mean: 116.29

X 1s 116.29 (1)79.31 $36.98 to 195.60

Six out of seven data values fall in this range, or 85.7%.

X 2 s 116.29 (2)79.31 -42.33 to 274.91

111

19.4 Dispersion for Both Samples (Fig 19-9)

112

19.4 Continuous Functions: Summarization

Continuous PDF’s:

Replace summations with integrals;

Over the defined range of the random

variable in question.

Let R represent the defined range of the

specific pdf.

P(X) is replaced by the differential element

f(x)dx.

113

19.4 Key Relationships for Continuous RV’s

If the random variable is described by a

continuous function, the following

relationships hold:

E(X)= X(0.2)dX =

R

0.1X

2 15

10

= 0.1(225 - 100) = $12.5

E(X) = = $12.5

114

19.4 Var(X): Continuous Uniform

The variance of the continuous uniform

is:

Var(X) = X (0.2)dX-12.5 =

2

2

R

0.2

3

X

3

15

(12.5)

2

10

= 0.06667(3375 - 1000) - 156.25 = 2.08

X 2.08 $1.44

115

19.4 Summary

For a continuous Uniform{10,15};

Then mean = $12.5;

The variance is 2 = Var(X) =

2.08

The standard deviation =

$1.44

Thus, the mean for U{10,15} = $12.5

and the variance = 2.08.

116

19.4 Next…

The next section presents an

overview of a fundamental

simulation methodology

termed,

Monte Carlo Sampling

and…

introduces basic Simulation of

cash flows.

117

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

19.5

MONTE CARLO SAMPLING AND

SIMULATION ANALYSIS

118

19.5 Monte Carlo Sampling

Monte Carlo Sampling is a traditional

approach (method) for generating pseudorandom numbers to sample from a

prescribed probability distribution.

Pseudo-random refers to the fact that a

digital computer can generate

approximate random numbers due to fixed

word size, and can round off problems.

119

19.5 Monte Carlo Sampling

Requires:

The CDF of the assumed pdf;

A uniform random number generator;

Application of the inverse transform approach.

Why require the CDF?

The y-axis of a CDF is scaled from 0 to 1.

That is the same as the range of U(0,1).

Facilitates mapping of an RN to achieve the

outcome value on the x-axis.

The U(0,1) selects a X-value from the CDF.

120

19.5 Monte Carlo Sampling Illustrated

Cumulative

Probability

A U(0,1) R. N.

Xj

121

19.5 Simulation Using Monte Carlo Sampling

Formulate the economic analysis:

The alternatives – if more than one;

Define which parameters are “constants” and

which are to be viewed as random variables.

For the random variable(s), assign the

appropriate PDF:

Discrete and or continuous.

Apply Monte Carlo sampling – a sample size of

“n” where it is suggested that n 30.

Compute the measure of worth (PW, AW,…)

Evaluate and draw conclusions.

122

19.5 Simulation Assumptions

It is assumed that:

All parameters are independent;

The value of a given parameter in no way

impacts or influences the value of another

parameter.

This is termed:

The property of independent random

variables.

123

19.5 Example 19.7: Overview System 1

Two alternative systems ( i = 15%/yr.);

System 1

P = $12,000, no salvage value.

n1 = 7 years;

No annual net revenue is offered.

Considered a “high risk” venture.

Assumption: NCF1-5 modeled by a

continuous U(-$4,000, +$6,000) – analyst's

best guess.

Certainty: P = $12,000 and n = 7!

124

19.5 Example 19.7: Overview System 2

System 2

P = $8,000, no salvage value.

Annual net revenue = $1,000 for each of the

first 5 years;

But after 5 years, no guarantee of future

revenues.

Equipment updates may be useful up to 15

years – BUT, the exact number of years is

unknown.

Cancel any time after 5 years.

125

19.5 Example 19.7: Overview System 2

Variable Assumptions:

P2 = $8,000;

NCFG = $1,000 first 5 years;

NCF2 years 6, 7, … assumed to follow:

Discrete uniform($1,000 to $6,000) in

$1,000 increments.

N2 after t = 5 assumed to be continuous

U(6,15)

126

19.5 Define the Random Variables

System 1:

NCF1 = U(-4000,6000)

System 2: NCF2:

DiscreteU(1000,6000)

=1000

System 2: n2 U(6,15)

127

19.5 Systems 1 & 2 PW Formulations

PW1 = -P1 + NCF1 (P/A,15%,n1)

[19.17]

PW2 = -P2 + NCFG(P/A,15%,5) +

NCF2(P/A,15%,n2-5)(P/F,15%,5)

[19.18]

• Terms in

represent varying parameters.

• NCFG = the guaranteed cash flow for System2

128

19.5 Summarizing: Analytical Setup

PW1 = -12,000 + NCF1(P/A,15%,7)

= -12,000 + NCF1(4.1604)

[19.19]

PW2 = -8000 + 1000(P/A,15%,5)

+ NCF2(P/A,15%,n2-5)(P/F,15%,5)

= -4648 + NCF2(P/A,15%,n2-5)(0.4972)

[19.20]

At this point – Design a spreadsheet model to

conduct a simulation for, say, n = 30 samples.

129

19.5 Example 19.8: Spreadsheet Model

Simulate NCF1 First 5 Values Shown…

C

D

E

=RAND()*100

Sample No

6

7

8

9

10

1

2

3

4

5

RN1(100)

NCF1-$

12.5625

0.5158

12.0306

73.8529

30.3512

-$2,800

-$4,000

-$2,800

$3,300

-$1,000

=INT((100*$C74000)/100)*100

Important Note: The values shown in this simulation

may not match the values shown in Figure 19-12

due to inability to generate the same exact sequence

of U(0,1) used in the text.

130

19.5 Generating NCF2

NCF2 =

DiscUniform{1,000,6,000,=1,000}

Six possible outcomes;

{1,000,2,000,3,000,4,000,5,000,6,000}

P(each outcome) = 1/6 =0.1667

The categories will be as shown on the

next slide…

131

19.5 NCF-2 CDF Assignments

RN from-to

NCF2 will Equal….

00 – 16

$1,000

17-32

$2,000

33-49

$3,000

50-66

$4,000

67-82

$5,000

83-99

$6,000

132

19.5 Generating NCF-2 in Excel

In Excel this will require a complex IF

statement to slot the generated RN into

the appropriate outcome value.

We will apply a Nested IF construct.

F

G

Sample No. RN2(100)

6

7

8

9

10

1

2

3

4

5

83.6176

26.5754

18.6240

27.0229

13.4377

H

NCF2-$

$6,000

$2,000

$2,000

$2,000

$1,000

=IF($G7<=16,1000,

IF($G7<=32,2000,IF($

G7<=49,3000,IF($G7

<=66,4000,IF($G7<=8

2,5000,IF($G7<=100,

6000,6000)

133

19.5 Generating n2

The random variable – n2, represents the

time period in years AFTER t = 5.

We know that System 2 will have at least

a 5-year life, but could go up to as much

as 15 years.

We need to simulate the number of years

after t = 5, and then apply the (P/A, n2-5)

to come back to t = 5. See [19.18, 19.20]

134

19.5 “n2” Analysis: The PDF

The n2 random variable is defined as:

Continuous Uniform{6,15}

f(x) = 1/(16-9)

= 1/9 = 0.1111

Mean = 10.

135

19.5 The CDF for n2

X = 15

136

19.5 Generating n2 Life

We use the CDF for the uniform.

Specific problem of the CDF is:

F(X) = (x-Low)/(High – Low);

F(X) = (X -6)/(15-6);

F(X) = (X-6)/9.

Set F(X) = a U(0,1) say, RNj

Then, RNJ = (X-6)/9; (solve for X).

X = 9(RNJ) + 6. (returns the additional life

after 5 years)

137

19.5 Generating n2 Life…

X = 9(RNJ) + 6. (returns the additional

life after 5 years given the j-th random

number)

=RAND()

Cell Equation:

6

7

8

9

10

I

J

K

Sample No.

RN3

0.556

0.406

0.527

0.295

0.699

N-yrs

1

2

3

4

5

=INT(((9*J7)+1) +6)

12

10

11

9

13

138

19.5 Example 19.8: Computing the PV’s

If “n” = 30, then 30 individual present

values will be computed over the different

simulated lives (System 2) and the varying

cash flows.

From the 30 PV results, we determine

how many out of 30 generate a positive PV

and how many generate a negative PV.

Calculate the percentages out of 30 that

have a positive present value for each

alternative.

139

19.5 Excel’s PV Function Dialog Data Entry

The “PV” function will be used to compute

the associated present values.

140

19.5 The “Random Number” Worksheet

C

Sample No

6

7

8

9

10

1

2

3

4

5

D

E

F

G

H

I

RN1(100)

NCF1-$

RN2(100)

NCF2-$

N-yrs

12.5625

82.0129

37.4472

89.9367

89.7730

-$2,800

$4,200

-$300

$4,900

$4,900

83.6176

91.9930

84.3865

81.1570

64.2324

$6,000

$6,000

$6,000

$5,000

$4,000

RN3

0.556

0.513

0.429

0.741

0.088

12

11

10

13

7

The above shows the first 5 out of 30 samples for NCF1,

NCF2 and N for System 2. These values will not

compare to the values in Figure 19-12 due to a different

sequence of RN’s that were generated by Excel.

141

19.5 Spreadsheet Design

For this example:

One workbook with,

Two spreadsheets:

Sheet 1 is named “Random Numbers”

Sheet 2 is named “PW Values”

Sheet 2 summary calculations will refer

to certain values in the “Random

Numbers” spreadsheet and to values in

the “PW Values” spreadsheet.

142

19.5 Design Overview for the Model

Sheet 1

“Random Numbers”

contains the simulated

values as specified

by the problem

statement.

Sheet 2

“PW Values”

Calculates the 30 PW

values for the

two systems and

summarizes.

Sheet 2 contains the 30 calculated PW values by

referencing data in Sheet 1: Summary results are

then presented in Sheet 2.

143

19.5 Calculation of 30 PW’s

Input Parameters

Input Parameters for the Alternatives

System 1,P1 $ 12,000.00

System 2, P2 $

n

7

yrs

NCF

$

MARR

15%

MARR

8,000.00

1,000.00

15%

5

Yrs

144

19.5 Simulation Analysis: Results

Sample No. PW - Sys 1

1

-$23,649

2

-$9,504

3

-$351

4

-$21,153

5

-$26,561

29

$65

30

$481

Present Worth Calculations

+

Sample No.

0

1

1

0

1

2

0

1

3

0

1

4

0

1

5

1

0

29

1

0

30

11

19

36.67% 63.33%

(+)

(-)

PW - Sys. 2

$7,763

-$3,031

$2,045

$97

$2,163

$6,507

-$511

Counts

(+)

(-)

1

0

0

1

1

0

1

0

1

0

1

0

0

1

21

9

70.0% 30.0%

(+)

(-)

The first five samples and the last two are shown above

for a given sequence of RN’s.

145

19.5 Analysis for Current Sequence of RN’s

Sample No. PW - Sys 1

1

-$23,649

2

-$9,504

3

-$351

4

-$21,153

5

-$26,561

29

$65

30

$481

Present Worth Calculations

+

Sample No.

0

1

1

0

1

2

0

1

3

0

1

4

0

1

5

1

0

29

1

0

30

11

19

36.67% 63.33%

(+)

(-)

For this run, 36.67% of

the generated PW’s for

System 1 were positive

and 63.63% were

negative.

PW - Sys. 2

$7,763

-$3,031

$2,045

$97

$2,163

$6,507

-$511

Counts

(+)

(-)

1

0

0

1

1

0

1

0

1

0

1

0

0

1

21

9

70.0% 30.0%

(+)

(-)

System 2:

70% had a positive PW

and 30% were

negative.

146

19.5 Final Comments

The results shown on the previous slide

were from a given sequence of RN’s.

The spreadsheet can be recalculated and

a different sequence of RN’s will be

generated.

The % positive and % negative will

change from run to run – as expected.

147

19.5 Conclusions Based on Current Run

From a sample of size 30:

System 2 presented a greater percentage of

positive present worth over the percentage of

positive present worth for System 1.

This could lead one to believe that System 2,

over the long run, is the better alternative.

Suggest going with System 2!

148

19.5 The Normal Distribution

Popular Distribution.

Continuous pdf.

Often referred to as the “Bell-Shaped

Curve.”

Applicable to a large number of physical

applications.

See Figure 19-15…

149

19.5 Different Normal Distributions

Different means with equal

variance.

Different means with different

variances.

The Standard Normal with mean =

to 0 and variance = 1.

150

19.5 PDF for the Normal

The distribution function for the normal is:

PDF:

2

1

( X X )

f (X )

exp

2

X 2

2 X

Note: There is no direct way to generate normally

distributed random numbers using the inverse

transform. Other approaches must be used.

151

19.5 The Standard Normal Distribution

Calculate a “Z” value as:

X X

Z

s

[19.22]

Where X-bar is the sample mean and s is the sample

standard deviation, Z is normally distributed with a

mean of 0 and a variance of 1.

152

19.5 Difficulties in Simulating

Generating random numbers that follow a

normal distribution are involved if one is

using Excel.

Most spreadsheets do not support a normal

random number generator.

Other methods must be used (refer to texts

on simulation and the generation of random

numbers from a prescribed normal).

153

19.5 Variation Ranges for the Normal

Variable X Range

Probability

Variable Z Range

+ 1

0.3413

0 to +1

1

0.6826

-1 to +1

+ 2

0.4773

0 to +2

2

0.9546

-2 to +2

+ 3

0.4987

0 to + 3

3

0.9974

-3 to +3

154

19.5 Beware!

When using the normal distribution with a

mean close to 0, it is possible to generate a

negative outcome.

This may not be applicable to the problem

at hand.

Some software systems provide a

“truncated normal,” where you can specify

a lower and/or upper cutoff point.

155

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

Chapter Summary

156

19. Summary

To perform decision making under risk

implies that some parameters of an

engineering alternative are treated as random

variables.

Assumptions about the shape of the

variable's probability distribution are used to

explain how the estimates of parameter

values may vary.

Additionally, measures such as the expected

value and standard deviation describe the

characteristic shape of the distribution.

157

19. Summary

In this chapter, we learned several of the

simple, but useful, discrete and continuous

population distributions used in engineering

economy–uniform and triangular–as well as

specifying our own distribution, or assuming

the normal distribution.

158

19. Summary

Since the population's probability distribution

for a parameter is not fully known, a random

sample of size n is usually taken, and its

sample average and standard deviation are

determined.

The results are used to make probability

statements about the parameter, which help

make the final decision with risk considered.

159

19. Summary

The Monte Carlo sampling method is combined

with engineering economy relations for a

measure of worth such as PW to implement a

simulation approach to risk analysis.

The results of such an analysis can then be

compared with decisions when parameter

estimates are made with certainty.

160

19. Summary

Simulation analysis is a powerful tool when

properly applied.

One must be fully versed in applied statistics

and modeling.

Several Excel add-ins are on the market to

simplify sophisticated simulations of

engineering economy problems.

Example: Palisade Corporations “@RISK”

Excel add-in, and “Crystal Ball” are popular

additions to Excel.

161

19. Summary

Simulation modeling is a valuable tool

to assist in the analysis of engineering

economy problems where risk is an

important consideration.

Simulation is widely used in the

petrochemical, manufacturing,

aerospace, and other prominent

industrial sectors.

162

ENGINEERING ECONOMY Fifth Edition

Blank and Tarquin

Mc

Graw

Hill

CHAPTER 19

End of Set

163