* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download B 7006 Intro, Demand & Supply

Survey

Document related concepts

Transcript

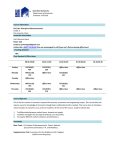

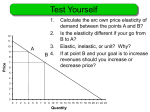

Managerial Economics Professor Geoffrey Heal 616 Uris Hall Phone: (212) 854-6459 e-mail: [email protected] (note - gmh “one” not “L”) Course Outline: (I) Analyzing the structure of a market Part A: Demand & Supply Part B: Costs (II) Pricing (most important part of course) (III) e-con.com (application and review) (IV) Foundations of Strategy Analyzing the Structure of a Market Aim: to understand key aspects of markets: nature of demands for the products closeness or otherwise of competitors structure of costs dependence of profits on the level of output Material to be covered: Analysis of demand – demand curves, – price, income & cross elasticities of demand – use of demand parameters in forecasting Structure of costs: – fixed & variable costs – break-even analysis – opportunity costs and sunk costs – learning curves & economies of scale. Pricing How much product should you produce and what price should you charge for it? How can you best segment your market if there are different types of buyers with different demand characteristics (e.g., business travelers vs. vacation travelers, home PC buyers vs. corporate buyers)? What are the types of pricing schemes available (e.g., bundling, promotional offers, loyalty bonuses, volume discounts)? e-con.com Applications of market analysis to electronic commerce How does the internet affect demand, pricing, and other aspects of running a business. e-commerce business strategies. Auctions and the internet. Foundations of Strategy Interacting with competitors Anticipating their reactions Forecasting the final outcome when everyone has reacted. Aim of Course To teach you to use basic economic ideas in making business decisions. Decisions about opening and closing businesses. Decisions about pricing and other policies. Level of Course Emphasis on understanding concepts and where and how they can be used. Don’t aim to make you an economist, but an intelligent consumer of economics. Evaluate and understand works of consultants, staff. Ask the right questions. Recognize BS when you see it! Consumption & Price of Copper 1880-1998 Profit margin 1999/2001 Operating margin 1999/2001 MSFT 40.0%/30.5% 49.5%/46.3% INTC 25%/17.7% 34.2%/20.7% CPQ 1.5%/0.8% 2.4%/1.2% DELL 7%/6.7% 9.9%/8% Compare Internet companies eBay AOL Yahoo Amazon.com Demand and Supply Demand Curve Shows amount purchased as a function of price Depends on: - income - tastes - prices of competitive products - prices of complementary products Supply Curve Amount offered for sale as a function of price Depends on costs of production, which in turn depend on - costs of inputs - technology The Market Mechanism Price ($ per unit) S The curves intersect at equilibrium, or marketclearing, price. At P0 the quantity supplied is equal to the quantity demanded at Q0 . P0 D Q0 Quantity The Market Mechanism Characteristics of the equilibrium or market clearing price: QD = QS No shortage No excess supply No pressure on the price to change Demand Curve -Income Rises Demand Shifts Supply shifts D & S shift The Market Mechanism Price ($ per unit) S Surplus P1 Assume the price is P1 , then: 1) Qs : Q1 > Qd : Q2 2) Excess supply is Q1:Q2. 3) Producers lower price. 4) Quantity supplied decreases and quantity demanded increases. 5) Equilibrium at P2Q3 P2 D Q1 Q3 Q2 Quantity The Market Mechanism A Surplus The market price is above equilibrium There is excess supply Producers lower prices Quantity demanded increases and quantity supplied decreases The market continues to adjust until the equilibrium price is reached. The Market Mechanism Price ($ per unit) S Assume the price is P2 , then: 1) Qd : Q2 > Qs : Q1 2) Shortage is Q1:Q2. 3) Producers raise price. 4) Quantity supplied increases and quantity demanded decreases. 5) Equilibrium at P3, Q3 P3 P2 Shortage Q1 Q3 D Q2 Quantity The Market Mechanism Shortage The market price is below equilibrium: There is a shortage Producers raise prices Quantity demanded decreases and quantity supplied increases The market continues to adjust until the new equilibrium price is reached. The Market Mechanism Market Mechanism - Summary: 1) Supply and demand interact to determine the market-clearing price. 2) When not in equilibrium, the market will adjust to alleviate a shortage or surplus and return the market to equilibrium. 3) Markets must be competitive for the mechanism to be efficient. Consumption & Price of Copper 1880-1998 The Long-Run Behavior of Natural Resource Prices Observations Consumption of copper has increased about a hundred fold from 1880 through 1998 indicating a large increase in demand. The real price for copper has remained relatively constant. Changes In Market Equilibrium S1998 Price S1900 S1950 D1998 D1950 D1900 Quantity Changes In Market Equilibrium Conclusion Decreases in the costs of production have increased the supply by more than enough to offset the increase in demand. Changes In Market Equilibrium Wage Inequality in the United States Real after-tax income from 1977 to 1999: – Rose 40+% for the top 20% of the income distribution – Fell 10+% for the bottom 20% Changes In Market Equilibrium Question Why did the income distribution become more unequal for 1977 to 1999? Price elasticity of demand: Measures responsiveness of demand to price. Defined as E = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q) Why is it defined in proportional terms? - Unit free. - Scale sensitive. A negative number. Q = 8 - 2P or P = 4 - 0.5Q Elasticity = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q) = -2*(P/Q) Elasticity and Pricing If elasticity is between 0 and -1 then raising price will raise profits - it will raise revenues and lower costs. If elasticity is lower than -1 then raising price will lower revenues and also costs, so the effect on profits is not clear. Moral - never operate where the elasticity is between 0 and -1. Relationship between demand, quantity and revenue: Q = 8 - 2P or P = 4 - 0.5Q so as revenue R is price times quantity R = 4Q - 0.5Q2 Revenue rises as price rises Revenue falls as price rises PED = -1 PED = 0 This is a quadratic pointing up. The slope is: DR =4-Q DQ which is zero at Q = 4. Slope is positive for Q<4 and vice versa. Maximum revenue comes when Q = 4, therefore P = 2, and max revenue is 8 PED when revenue is maximum Revenue is max when Q = 4, P = 2. E = (DQ/Q)/(DP/P) = (DQ/DP)*(P/Q) So E = (DQ/DP)*(1/2) and DQ/DP = -2 so E = -2 * 1/2 = -1 when R is at a maximum. Cross price elasticity of demand: The responsiveness of demand for good A to change in price of good B: DQA/QA = DQA * PB DPB/PB DPB PA Example: responsiveness of demand for Dell computers to prices of Gateway computers Supply Elasticity The responsiveness of supply to price changes. (DS/S)/(DP/P), proportional change in supply divided by proportional change in price. Usually positive. Elasticities of Supply and Demand The Market for Wheat 1981 Supply Curve for Wheat QS = 1,800 + 240P 1981 Demand Curve for Wheat QD = 3,550 - 266P Elasticities of Supply and Demand The Market for Wheat Equilibrium: Q S = Q D 1,800 240 P 3,550 266 P 506 P 1,750 P 3.46 / bushel Q 1,800 (240)(3.46) 2,630 million bushels Elasticities of Supply and Demand The Market for Wheat ED=(P/Q) (DQD/DP) = (3.46/2630)(-266)= 0.35 ES=(P/Q) (DQS/DP) = (3.46/2630)(+240)= 0.32 Changes in the Market: 1981-1998 The Market for Wheat Supply (Qs) Demand (QD) Equilibrium Price (Qs = QD) 1981 1800 + 240P 3550 - 266P 1800+240P = 3550-266P 506P = 1750 P1981 = $3.46/bushel 1998 1,944 + 207P 3,244 - 283P 1,944+207P = 3,244-283P P1998 = $2.65/bushel Marginal Revenue Increase in revenue from one extra sale Rate of change of revenue with respect to sales Typically less than price as demand curve slopes down Depends on PED Marginal Revenue & PED MR = P{1 + 1/PED} Remember PED < 0 so MR < P. The larger PED as a number the nearer MR is to P If PED = - 1, then MR = 0. (Top of revenue curve) ………………………………………… Derivation - dR/dQ = d{P(Q).Q}/dQ = P + Q*dP/dQ = P{1 + (Q/P)*dP/dQ} Income Elasticity of Demand: Responsiveness of demand to changes in income IED = (DQ/Q)/DI/I) = (DQ/DI)*(I/Q) Use to define necessities and luxuries Necessities - IED < 1 Luxuries - IED > 1 Cyclical vs. defensive sectors Cyclical - high IED - foreign travel, consumer durables Defensive - low IED - food, utilities Short-run vs. long-run elasticities Critical in understanding oil market, energy markets, metal markets Responding to a price movement takes time possibly many years Long-run elasticity measures total response Short-run elasticity measures immediate response Short-run demand P1 Po Long-run drop in demand Long-run demand Short-run drop in demand Short-Run Versus Long-Run Elasticities The Demand for Gasoline Years Following Price or Income Change Elasticity 1 2 3 4 5 6 Price -0.11 -0.22 -0.32 -0.49 -0.82 -1.17 Income 0.07 0.13 0.20 0.32 0.54 0.78 Short-Run Versus Long-Run Elasticities The Demand for Automobiles Years Following Price or Income Change Elasticity Price Income 1 2 3 4 5 6 -1.20 -0.93 -0.75 -0.55 -0.42 -0.40 3.00 2.33 1.88 1.38 1.02 1.00 Short-Run Versus Long-Run Elasticities The Demand for Gasoline and Automobiles Data Explains: 1) Why the price of oil did not continue to rise above $30/barrel even though it rose very rapidly in the early 1970s. 2) Why automobile sales are so sensitive to the business cycle. The World Oil Market In 1995: P* = $18/barrel World demand and total supply = 23 bb/yr (= 63 mbd) OPEC supply = 10 bb/yr (= 27 mbd) Non-OPEC supply = 13 bb/yr (= 35 mbd) US consumption about 17 mbd = 5.5 bb/yr Price of Crude Oil Impact of Saudi Production Cut SC D S’T ST Price 45 ($ per barrel) 40 Short-Run Effect 35 30 25 20 18 15 10 5 0 5 10 15 20 23 25 30 Quantity 35 (billions barrels/yr) Impact of Saudi Production Cut SC Price 45 D ($ per barrel) 40 S’T ST Long-run Effect Due to the elasticity of the long-run supply and demand curves, the long-run effect of a cut in production is much less. 35 30 25 20 18 15 10 5 0 5 10 15 20 23 25 30 35 Quantity (billions barrels/yr) AMAX Case Price (1980 $) 10 9 8 7 6 5 Price (1980 $) 4 3 2 1 0 1975 1976 1977 1978 Year 1979 1980 Moly Consumption & Production 250 200 150 Consumption Production 100 50 0 1975 1976 1977 Year 1978 1979 Output 350 325 300 275 250 225 200 175 150 125 100 75 50 25 0 Marginal Cost Marginal Costs MC 14 12 10 8 6 MC 4 2 0