* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Lecture 3a

Exchange rate wikipedia , lookup

Social credit wikipedia , lookup

Economic bubble wikipedia , lookup

Monetary policy wikipedia , lookup

Nominal rigidity wikipedia , lookup

Virtual economy wikipedia , lookup

Long Depression wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Quantitative easing wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Real bills doctrine wikipedia , lookup

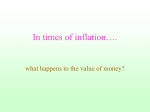

MONEY AND INFLATION What is money? • Money is a generalized claim on all other assets. It must be acceptable, scarce, desirable, and divisible. Three Properties of Money • Medium of Exchange--A financial asset (money) is used to trade (exchange) real assets (goods and services). • Store of Value--Money serves as a means of storing purchasing power. • Unit of Account--All prices are denominated in terms of the monetary unit, such as the dollar. Types of Assets that Serve as Money • Physical or Full-Bodied Money -- Assets with real or intrinsic value that serve as money as long as their value in exchange exceeds their value in use. (Gold) • Representative Money -- Assets with little or no intrinsic value, such as currency and cheap metal coins, that represent claims on assets with intrinsic value. • Fiat Money -- Money unbacked by any form of Physical Money Types of Assets that Serve as Money • Legal Tender Laws – Laws passed to mandate the acceptance of Fiat Money within an economy • Seigniorage – Government revenue from the manufacture of money calculated as the difference between the face value and the cost of the note or coin • Deposit or Credit Money -- Assets without either intrinsic value or representative value. Credit money (deposit liabilities of banks) are backed by financial assets, such as loans or securities. Definition of the Money Supply • Monetary Aggregates – M1 – Currency, Travelers Checks and other demand deposits – M2 – M1 + Retail MMMF’s , savings, and small time deposits – M3 – M2 + Institutional MMMF’s, Large time deposits, and Eurodollars – MZM – Readily available M2 and M3 – L – The Total Stock of Money Definition of the Money Supply • The Transaction Approach--Any definition of the money supply relating money to current spending. – Money (M1) is special--It is the medium of exchange in the economy. Money is obtained for the purpose of spending. – All other assets must be converted to money (M1) before "spending". Definition of the Money Supply (continued) • The Store of Value Approach--Any definition of the money supply associating money to its ability to store or hold purchasing power through time. Spending may occur now or later. – Money serves as a store of purchasing power. – Monetarists believe that liquid, near-money financial assets, such as M2, M3, serve as means to "store" purchasing power. – MZM is a definition of money that includes those parts of M2 and M3 that can be obtained immediately. Recent Measures of Money and the Money Supply DEFINITION BILLIONS Currency and travelers checks M1 MZM M2 M3 L $ 457.0 1,072.0 3,789.0 4,293.0 5,776.0 7,062.0 PERCENTAGE DEGREE OF LIQUIDITY1 OF L 6.5 Highest 15.2 53.6 60.8 81.8 100.0 Source: Federal Reserve Bank of St. Louis monetary data for September 1998. Lowest Money and Money Substitutes • Credit Cards Versus Debit Cards – Deposit balances, a part of the money supply, are liabilities (credit balance) of depository institutions. – A check, paper or electronic order, transfers (debits) deposits to new owners and their designated bank. Money and Money Substitutes (continued) – Debit cards, used in automatic teller machines (ATM), point of sale terminals where payment is made electronically, or in a paper-based system when something is purchased. A debit to a credit deposit balance reduces the balance. Hence, the name, debit card. Money and Money Substitutes (continued) – Credit cards are preapproved lines of credit. When used, the bank is making a loan (asset) and paying someone (deposit). Later, the credit card user pays off the loan with a check (debit to their deposit account). Credit card usage is not a money or deposit transfer. It is a loan/deposit transaction, increasing the money supply, until the credit card bill is paid. Money and Money Substitutes (continued) • Money Market Mutual Funds (MMMF) and Stock and Bond Mutual Funds – MMMF are investment companies that issue $1 shares in return for money to invest in liquid, short-term, high quality debt securities. – MMMF balances are a store of value and are a part of the M2 money supply definition, not the M1 definition of transaction balances. Money and Money Substitutes (concluded) – Mutual funds, other than MMMF, also have check-writing services, though the value of the MF shares vary with the value of the asset, stocks, bonds, commodities, etc. Role of Money in an Economy • To facilitate efficient (lowest cost) exchange between economically specialized persons. • Barter is inefficient and does not facilitate exchange. There are many barter prices for an item in a barter economy; only one price in a money economy. Transmission Mechanism for Monetary Policy: Keynesian View What is Inflation • Inflation is the proliferation of monetary units (currency) leading to a general rise in the price level The value of money is evidenced in its purchasing power. • Sustained decreases in the ratio (exchange value) between money (financial assets) and goods and services (real assets) represent a decline in the purchasing power of money. • The value of money can be measured by the change in price levels. Inflation is an increase in the general price level over time. The value of money can be measured by inflation. Price Index--A measure of the price levels at a particular point in time. • A broadly determined market basket of goods and services is assembled and priced for the (base year) starting point. • Using the base year as 100, subsequent prices for the market basket are compared to the "base" year. • Changes in the price index measures the inflation or deflation rate and thus the changing value of money. Widely Used Price Indices • The Consumer Price Index (CPI) -- The price of a broad consumer market basket of new, final goods and services. Updated monthly. • Producer Price Index (PPI) -- A set of prices for a cross section of intermediate (not final) goods. Updated monthly. • Gross Domestic Product Deflator -- A set of prices for all goods and services included in GDP. Updated quarterly. Annual Rate of Inflation (CPI) for the Economy (1965-1998) 14.0 Percentage Change 12.0 10.0 8.0 6.0 4.0 2.0 0.0 1965 75 85 95 Using Price Indices--Comparing nominal (current market prices) and real (purchasing power) values. • Nominal values are price-weighted measures of goods and services. Nominal values increase and decrease as prices rise and fall, respectively. In the base year (period) of a price index, the nominal value equals the real value. • Real values are nominal values adjusted (deflated) for price level changes. With increases in the price level (measured by the price index), the real values decline. Inflation Summary--Continued increase in average price levels. • With unanticipated inflation, wealth transfers from savers to borrowers in financial markets. • Persons with fixed incomes are able to buy less in periods of inflation. • Interest rates, the time price of money, increase with inflation. • Inflation is associated with periods of high money supply growth relative to the growth of the economy.