* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Transcript

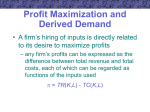

Chapter 21 FIRMS’ DEMANDS FOR INPUTS MICROECONOMIC THEORY BASIC PRINCIPLES AND EXTENSIONS EIGHTH EDITION WALTER NICHOLSON Copyright ©2002 by South-Western, a division of Thomson Learning. All rights reserved. Profit Maximization and Derived Demand • A firm’s hiring of inputs is directly related to its desire to maximize profits – any firm’s profits can be expressed as the difference between total revenue and total costs, each of which can be regarded as functions of the inputs used = TR(K,L) - TC(K,L) Profit Maximization and Derived Demand • First-order conditions for a maximum are TR TC 0 K K K TR TC 0 L L L – the firm should hire each input up to the point at which the extra revenue yielded from one more unit is equal to the extra cost Marginal Revenue Product • The marginal revenue product (MRP) from hiring an extra unit of any input is the extra revenue yielded by selling what that extra input produces MRP = MR MP Marginal Expense • If the supply curve facing the firm for the inputs it hires are infinitely elastic at prevailing prices, the marginal expense of hiring a worker is simply this market wage • If input supply is not infinitely elastic, a firm’s hiring decision may have an effect on input prices Marginal Expense • For now, we will assume that the firm is a price taker for the inputs it buys TC/K = v TC/L = w • The first-order conditions for profitmaximization become MRPK = v MRPL = w An Alternative Derivation • The Lagrangian expression associated with a firm’s cost-minimization problem is L = vK + wL + [q0 - f(K,L)] • First-order conditions are L/K = v - (f /K) = 0 L/L = w - (f /L) = 0 L/ = q0 - f (K,L) = 0 An Alternative Derivation • The first two equations can be written as f MPK v K f MPL w L An Alternative Derivation • Since can be interpreted as marginal cost in this problem, we have MC MPK = v MC MPL = w • Profit maximization requires that MR = MC so we have MR MPK = MRPK = v MR MPL = MRPL = w Price Taking in the Output Market • If a firm exhibits price-taking behavior in its output market, MR = P • This means that at the profit-maximizing levels of each input P MPK = v P MPL = w – sometimes P multiplied by an input’s MP is called the value of marginal product Comparative Statics of Input Demand • We will focus on the comparative statics of the demand for labor – the analysis for capital would be symmetric • For the most part, we will assume pricetaking behavior for the firm in its output market Single-Input Case • It is likely that L/w < 0 – this is based on the presumption that the marginal physical product of labor declines as the quantity of labor employed rises • a fall in w must be met by a fall in MPL for the firm to continue maximizing profits (because P is fixed) – this argument is strictly correct for the case of one input Single-Input Case • Taking the total differential of P MPL = w yields MPL L dw P dw L w MPL L 1 P L w L 1 w P MPL / L Single-Input Case • If we assume that MPL /L < 0 (MPL falls as L increases), we have L/w < 0 • A fall in w will cause more labor to be hired – more output will be produced as well Single-Input Demand • Suppose that the number of truffles harvested in a particular forest is Q 100 L • Assuming that truffles sell for $50 per pound, total revenue for the owner is TR P Q 5,000 L Single-Input Demand • Marginal revenue product is given by TR 2,500L1/ 2 L • If truffle searchers’ wages are $500, the owner will determine the optimal amount of L to hire by 1/ 2 500 2,500L L 25 Two-Input Case • If w falls, both L and K will change as a new cost-minimizing combination of inputs is chosen • When K changes, the entire MPL function changes – labor has a different amount of capital to work with • However, we still expect that L /w < 0 Two-Input Case • When w changes, we can decompose the total effect on the quantity of L hired into two components – substitution effect – output effect Substitution Effect • If output is held constant and w falls, there will be a tendency to substitute L for K in the production process – cost-minimization requires that RTS = w/v – a fall in w means that RTS must fall as well • because isoquants exhibit a diminishing RTS, the cost-minimizing level of labor hired rises Substitution Effect The substitution effect is shown holding output constant at q0 K slope K1 w1 v A As w falls, the firm will substitute L for K in the production process B K2 q0 w slope 2 v L1 L2 L Output Effect • A change in w will shift the firm’s expansion path • This means that the firm’s cost curves will also shift – a drop in w will lower MC and lead to a higher level of output • This increase in output will lead to a higher level of L being demanded Output Effect K The output effect is shown holding relative input prices constant slope w2 v Since a drop in w leads to a decline in MC, optimal output will rise and the firm will demand more L C K3 B K2 q1 q0 w slope 2 v L2 L3 L Substitution and Output Effects Both the substitution effect and the output effect lead to a rise in the quantity of L demanded when w falls K K1 A C K3 B K2 q1 q0 L1 L2 L3 L Cross-Price Effects • No definite statement can be made about how capital will change when w changes • The substitution and output effects move in opposite directions – a fall in w will lead the firm to substitute away from K – a fall in w will lead the firm to increase output and thus demand more K Mathematical Derivation • General input demand functions generated by the firm’s profit-maximizing decision are L = L(P,w,v) K = K(P,w,v) • The presence of P in these functions indicates the close connection between product demand and input demand Substitution and Output Effects • We can now look mathematically at the substitution and output effects of a change in w L L L (q constant) (from changes in q ) w w w Constant Output Demand Functions • Shephard’s lemma uses the envelope theorem to show that the constant output demand function for L can be found by partially differentiating total cost with respect to w TC L' (q,w ,v ) w Constant Output Demand Functions • Two arguments suggest why L’/w < 0 – in the two-input case, the assumption of a diminishing RTS combined with the assumption of cost-minimization requires that w and L move in opposite directions when output is held constant – even in the many-input case, L’/w = 2TC/w2 < 0 if costs are truly minimized Output Effects • We can use a “chain rule” argument to examine the causal links that determine how changes in w affect the demand for L through induced output changes L L q P MC (from changes in q ) w q P MC w Output Effects L L q P MC (from changes in q ) w q P MC w – P/MC = 1 because P=MC for profit maximization under perfect competition – q/P < 0 since there is an inverse relationship between the firm’s price and its share of market demand – L/q and MC/w must have the same sign Output Effects L L q P MC (from changes in q ) w q P MC w <0 =1 product > 0 L/w (from changes in q) < 0 Mathematical Derivation • The mathematical conclusion is that L/w < 0 – substitution and output effects move in the same direction Decomposing Input Demand • The short-run supply function for a hamburger producer is 40(10P ) q (vw )0.5 • The firm’s demand for labor is (10P )2 L 0. 5 1. 5 v w Decomposing Input Demand • If w = v = $4 and P = $1, the firm will produce 100 hamburgers hire 6.25 workers • If w rises to $9 while v and P remain unchanged, the firm will produce 66.6 hamburgers and hire only 1.9 workers Decomposing Input Demand • Suppose that the firm had continued to produce 100 hamburgers even though w rose to $9 • Cost minimization requires: K/L = w/v = 9/4 Decomposing Input Demand • Substituting into the original production function, we get q = 100 = 40K0.25L0.25 10 = 4[(9/4)L]0.25L0.25 L = 4.17 • This is the substitution effect – even if output remained at 100 hamburgers, employment of L would decline from 6.25 to 4.17 Decomposing Input Demand • We can compute the constant output demand for labor using Shephard’s lemma • Total costs are TC = vK + wL • If we substitute the input demand functions, we get TC = [q2v0.5w0.5]/800 Decomposing Input Demand • Applying Shephard’s lemma yields TC q 2v 0.5w 0.5 L' w 1,600 • For q = 100, we have L’ = 6.25v0.5w -0.5 • If v = w = $4, L’ = 6.25 • If w changes to $9, L’ = 4.17 Decomposing Input Demand • Note how the constant output demand function (L’) allows us to hold output constant in our analysis, while the total demand function (L) allows output to change – there will be a larger impact of a wage change when using the total demand function Responsiveness of Input Demand to Changes in Input Prices • We can now explain the degree to which input demand will respond to changes in input prices • When w rises, will the decline in L be large or small? Responsiveness of Input Demand to Changes in Input Prices • Substitution effect – this will depend on how easy it is to substitute other inputs for L • the elasticity of substitution for the firm’s production function • the length of time allowed for adjustment Responsiveness of Input Demand to Changes in Input Prices • Output effect – this will depend on the size of the decline in output • how important labor is in the firm’s total costs • the price elasticity of demand for the output Responsiveness of Input Demand to Changes in Input Prices • The price elasticity of demand for any input will be greater (in absolute value), – the larger is the elasticity of substitution for other inputs – the larger is the share of total cost represented by expenditures on that input – the larger is the price elasticity of demand for the good being produced Elasticity of Demand for Inputs • Suppose that the constant output demand for labor for our hamburger producer is L’ = (q2v0.5w -0.5)/1,600 • The constant output wage elasticity of demand (LL) is L' w ln L' LL 0.5 w L' ln w Elasticity of Demand for Inputs • Suppose that labor costs represent half of all variable costs – sL = 0.5 • This implies that LL = sL – 1 = -(1 – sL) = -0.5 • This result is a special case of LL = -(1 – sL) Elasticity of Demand for Inputs • In order to quantify output effects, we will need to use an elasticity form of the chain of events that occurs when the wage changes eL,w (from changes in q) = eL,q eq,P eP,MC eMC,w • If P is assumed constant and MC is a linear function of q, any increase in P must result in a proportional change in q – this implies that eq,P eP,MC = -1 Elasticity of Demand for Inputs • In addition, we know that – using the TC curve shown earlier, we can calculate eMC,w = 0.5 – because the production function exhibits diminishing returns to scale, eL,q = 1/eq,L = 2 for movements along the expansion path Elasticity of Demand for Inputs • Thus, eL,w (from changes in q) = (2)(-1)(0.5) = -1 and the total elasticity of demand (including substitution and output effects) is eL,w = -0.5 – 1.0 = -1.5 Elasticity of Demand for Inputs • When the change in w affects all firms, the price of the product will change – In the long run, with constant returns to scale, eL,q = 1, eP,MC = 1, and eMC,w = sL • The output effect can be written as eL,w (from changes in q) = sLeq,P • The total wage elasticity is eL,w = LL + sLeq,P = -(1 – sL) + sLeq,P Competitive Determination of Income Shares • Assume there is only one firm producing a homogeneous output using L and K • The production function for the firm is Q = f(K,L) and output sells at a price of P • The total income received by labor is wL, while the total income accruing to capital is vK Competitive Determination of Income Shares • If the firm is profit-maximizing, each input will be hired to the point where its MRP is equal to its price • Thus, wL P MPL L MPL L labor' s share PQ PQ Q vK P MPK K MPK K capital' s share PQ PQ Q Factor Shares and the Elasticity of Substitution • The elasticity of substitution is defined as %(K / L ) %(w / v ) – If = 1, the relative shares of K and L will remain constant as the capital-labor ratio rises – If > 1, the relative share of K will rise as the capital-labor ratio increases – If < 1, the relative share of K will fall as the capital-labor ratio increases Monopsony in the Labor Market • In many situations, the supply curve for an input (L) is not perfectly elastic • We will examine the polar case of monopsony, where the firm is the single buyer of the input in question – the firm faces the entire market supply curve – to increase its hiring of labor, the firm must pay a higher wage Monopsony in the Labor Market • The marginal expense of hiring an extra unit of labor (MEL) exceeds the wage • If the total cost of labor is wL, then wL w MEL w L L L • In the competitive case, w/L = 0 and MEL = w • If w/L > 0, MEL > w Monopsony in the Labor Market Wage ME S The firm will set MEL = MRPL to determine its profit-maximizing level of labor (L1) The wage is determined by the supply curve w1 D L1 Labor Monopsony in the Labor Market Wage ME S w* w1 D L1 L* Note that the quantity of labor demanded by this firm falls short of the level that would be hired in a competitive labor market (L*) The wage paid by the firm will also be lower than the competitive level (w*) Labor Monopsonistic Hiring • Suppose that a coal mine’s workers can dig 2 tons per hour and coal sells for $10 per ton – this implies that MRPL = $20 per hour • If the coal mine is the only hirer of miners in the local area, it faces a labor supply curve of the form L = 50w Monopsonistic Hiring • The firm’s wage bill is wL = L2/50 • The marginal expense associated with hiring miners is MEL = wL/L = L/25 • Setting MEL = MRPL, we find that the optimal quantity of labor is 500 and the optimal wage is $10 Monopoly in the Supply of Inputs • Imperfect competition may also occur in input markets if suppliers are able to form a monopoly – labor unions in “closed shop” industries – production cartels for certain types of capital equipment – firms (or countries) that control unique supplies of natural resources Monopoly in the Supply of Inputs • If both the supply and demand sides of an input market are monopolized, the market outcome will be indeterminate – the actual outcome will depend on the bargaining skills of the parties Monopoly in the Supply of Inputs The monopoly seller would prefer a wage of w1 with L1 workers hired Wage ME S w1 The monopsony buyer would prefer a wage of w2 with L2 workers hired w2 MR L1 L2 D Labor Important Points to Note: • The marginal revenue product from hiring extra units of an input is the combined influence of the marginal physical product of the input and the firm’s marginal revenue in its output market Important Points to Note: • If the firm is a price taker for the inputs it buys, it is possible to analyze the comparative statics of its demand fairly completely – a rise in the price of an input will cause fewer units to be hired because of substitution and output effects • the size of these effects will depend on the firm’s technology and on the price responsiveness of the demand for its output Important Points to Note: • The marginal productivity theory of input demand can also be used to study the determinants of relative income shares accruing to various factors of production – the elasticity of substitution indicates how these shares change in response to changing factor supplies Important Points to Note: • If a firm has a monopsonistic position in an input market, it will recognize how its hiring affects input prices – the marginal expense associated with hiring additional units of an input will exceed that input’s price, and the firm will reduce hiring below competitive levels to maximize profits Important Points to Note: • If input suppliers form a monopoly against a monopsonistic demander, the result is indeterminate – in such a situation of bilateral monopoly, the market equilibrium chosen will depend on the bargaining of the two parties