* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download a complete presentation - State Bank of Pakistan

Survey

Document related concepts

Transcript

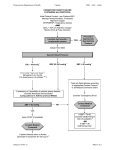

Two-Day Users-Producers Workshop Functions of STATISTICS DEPARTMENT State Bank of Pakistan Mission Statement "Our mission is to ensure timely dissemination of high quality statistics for the monetary and macro-economic policies leading to the prosperity of Pakistan" Components of the Business Process Operational: Compilation and dissemination of statistics according to the specification of annual Business Plan Developmental: Projects aimed for innovation and improvements in methodologies to: ● bring it in line with the international standards ● cater the growing needs of the stakeholders ● improve the quality, transparency and timeliness of the statistics compiled ● adopt new developments Operational Functions Compilation and dissemination of the following statistics: (Monthly) • Balance of payments statistics • Statistics on import payments and export receipts, • Workers’ remittances • Foreign direct & portfolio investment • Weighted average lending & Deposit rates • Loans & Deposits classified by borrowers – ISIC classification • Pakistan monetary survey • Institutional distribution of funds • Statements of stocks and utilization of FCA Main Functions continued… (Quarterly) • Compilation of fixed industrial investment in private sector • Outstanding stock of external debt & liabilities and debt servicing • Sectoral Balance Sheets of non-bank financial institutions (NBFIs) (Half Yearly) • Statistics of scheduled banks – various dimensions • Statistics of Co-operative banks – various dimensions • Seasonal adjustment of important data series Main Functions continued… (Annual) • Survey of foreign investment & liabilities/assets • International Investment Position (IIP) • Ownership of federal government debt • Analysis of balance sheets of joint stock companies listed on KSE (non-financial) • Estimates of flow of funds accounts • Equity yield of ordinary shares quoted at KSE Main Functions continued… (Daily) • Position of SCRA • Index numbers of stock exchange securities traded at KSE Publications (11 +) Publication Frequency Statistical Bulletin Monthly Export Receipts Monthly Statistics on Scheduled Banks in Pakistan Half Yearly Export Receipts Annual Annual Report (Statistical Annexure) Annual Pakistan’s Balance of Payments Annual Balance Sheet Analysis of Joint Stock Co’s listed at Karachi Stock Exchange Annual Banking Statistics of Pakistan Annual Equity Yields on Ordinary Shares Annual Foreign Liabilities & Assets and Foreign Investment in Pakistan Annual Index Numbers of Stock Exchange Securities Annual Handbook of statistics on Pakistan’s economy 5 years Updating statistics on SBP Website Regularly Key Developmental Projects • Adoption of HS classification of commodities for trade data • Implementation of 5th Manual for compilation of Balance of payments • Coordinated Portfolio Investment Survey • Review of all publications on the basis of users’ feedback • Adoption of ISIC for classification of private sector business • Implementation of SNA 93 for compilation of FFA • Compilation of IIP Key Developmental Projects • Implementation of MFSM 2000 • Seasonal adjustment of data • Handbook of statistics on Pakistan economy • Preparation of Data Revision Policy • Data Dissemination Policy • Improve effectiveness of banking and monetary data … in progress • Collaboration among data compilers and users Key Developmental Projects Collaboration among data compilers and users Objectives • To establish interaction among data providers & users • to create awareness on the methodologies and availability of statistics • to identify shortfalls in scope and coverage of available data • to identify gaps in availability and needs of users • to formulate strategies and recommendations for filling gaps • implementation of strategies relating to SBP Key Developmental Projects Collaboration among data compilers and users Implementation • To conduct users-producers workshops • Steering Committee of Coordinators • Technical Committees of users and producers Collaboration among data compilers and users Responsibilities of Technical committees • Identification of areas for improvements on the basis of feedback from the users during presentations • to examine feasibility and implications of the suggestions provided by the users • presentations of the recommendation in the workshop • to prepare recommendations for review by the Steering committee Collaboration among data compilers and users Composition of Technical committees External Sector Real Sector Mr Zafar ul Hassan, Finance Div (Leader) Mr Muhammad Afzal, P&D (Leader) Mr Zafar Iqbal, SD, SBP Mr Raees ul Hassan, FBS Mr Naseer Ahmad, SD, SBP Mr Rana Ishaque Rana, FBS Mr Khalid Siddique, FBS Mr Muneer Aslam, FBS Mr Arshad Mehmood Sahi, EAD Mr Abdul Azeem Sahaitho, FBS Mr Mohammad Afaq, EAD Mr Moin ud Din, RD, FBS Syed Sajid Ali, RD, SBP Dr Fazal Hussain, PIDE/CBM Mr Ghulam Rabbani, AC, SBP Mr Arif Mahmood Cheema, FBS Mr Junaid Iqbal, Head Res; CNBC Malik Muhammad Ashraf, SD, SBP Collaboration among data compilers and users Composition of Technical committees Fiscal Sector Financial Sector Mr Najeeb Qadir (Leader), CBR Dr Azizullah Khattak, SD, SBP (Leader) Mr Zafar ul Hassan, EAD Mr Faisal Maqsood, EDMD, SBP Dr Saeed Ahmad, RD, SBP Mr Muhammad Arif, EDMD, SBP Mr Wamiq Rasheed Khan, ED Res: EPB Mr Haroon Askari, KSE Mr Mohammad Amin Lodhi, RD, SBP Ms Moneeza Kalsoom Ahmad, IBP Collaboration among data compilers and users Composition of Technical committees Socio-Demographic Miscellaneous Dr Ishaq Ansari, SD, SBP (Leader) Mr K.K Suri, EPB (Leader) Mr Mehboob Sultan, NIPS Mr Ali Rehman SECP Mr Muhammad Saeed, PCO Mr Ali Ahmad, SBS Dr Mian Farood Haq, RD, SBP Mr Shamim Rafiq PBS Prof Zahid Mehmood, KU Mr Aslam Shakir Baloch, BBS Ms Iqbal Ahmad, NWFPBS Prof Dr Shafiq ur Rehman Dr S.M. Hasnain Bokhari, SD, SBP Users-Producers Workshop Final Request • Time management • Uses’ Feedback International Investment Position (IIP) IIP shows stock of an economy’s external asset and liabilities at a particular point of time Assets Liabilities Direct investment Portfolio investment Direct investment – Equity securities – Debt securities Other investment – Trade credits – Loans Reserve Assets Portfolio investment Other Investment Seasonal adjustment of Data Most of banking and economic data follow seasonal patterns and unadjusted data is usually misleading Data series of advances, deposits, imports, exports, workers’ remittances, borrowing from SBP, currency in circulation, M1 and M2 The analysis is carried out regularly according to the frequency of the data series Index numbers of stock exchange securities Objective To measure changes in the prices of shares traded at KSE for the 641 Cos listed at KSE. Coverage The index of share prices cover ordinary shares of all companies traded at KSE on a particular day Scope Overall and economic group wise general index, sensitive index and market capitalization on daily basis Balance sheet analysis of joint stock companies listed at KSE Objective To evaluate the performance of non-financial Cos /sectors listed at KSE through various indicators developed from the data provided in Cos’ published annual reports Coverage The analysis is based on the published annual reports of non financial sector companies listed at KSE Scope The performance indicators include: • Current ratio • Debt equity ratio • Cash flow ratio • Indicators of growth • Indicators of financial flows Equity yields on ordinary shares Objective The term yields indicates return per hundred rupees of capital cost of investment. The objective of the study is to evaluate the performance of different investments in ordinary shares. Coverage All listed companies Scope Overall, economic group-wise indicators such as • Dividend yield • Earning yield • Index of dividend • index of earning Half yearly Statistics on Scheduled Banks • Objective To provide comprehensive and reliable statistics covering major aspects of banking such as. – Deposits • By category of deposit holder • By type of account • By rate of return – Advances • By borrower • By collateral • By rate of margin retained • By rate of return – Bills purchased and discounted – Investment • By institution • By securities – Liability & Asset Ownership classification of Federal Govt Debt Sources (2000) • Scheduled & Cooperative banks • NBFCs • Insurance Companies • Govt sponsored institutions • Other public institutions • Local authorities • staff provident funds • Joint stock companies Classification of debt • Federal Govt securities/bonds • National prize bonds • National saving schemes • Treasury bills