Credit contractions and unemployment

... young workers is even more pronounced, increasing the rate of youth unemployment by more than 2.4%. The lasting effects on long-term unemployment indicate a high degree of persistence and slow recovery of labor markets following a credit downturn. In addition, severe credit busts are coupled with a g ...

... young workers is even more pronounced, increasing the rate of youth unemployment by more than 2.4%. The lasting effects on long-term unemployment indicate a high degree of persistence and slow recovery of labor markets following a credit downturn. In addition, severe credit busts are coupled with a g ...

L. Albert Hahn`s Economic Theory of Bank Credit

... Schumpeter, Hahn, Mises and Hayek. Knut Wicksell had not only been among those economists who early on perceived the growing importance of the banking system for the money supply of the economy at the end of the nineteenth century, and the elasticity or endogeneity associated with credit creation, i ...

... Schumpeter, Hahn, Mises and Hayek. Knut Wicksell had not only been among those economists who early on perceived the growing importance of the banking system for the money supply of the economy at the end of the nineteenth century, and the elasticity or endogeneity associated with credit creation, i ...

Managing Credit Bubbles - Universitat Pompeu Fabra

... we extended the analysis to an economy with credit, and argued that bubbles could be a source of collateral. Those papers used a simple growth economy to establish two key results regarding …nancial frictions and bubbles. First, …nancial frictions that limit borrowers’ ability to pledge their future ...

... we extended the analysis to an economy with credit, and argued that bubbles could be a source of collateral. Those papers used a simple growth economy to establish two key results regarding …nancial frictions and bubbles. First, …nancial frictions that limit borrowers’ ability to pledge their future ...

Political Credit Cycles: Myth or Reality?

... to use other means to create employment and redistribute wealth such as through non-traditional macroeconomic instruments that relax regulations and borrowing constraints in the credit market (Demertzis et al. 2004). If this hypothesis was valid, we would expect to see more frequent occurrences of p ...

... to use other means to create employment and redistribute wealth such as through non-traditional macroeconomic instruments that relax regulations and borrowing constraints in the credit market (Demertzis et al. 2004). If this hypothesis was valid, we would expect to see more frequent occurrences of p ...

Neo-Brandeisianism and the New Deal: Adolf A. Berle, Jr., William O

... (SEC) and the promise of new mechanisms to regulate the securities market. Douglas, never one to conceal his ambitions, angled for a seat on the commission. He did not come away with the prize that he sought. But James M. Landis, impressed by an article Douglas had written on railroad reorganization ...

... (SEC) and the promise of new mechanisms to regulate the securities market. Douglas, never one to conceal his ambitions, angled for a seat on the commission. He did not come away with the prize that he sought. But James M. Landis, impressed by an article Douglas had written on railroad reorganization ...

English - Inter-American Development Bank

... their origin in fiscal and FX actions. This evidence also points out that policy shocks have, on average, contributed importantly to explaining credit expansion during the exchange rate control. While an unexpected increase in fiscal spending generates a significant and persistent rise in credit, a ...

... their origin in fiscal and FX actions. This evidence also points out that policy shocks have, on average, contributed importantly to explaining credit expansion during the exchange rate control. While an unexpected increase in fiscal spending generates a significant and persistent rise in credit, a ...

The Coexistence of Money and Credit as Means of Payment ∗ S´

... In addition, inflation has two effects when enforcement is limited: a higher inflation rate both lowers the rate of return on money and makes default more costly. This relaxes the credit constraint and induces agents to shift from money to credit to finance their consumption. Consequently, consumer ...

... In addition, inflation has two effects when enforcement is limited: a higher inflation rate both lowers the rate of return on money and makes default more costly. This relaxes the credit constraint and induces agents to shift from money to credit to finance their consumption. Consequently, consumer ...

How Heterodox Is the Heterodoxy of the Monetary

... reasoning, Mises proposed the (in)famous regression theorem, by which the value of money today depends on the purchasing power that the money had yesterday. Moving backwards, however, he could not help reaching the logical conclusion that “before an economic good begins to function as money it must ...

... reasoning, Mises proposed the (in)famous regression theorem, by which the value of money today depends on the purchasing power that the money had yesterday. Moving backwards, however, he could not help reaching the logical conclusion that “before an economic good begins to function as money it must ...

Money and Costly Credit

... three features observed in an economy with money and credit: …rst, money and credit coexist as means of payment; second, the choice of using money or credit is endogenous; and third, the settlement of credit requires money. Several recent papers have attempted to construct models with both money and ...

... three features observed in an economy with money and credit: …rst, money and credit coexist as means of payment; second, the choice of using money or credit is endogenous; and third, the settlement of credit requires money. Several recent papers have attempted to construct models with both money and ...

Money and Credit Overhang in the Euro Area

... strongest credit overhang around 2007. Second, we want to investigate the potential impact of cross border credit flows on creating money and credit overhang in individual countries in the euro area. The link between domestic credit growth and external imbalances has recently received extra attentio ...

... strongest credit overhang around 2007. Second, we want to investigate the potential impact of cross border credit flows on creating money and credit overhang in individual countries in the euro area. The link between domestic credit growth and external imbalances has recently received extra attentio ...

Fiscal multipliers across the credit cycle

... Section 4 considers the broader implications of the main findings, and finally concludes. ...

... Section 4 considers the broader implications of the main findings, and finally concludes. ...

Economic Benefits of the Credit Union Tax Exemption to Consumers

... increase in vehicle loan rates at banks. The 2.5 percent increase is also applied in this report to all other consumer bank loans. The effect of a 50 percent reduction in credit union presence on bank automobile loan rates is estimated to range from a 21 basis point to a 39 basis point increase per ...

... increase in vehicle loan rates at banks. The 2.5 percent increase is also applied in this report to all other consumer bank loans. The effect of a 50 percent reduction in credit union presence on bank automobile loan rates is estimated to range from a 21 basis point to a 39 basis point increase per ...

Money Overhang, Credit Overhang and Financial Imbalances in the

... We choose to focus on M3 since it is the monetary aggregate most closely monitored by the ECB (ECB, 1999) and other major central banks. For that reason, it also is the variable most often used in euro area money demand studies. ...

... We choose to focus on M3 since it is the monetary aggregate most closely monitored by the ECB (ECB, 1999) and other major central banks. For that reason, it also is the variable most often used in euro area money demand studies. ...

Working Paper No. 832

... The devastating trends in social and economic inequality in developed industrialized nations have been the subject of a growing body of literature—economic and non-economic alike (see Piketty 2014; Taibbi 2014; Stiglitz 2013; Reich 2013; Wilkinson and Pickett 2009). While the experience of the Great ...

... The devastating trends in social and economic inequality in developed industrialized nations have been the subject of a growing body of literature—economic and non-economic alike (see Piketty 2014; Taibbi 2014; Stiglitz 2013; Reich 2013; Wilkinson and Pickett 2009). While the experience of the Great ...

PDF Download

... started to run increasing current account deficits after the introduction of the euro, while Northern European countries did the opposite and exhibited persistently growing current account surpluses (see Holinski, Kool and Muysken, 2012). Interestingly, the growth of foreign assets and liabilities w ...

... started to run increasing current account deficits after the introduction of the euro, while Northern European countries did the opposite and exhibited persistently growing current account surpluses (see Holinski, Kool and Muysken, 2012). Interestingly, the growth of foreign assets and liabilities w ...

mmi14-vanveen 19106661 en

... 4.5 percent served the same purpose.8 Nevertheless, actual M3 structurally grew faster than 4.5 percent per year in the first years of ECB operation but without noticeable effects on inflation or inflationary expectations. It definitely contributed to the ECB decision to lower the weight of the mone ...

... 4.5 percent served the same purpose.8 Nevertheless, actual M3 structurally grew faster than 4.5 percent per year in the first years of ECB operation but without noticeable effects on inflation or inflationary expectations. It definitely contributed to the ECB decision to lower the weight of the mone ...

C ARE CREDIT BOOMS IN EMERGING MARKETS A CONCERN? CHAPTER IV

... trend is estimated here using the HodrickPrescott (H-P) filter.10 Once a credit boom is identified, the macroeconomic and financial conditions that prevailed before, during, and after these episodes are examined. To gauge the robustness of the results, the behavior of the typical credit boom (the me ...

... trend is estimated here using the HodrickPrescott (H-P) filter.10 Once a credit boom is identified, the macroeconomic and financial conditions that prevailed before, during, and after these episodes are examined. To gauge the robustness of the results, the behavior of the typical credit boom (the me ...

Credit Expansions and Banking Crises: The Roles of Household

... by overly optimistic expectations of future income and asset prices, combined with financial liberalization and capital inflows. Over time, households and firms accumulate substantial debt while income does not keep pace.1 A decline in income or asset prices then leads to an increase in non-performi ...

... by overly optimistic expectations of future income and asset prices, combined with financial liberalization and capital inflows. Over time, households and firms accumulate substantial debt while income does not keep pace.1 A decline in income or asset prices then leads to an increase in non-performi ...

The characteristics of a monetary economy: a Keynes

... way in which an economy works in the presence of a fiat money by adopting the same theoretical framework used to describe a barter economy. The introduction of a fiat money transforms the system from a pure exchange economy in which all agents have a given endowment of resources and in which the fun ...

... way in which an economy works in the presence of a fiat money by adopting the same theoretical framework used to describe a barter economy. The introduction of a fiat money transforms the system from a pure exchange economy in which all agents have a given endowment of resources and in which the fun ...

Credit and business cycles in Greece: Is there any relationship?

... http://dx.doi.org/10.1016/j.econmod.2013.01.036 ...

... http://dx.doi.org/10.1016/j.econmod.2013.01.036 ...

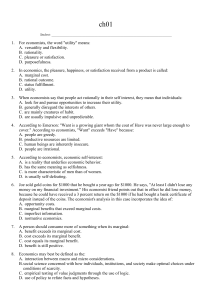

1. For economists, the word "utility" means: A

... 52. Which of the following is a positive statement? A. The humidity is too high today. B. It is too hot to jog today. C. The temperature is 92 degrees today. D. Summer evenings are nice when it cools off. 53. Normative statements are concerned primarily with: A. facts and theories. B. what ought to ...

... 52. Which of the following is a positive statement? A. The humidity is too high today. B. It is too hot to jog today. C. The temperature is 92 degrees today. D. Summer evenings are nice when it cools off. 53. Normative statements are concerned primarily with: A. facts and theories. B. what ought to ...

Business and Default Cycles for Credit Risk Siem Jan Koopman Andr

... the same vein as in Pesaran et al. (2003). Our second contribution lies in the fact that we use an unobserved components model, see Harvey (1989) and Durbin and Koopman (2001). In this way, we are able to disentangle long-term (co)-movements from short-term cyclical movements in a clear and interpr ...

... the same vein as in Pesaran et al. (2003). Our second contribution lies in the fact that we use an unobserved components model, see Harvey (1989) and Durbin and Koopman (2001). In this way, we are able to disentangle long-term (co)-movements from short-term cyclical movements in a clear and interpr ...

The need for consumer credit controls with emphasis on

... insight into the complexity of the problem of consumer credit? showing that in a capitalistic economy, government intervention is sometimes necessitated to insure continuous economic growth in the best interest of all citizens; and will serve as an evaluation of consumer credit controls. ...

... insight into the complexity of the problem of consumer credit? showing that in a capitalistic economy, government intervention is sometimes necessitated to insure continuous economic growth in the best interest of all citizens; and will serve as an evaluation of consumer credit controls. ...

Mohan Bijapur Are credit crunches supply or demand shocks?

... period 1972Q2-2007Q2, given that Eurodollar deposit rates were only available from 1971, and the current credit crunch represents an incomplete cycle to date. ADF tests indicated that all variables were non-stationary, hence all were first differenced such that non-stationarity was no longer detecte ...

... period 1972Q2-2007Q2, given that Eurodollar deposit rates were only available from 1971, and the current credit crunch represents an incomplete cycle to date. ADF tests indicated that all variables were non-stationary, hence all were first differenced such that non-stationarity was no longer detecte ...

Nonneutrality of Money in Classical Monetary Thought

... 1989 book Free Banking and Monetary Refire, asserts that “in the economy the classical theorists envisioned, the monetary sector could not . . . be a source of instability. A disturbance could only arise in the nonmonetary or real sector . . .” (p. 59). Arjo Klamer agrees. In the first chapter of hi ...

... 1989 book Free Banking and Monetary Refire, asserts that “in the economy the classical theorists envisioned, the monetary sector could not . . . be a source of instability. A disturbance could only arise in the nonmonetary or real sector . . .” (p. 59). Arjo Klamer agrees. In the first chapter of hi ...